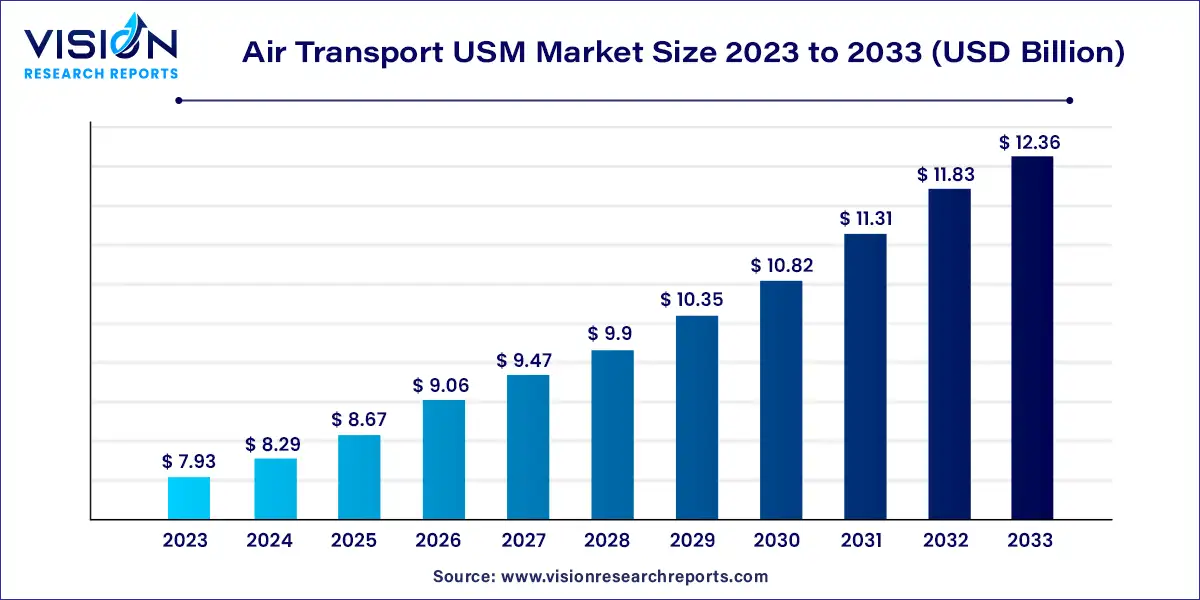

The global air transport USM market size was valued at USD 7.93 billion in 2023 and it is predicted to surpass around USD 12.36 billion by 2033 with a CAGR of 4.54% from 2024 to 2033.

The air transport used serviceable materials (USM) market is a critical segment of the aviation industry, focusing on the supply and management of used serviceable parts. USM encompasses components that have been previously used but are refurbished, tested, and certified for reuse. This market plays a pivotal role in maintaining aircraft operational efficiency, ensuring safety, and managing costs.

The air transport USM market is experiencing significant growth due to the demand for cost-effective solutions in the aviation sector is driving the adoption of used serviceable materials (USM), as they offer substantial savings compared to new parts. Airlines and maintenance, repair, and overhaul (MRO) providers are increasingly opting for USM to manage operational expenses more efficiently. Additionally, the industry's growing focus on environmental sustainability is contributing to market growth; reusing and refurbishing parts reduces waste and minimizes the ecological impact associated with manufacturing new components. Technological advancements in refurbishment processes have also played a crucial role by enhancing the reliability and quality of USM, making it a viable alternative to new parts.

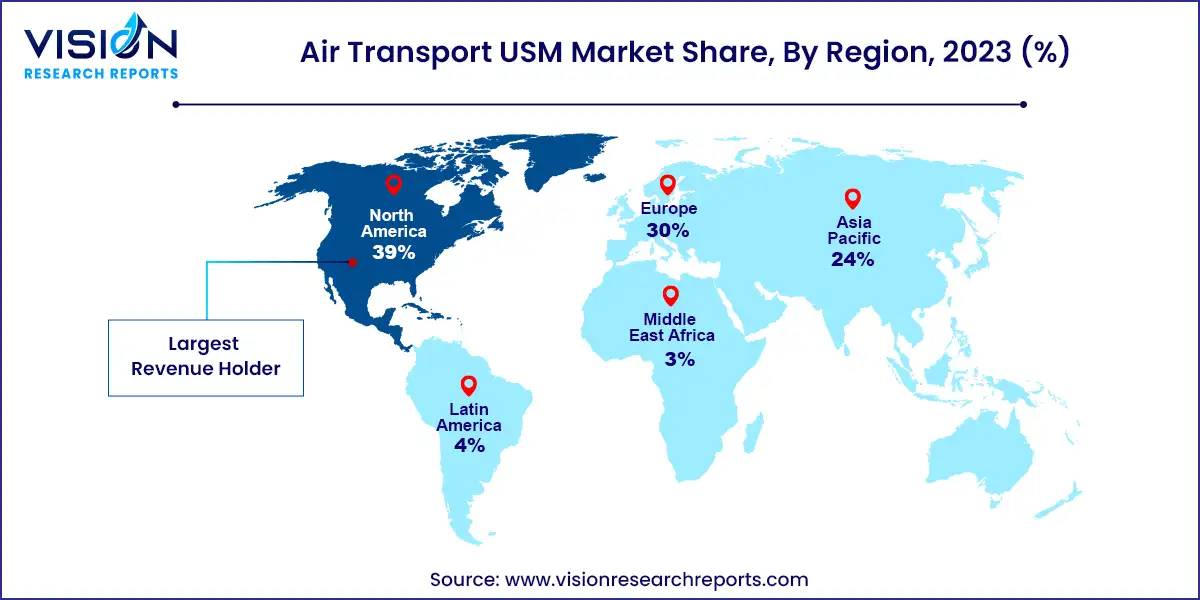

North America led the global air transport USM market with a major share of over 39% in 2023. In North America, the market is characterized by a high demand for USM due to the large number of aircraft operators and maintenance, repair, and overhaul (MRO) facilities. This region benefits from a well-established infrastructure and a robust regulatory framework, driving the adoption of USM to manage maintenance costs and enhance operational efficiency. The North American market is also supported by advancements in refurbishment technologies and a focus on sustainability, which further bolsters the demand for USM.

In Europe, the USM market is driven by similar factors, including a significant number of aircraft operators and stringent regulatory standards. European airlines and MRO providers are increasingly turning to USM to comply with environmental regulations and manage operational expenses effectively. The market is also characterized by a strong emphasis on quality assurance and certification, reflecting the region’s commitment to safety and performance.

The Asia-Pacific region is experiencing rapid growth in the USM market, fueled by expanding aviation infrastructure and a growing fleet of aircraft. Emerging economies in this region are increasingly adopting USM to manage maintenance costs and support the rising demand for air travel. The market is also supported by investments in MRO facilities and technological advancements, which enhance the availability and quality of USM.

The OEM segment accounted for a market share of over 61% in 2023. OEMs are pivotal players in this market as they supply parts that are directly linked to the original design and production of aircraft. These manufacturers offer a range of USM products, including components that have been refurbished to meet the original specifications. Their involvement ensures that the materials adhere to the highest standards of quality and safety, maintaining the integrity of the aircraft’s performance and compliance with regulatory requirements.

On the other hand, aftermarket suppliers play a crucial role in the USM market by providing parts that have been refurbished, repaired, or overhauled to extend their lifecycle. These suppliers are often involved in sourcing used components from various sources, performing necessary refurbishment processes, and certifying the materials for continued use. The aftermarket segment is characterized by its focus on cost-effectiveness and efficiency, offering competitive pricing for parts that meet rigorous standards.

Widebody jets, known for their larger size and capacity, utilize a variety of USM components due to their complex and extensive systems. These aircraft typically require high-value parts that have undergone rigorous refurbishment and testing to ensure they meet the demanding operational standards. The USM market for widebody jets includes components such as engines, landing gear, and avionics, all of which are crucial for maintaining the performance and safety of these large aircraft. The emphasis on high-quality, certified USM is particularly important in this segment due to the intricate nature of the systems and the high operational demands.

In contrast, turboprop aircraft, which are generally smaller and used for regional and shorter-haul flights, have different USM needs. The components for turboprops, including engines, propellers, and hydraulic systems, are often less complex than those for widebody jets but still require thorough refurbishment and certification. The USM market for turboprops focuses on providing cost-effective solutions while ensuring the reliability and performance of these aircraft. Both widebody jets and turboprops benefit from the availability of USM, though the specific requirements and market dynamics for each type of aircraft vary, reflecting their operational roles and the technical demands associated with their maintenance.

The engine segment currently holds a high market share of around 45% in the market. The engine segment represents a crucial part of the USM market, encompassing major engines that are integral to aircraft operations. Engines, being high-value items, undergo extensive refurbishment processes to ensure they meet stringent safety and performance standards. The refurbishment involves thorough testing, repair, and certification to restore engines to a condition that is comparable to new, allowing them to continue performing reliably in various aircraft types.

The component segment of the USM market includes a wide range of parts that are essential for the functionality and safety of aircraft. These components cover various systems such as landing gear, avionics, hydraulic systems, and fuel systems. Each component undergoes a rigorous refurbishment process to address wear and tear, ensuring it meets the operational requirements of the aircraft. The availability of refurbished components helps airlines manage maintenance costs effectively while maintaining high standards of safety and performance. Both engines and components are critical to the USM market, with each requiring specific attention to quality and reliability to support the diverse needs of the global air transport industry.

By Provider

By Aircraft

By Product

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others