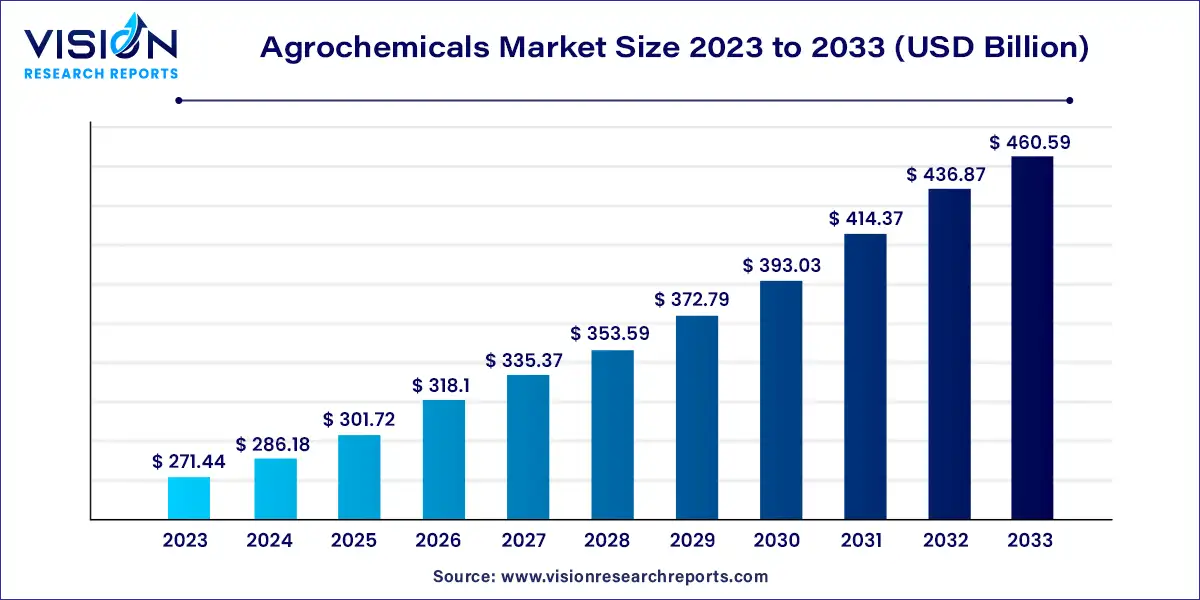

The global agrochemicals market size was estimated at around USD 271.44 billion in 2023 and it is projected to hit around USD 460.59 billion by 2033, growing at a CAGR of 5.43% from 2024 to 2033. The agrochemicals market encompasses a broad range of chemical products used in agriculture to enhance crop productivity and protection. These include fertilizers, pesticides, herbicides, fungicides, and insecticides. The global agrochemicals market plays a critical role in the agricultural sector by boosting yields, controlling pests and diseases, and ensuring food security.

The agrochemicals market is experiencing robust growth due to an increasing global population drives the demand for higher agricultural yields to ensure food security. This heightened demand for food necessitates advanced agricultural inputs, including agrochemicals, to maximize crop productivity and manage resources efficiently. Additionally, technological advancements in agrochemical formulations and application methods enhance their effectiveness and efficiency, further stimulating market growth. Innovations such as precision agriculture and smart farming practices optimize the use of agrochemicals, reducing waste and improving crop outcomes. Government initiatives and subsidies also play a crucial role, as they support the adoption of agrochemical products and promote sustainable agricultural practices. Together, these factors contribute to the continuous expansion of the agrochemicals market, addressing the evolving needs of modern agriculture.

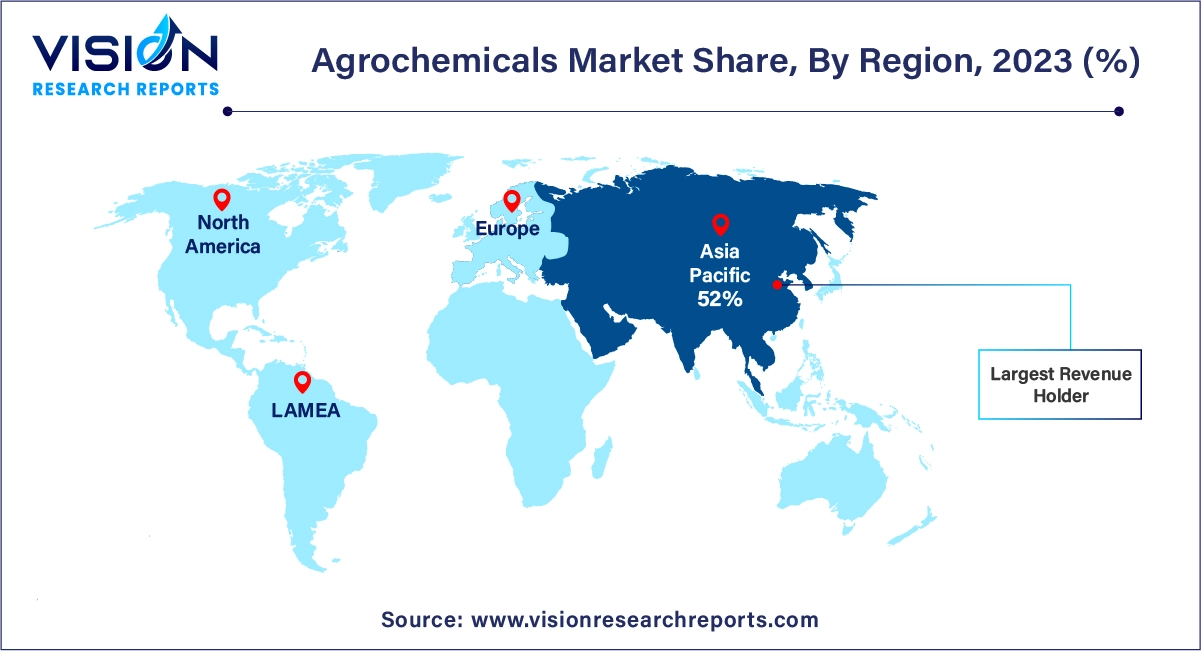

The Asia-Pacific region held a significant revenue share of 52% in 2023. This dominance is driven by the large population, increasing food demand, and rising agricultural production in countries such as India, China, Japan, and Australia. According to researchers from the University of Melbourne and Zhejiang, China is a major player in pesticide use, accounting for about 30% of global pesticide and fertilizer consumption and supplying over 90% of the world's technical raw material needs.

| Attribute | Asia Pacific |

| Market Value | USD 141.14 Billion |

| Growth Rate | 5.44% CAGR |

| Projected Value | USD 239.5 Billion |

North America is home to many agrochemical manufacturers and is expected to be the largest market for organic agrochemicals, including bio-fertilizers and bio-pesticides, due to strict environmental regulations. The region's thriving dairy industry and favorable climate conditions for crops like corn and maize are key drivers of market growth.

In Europe, countries like Germany, France, the UK, and Italy were major contributors to market growth in 2023. However, Spain, Bulgaria, Romania, and other nations have also seen rapid growth due to increased investments in agriculture and improved water preservation techniques. These factors have led to enhanced agricultural activities in the region, thereby boosting the demand for agrochemicals.

In 2023, the fertilizers segment led the market with a commanding revenue share of 77%. This dominance is primarily due to farmers’ increasing focus on boosting crop yields within shorter timeframes. The rising global demand for food and crops is putting pressure on agricultural lands, prompting farmers to use more fertilizers to enhance productivity and crop output.

The fertilizer segment includes various types such as nitrogenous, phosphatic, potassic, secondary fertilizers, and others. Among these, nitrogenous fertilizers are projected to experience rapid growth during the forecast period. These fertilizers are widely used due to their ability to accelerate plant growth and improve yields. However, excessive use of nitrogenous fertilizers can negatively impact the environment, including water sources.

The cereals and grains segment captured a significant share of 48% in 2023. This is attributed to the high consumption of cereals and grains like rice, wheat, rye, corn, oats, sorghum, and barley across various regions. Agrochemicals are predominantly utilized for these crops in Asia-Pacific and North America, where high volumes of wheat and corn are cultivated, notably in countries such as China and the U.S. Non-ionic surfactants, along with agrochemicals, are typically recommended for these crops.

The oilseeds and pulses segment, which includes crops such as sunflower seeds, soybeans, and legumes, is also experiencing growth. Increased focus on oilseed production, particularly in major producers like Brazil, China, and the U.S., is expected to drive demand for agrochemicals in these countries.

The rising global consumption of vegetarian foods and increasing health consciousness among consumers are contributing to the demand for fruits and vegetables. This growing demand is anticipated to positively impact the agrochemicals market. Additionally, increased production of fruit and vegetable crops is expected to further drive market growth.

The "others" segment includes various crops such as herbs, tea, spices, and coffee. The growing preference for beverages like tea and coffee, along with the expansion of the hospitality industry, is likely to boost agrochemical demand in this segment.

By Product

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Agrochemicals Market

5.1. COVID-19 Landscape: Agrochemicals Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Agrochemicals Market, By Product

8.1. Agrochemicals Market, by Product, 2024-2033

8.1.1. Fertilizers

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Crop Protection Chemicals

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Plant Growth Regulators

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Agrochemicals Market, By Application

9.1. Agrochemicals Market, by Application, 2024-2033

9.1.1. Cereal & Grain

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Oilseeds & Pulses

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Fruits & Vegetables

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Agrochemicals Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Royal Dutch Shell plc

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. OCP Group

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. SABIC

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. PhosAgro

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Yara International

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Rashtriya Chemical Fertilizer Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Adjuvants Plus Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Merck KGaA

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Praxair Technology, Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Southern Agricultural Insecticides, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others