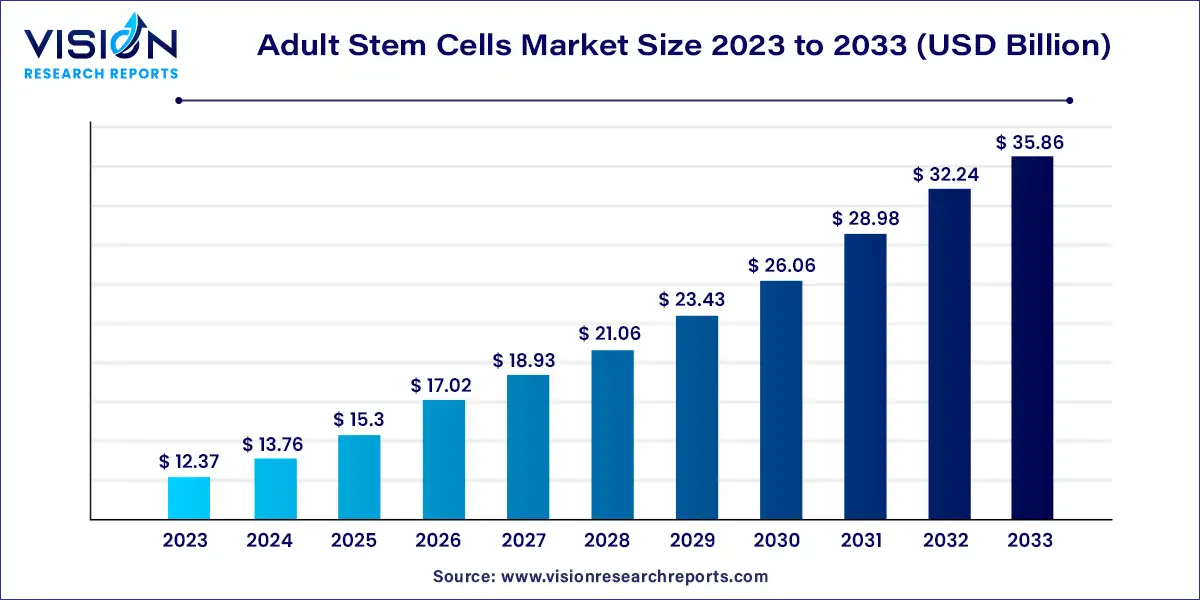

The global adult stem cells market was estimated at USD 12.37 billion in 2023 and it is expected to surpass around USD 35.86 billion by 2033, poised to grow at a CAGR of 11.23% from 2024 to 2033. Adult stem cells, also known as somatic stem cells, are undifferentiated cells found throughout the body that can differentiate into various cell types of their tissue of origin. Unlike embryonic stem cells, adult stem cells are found in mature tissues and have a more limited capacity for differentiation. However, they play a crucial role in the body's ability to repair and regenerate damaged tissues, making them a focal point for regenerative medicine and therapeutic research.

The adult stem cells market is experiencing robust growth driven by an increasing prevalence of chronic diseases like diabetes and cardiovascular disorders has heightened demand for effective treatments, enhancing the market's expansion. Advancements in stem cell research, including improved isolation and differentiation techniques, are accelerating therapeutic applications across various medical fields. Moreover, rising adoption of regenerative therapies, supported by promising clinical outcomes, continues to drive market growth. These factors collectively contribute to a promising outlook for the adult stem cells market, fostering innovation and expanding treatment possibilities in regenerative medicine.

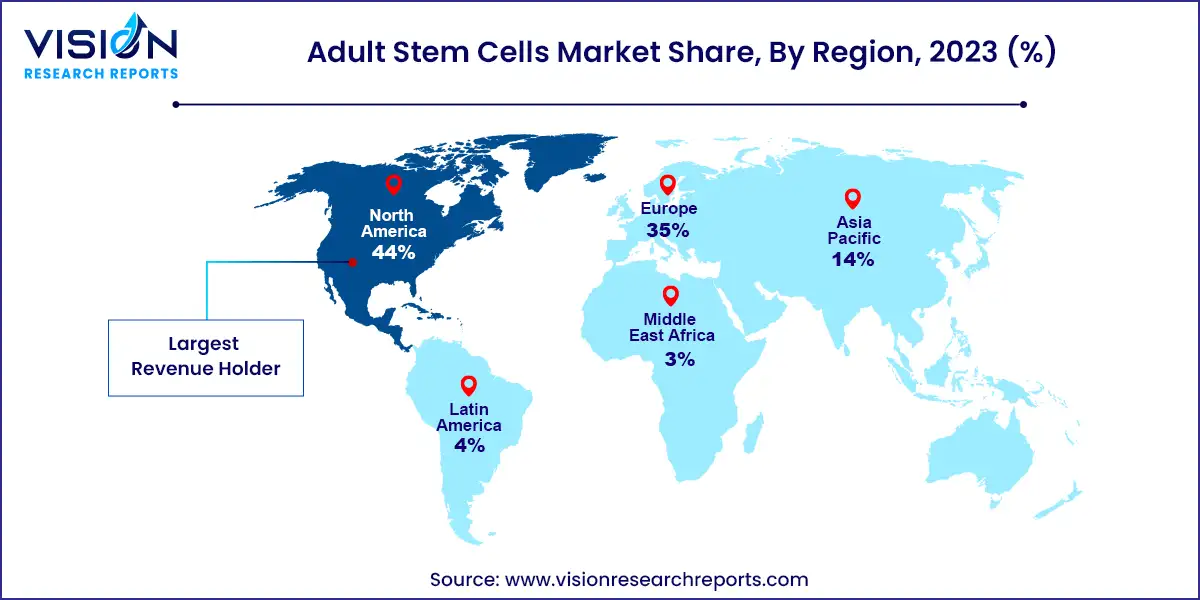

North America dominated the global market, accounting for a 44% revenue share in 2023, driven by increased research and development activities focused on regenerative medicine solutions. Pharmaceutical companies, academic institutions, and biotechnology firms in the region are heavily investing in exploring the therapeutic potential of adult stem cells. These efforts aim to develop innovative treatments for conditions such as cardiovascular diseases, neurodegenerative disorders, and orthopedic injuries.

| Attribute | North America |

| Market Value | USD 5.44 Billion |

| Growth Rate | 11.25% CAGR |

| Projected Value | USD 15.77 Billion |

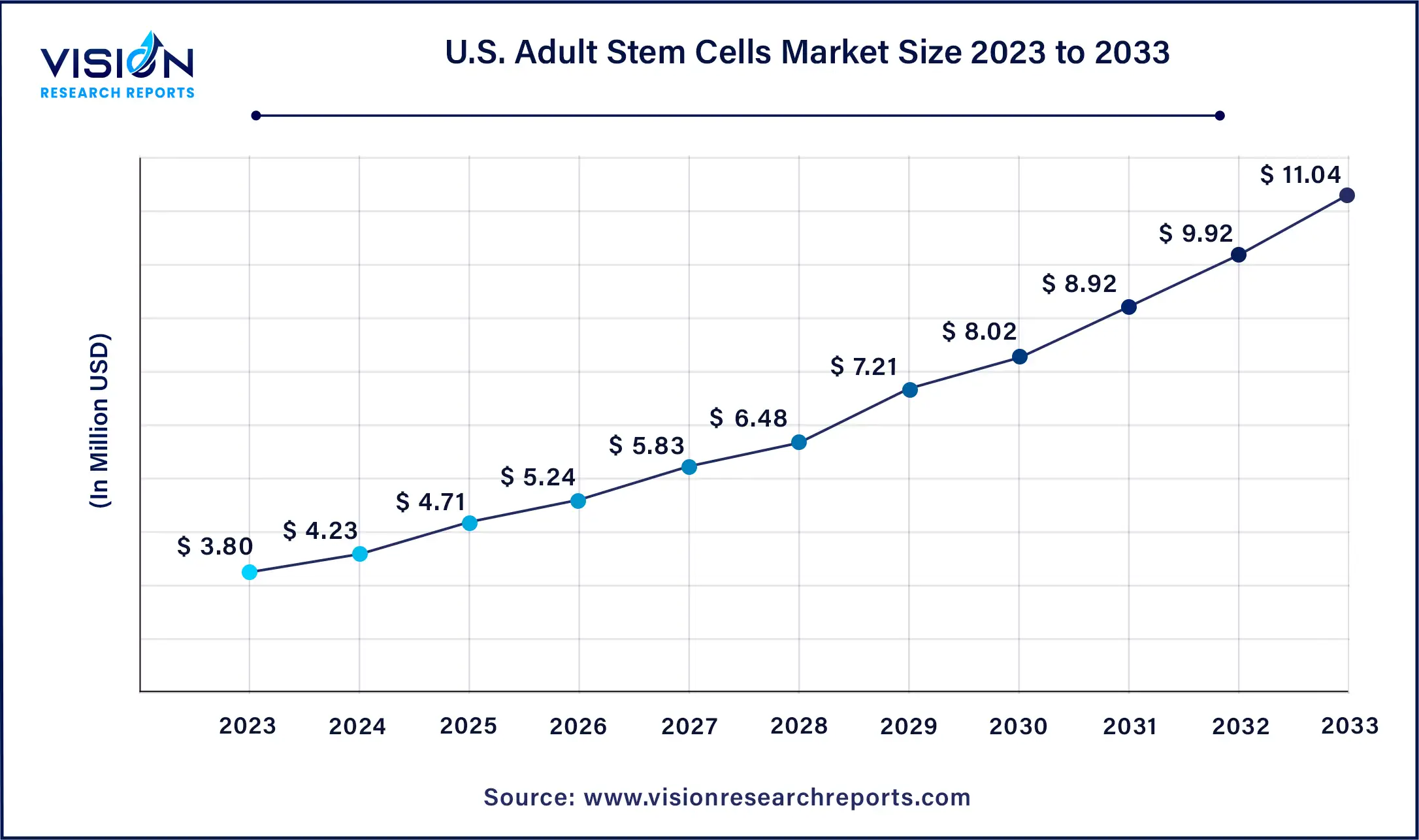

The U.S. adult stem cells market size was valued at USD 3.80 billion in 2023 and is expected to hit around USD 11.04 billion by 2033, poised to grow at a CAGR of 11.25% from 2024 to 2033.

The U.S. market held a significant share of the North American market in 2023, primarily driven by the expanding field of stem cell therapy. Increasing numbers of clinical trials across various therapeutic areas, including oncology, orthopedics, and autoimmune diseases, are demonstrating the efficacy and safety of adult stem cell treatments.

The Asia Pacific market is experiencing the fastest growth, driven by significant research and development efforts in adult stem cell technology. Countries like Japan, South Korea, and China are at the forefront, investing heavily in advanced technologies and innovative therapies. These nations focus on developing cutting-edge treatments for various diseases, including cardiovascular, neurological, and autoimmune disorders.

The allogeneic adult stem cells segment dominated the market with a share of 56% in 2023, driven by continuous innovation and contributions from leading market players. Companies are actively developing advanced therapies and expanding their product portfolios to address diverse medical conditions. For example, in September 2022, Bristol Myers Squibb and Century Therapeutics formed a strategic alliance to develop therapies using allogeneic cells derived from induced pluripotent stem cells (iPSCs). This collaboration leverages Century's advanced iPSC-derived allogeneic cell therapy technology with Bristol Myers Squibb's extensive expertise in oncology drug development and cell therapy.

The autologous adult stem cells segment is projected to exhibit the fastest CAGR over the forecast period, driven by increasing clinical trials and research endeavors. This personalized approach, utilizing a patient's own stem cells, minimizes rejection risks and enhances treatment efficacy. Several ongoing clinical trials are exploring autologous therapies for conditions such as cardiovascular diseases, neurological disorders, and orthopedic injuries. Significant investments in research and development are accelerating the advancement of innovative therapies, further propelling market expansion and offering promising solutions for various medical conditions.

The products segment dominated the market with a share of 80% in 2023, driven by several key factors. Within this segment, the cells and cell lines category has emerged as a significant revenue generator, bolstering market growth. Numerous market participants are actively pursuing untapped opportunities in this domain through strategies such as new product development and business expansion. For instance, in January 2024, Cellcolabs AB, a spin-off from the prestigious Karolinska Institute specializing in both research-grade and Good Manufacturing Practice (GMP) mesenchymal stem cells (MSCs), entered a strategic partnership with REPROCELL Inc., a pioneering Japanese company focused on induced pluripotent stem cells (iPSCs).

The services segment is experiencing robust growth, driven by increasing demand for stem cell banking, processing, and storage services. This expansion is fueled by heightened awareness of stem cell therapies and their potential benefits. Service providers are investing in advanced technologies and robust infrastructure to ensure high-quality, reliable services. Additionally, collaborations with healthcare institutions and ongoing research efforts are enhancing service capabilities and scope, contributing to overall market growth.

The bone and cartilage repair segment led the market with a share of 30% in 2023, driven by advancements in regenerative medicine. Innovations in stem cell therapies are offering new, effective treatment options for conditions such as osteoarthritis, fractures, and cartilage injuries. Adult stem cells, particularly mesenchymal stem cells (MSCs), are increasingly utilized due to their ability to differentiate into bone and cartilage tissues, promoting natural healing and regeneration. For instance, a review published in the Journal of Translational Medicine in 2022 discussed the modification of MSCs for cartilage-targeted therapy, highlighting the significance of MSC homing for effective MSC-based cartilage repair.

The inflammatory and immunological diseases segment is anticipated to grow at the fastest CAGR during the forecast period, driven by the increasing recognition of stem cell therapies' potential in treating autoimmune disorders and inflammatory conditions. Adult stem cells, particularly mesenchymal stem cells (MSCs), have demonstrated promise in modulating immune responses and reducing inflammation. Clinical trials and research studies are exploring their efficacy in conditions such as rheumatoid arthritis, multiple sclerosis, and inflammatory bowel disease. Advances in understanding immune system interactions and refining cell therapy techniques are propelling market expansion, opening new avenues for effectively managing chronic inflammatory and immunological diseases.

The disease modeling segment held the largest share of 30% in 2023, driven by technological advancements and increased research activities. Adult stem cells, particularly induced pluripotent stem cells (iPSCs), serve as valuable tools for modeling various diseases in laboratory settings. They enable researchers to study disease mechanisms, screen potential drug candidates, and develop personalized medicine approaches. The application of iPSCs in disease modeling is expanding across a wide range of conditions, including genetic disorders, neurodegenerative diseases, and cardiovascular disorders. This growth is enhancing our understanding of disease pathophysiology and accelerating the development of targeted therapies.

The tissue engineering segment is expected to grow significantly over the forecast period, driven by substantial investments in regenerative medicine and advanced biotechnology. Adult stem cells, particularly mesenchymal stem cells (MSCs), play a pivotal role in tissue regeneration and repair. Innovations in biomaterials, 3D bioprinting, and scaffold technologies are enhancing the efficacy of stem cell-based tissue engineering therapies. These advancements enable the creation of functional tissues for applications in orthopedics, cardiovascular repair, and wound healing.

The biopharmaceutical companies segment accounted for the largest share of 56% in 2023 and is projected to grow at the fastest CAGR of 11.53%, driving innovation and commercialization of stem cell-based therapies. These companies are heavily investing in research and development to harness the therapeutic potential of adult stem cells across various medical applications. They collaborate with academic institutions and clinical research organizations to advance clinical trials and regulatory approvals. For instance, in August 2021, Gilead Sciences subsidiary Kite announced the acquisition of Appia Bio Inc., a biotechnology company. The partnership aims to jointly explore and develop new hematopoietic stem cell (HSC)-derived therapies specifically targeting hematopoietic cancers (haematological malignancies).

The research institutes segment is expanding as institutions focus on pioneering advancements in stem cell research. These institutes drive innovation through fundamental research, clinical trials, and collaborations with biotechnology firms and healthcare providers. They play a critical role in advancing knowledge of stem cell biology, therapeutic applications, and translational research efforts. With increased funding and interdisciplinary collaborations, research institutes are shaping the future of regenerative medicine and contributing to the growth and development of the market.

By Type

By Product & Services

By Indication

By Application

By End Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Adult Stem Cells Market

5.1. COVID-19 Landscape: Adult Stem Cells Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Adult Stem Cells Market, By Type

8.1. Adult Stem Cells Market, by Type, 2024-2033

8.1.1. Autologous Adult Stem Cells

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Allogeneic Adult Stem Cells

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Adult Stem Cells Market, By Product & Services

9.1. Adult Stem Cells Market, by Product & Services, 2024-2033

9.1.1. Product

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Services

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Adult Stem Cells Market, By Indication

10.1. Adult Stem Cells Market, by Indication, 2024-2033

10.1.1. Bone and Cartilage Repair

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Cardiovascular Diseases

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Inflammatory and Immunological Diseases

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Liver diseases

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Cancer

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. GvHD

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Adult Stem Cells Market, By Application

11.1. Adult Stem Cells Market, by Application, 2024-2033

11.1.1. Therapeutics

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Disease Modeling

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Drug Development & Discovery

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Toxicology Studies

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Biobanking

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Tissue Engineering

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Others

11.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Adult Stem Cells Market, By End Use

12.1. Adult Stem Cells Market, by End Use, 2024-2033

12.1.1. Biopharmaceutical Companies

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Research Institutes

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Hospitals & Clinics

12.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Adult Stem Cells Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Type (2021-2033)

13.1.2. Market Revenue and Forecast, by Product & Services (2021-2033)

13.1.3. Market Revenue and Forecast, by Indication (2021-2033)

13.1.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.5. Market Revenue and Forecast, by End Use (2021-2033)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Type (2021-2033)

13.1.6.2. Market Revenue and Forecast, by Product & Services (2021-2033)

13.1.6.3. Market Revenue and Forecast, by Indication (2021-2033)

13.1.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.7. Market Revenue and Forecast, by End Use (2021-2033)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Type (2021-2033)

13.1.8.2. Market Revenue and Forecast, by Product & Services (2021-2033)

13.1.8.3. Market Revenue and Forecast, by Indication (2021-2033)

13.1.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.8.5. Market Revenue and Forecast, by End Use (2021-2033)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Type (2021-2033)

13.2.2. Market Revenue and Forecast, by Product & Services (2021-2033)

13.2.3. Market Revenue and Forecast, by Indication (2021-2033)

13.2.4. Market Revenue and Forecast, by Application (2021-2033)

13.2.5. Market Revenue and Forecast, by End Use (2021-2033)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

13.2.6.2. Market Revenue and Forecast, by Product & Services (2021-2033)

13.2.6.3. Market Revenue and Forecast, by Indication (2021-2033)

13.2.7. Market Revenue and Forecast, by Application (2021-2033)

13.2.8. Market Revenue and Forecast, by End Use (2021-2033)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Type (2021-2033)

13.2.9.2. Market Revenue and Forecast, by Product & Services (2021-2033)

13.2.9.3. Market Revenue and Forecast, by Indication (2021-2033)

13.2.10. Market Revenue and Forecast, by Application (2021-2033)

13.2.11. Market Revenue and Forecast, by End Use (2021-2033)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Type (2021-2033)

13.2.12.2. Market Revenue and Forecast, by Product & Services (2021-2033)

13.2.12.3. Market Revenue and Forecast, by Indication (2021-2033)

13.2.12.4. Market Revenue and Forecast, by Application (2021-2033)

13.2.13. Market Revenue and Forecast, by End Use (2021-2033)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Type (2021-2033)

13.2.14.2. Market Revenue and Forecast, by Product & Services (2021-2033)

13.2.14.3. Market Revenue and Forecast, by Indication (2021-2033)

13.2.14.4. Market Revenue and Forecast, by Application (2021-2033)

13.2.15. Market Revenue and Forecast, by End Use (2021-2033)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Type (2021-2033)

13.3.2. Market Revenue and Forecast, by Product & Services (2021-2033)

13.3.3. Market Revenue and Forecast, by Indication (2021-2033)

13.3.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.5. Market Revenue and Forecast, by End Use (2021-2033)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

13.3.6.2. Market Revenue and Forecast, by Product & Services (2021-2033)

13.3.6.3. Market Revenue and Forecast, by Indication (2021-2033)

13.3.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.7. Market Revenue and Forecast, by End Use (2021-2033)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Type (2021-2033)

13.3.8.2. Market Revenue and Forecast, by Product & Services (2021-2033)

13.3.8.3. Market Revenue and Forecast, by Indication (2021-2033)

13.3.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.9. Market Revenue and Forecast, by End Use (2021-2033)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Type (2021-2033)

13.3.10.2. Market Revenue and Forecast, by Product & Services (2021-2033)

13.3.10.3. Market Revenue and Forecast, by Indication (2021-2033)

13.3.10.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.10.5. Market Revenue and Forecast, by End Use (2021-2033)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Type (2021-2033)

13.3.11.2. Market Revenue and Forecast, by Product & Services (2021-2033)

13.3.11.3. Market Revenue and Forecast, by Indication (2021-2033)

13.3.11.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.11.5. Market Revenue and Forecast, by End Use (2021-2033)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Type (2021-2033)

13.4.2. Market Revenue and Forecast, by Product & Services (2021-2033)

13.4.3. Market Revenue and Forecast, by Indication (2021-2033)

13.4.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.5. Market Revenue and Forecast, by End Use (2021-2033)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

13.4.6.2. Market Revenue and Forecast, by Product & Services (2021-2033)

13.4.6.3. Market Revenue and Forecast, by Indication (2021-2033)

13.4.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.7. Market Revenue and Forecast, by End Use (2021-2033)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Type (2021-2033)

13.4.8.2. Market Revenue and Forecast, by Product & Services (2021-2033)

13.4.8.3. Market Revenue and Forecast, by Indication (2021-2033)

13.4.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.9. Market Revenue and Forecast, by End Use (2021-2033)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Type (2021-2033)

13.4.10.2. Market Revenue and Forecast, by Product & Services (2021-2033)

13.4.10.3. Market Revenue and Forecast, by Indication (2021-2033)

13.4.10.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.10.5. Market Revenue and Forecast, by End Use (2021-2033)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Type (2021-2033)

13.4.11.2. Market Revenue and Forecast, by Product & Services (2021-2033)

13.4.11.3. Market Revenue and Forecast, by Indication (2021-2033)

13.4.11.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.11.5. Market Revenue and Forecast, by End Use (2021-2033)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Type (2021-2033)

13.5.2. Market Revenue and Forecast, by Product & Services (2021-2033)

13.5.3. Market Revenue and Forecast, by Indication (2021-2033)

13.5.4. Market Revenue and Forecast, by Application (2021-2033)

13.5.5. Market Revenue and Forecast, by End Use (2021-2033)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Type (2021-2033)

13.5.6.2. Market Revenue and Forecast, by Product & Services (2021-2033)

13.5.6.3. Market Revenue and Forecast, by Indication (2021-2033)

13.5.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.5.7. Market Revenue and Forecast, by End Use (2021-2033)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Type (2021-2033)

13.5.8.2. Market Revenue and Forecast, by Product & Services (2021-2033)

13.5.8.3. Market Revenue and Forecast, by Indication (2021-2033)

13.5.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.5.8.5. Market Revenue and Forecast, by End Use (2021-2033)

Chapter 14. Company Profiles

14.1. Thermo Fisher Scientific, Inc

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. STEMCELL Technologies

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Osiris Therapeutics

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Vericel Corporation

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. ZenBio, Inc.

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Stempeutics Research

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Fate Therapeutics, Inc.

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. BrainStorm Cell Therapeutics Inc.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Celgene Corporation

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Stemedica Cell Technologies, Inc.

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others