The global air transport MRO market size was estimated at around USD 82.22 billion in 2023 and it is projected to hit around USD 137.02 billion by 2033, growing at a CAGR of 5.24% from 2024 to 2033.

The Air Transport Maintenance, Repair, and Overhaul (MRO) market is a critical segment within the aviation industry, ensuring the safety, reliability, and efficiency of aircraft operations. This market encompasses a wide range of services, including routine maintenance, extensive repairs, and comprehensive overhauls of aircraft and their components. The significance of MRO services has been magnified in recent years due to increasing air traffic, stringent safety regulations, and the technological advancements in modern aircraft.

The growth of the air transport MRO market is propelled by the surge in air travel demand globally has led to an expansion of commercial aircraft fleets, necessitating regular maintenance and overhaul services to ensure safety and reliability. Additionally, advancements in aircraft technology, including avionics and materials, drive the need for specialized MRO services to maintain and optimize modern aircraft systems. Stringent regulatory requirements imposed by aviation authorities further contribute to the demand for compliant maintenance services. Moreover, the focus on cost efficiency and operational reliability by airlines underscores the importance of efficient MRO solutions in minimizing aircraft downtime and enhancing overall operational performance.

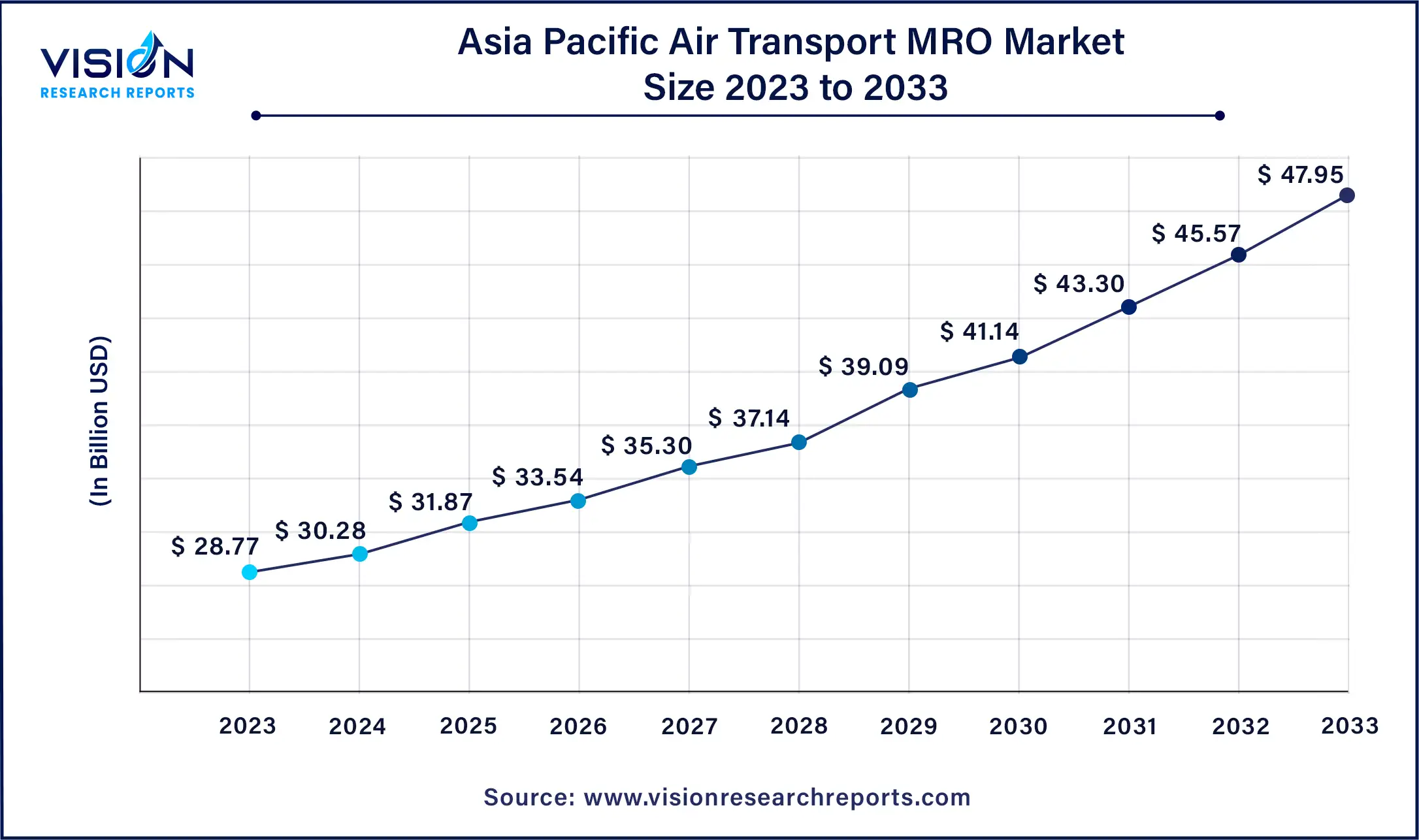

The Asia Pacific air transport MRO market was valued at USD 28.77 billion in 2023 and it is predicted to surpass around USD 47.95 billion by 2033 with a CAGR of 5.24% from 2024 to 2033.

In 2023, Asia Pacific secured the largest revenue share of 35%. This dominance stems from the region's thriving aviation industry, fueled by robust expansion, heightened air travel demand, and a burgeoning aircraft fleet. Notably, economic powerhouses like China and India have witnessed substantial growth, prompting significant investments in aviation infrastructure and maintenance, repair, and overhaul (MRO) services. Furthermore, Asia Pacific's strategic geographic positioning as a global transportation nexus further amplifies its influence in the air transport MRO market, attracting both domestic and international airlines seeking top-tier maintenance solutions for their expanding fleets.

Meanwhile, North America is poised for rapid expansion in the air transport MRO market. The region's dominance is underpinned by a robust aviation sector, boasting a vast and varied fleet of commercial aircraft and notable technological advancements. North America hosts major MRO providers, original equipment manufacturers (OEMs), and boasts a well-established infrastructure supporting aviation maintenance operations. Additionally, stringent safety regulations and a heightened awareness regarding the significance of regular maintenance practices solidify the region's foothold in the industry.

The engine overhaul segment claimed the largest market share of 42% among service types in 2023. Engine Overhaul services play a pivotal role in ensuring the optimal performance and longevity of aircraft engines, which are essential components for safe and efficient flight operations. These services involve comprehensive inspections, repairs, and refurbishments of engine components, including turbines, compressors, and fuel systems. Engine Overhaul specialists utilize advanced technologies and precision engineering techniques to restore engines to their original specifications, thereby enhancing reliability and reducing the risk of in-flight failures.

The component segment is expected to witness significant growth, with a projected CAGR of 6.33% during the forecast period. Component Repair services focus on the maintenance and refurbishment of various aircraft components, ranging from avionics and landing gear to hydraulic systems and electrical components. Component Repair specialists possess expertise in diagnosing and addressing issues with individual aircraft parts, utilizing specialized equipment and techniques to restore functionality and integrity. These services are essential for extending the lifespan of aircraft components, minimizing downtime, and ensuring compliance with stringent safety regulations.

Independent MRO providers dominated the market in 2023, holding a remarkable 53% revenue share. Independent MRO providers specialize in offering third-party maintenance, repair, and overhaul services to a wide range of aircraft operators, including airlines, leasing companies, and government agencies. These independent entities operate autonomously from aircraft manufacturers and offer a comprehensive suite of MRO solutions tailored to meet the specific needs of their clients. Independent MRO providers leverage their expertise, infrastructure, and industry partnerships to deliver cost-effective and efficient maintenance services, catering to the growing demand for outsourced MRO solutions in the global aviation market.

The OEMs segment is poised for the fastest expansion in the projected period. OEM MRO providers are affiliated with aircraft manufacturers and specialize in providing maintenance and support services for the original equipment they produce. These OEM-affiliated entities leverage their intimate knowledge of aircraft design, engineering, and manufacturing processes to offer specialized MRO solutions tailored to their proprietary aircraft models. OEM MRO providers often collaborate closely with aircraft operators from the initial procurement phase through the entire lifecycle of the aircraft, offering integrated support services, spare parts provisioning, and technical expertise.

The narrow-body aircraft accounted for the highest market share of 56% in 2023. Narrow-body aircraft, also known as single-aisle aircraft, are designed primarily for short to medium-haul routes and are characterized by their compact size and single aisle cabin configuration. These aircraft are widely used by commercial airlines for domestic and regional flights, as well as by low-cost carriers seeking to optimize operational efficiency and passenger capacity. Narrow-body aircraft, such as the Boeing 737 and Airbus A320 families, represent a significant portion of the global commercial fleet and require specialized maintenance, repair, and overhaul (MRO) services to ensure airworthiness, reliability, and regulatory compliance.

The wide-body segment is projected to experience the most rapid growth over the forecast period. Wide-body aircraft, also known as twin-aisle aircraft, are designed for long-haul flights and are distinguished by their spacious cabin layout with two aisles running through the aircraft fuselage. These larger aircraft offer increased passenger capacity, enhanced comfort, and greater range capabilities, making them ideal for transcontinental and intercontinental routes. Wide-body aircraft, such as the Boeing 777 and Airbus A350 families, are operated by major airlines and cargo carriers worldwide, serving as the backbone of international air travel. Due to their size, complexity, and extended operational range, Wide-body aircraft require comprehensive MRO solutions tailored to address the unique maintenance needs of their airframes, engines, and systems.

By Service Type

By Organization Type

By Aircraft Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Service Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Air Transport MRO Market

5.1. COVID-19 Landscape: Air Transport MRO Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Air Transport MRO Market, By Service Type

8.1. Air Transport MRO Market, by Service Type, 2024-2033

8.1.1 Engine Overhaul

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Airframe Maintenance

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Line Maintenance

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Modification

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Components

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Air Transport MRO Market, By Organization Type

9.1. Air Transport MRO Market, by Organization Type, 2024-2033

9.1.1. Airline/Operator MRO

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Independent MRO

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Original Equipment Manufacturer (OEM) MRO

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Air Transport MRO Market, By Aircraft Type

10.1. Air Transport MRO Market, by Aircraft Type, 2024-2033

10.1.1. Narrow-body

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Wide-body

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Regional Jet

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Air Transport MRO Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Organization Type (2021-2033)

11.1.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Organization Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Organization Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Organization Type (2021-2033)

11.2.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Organization Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Organization Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Organization Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Organization Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Organization Type (2021-2033)

11.3.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Organization Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Organization Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Organization Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Organization Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Organization Type (2021-2033)

11.4.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Organization Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Organization Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Organization Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Organization Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Organization Type (2021-2033)

11.5.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Organization Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Organization Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Aircraft Type (2021-2033)

Chapter 12. Company Profiles

12.1. Boeing Global Services.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Airbus S.A.S.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Lufthansa Technik AG.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. GE Aviation.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. SIA Engineering Company Ltd.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. ST Engineering Aerospace

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Delta TechOps.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. AAR Corp

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Rolls-Royce plc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Safran Aircraft Engines

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others