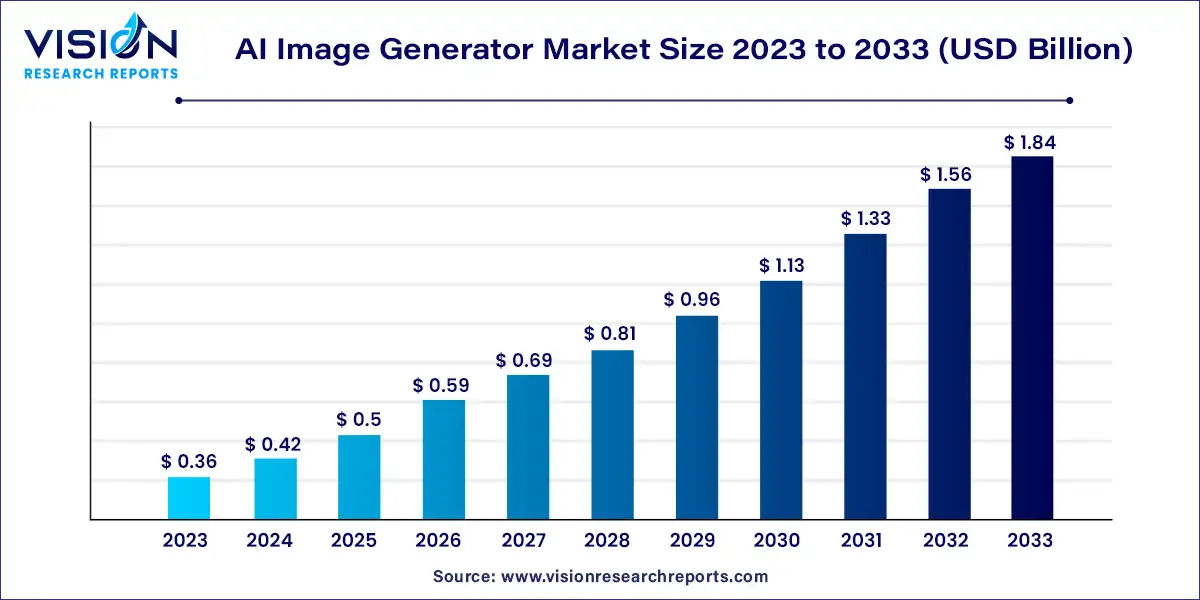

The global AI image generator market size was estimated at around USD 0.36 billion in 2023 and it is projected to hit around USD 1.84 billion by 2033, growing at a CAGR of 17.73% from 2024 to 2033.

The AI image generator market is rapidly expanding as advancements in artificial intelligence and machine learning technologies continue to evolve. This market encompasses a range of applications from entertainment and advertising to healthcare and education, where AI-generated images enhance creativity, efficiency, and functionality.

The growth of the AI image generator market is primarily driven by the technological advancements, increasing demand for digital content, and cost efficiency. Continuous improvements in AI algorithms, particularly Generative Adversarial Networks (GANs), are enhancing the quality and realism of generated images, making them more appealing for various applications. The rising need for unique and high-quality digital content in industries such as media, entertainment, and advertising is accelerating the adoption of AI image generators. Additionally, these tools offer significant cost savings by reducing the time and resources required for manual graphic design, further propelling market growth.

The software segment dominated the market in 2023, capturing a revenue share of 80%. AI image generator software offers features that enable users to customize and personalize the generated images. Users can adjust parameters, styles, and attributes to create images that meet their specific requirements and preferences, thereby enhancing user engagement and providing more tailored visual outputs. Cloud computing plays a significant role in the AI image generator market, supporting the development and deployment of these tools. Additionally, deep learning platforms like TensorFlow, PyTorch, and Keras continue to evolve, providing developers with powerful tools and libraries for building, training, and deploying AI models, thus facilitating the creation of sophisticated AI image generator software solutions.

AI image generator services can produce new images based on inputs such as text descriptions, semantic tags, or specific style preferences. These services leverage deep learning models, including generative adversarial networks (GANs), to create images that replicate certain styles, objects, or concepts. Moreover, AI image generator services offer style transfer capabilities, allowing users to apply the visual style of one image to another, creating unique and visually appealing compositions.

The media and entertainment segment led the market in 2023, holding the largest revenue share. AI image generators are increasingly utilized in this industry to enhance various aspects of content creation, production, and delivery. For instance, AI image generators are employed to create visual effects for films, television shows, and commercials, generating realistic CGI elements such as virtual environments, creatures, and simulations. These tools assist in seamlessly integrating CGI with live-action footage, thus enhancing the overall visual impact of the content. Additionally, AI image generators are used to restore and remaster old or damaged media content, improving image quality, reducing noise, restoring color, and repairing artifacts, thereby revitalizing classic films, documentaries, and archival footage.

AI image generators are also revolutionizing the e-commerce industry by enhancing the visual experience, improving product visualization, and increasing customer engagement. They enable virtual try-on experiences for fashion and accessories, allowing customers to upload their photos or use their device’s camera to see how clothing items, eyewear, or accessories would look on them. AI algorithms generate realistic representations of the products on the user’s image, helping them make informed purchase decisions and reducing the likelihood of returns. Notable examples include Warby Parker in the U.S. for eyewear and ASOS in London for clothing.

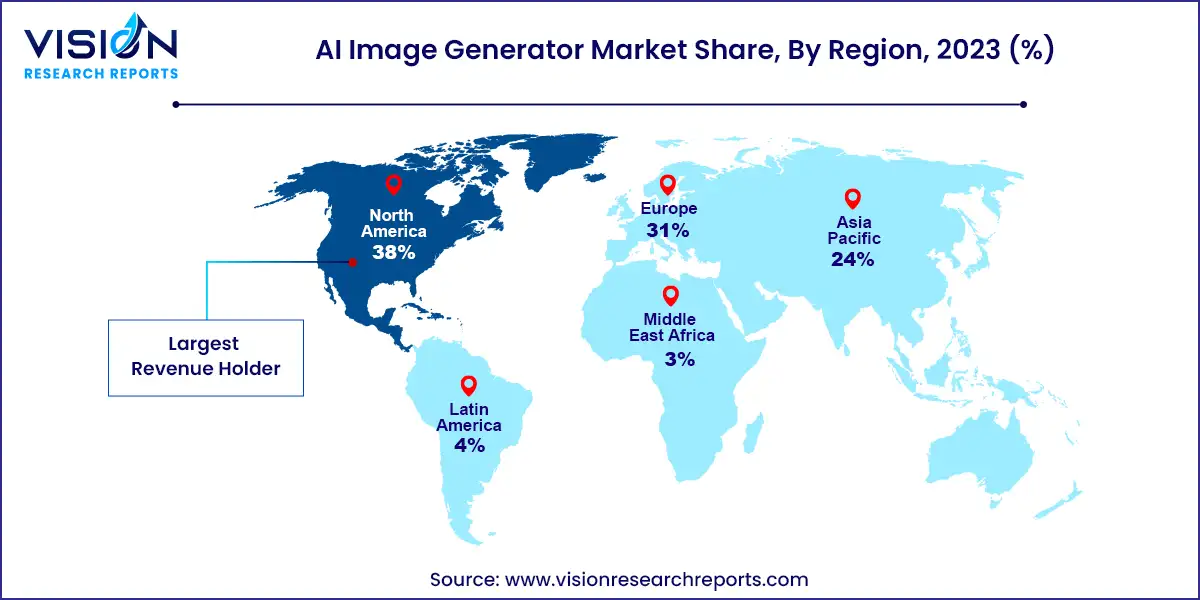

In 2023, North America dominated the market with a revenue share of 38%. The presence of major technology companies, research institutions, and startups focused on AI development drives innovation and adoption of AI image generator technology in the region. North America's mature e-commerce industry further fuels the demand for advanced visual experiences and personalized product recommendations. Additionally, the media and entertainment, gaming, and advertising industries extensively utilize AI image generator technology.

The AI image generator market in Asia Pacific is projected to grow at the highest CAGR over the forecast period of 2024-2033. Countries such as China, Japan, South Korea, and India are at the forefront of AI technology adoption. E-commerce giants in the region are integrating AI image generators to enhance the visual experience, improve product discovery, and increase customer engagement. The gaming industry in Asia Pacific is also leveraging AI image generators for character and world design, contributing to the market's expansion.

By Component

By End-user

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on AI Image Generator Market

5.1. COVID-19 Landscape: AI Image Generator Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global AI Image Generator Market, By Component

8.1. AI Image Generator Market, by Component, 2024-2033

8.1.1. Software

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global AI Image Generator Market, By End-user

9.1. AI Image Generator Market, by End-user, 2024-2033

9.1.1. Media & Entertainment

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Healthcare

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Fashion

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Social Media

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. E-commerce

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global AI Image Generator Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Component (2021-2033)

10.1.2. Market Revenue and Forecast, by End-user (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Component (2021-2033)

10.1.3.2. Market Revenue and Forecast, by End-user (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Component (2021-2033)

10.1.4.2. Market Revenue and Forecast, by End-user (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Component (2021-2033)

10.2.2. Market Revenue and Forecast, by End-user (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Component (2021-2033)

10.2.3.2. Market Revenue and Forecast, by End-user (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Component (2021-2033)

10.2.4.2. Market Revenue and Forecast, by End-user (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Component (2021-2033)

10.2.5.2. Market Revenue and Forecast, by End-user (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Component (2021-2033)

10.2.6.2. Market Revenue and Forecast, by End-user (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Component (2021-2033)

10.3.2. Market Revenue and Forecast, by End-user (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Component (2021-2033)

10.3.3.2. Market Revenue and Forecast, by End-user (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Component (2021-2033)

10.3.4.2. Market Revenue and Forecast, by End-user (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Component (2021-2033)

10.3.5.2. Market Revenue and Forecast, by End-user (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Component (2021-2033)

10.3.6.2. Market Revenue and Forecast, by End-user (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Component (2021-2033)

10.4.2. Market Revenue and Forecast, by End-user (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Component (2021-2033)

10.4.3.2. Market Revenue and Forecast, by End-user (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Component (2021-2033)

10.4.4.2. Market Revenue and Forecast, by End-user (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Component (2021-2033)

10.4.5.2. Market Revenue and Forecast, by End-user (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Component (2021-2033)

10.4.6.2. Market Revenue and Forecast, by End-user (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Component (2021-2033)

10.5.2. Market Revenue and Forecast, by End-user (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Component (2021-2033)

10.5.3.2. Market Revenue and Forecast, by End-user (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Component (2021-2033)

10.5.4.2. Market Revenue and Forecast, by End-user (2021-2033)

Chapter 11. Company Profiles

11.1. AISEO

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Box 20 LLC

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Craiyon LLC.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. CodeSandbox B.V.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. DeepAI

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Jasper.ai

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. NightCafe Studio

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Panabee, LLC.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Runway AI, Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Starryai

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others