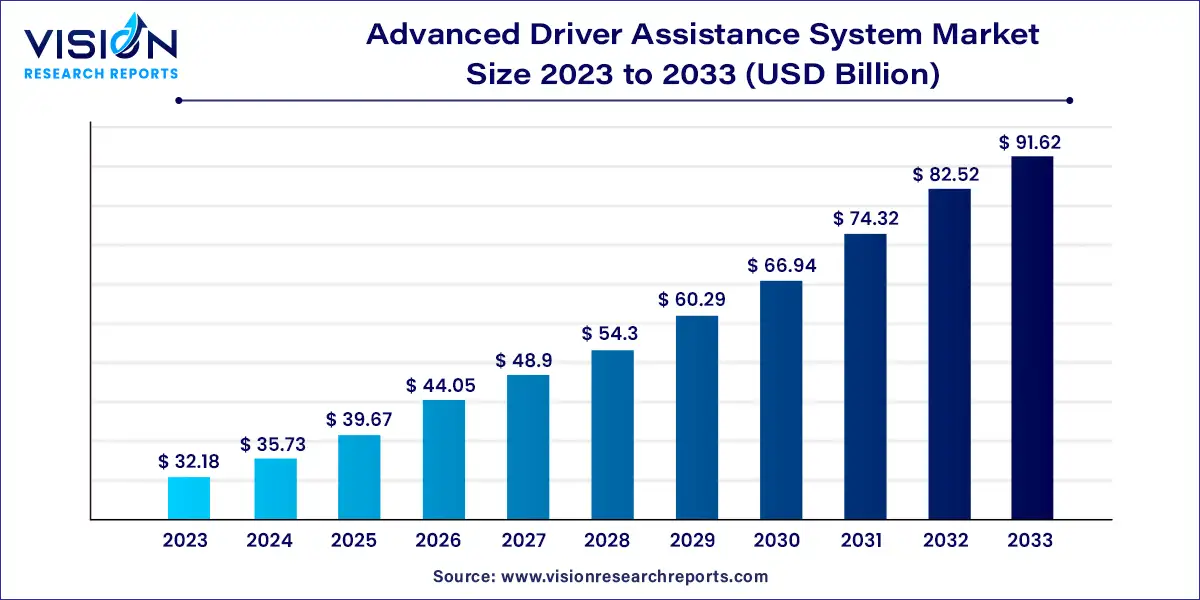

The global advanced driver assistance system market size was estimated at USD 32.18 billion in 2023 and it is expected to surpass around USD 91.62 billion by 2033, poised to grow at a CAGR of 11.03% from 2024 to 2033.

The advanced driver assistance system (ADAS) market is experiencing rapid growth driven by increasing demand for safety features in automobiles and the advancement of autonomous driving technology. ADAS encompasses a range of systems and sensors designed to enhance vehicle safety and driver convenience by providing assistance and alerts for tasks such as lane-keeping, collision avoidance, adaptive cruise control, and parking assistance. With the rise in traffic congestion, stringent safety regulations, and the push towards autonomous vehicles, the adoption of ADAS is expected to continue growing across the globe.

The advanced driver assistance system (ADAS) market is driven by an increasing concerns regarding road safety and the rising number of road accidents have led to a growing demand for advanced safety features in vehicles. ADAS technologies offer functionalities such as lane departure warning, adaptive cruise control, and automatic emergency braking, which help mitigate accidents and enhance overall safety on the roads. Secondly, advancements in sensor technology, artificial intelligence, and machine learning have enabled the development of more sophisticated ADAS systems that offer higher levels of accuracy and reliability. Additionally, stringent government regulations mandating the inclusion of safety features in vehicles, coupled with consumer preferences for vehicles equipped with ADAS, are driving the market growth further.

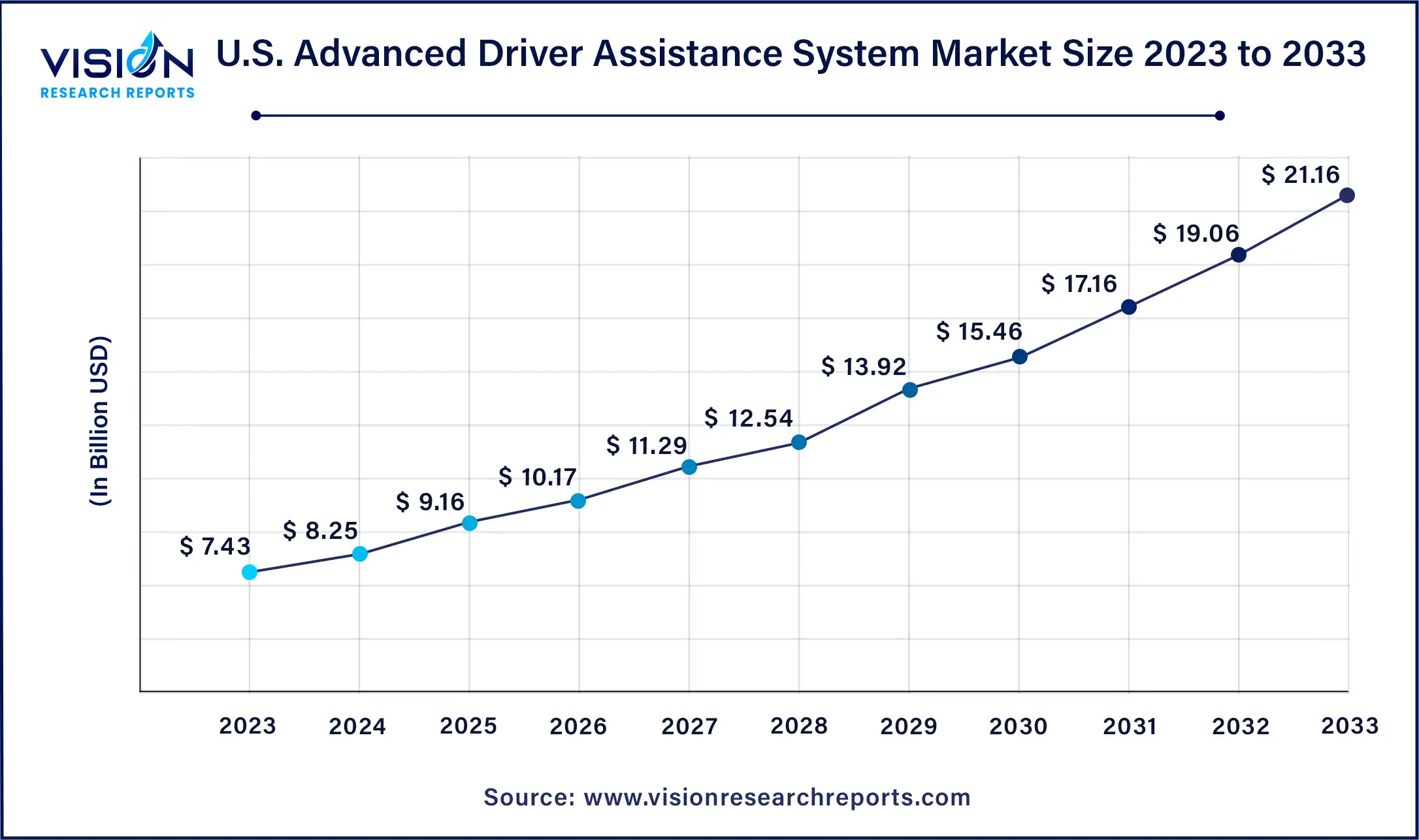

The U.S. advanced driver assistance system market size was estimated at around USD 7.43 billion in 2023 and is projected to hit around USD 21.16 billion by 2033, growing at a CAGR of 11.03% from 2024 to 2033.

North America emerged with the highest market share of 33% in 2023. The region's growth is propelled by technological advancements in the automotive sector and the presence of key industry players. Additionally, the region exhibits a higher adoption rate of new technologies, coupled with improved economic conditions. Rising fatality rates and increased sales of high-end vehicles, particularly in countries like Canada and the U.S., further contribute to market expansion in this region.

The Asia Pacific region is forecasted to witness the fastest CAGR of 12.34% over the projection period. This growth is attributed to heightened utilization of advanced electronics and significant automobile production in countries such as Japan, China, and South Korea. Government initiatives, including the implementation of emergency brake systems and adaptive cruise control systems, aim to incentivize Original Equipment Manufacturers (OEMs) to enter the market. Notably, several European and American manufacturers like Mercedes Benz, Volkswagen, and General Motors have relocated their production facilities to these countries, further driving market growth.

In 2023, the market was predominantly led by the adaptive cruise control (ACC) segment, holding the highest market share of 21%. This growth was propelled by heightened demand for safety features, advancements in sensor and radar technology, and governmental regulations mandating the inclusion of ACC systems in specific vehicles, notably commercial ones.

The blind spot detection system (BSD) segment is forecasted to witness the most rapid CAGR of 13.43% during the projection period. BSD systems utilize sensors to detect vehicles in a driver's blind spot, issuing visual or audible alerts to prevent accidents caused by lane changes without proper blind spot checks. Alongside the increasing demand for safety features, technological enhancements have made BSD systems more affordable and reliable in recent years.

In terms of component types, the advanced driver assistance system market is categorized into sensors, processors, software, and others. The sensor segment held the largest revenue share of 32% in 2023 and is anticipated to witness the fastest CAGR of 12.33% over the forecast period. This surge is attributed to the pivotal role of sensors in vehicle automation, with ADAS functionality primarily dependent on their accuracy. Various sensors like LIDAR, RADAR, ultrasonic, cameras, and others collaborate to execute the required assistance and safety functions.

The processor segment is projected to experience significant growth during the forecast period, driven by escalating demand for more robust and sophisticated ADAS features. ADAS systems necessitate potent processors to execute complex algorithms for object detection, movement tracking, and decision-making. Enhanced processors empower ADAS systems to undertake intricate tasks like lane-keeping assistance and adaptive cruise control.

The passenger car segment dominated with the largest revenue share of 74% in 2023 and is poised to exhibit the fastest CAGR of 11.24% over the forecast period. This growth is underpinned by heightened demand for safety systems in developing markets, buoyed by increasing consumer awareness, supportive legislation, and advancements in road safety standards.

The commercial car segment is anticipated to experience substantial growth with a significant CAGR over the forecast period. Among various commercial vehicle categories, the light commercial vehicles segment held the largest market share in 2021. However, spurred by directives from the European Union mandating the incorporation of fundamental ADAS functionalities like lane departure warning systems, adaptive cruise control systems, and autonomous emergency braking systems in all heavy commercial vehicles, a surge in demand for ADAS in heavy commercial vehicles is expected in the forecast period.

By Solution Type

By Component Type

By Vehicle Type

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others