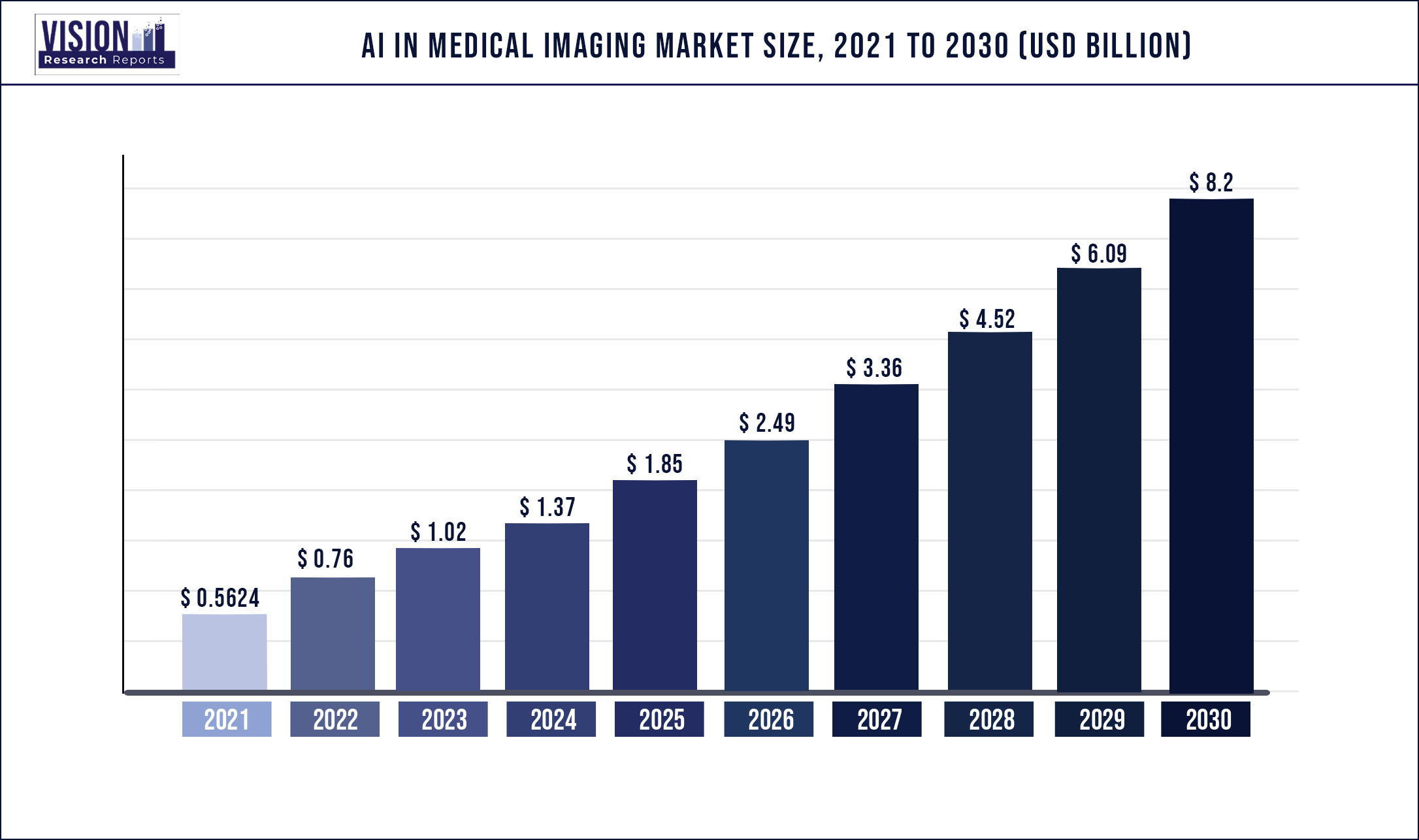

The global AI in medical imaging market was surpassed at USD 562.4 million in 2021 and is expected to hit around USD 8.2 billion by 2030, growing at a CAGR of 34.68% from 2022 to 2030.

Report Highlights

The growing aging population and increased investment in the healthcare ecosystem by government and private players. Moreover, developed countries have been investing in offering people access to inexpensive and advanced healthcare systems in response to this demographic challenge, ultimately boosting the market growth. Additionally, X-ray imaging technology is utilized to identify a variety of disorders, including fractures, infections, various malignancies, and arthritis. As a result, the rise in the incidence rate of these diseases is expected to have a positive impact on the market growth.

COVID-19 had a positive impact on the market as the majority of medical professionals chose imaging as one of the most popular COVID-19 screening modalities as it provided critical diagnostic in a short time. The entire set of imaging data has been used to research the virus and its effect on people of various demographics. Many hospitals have resorted to medical imaging and image analytics techniques to improve the identification and control of the virus as nearly every healthcare organization is working to manage COVID-19 better and limit its spread. For instance, in June 2020, a hospital in Florida, the Tampa General Hospital employed AI-driven technology to check people for COVID-19 before they interacted with staff members and other patients.

The rising awareness regarding the benefits offered by Artificial Intelligence (AI) technologies and their application in the medical field has led to increased adoption of AI-based solutions, products, and services in the healthcare market. Moreover, to develop advanced AI-based applications for the healthcare industry, several leading healthcare companies are adopting different strategies such as collaborations, mergers & acquisitions, and partnerships with top AI technology vendors to provide cutting-edge solutions to their clients and strengthen their position in this competitive market environment. For instance, in June 2020, Intel announced its partnership with Maricopa County Community College District to introduce the first artificial intelligence associate degree in the North American region. The initiative will also be supported by a USD 100,000 workforce grant from the Arizona Commerce Authority. A number of students are expected to benefit from this partnership as it enables students to pursue employment in the automotive, technology, healthcare, and aerospace industries.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 562.4 million |

| Revenue Forecast by 2030 | USD 8.2 billion |

| Growth rate from 2022 to 2030 | CAGR of 34.68% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Technology, application, modality, end-use, region |

| Companies Covered |

Siemens Healthineers; General Electric; Koninklije Philips; IBM; Agfa-Gevaert Group/Agfa Health Care; Arterys; AZmed; Caption Health; Gleamer; Butterfly Network |

Technology Insights

The deep learning segment held the largest share of over 55.02% in 2021 as it is used in radiological applications such as object detection, image generation, image transformation, and image segmentation. By technology, the market is divided into deep learning, NLP, and others.

The NLP segment is anticipated to grow at the fastest rate of 35.75% from 2022 to 2030. NLP technology uses a computer program that comprehends and presents data in the form of current human language, images, and text. The growth is attributed to the increased use of NLP in the popular fields of machine learning (ML) and artificial intelligence (AI). New trends and developments in the discipline have emerged due to NLP's quick growth. It helps in everything from diagnosis to the discovery of new drugs. Healthcare also strongly relies on various forms of photos and scans. Computer vision in NLP healthcare emerges. These images are frequently blurry and difficult to recognize or identified precise patterns. In these kinds of picture processing, NLP can help and frequently outperform humans. Medical professionals and providers can benefit from using computer vision in healthcare to obtain quicker, more precise findings from examinations, scans, and screenings.

Application Insights

The neurology segment held the largest share of over 35.03% in 2021 owing to the increased use of AI in neurology as it enables higher accuracy, better patient care, and high efficiency. Additionally, AI is used in neuro-oncology, neuro-vascular disease detection, neurosurgery, and traumatic brain injury detection. By application, the market is segmented into neurology, respiratory and pulmonary, cardiology, breast screening, orthopedics, and others.

The breast screening segment is anticipated to grow at the fastest rate of 41.7% during the forecast period. The rise in breast cancer cases and patient desire for early-stage diagnosis, which helps in getting the precise treatment at the earliest, are factors driving the demand for breast screening. Some other key drivers anticipated to fuel market growth include supportive government initiatives to assist clinical interpretation and increased access to breast cancer screening technologies. In October 2021, the government of Goa initiated a program for 1 lakh women offering free breast cancer screenings. As part of this initiative, breast cancer screening is done at the 35 health centers in Goa.

Modality Insights

In 2021, the CT scan segment held the largest revenue share of over 35.05% due to the higher standard method of imaging for many clinical results. A wide variety of AI-based medical imaging solutions are being offered by both major and minor suppliers for use in the CT scan modality. The CT scan collects more thorough data as compared to other methods. In addition, it has not been demonstrated that the little amounts of radiation used in CT scans are harmful over the long term. Based on modality, the market is segmented into CT scan, MRI, X-rays, ultrasound, and nuclear imaging.

The X-ray segment is anticipated to expand at the fastest CAGR during the forecast period. The increased usage of interventional x-ray equipment, such as C-arms and others, for image-guided surgeries, is the main factor driving the segment. The development of C-arms, notably tiny C-arms with flat panel detectors and digital radiography, has significantly increased the need for X-rays worldwide. In July 2019, based on X-ray technology, a mobile C-arm a flexible medical imaging tool has been developed that can be utilized in different operating rooms (ORs) throughout a clinic.

End-use Insights

The hospitals segment dominated the market with a revenue share of over 50.03% in 2021 and is expected to expand at the fastest CAGR during the forecast period. The growth is anticipated as hospitals are preferred by patients for the treatment process in the context of convenience and a variety of product offerings in one place. Moreover, hospitals are omnipresent and easily accessible.

Based on end-use, the market is segmented into hospitals, diagnostic imaging centers, and others. The hospitals segment is also anticipated to benefit from favorable reimbursement regulations. For instance, as per the American Hospital Association’s 2020 annual survey, AI-based imaging technology was used more in hospitals as compared to diagnostic centers.

Regional Insights

North America dominated the market with a revenue share of over 40.04% in 2021 owing to the technologically advanced infrastructure and high per capita income. In addition, presence of a large number of market players and supporting government regulations in the region are driving the market for AI in medical imaging. In June 2021, Avicenna received FDA approval for CINA-LVO, CINA-ICH, and neurovascular emergency apps and is available on the Nuance AI marketplace. It provides a specific point of access to a wide range of AI diagnostic models within the radiology platform offering.

Asia Pacific is expected to register the fastest growth rate of 37.27% over the forecast period owing to the significant adoption of advanced technologies, enhanced network connectivity, and increased government programs. In addition, the rising number of startups using artificial intelligence (AI), particularly in China and India, the rapidly increasing investment, and the enormous potential of AI to close the region's healthcare infrastructure gap by improving image quality are driving factors. In May 2021, ThinkCyte, an AI-based medical imaging company, and Sysmex Corporation collaborated to improve the accuracy of diagnoses and enhance treatment. In addition, both companies are working to develop novel testing and diagnostic technologies. These technologies have high clinical value. Meanwhile, digitalization is accelerating in areas of healthcare including AI-powered medical image processing and robotically assisted testing.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on AI In Medical Imaging Market

5.1. COVID-19 Landscape: AI In Medical Imaging Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global AI In Medical Imaging Market, By Technology

8.1. AI In Medical Imaging Market, by Technology, 2022-2030

8.1.1. Deep Learning

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Natural Language Processing (NLP)

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global AI In Medical Imaging Market, By Application

9.1. AI In Medical Imaging Market, by Application, 2022-2030

9.1.1. Neurology

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Respiratory and Pulmonary

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Cardiology

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Breast Screening

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Orthopedics

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global AI In Medical Imaging Market, By Modality

10.1. AI In Medical Imaging Market, by Modality, 2022-2030

10.1.1. CT Scan

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. MRI

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. X-rays

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Ultrasound

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Nuclear Imaging

10.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global AI In Medical Imaging Market, By End-use

11.1. AI In Medical Imaging Market, by End-use, 2022-2030

11.1.1. Hospitals

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Diagnostic Imaging Centers

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Others

11.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global AI In Medical Imaging Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Technology (2017-2030)

12.1.2. Market Revenue and Forecast, by Application (2017-2030)

12.1.3. Market Revenue and Forecast, by Modality (2017-2030)

12.1.4. Market Revenue and Forecast, by End-use (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Technology (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Application (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Modality (2017-2030)

12.1.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Technology (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Application (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Modality (2017-2030)

12.1.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Technology (2017-2030)

12.2.2. Market Revenue and Forecast, by Application (2017-2030)

12.2.3. Market Revenue and Forecast, by Modality (2017-2030)

12.2.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Technology (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Modality (2017-2030)

12.2.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Technology (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Modality (2017-2030)

12.2.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Technology (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Application (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Modality (2017-2030)

12.2.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Technology (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Application (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Modality (2017-2030)

12.2.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Technology (2017-2030)

12.3.2. Market Revenue and Forecast, by Application (2017-2030)

12.3.3. Market Revenue and Forecast, by Modality (2017-2030)

12.3.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Technology (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Modality (2017-2030)

12.3.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Technology (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Modality (2017-2030)

12.3.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Technology (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Application (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Modality (2017-2030)

12.3.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Technology (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Application (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Modality (2017-2030)

12.3.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Technology (2017-2030)

12.4.2. Market Revenue and Forecast, by Application (2017-2030)

12.4.3. Market Revenue and Forecast, by Modality (2017-2030)

12.4.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Technology (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Modality (2017-2030)

12.4.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Technology (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Modality (2017-2030)

12.4.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Technology (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Application (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Modality (2017-2030)

12.4.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Technology (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Application (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Modality (2017-2030)

12.4.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Technology (2017-2030)

12.5.2. Market Revenue and Forecast, by Application (2017-2030)

12.5.3. Market Revenue and Forecast, by Modality (2017-2030)

12.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Technology (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Application (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Modality (2017-2030)

12.5.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Technology (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Application (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Modality (2017-2030)

12.5.6.4. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 13. Company Profiles

13.1. Siemens Healthineers

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. General Electric

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Koninklije Philips

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. IBM

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Agfa-Gevaert Group/Agfa Health Care

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Arterys

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. AZmed

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Caption Health

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Gleamer

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Butterfly Network

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others