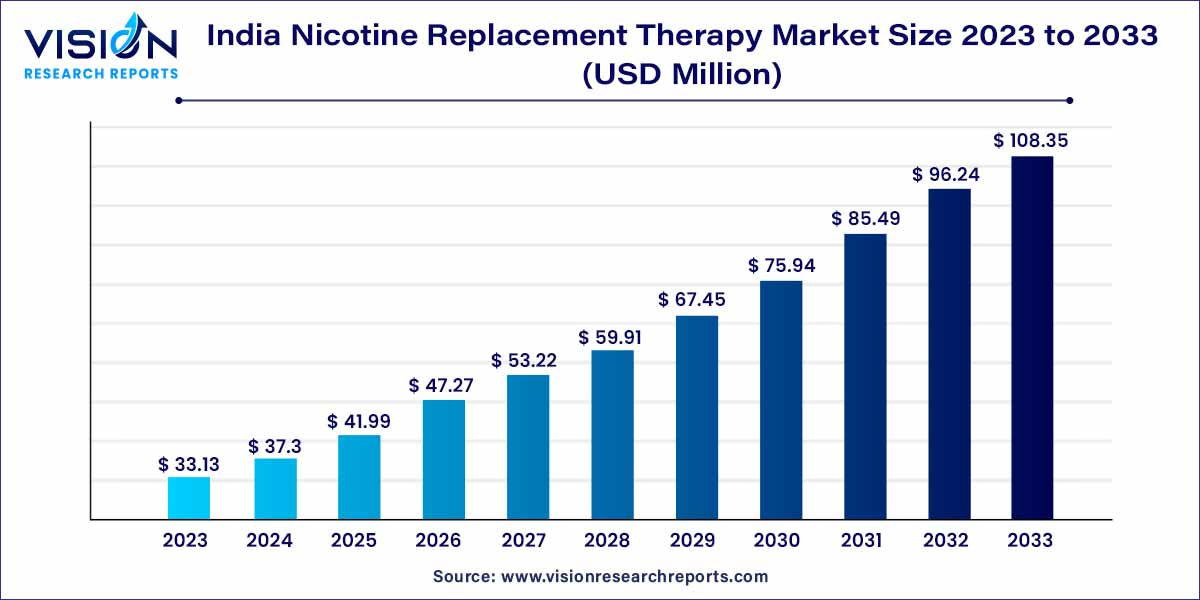

The India nicotine replacement therapy market was surpassed at USD 33.13 million in 2023 and is expected to hit around USD 108.35 million by 2033, growing at a CAGR of 12.58% from 2024 to 2033.

The nicotine replacement therapy (NRT) market in India has witnessed substantial growth in recent years, reflecting an increased emphasis on addressing tobacco addiction. This overview aims to provide insights into the key aspects of the Indian NRT market, examining its current status, growth drivers, and the broader implications for public health.

The growth of the nicotine replacement therapy (NRT) market in India is propelled by several key factors. Firstly, the increasing awareness surrounding the detrimental health effects of tobacco use has stimulated a greater demand for smoking cessation solutions. Individuals are actively seeking effective methods to overcome nicotine dependency, driving the adoption of NRT products. Additionally, government-led initiatives and public health campaigns focused on tobacco control contribute significantly to market growth. The implementation of stringent regulations and policies to curb smoking, combined with efforts to educate the public about the benefits of NRT, creates a conducive environment for market expansion. Furthermore, continuous advancements in product formulations and delivery mechanisms enhance the appeal and efficacy of NRT options, attracting a broader demographic of users. As a result, the confluence of heightened awareness, supportive government measures, and ongoing product innovations collectively fuels the positive trajectory of the nicotine replacement therapy market in India.

| Report Coverage | Details |

| Growth rate from 2024 to 2033 | CAGR of 12.58% |

| Market Size in 2023 | USD 33.13 million |

| Revenue Forecast by 2033 | USD 108.35 million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Based on product, nicotine gums accounted for the largest revenue share of 84% in 2023 and are expected to grow at the fastest CAGR over the forecast period. Increasing emphasis on NRTs, growing involvement of the government, and developments in the industry are key drivers of response for the dominance. Active involvement of government in preventing the misuse of NRTs is also a major factor propelling the segment’s growth.

In 2023, to prevent the misuse of NRTs, such as nicotine gums, lozenges, and patches, the government is contemplating mandating the requirement of a prescription for the sale of all formulations containing 2 & 4 mg of nicotine. This issue was discussed by the Drugs Technical Advisory Board (DTAB), India's leading technical advisory body on pharmaceuticals, during a meeting conducted in August 2023.

Strategic activities by emerging players are expected to offer lucrative opportunities in the review period. For instance, in May 2020, Nicotex, a smoking cessation brand under Cipla Health, joined forces with the governments of Karnataka and Goa to offer NRT to frontline workers. Such partnerships with various state health ministries enable the company to conduct these initiatives on a much larger scale and extend the company's assistance to a broader population in their efforts to quit smoking.

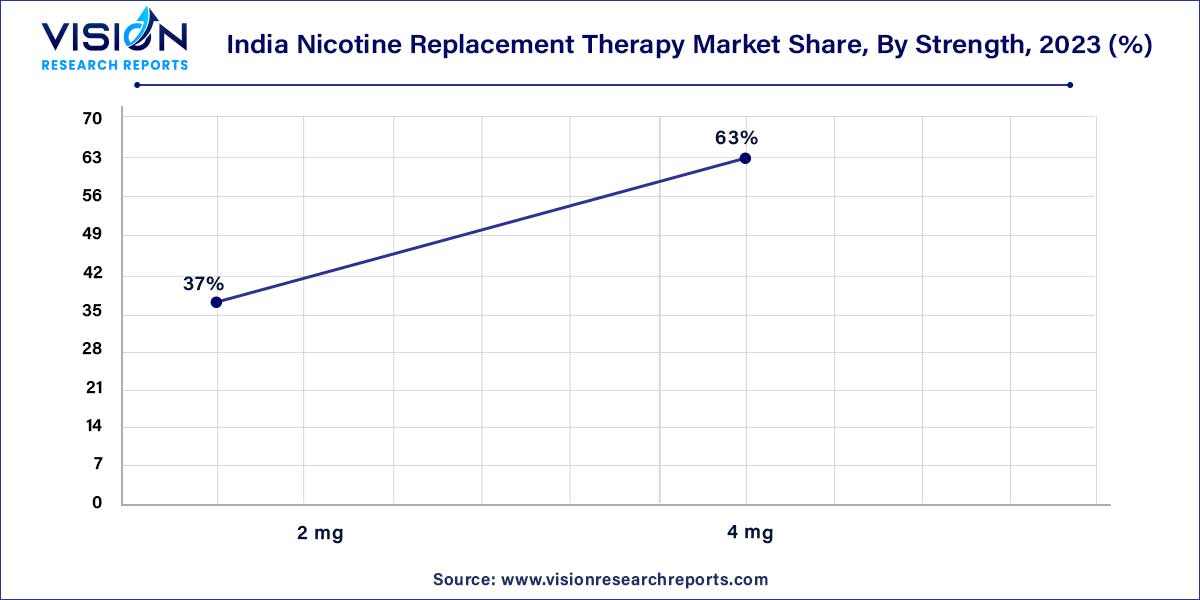

The 4 mg segment held the largest market share of over 63% in 2023. One of the primary drivers is the relatively higher price of 4 mg strength nicotine replacement products compared to their 2 mg counterparts. This higher pricing is often seen as indicative of increased potency for heavy smokers, which appeals to consumers seeking more robust solutions to address their nicotine cravings and addiction. Perceived effectiveness of higher nicotine concentrations and the willingness of certain consumers, such as heavy smokers, to navigate the prescription requirement in pursuit of more potent solutions to overcome nicotine addiction is another factor driving the segment growth.

2 mg nicotine replacement products are expected to witness the fastest growth over the forecast period, which can primarily be attributed to the fact that 2 mg strength products are easily available Over the Counter (OTC). Unlike the 4 mg strength nicotine replacement products, which require a prescription for purchase, the 2 mg variant can be obtained directly by consumers without doctor's prescription. This accessibility made it a preferred choice for individuals seeking nicotine replacement therapy, improving its market penetration.

The offline segment accounted for the largest revenue share of 69% in 2023. The offline distribution channel for NRT remains a critical avenue for reaching a diverse range of consumers seeking to quit smoking. Offline distribution channels allow an individual to interact directly with trained professionals. Retail pharmacies are the most preferred offline channel as these pharmacies provide a one-stop solution for smokers seeking effective cessation options. The comprehensive selection of a wide range of NRT products at retail pharmacies allows consumers to choose the most suitable NRT method.

The online distribution channel segment is expected to grow at a significant rate during the study period. The growth can be attributed to the consumer preferences, user-friendly platforms, faster shipping, and optimum prices. The online NRT market has significantly improved accessibility for individuals seeking to quit smoking. Online platforms often offer comprehensive information about various NRT options, allowing consumers to make informed decisions based on their preferences and needs. This wealth of information empowers consumers to choose the most suitable NRT product for their quit-smoking journey. These capabilities are expected to drive the segment growth.

By Product

By Strength

By Distribution Channel

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on India Nicotine Replacement Therapy Market

5.1. COVID-19 Landscape: India Nicotine Replacement Therapy Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. India Nicotine Replacement Therapy Market, By Product

8.1. India Nicotine Replacement Therapy Market, by Product, 2024-2033

8.1.1 Gum

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Lozenges

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. India Nicotine Replacement Therapy Market, By Strength

9.1. India Nicotine Replacement Therapy Market, by Strength, 2024-2033

9.1.1. 2 mg

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. 4 mg

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. India Nicotine Replacement Therapy Market, By Distribution Channel

10.1. India Nicotine Replacement Therapy Market, by Distribution Channel, 2024-2033

10.1.1. Online

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Offline

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. India Nicotine Replacement Therapy Market, Regional Estimates and Trend Forecast

11.1. India

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Strength (2021-2033)

11.1.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 12. Company Profiles

12.1. Glenmark Pharmaceuticals Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Fertin Pharma.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Rubicon Consumer Healthcare Pvt. Ltd.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Rusan Pharma Ltd.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Cipla, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Piramal Pharma Limited

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Johnson & Johnson Services, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. ITC Limited

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. INVENTZ Lifesciences.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Sparsha Pharma International Pvt. Ltd.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others