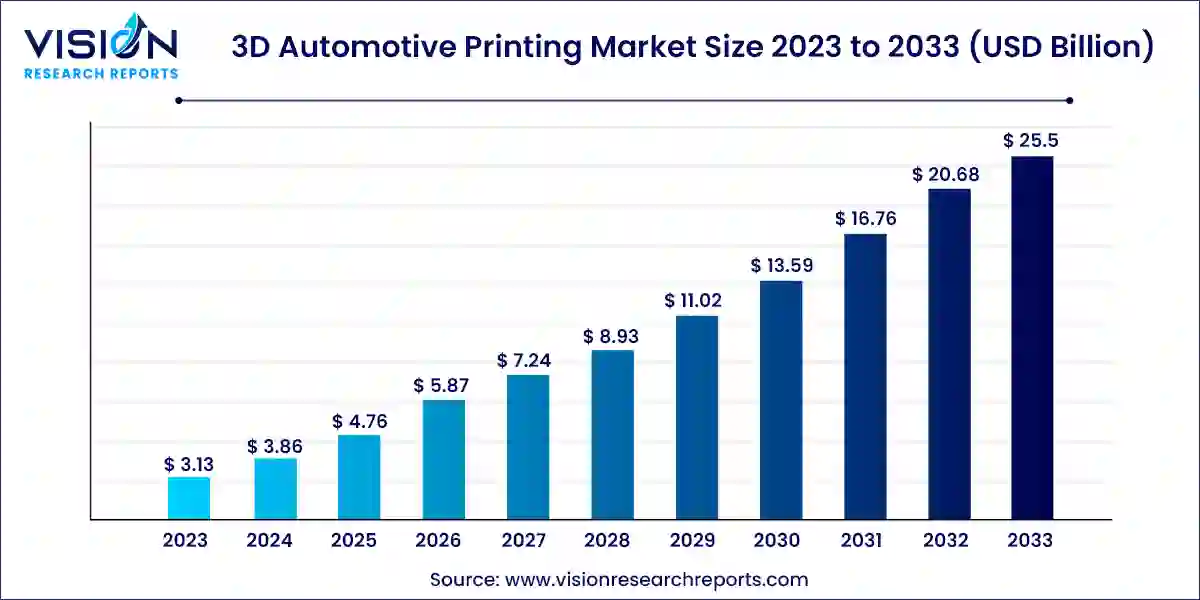

The global 3D automotive printing market size was estimated at around USD 3.13 billion in 2023 and it is projected to hit around USD 25.5 billion by 2033, growing at a CAGR of 23.34% from 2024 to 2033. The 3D automotive printing market has witnessed significant growth driven by advancements in additive manufacturing technology and increasing demand for customized automotive components.

The growth of the 3D automotive printing market is propelled by several key factors. Firstly, the increasing demand for customization in automotive components drives the adoption of 3D printing technology, allowing manufacturers to efficiently produce personalized parts tailored to specific requirements. Secondly, cost efficiency plays a significant role, as 3D printing eliminates the need for traditional tooling and reduces material waste, resulting in overall cost savings for automotive companies. Additionally, the flexibility offered by 3D printing enables designers to create complex geometries and lightweight structures, enhancing design freedom and product innovation. Moreover, the resilience of the supply chain is bolstered by localized production capabilities enabled by additive manufacturing technologies, addressing vulnerabilities exposed during global disruptions such as the COVID-19 pandemic.

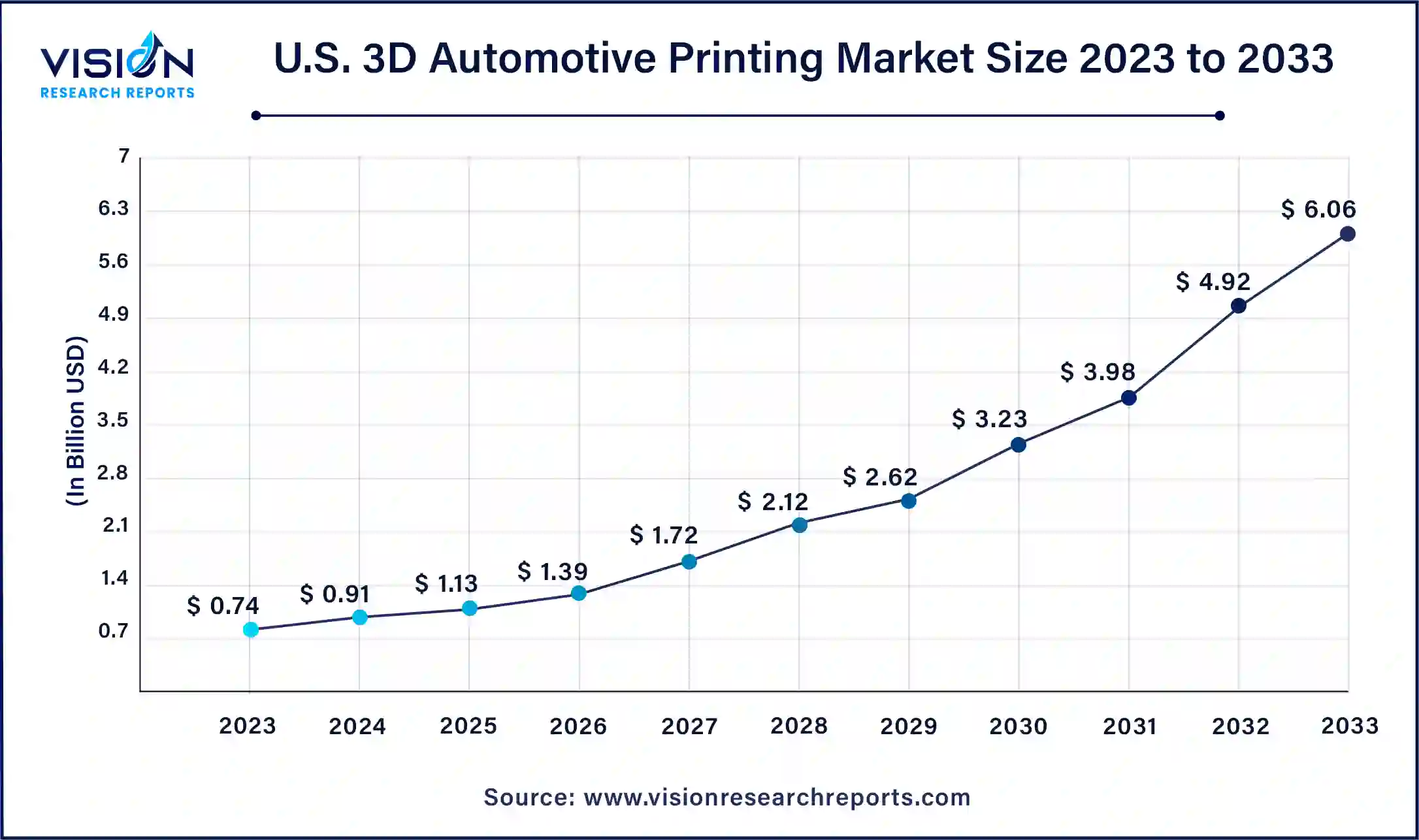

The U.S. 3D automotive printing market size was estimated at around USD 0.74 billion in 2023 and it is projected to hit around USD 6.06 billion by 2033, growing at a CAGR of 23.40% from 2024 to 2033.

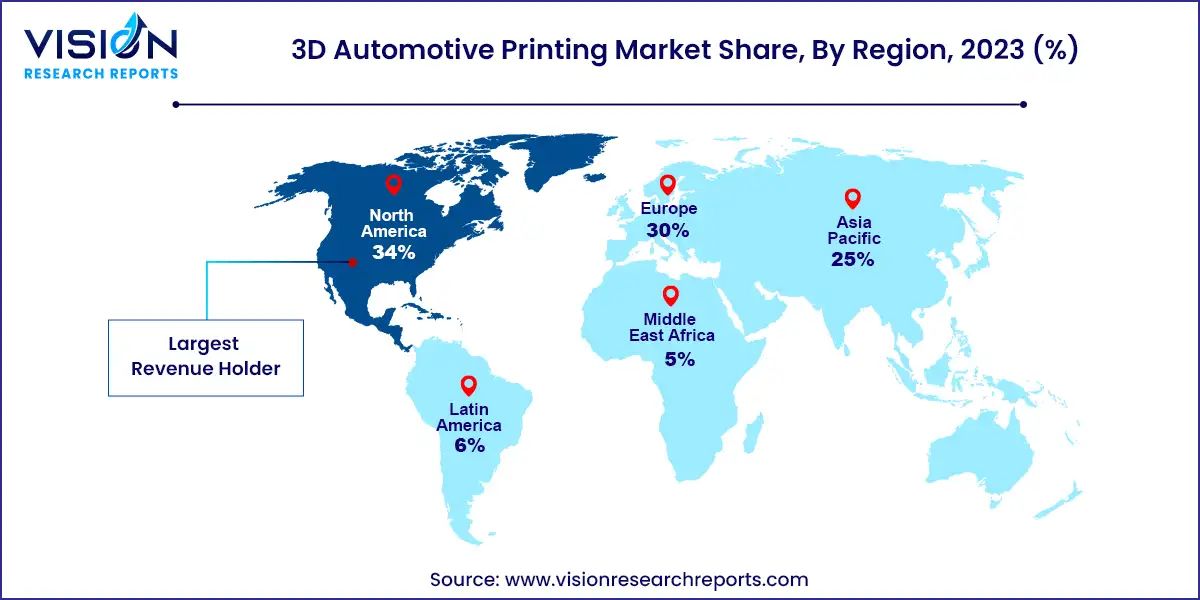

North America emerged as the reigning champion in 2023, clinching the largest revenue share at 34%. The region's dominance is attributed to its robust automotive industry, characterized by a dense concentration of automotive manufacturers, suppliers, and research institutions. This ecosystem fosters innovation and collaboration in embracing advanced manufacturing technologies like 3D printing. Additionally, North America boasts leading additive manufacturing technology providers like Stratasys Ltd., 3D Systems Corporation, Autodesk, Inc., and service bureaus specializing in automotive applications.

Asia Pacific exhibited the swiftest CAGR of 25.14% within the 3D automotive printing market throughout the forecast period. The region's remarkable growth can be attributed to its expansive consumer market, which fosters a heightened demand for customized and personalized automotive products. Leveraging 3D printing technology, manufacturers can provide bespoke solutions, including custom-designed interior components and personalized vehicle accessories, effectively catering to diverse consumer preferences and bolstering market competitiveness. Furthermore, the presence of skilled labor and comparatively lower labor costs in select countries across the Asia Pacific region enhance its allure for 3D printing adoption. This enables automotive manufacturers to harness additive manufacturing technologies in a cost-effective manner while upholding stringent production standards.

In terms of offerings, the hardware segment emerged as the dominant force in the market, capturing the largest revenue share of 68% in 2023. This prominence stems from its indispensable role in additive manufacturing, continuous technological advancements, diverse product portfolios, fierce market competition, and strict adherence to industry standards and certifications. As additive manufacturing continues to transform the automotive sector, hardware manufacturers will remain pivotal in driving innovation and market expansion. Furthermore, manufacturers are consistently introducing new printer models equipped with enhanced features such as larger build volumes, accelerated printing speeds, and superior resolution. These advancements empower automotive companies to fabricate intricate components with heightened precision and efficiency, thus fueling the demand for 3D printing hardware.

Concurrently, the services segment is poised to exhibit the highest CAGR of 25.73% over the forecast period. With the increasing adoption of additive manufacturing technology within the automotive realm, numerous companies are seeking external expertise and services to complement their in-house capabilities. Outsourcing 3D printing services enables automotive manufacturers to leverage specialized skills, equipment, and resources without necessitating substantial investments in infrastructure or training initiatives.

Regarding applications, the prototyping segment emerged as the frontrunner in the target market, commanding the largest revenue share in 2023. Prototyping stands as a pivotal phase in the automotive manufacturing journey. Prior to finalizing designs for mass production, automotive manufacturers rely on prototypes to evaluate the functionality, aesthetics, and performance of diverse components. Additive manufacturing presents notable advantages in this domain, facilitating rapid and cost-efficient prototyping characterized by intricate geometries and detailed features. Additionally, 3D printing facilitates iterative design processes, enabling engineers to swiftly iterate and refine designs based on testing outcomes and stakeholder feedback.

The production segment is poised to experience the fastest CAGR throughout the forecast period. This surge in growth is primarily driven by the automotive industry's paradigm shift towards more customizable and on-demand manufacturing models. Consumer preferences are increasingly veering towards personalized vehicles with unique features and designs. 3D printing technology emerges as a facilitator for manufacturers to efficiently produce customized parts without necessitating expensive tooling or prolonged retooling processes. Such manufacturing flexibility aptly aligns with the dynamic demands of the market.

Within the market segmentation by type, the fused deposition modeling (FDM) segment emerged as the frontrunner in 2023, claiming the largest revenue share. Renowned for its cost-effectiveness compared to other additive manufacturing processes, FDM technology offers accessible solutions to a diverse array of automotive manufacturers, including small and medium-sized enterprises (SMEs) with constrained budgets. Moreover, FDM technology's scalability enables its application across both small and large-scale automotive component production, accommodating varying production volumes seamlessly.

The stereolithography (SLA) segment is anticipated to exhibit the swiftest CAGR over the forecast period. Distinguished by its high printing speed and efficiency relative to other additive manufacturing technologies, such as selective laser sintering (SLS), SLA technology's rapid build times empower automotive manufacturers to expedite product development cycles and curtail time-to-market for new vehicle models and components. Recent technological advancements in SLA printers have further broadened their appeal, with larger build volumes capable of producing sizable automotive components or multiple parts concurrently.

Examining the market segmentation by material, the metal segment seized the market's reins in 2023, clinching the largest revenue share. Metal 3D printing stands out for its superior mechanical properties compared to conventional automotive manufacturing materials like plastics or composites. Esteemed metals such as titanium, aluminum, and stainless steel deliver exceptional strength, durability, and heat resistance, rendering them ideal for fabricating critical automotive components like engine parts, brackets, and structural elements. Additionally, metal 3D printing technologies, including fused deposition modeling (FDM) and electron beam melting (EBM), enable the production of high-performance, intricate parts characterized by tight tolerances and intricate geometries.

Conversely, the polymer segment is anticipated to witness the most rapid CAGR over the forecast period. Polymer-based 3D printing presents a plethora of materials boasting diverse properties, including acrylonitrile butadiene styrene (ABS), polylactic acid, nylon, polyethylene terephthalate glycol (PETG), and thermoplastic polyurethane (TPU). These materials can be tailored to meet specific performance requisites such as strength, flexibility, heat resistance, and chemical resilience. With ongoing material innovations, polymer 3D printing's applicability within the automotive sector continues to expand across varied applications encompassing prototyping, tooling, and end-use parts production.

Within the component segmentation, the interior component segment commanded the market's throne in 2023, capturing the largest revenue share. Interior components, renowned for their intricate designs and complex geometries, pose challenges for conventional manufacturing methods. Additive manufacturing technologies like fused deposition modeling (FDM) and stereolithography (SLA) offer the flexibility to produce highly detailed and customized interior components encompassing dashboard panels, center consoles, door handles, and trim pieces. Moreover, lightweight yet robust interior parts play a pivotal role in enhancing vehicle fuel efficiency and overall performance, a feat made achievable through 3D printing's utilization of advanced polymers or composite materials.

Conversely, the exterior segment is poised to experience the most rapid CAGR over the forecast period. The segment's dominance can be ascribed to the innovation and customization opportunities presented by 3D printers. Exterior components, including body panels, grilles, spoilers, and trim pieces, wield substantial influence in defining a vehicle's aesthetics and brand identity. 3D printing technology empowers automotive designers to explore innovative and customizable designs characterized by intricate geometries, patterns, and textured surfaces. This design versatility facilitates heightened differentiation and personalization of vehicles, thereby driving demand for 3D-printed exterior components.

By Offering

By Type

By Material

By Component

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others