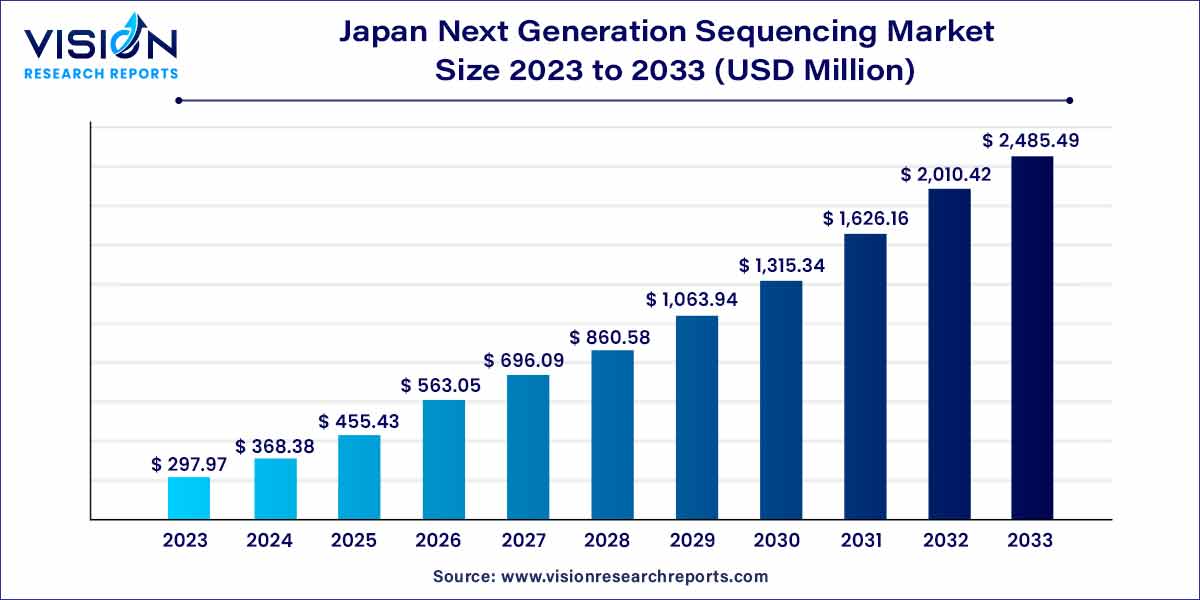

The Japan next generation sequencing market size was estimated at around USD 297.97 million in 2023 and it is projected to hit around USD 2,485.49 million by 2033, growing at a CAGR of 23.63% from 2024 to 2033.

The next-generation sequencing (NGS) market in Japan stands at the forefront of genomic innovation, driving advancements in research, diagnostics, and personalized medicine. This overview aims to provide a comprehensive insight into the current state of the Japan next-generation sequencing Market, highlighting key players, market dynamics, and the transformative impact of NGS technologies across various sectors.

The growth of the next-generation sequencing (NGS) market in Japan is propelled by a confluence of factors contributing to its dynamic expansion. A key driver is the increasing prevalence of genetic disorders, prompting a heightened demand for advanced genomic diagnostics and personalized medicine solutions. The collaborative efforts between academic institutions, healthcare providers, and industry stakeholders play a pivotal role in fostering innovation and driving the adoption of NGS technologies across diverse applications. The continuous evolution of sequencing platforms and bioinformatics tools, marked by technological advancements such as single-cell sequencing and long-read sequencing, enhances the accuracy and efficiency of genomic analysis. Additionally, the supportive regulatory environment in Japan, with ongoing initiatives to streamline approval processes for NGS-based diagnostics and therapies, creates a conducive atmosphere for market growth. As the NGS market addresses challenges like data standardization and ethical considerations, these obstacles present opportunities for industry players to innovate, ensuring sustained growth in this dynamic landscape. Overall, the robust growth of the NGS market in Japan is underpinned by a combination of technological progress, collaborative initiatives, and a rising awareness of the transformative potential of genomics across various sectors.

| Report Coverage | Details |

| Market Size in 2023 | USD 297.98 million |

| Revenue Forecast by 2033 | USD 2,487.58 million |

| Growth rate from 2024 to 2033 | CAGR of 23.64% |

| Base Year | 2023 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Restraints

Opportunities

Based on technology, the market is segmented into whole genome sequencing, whole exome sequencing, targeted sequencing & resequencing, and others. The targeted sequencing and resequencing segment accounted for the largest revenue share in 2023 and is also anticipated to grow the fastest CAGR over the forecast period. This segment’s dominance can be due to the several advantages offered by this technology for next-generation sequencing. This is a cost-effective technique and offers actionable and clear information to physicians.

The whole genome sequencing (WGS) segment is anticipated to witness significant growth during the forecast period, owing to the wide use of WGS to combat COVID-19. For instance, in March 2022, an article published in Frontiers stated that WGS has a potential application to detect SARS-CoV-2 Infection. Moreover, it helped differentiate community-acquired infection from hospital-acquired infection among pediatric oncology patients.

Based on product, the market is segmented into consumables and platforms. The consumables segment accounted for the largest revenue share of 75% in 2023, and it is also anticipated to grow at the fastest CAGR of 24.24% over the forecast period. The dominance can be attributed to an increase in investment in the development of advanced genomics techniques for prevention and detection, and a decrease in sequencing costs are contributing to the growth of the NGS consumables market.

The platforms segment is anticipated to witness significant market growth over the forecast period. NGS platforms allow the implementation of a broad range of techniques, enabling scientists to address questions related to transcriptome, genome, or epigenome. These applications make the platform a preferred choice in agriculture, clinical diagnosis, research, and sustainable development.

Based on application, the market is segmented into oncology, HLA typing/immune system monitoring, clinical investigation, epidemiology & drug development, reproductive health, metagenomics, agrigenomics & forensics, and consumer genomics. The oncology segment accounted for the largest revenue share in 2023. This segment dominance can be due to the wide use of NGS in oncology, where gene mutations are sequenced to develop new cancer diagnostic & treatment methods. The NGS in oncology has also been aiding a better understanding of different tumor growth cell signaling pathways, which provides oncologists insights for better diagnosis and management of various forms of cancer

The consumer genomics segment has been anticipated to grow fastest during the forecast period, owing to the rapid development in personal health awareness, paternity testing, and genealogy. Several key market players are constantly working toward expanding their product portfolio by launching new products, which would further drive the segment growth. For instance, in May 2022, PerkinElmer, Inc. expanded its genome testing services by adding ultrarapid whole genome sequencing to its portfolio.

Based on workflow, the market is segmented into pre-sequencing, sequencing, and NGS data analysis. The sequencing segment accounted for the highest revenue share in 2023. This can be attributed to the availability of various platforms such as iSeq, MiniSeq, MiSeq, NextSeq, HiSeq X, & NovaSeq series from illumina and Ion Proton, PGM, & IonS5 system from Thermo Fisher Scientific for the next generation sequencing.

The NGS data analysis segment is estimated to register the fastest CAGR over the forecast period. NGS data analysis includes sequence assembly and data analysis. As terabytes of data are produced during a single run of NGS, data storage and interpretation equipment are essential to any NGS workflow. Furthermore, several recent developments for improving data analysis by the key market players are driving the segment's growth.

Based on the end-use, the market is segmented into clinical research, academic research, pharma & biotech entities, hospitals & clinics, and other users. The academic research segment held the largest revenue share in 2023. The segment's growth can be attributed to the availability of various institutes offering on-site bioinformatics courses and training programs that enhance knowledge about various sequencing data analysis solutions, which are expected to drive the segment growth.

The clinical research segment is predicted to grow at the remarkable CAGR during the forecast period. Implementation of NGS for studying tumor heterogeneity, the discovery of new cancer-related genes, and the identification of alterations related to tumorigenesis are expected to result in significant growth of this segment.

Astride, a significant NGS service distributor in Japan, partnered with Basepair in September 2023 to offer its visualization platform in that country.

Illumina, Inc. introduced a product for short- and long-read sequencing on a single device in March 2023 that is based on its ground-breaking Illumina Complete Long Read technology.

Agilent Technologies Inc. launched the NGS assay for comprehensive genomic profiling (CGP) in April 2023 with the goal of increasing precision oncology.

By Technology

By Product

By Application

By Workflow

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Japan Next Generation Sequencing Market

5.1. COVID-19 Landscape: Japan Next Generation Sequencing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Japan Next Generation Sequencing Market, By Technology

8.1. Japan Next Generation Sequencing Market, by Technology, 2024-2033

8.1.1. Whole Genome Sequencing

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Whole Exome Sequencing

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Targeted Sequencing & Resequencing

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Japan Next Generation Sequencing Market, By Product

9.1. Japan Next Generation Sequencing Market, by Product, 2024-2033

9.1.1. Consumables

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Platforms

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Japan Next Generation Sequencing Market, By Application

10.1. Japan Next Generation Sequencing Market, by Application, 2024-2033

10.1.1. Oncology

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. HLA Typing/Immune System Monitoring

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Metagenomics, Epidemiology & Drug Development

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Agrigenomics & Forensics

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Consumer Genomics

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Japan Next Generation Sequencing Market, By Workflow

11.1. Japan Next Generation Sequencing Market, by Workflow, 2024-2033

11.1.1. Pre-Sequencing

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Sequencing

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. NGS Data Analysis

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Japan Next Generation Sequencing Market, By End-use

12.1. Japan Next Generation Sequencing Market, by End-use, 2024-2033

12.1.1. Academic Research

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Clinical Research

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Hospitals & Clinics

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Pharma & Biotech Entities

12.1.4.1. Market Revenue and Forecast (2021-2033)

12.1.5. Other users

12.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Japan Next Generation Sequencing Market, Regional Estimates and Trend Forecast

13.1. Japan

13.1.1. Market Revenue and Forecast, by Technology (2021-2033)

13.1.2. Market Revenue and Forecast, by Product (2021-2033)

13.1.3. Market Revenue and Forecast, by Application (2021-2033)

13.1.4. Market Revenue and Forecast, by Workflow (2021-2033)

13.1.5. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 14. Company Profiles

14.1. Illumina, Inc

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. QIAGEN

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Thermo Fisher Scientific, Inc

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. BGI

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Pacific Biosciences

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Bio Rad Laboratories

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Oxford Nanopore Technologies, Inc

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Myriad Genetics. Inc.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Agilent Technologies, Inc

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Eurofins Scientific

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others