The global air freight market size was estimated at around USD 257.47 billion in 2023 and it is projected to hit around USD 689.37 billion by 2033, growing at a CAGR of 10.35% from 2024 to 2033. The air freight market plays a crucial role in global trade by providing fast and reliable transportation of goods across international borders. This sector has seen significant growth in recent years due to increasing demand for timely deliveries and the expansion of global supply chains.

The air freight market is experiencing robust growth due to the surge in e-commerce activities is a primary driver, as the demand for rapid and reliable delivery solutions has intensified. This trend is bolstered by advancements in technology, such as enhanced tracking systems and automation, which streamline operations and improve service efficiency. Additionally, the global expansion of supply chains has increased reliance on air freight for timely and secure delivery of goods, particularly in industries where speed is critical, like pharmaceuticals and high-tech electronics. Furthermore, the rise in international trade and the need for just-in-time inventory management are fueling the demand for air cargo services.

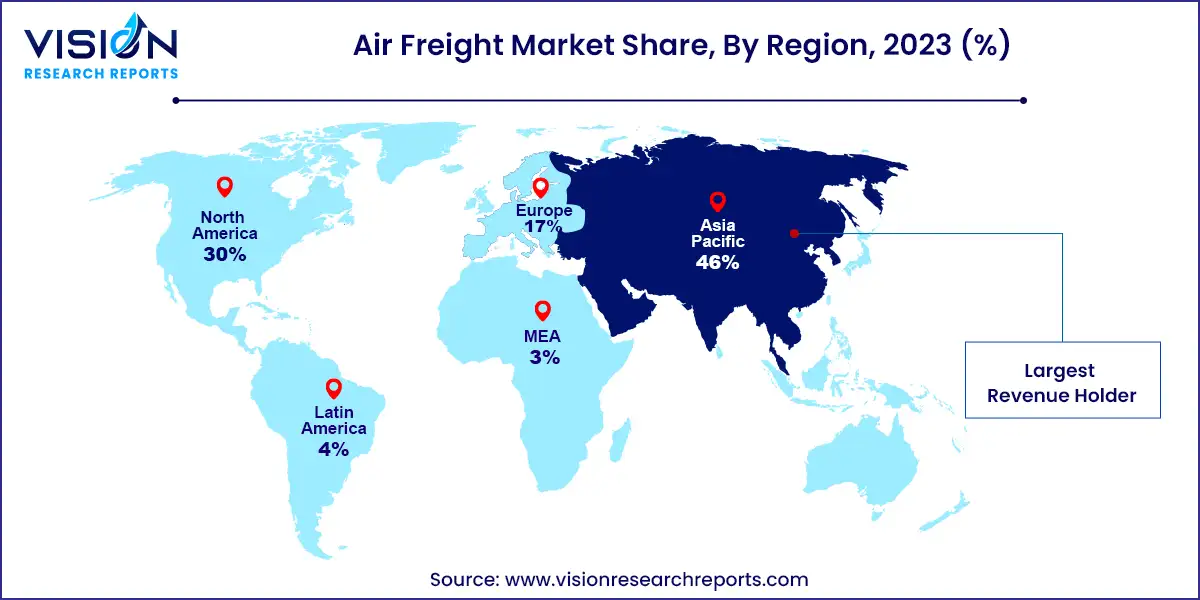

In 2023, the Asia Pacific air freight market dominated globally, accounting for 46% of the total revenue. The region's dominance is driven by robust economic growth, a vast manufacturing base, and significant trade activities. Major exporters like China, Japan, and South Korea necessitate efficient air freight services for electronics, automotive parts, and industrial machinery. The region’s advanced logistics infrastructure, including top-tier airports and sophisticated supply chain systems, supports its market leadership. Additionally, the growth of e-commerce giants like Alibaba and JD.com has increased the demand for rapid and reliable air freight services to meet fast delivery expectations.

| Attribute | Asia Pacific |

| Market Value | USD 118.43 Billion |

| Growth Rate | 10.37% CAGR |

| Projected Value | USD 317.11 Billion |

North America Air Freight Market Trends

The North American air freight market is projected to grow steadily from 2024 to 2033, supported by a strong economy, advanced logistics infrastructure, and a thriving e-commerce sector. The U.S. and Canada are central to this growth, with their extensive airport networks and sophisticated supply chain systems. Economic strength and high consumer demand for quick deliveries drive the need for efficient air freight services. The expansion of e-commerce platforms like Amazon and the prevalence of just-in-time delivery models are key growth factors. North America's strategic trade agreements, such as the USMCA, further streamline cross-border air freight operations. Ongoing investments in technology and infrastructure are also enhancing the region's air freight capabilities, ensuring its position as a leading market.

Europe Air Freight Market Trends

The air freight market in Europe is expected to grow at a notable CAGR from 2024 to 2033. Europe's growth is driven by its advanced industrial base, strong trade links, and extensive logistics networks. Key economies like Germany, the U.K., and the Netherlands play a significant role, thanks to their robust manufacturing sectors and high export volumes of machinery, automotive parts, and pharmaceuticals. The region's well-developed infrastructure, including major airports such as Frankfurt, Amsterdam Schiphol, and London Heathrow, supports efficient air freight operations. The rise of e-commerce and the increasing consumer demand for quick delivery services are also fueling market growth. Furthermore, ongoing investments in technology and sustainability, such as reducing carbon emissions from air transport, are enhancing the efficiency and competitiveness of the European air freight market.

In 2023, the freight segment led the market, capturing over 38% of global revenue. This dominance is attributed to its capability to handle large volumes of goods efficiently, which is essential for industries like manufacturing, retail, and automotive that depend on reliable and timely bulk shipments. The robust infrastructure supporting freight services at major airports worldwide enhances their operational efficiency. Additionally, globalization and the expansion of e-commerce have escalated the demand for freight services, as businesses strive to maintain inventory levels and meet consumer expectations promptly.

The express segment, however, is expected to experience faster growth from 2024 to 2033. The rise in e-commerce and the increasing need for swift delivery solutions are driving this growth. The demand for quicker delivery times is compelling logistics providers to enhance their express service offerings. Innovations such as real-time tracking and advanced logistics management have improved the efficiency and reliability of express services, making them the preferred choice for high-priority and time-sensitive shipments.

The domestic air freight segment is anticipated to grow at the highest CAGR during the forecast period, fueled by the high volume of goods transported within countries. This growth is driven by strong domestic trade and efficient national logistics networks. Key industries such as retail, manufacturing, and agriculture rely heavily on domestic air freight for timely distribution. The well-developed infrastructure and streamlined customs processes within countries enhance the efficiency of domestic air freight services, supporting the need for rapid local market replenishment.

Conversely, the international segment is projected to grow substantially from 2024 to 2033. This growth is driven by increased global trade and the expansion of international supply chains. Businesses are seeking faster and more reliable cross-border transportation methods, boosting demand for international air freight services. Improvements in global logistics infrastructure and international trade agreements facilitate smoother cross-border operations. As e-commerce continues to grow globally, the need for efficient international shipping solutions is expanding, driving this segment’s rapid growth.

In 2023, the commercial segment led the market due to high demand from industries such as manufacturing, retail, and pharmaceuticals. These sectors require consistent and reliable transportation for large quantities of goods to sustain operations and supply chains. The scale and frequency of commercial shipments contribute significantly to the air freight volume. Technological advancements and enhanced logistics efficiency have reinforced the commercial segment's leadership.

The private segment is expected to grow at a higher CAGR from 2024 to 2033. There is increasing demand for personalized and expedited shipping solutions for high-value and time-sensitive goods, including luxury items, art, and personal belongings. The growth of e-commerce and global living and working trends are contributing to this rise. Private air freight services are addressing these needs with tailored logistics solutions that focus on speed and security.

By Service

By Destination

By End Use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others