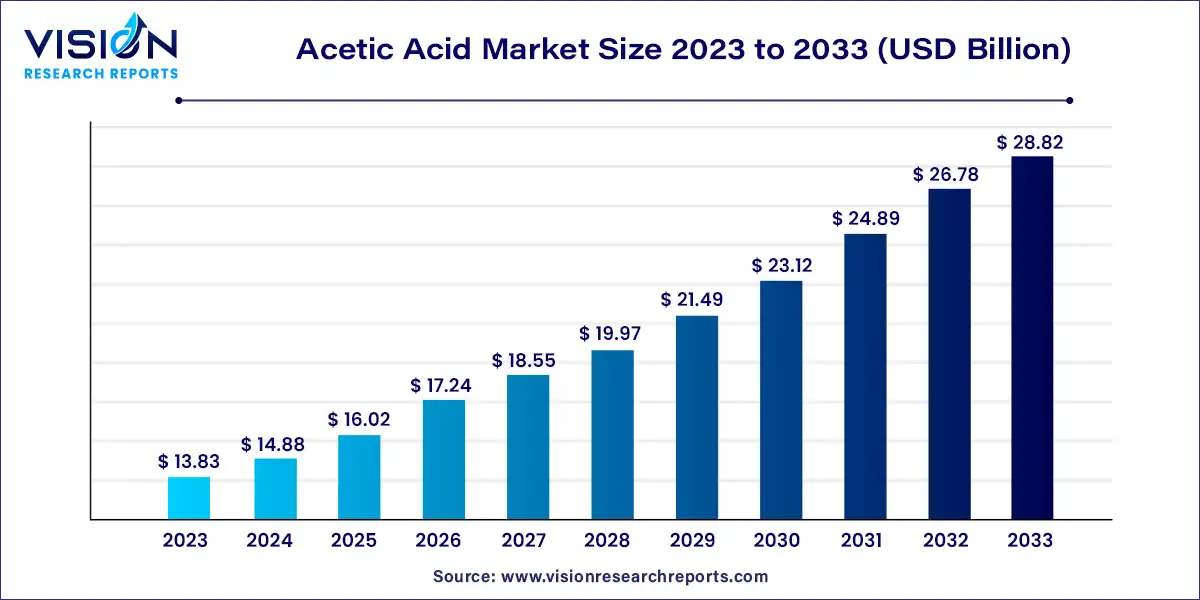

The global acetic acid market size was valued at USD 13.83 billion in 2023 and it is predicted to surpass around USD 28.82 billion by 2033 with a CAGR of 7.62% from 2024 to 2033. Acetic acid, a fundamental organic compound with the formula CH₃COOH, plays a crucial role in various industrial processes. Often referred to as ethanoic acid, it is a key component in the production of vinegar, plastics, synthetic fibers, and a myriad of other chemical products. The global acetic acid market has witnessed significant growth in recent years, driven by increasing demand from diverse end-use industries.

The acetic acid market is experiencing robust growth due to the rising demand from industrial applications, particularly in the production of vinyl acetate monomer (VAM), is a significant driver. VAM is crucial in manufacturing adhesives, paints, and coatings, fueling market expansion. Additionally, the increasing consumption of acetic acid in the food and beverage sector, driven by the growing popularity of vinegar and other acetic acid-based products, further supports market growth. The rapid industrialization and urbanization in emerging economies, especially in the Asia-Pacific region, also contribute to the market's upward trajectory. Furthermore, advancements in production technologies, which improve efficiency and reduce costs, enhance the overall market dynamics.

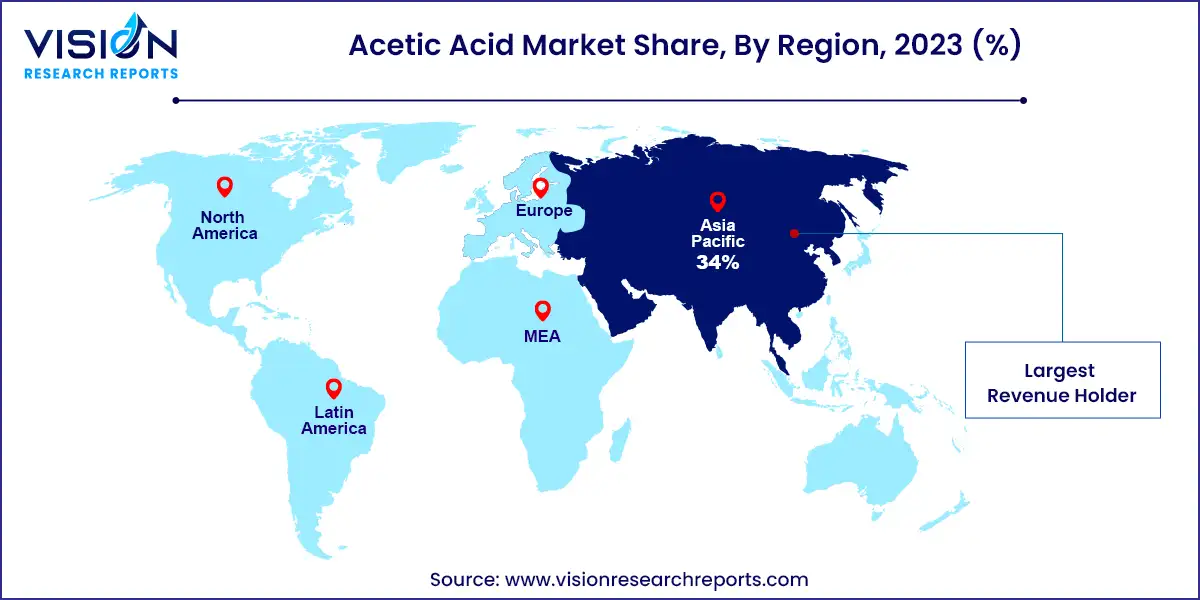

Asia-Pacific dominating the global acetic acid market, the Asia-Pacific region held a 34% revenue share in 2023. The region experiences substantial demand growth across sectors such as construction, pharmaceuticals, automotive, and textiles. This demand is driven by a burgeoning pharmaceutical industry where acetic acid is vital for medicine development. As consumer reliance on medicinal tablets increases, the region's demand for acetic acid is expected to rise further.

| Attribute | Asia Pacific |

| Market Value | USD 4.70 Billion |

| Growth Rate | 7.64% CAGR |

| Projected Value | USD 9.79 Billion |

North America: The acetic acid market in North America, particularly in the U.S. and Canada, is driven by its widespread use in the food and beverage industry for meat preservation. Increasing life expectancy and growing use of medicinal tablets in the pharmaceutical sector also contribute to demand. In the U.S., the acetic acid market benefits from significant consumption, especially in food-grade applications, with the U.S. being the largest North American consumer of acetic acid, notably in vinegar production. In Canada, industrial growth and a burgeoning manufacturing sector are enhancing demand, with applications spanning construction, automotive, and textiles.

Europe: In Europe, including Germany and the UK, the acetic acid market faces fluctuating demand influenced by the availability and cost of primary feedstock, particularly methanol. The demand from downstream industries like ethyl acetate and butyl acetate, especially within the construction sector, impacts market dynamics. However, anticipated price increases due to higher import prices from China and rising methanol feedstock costs may lead to a shift in market trends.

In 2023, the vinyl acetate monomer segment led the acetic acid market, commanding a significant revenue share of 42%. This dominant position is primarily due to the rising demand for paints and coatings, paper coatings, and printed materials, which drive the need for vinyl acetate monomer. Acetic acid serves as a key raw material in producing vinyl acetate monomer, which is then utilized to manufacture polyvinyl acetate. Polyvinyl acetate, in turn, is crucial for producing paints and coatings. As consumer lifestyles improve and home renovations and redecoration increase, the demand for paints and coatings rises, thereby boosting the demand for vinyl acetate monomer.

Acetic anhydride held the second-largest market share globally in 2023, with a 20% share. Its growth is attributed to its extensive use in photographic films, various coated materials, and cigarette filters. Additionally, acetic anhydride is essential for producing medicines like aspirin, used for headache relief, and plays a significant role in wood preservation.

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Acetic Acid Market

5.1. COVID-19 Landscape: Acetic Acid Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Acetic Acid Market, By Application

8.1. Acetic Acid Market, by Application Type, 2024-2033

8.1.1. Vinyl Acetate Monomer

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Acetic Anhydride

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Acetate Esters

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Purified Terephthalic Acid

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Ethanol

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Other Applications

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Acetic Acid Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Application (2021-2033)

Chapter 10. Company Profiles

10.1. Eastman Chemical Company

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Celanese Corporation

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. LyondellBasell Industries Holdings B.V.

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. SABIC

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. HELM AG

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Indian Oil Corporation Ltd.

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Gujarat Narmada Valley Fertilizers & Chemicals Limited

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. DAICEL CORPORATION

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. Dow

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. INEOS

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others