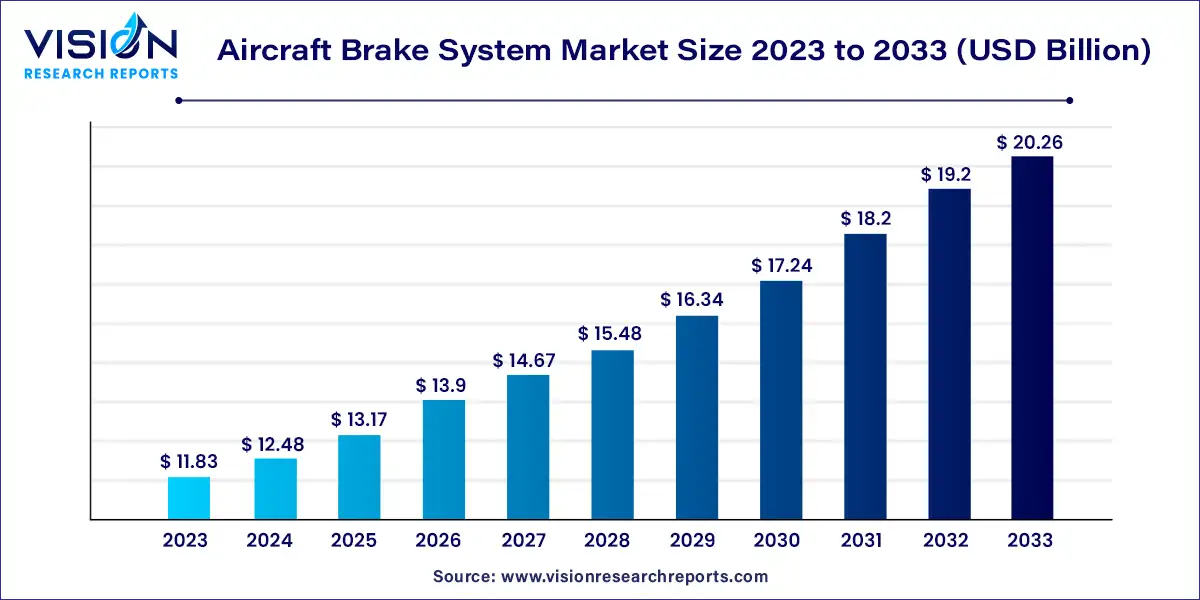

The global aircraft brake system market size was estimated at around USD 11.83 billion in 2023 and it is projected to hit around USD 20.26 billion by 2033, growing at a CAGR of 5.53% from 2024 to 2033. The aircraft brake system market is a critical segment of the aerospace industry, encompassing the design, development, and production of braking systems for various types of aircraft, including commercial, military, and general aviation. These systems are essential for the safe operation of aircraft, ensuring effective stopping power during landing and providing necessary support during ground operations.

The growth of the aircraft brake system market is propelled by the surge in global air travel and the consequent expansion of airline fleets drive demand for advanced braking systems. Innovations in brake technology, such as the development of lightweight carbon-carbon and carbon-ceramic materials, are enhancing performance and fuel efficiency, further stimulating market growth. Additionally, military modernization efforts and upgrades to existing aircraft fleets contribute to increased demand for sophisticated brake systems. Technological advancements in electric and hybrid braking systems are also playing a crucial role, offering improved reliability and reduced maintenance costs. Collectively, these factors are fostering a robust growth environment for the aircraft brake system market.

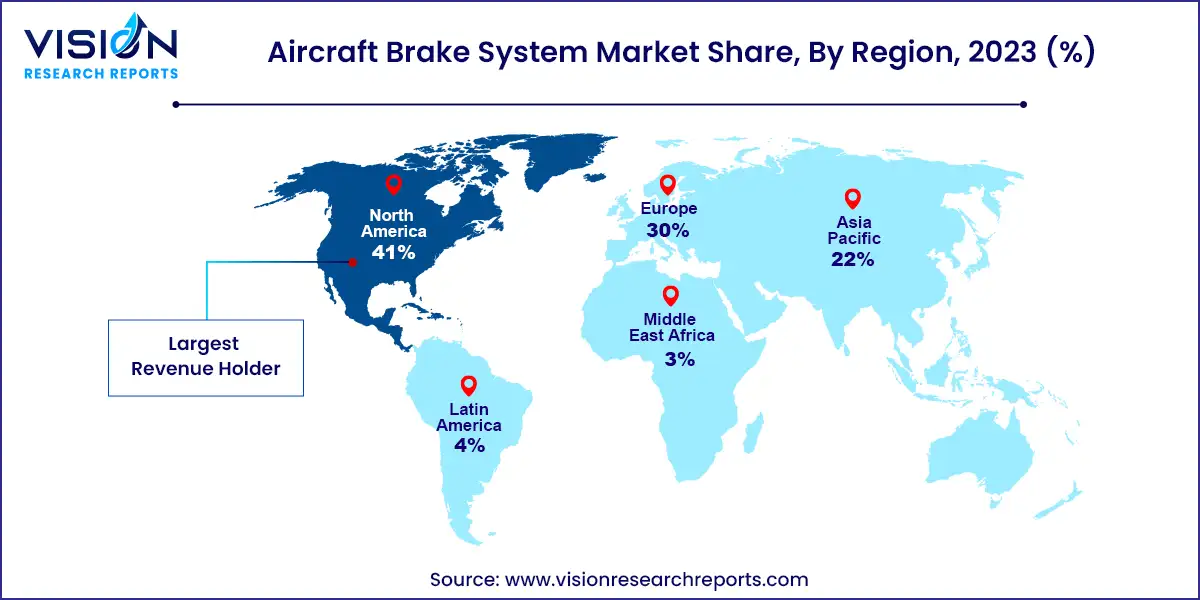

North America dominated the market in 2023 and accounted for around 41% of the global revenue. In North America, the market is robust due to the presence of major aircraft manufacturers and a well-established aerospace sector. The United States, in particular, is a significant player, with substantial investments in both commercial and military aviation. The region's strong focus on technological innovation and advanced manufacturing processes contributes to the high demand for sophisticated aircraft brake systems. Additionally, the ongoing fleet modernization and replacement initiatives further drive market growth in this area.

| Attribute | North America |

| Market Value | USD 4.85 Billion |

| Growth Rate | 5.55% CAGR |

| Projected Value | USD 8.30 Billion |

Europe also represents a prominent market for aircraft brake systems, driven by a combination of factors including a strong aerospace industry, defense spending, and the presence of leading aircraft manufacturers such as Airbus. The European market benefits from continuous advancements in braking technologies and an emphasis on enhancing aircraft safety and performance. Regional regulations and standards also play a crucial role in shaping the market dynamics, ensuring that brake systems meet stringent safety and environmental requirements.

Asia Pacific is the fastest-growing region during the forecast period. In the Asia-Pacific region, the aircraft brake system market is experiencing significant growth due to the rapid expansion of air travel and increasing investments in aviation infrastructure. Countries like China and India are seeing a surge in both commercial and military aircraft fleets, which drives the demand for advanced braking systems. The region’s growing middle class and expanding airline networks contribute to the rising need for new and upgraded aircraft, boosting market opportunities.

For rotary wing aircraft, which include helicopters and tiltrotor aircraft, brake systems are designed to handle the unique operational demands of vertical takeoff and landing. These systems must ensure effective performance during both hover and forward flight, with an emphasis on precision and reliability. Rotary wing aircraft often utilize advanced braking technologies to manage the complexities of rotor dynamics and maintain safety during ground operations. The brake systems in these aircraft are engineered to handle high loads and provide reliable stopping power under diverse conditions.

In contrast, fixed wing aircraft, encompassing a wide range of planes from commercial airliners to military jets, require brake systems tailored to their specific operational environments. Fixed wing aircraft brake systems must accommodate high-speed landings and the stress of frequent takeoffs and landings. These systems are designed to offer robust performance under varying conditions, including wet or icy runways. The focus for fixed wing aircraft is on maximizing braking efficiency and ensuring durability, often involving sophisticated materials and technologies to handle the stresses of high-speed operations and extended use.

The boosted brake systems category holds a prominent market share in 2023. Boosted brake systems utilize hydraulic or electric actuation mechanisms to amplify the braking force applied by the pilot. These systems are designed to enhance braking efficiency and response, making them particularly valuable in high-performance and commercial aircraft where precise control and rapid deceleration are critical. By boosting the pilot’s input, these systems reduce the physical effort required and improve overall braking performance, offering greater reliability and consistency under various operating conditions. Boosted brakes are often integrated with advanced control systems that adjust the braking force based on real-time data, contributing to improved safety and operational efficiency.

The independent brake systems are the fastest-growing category over the forecast period. This design allows for greater flexibility and redundancy, ensuring that if one brake system fails, the remaining systems can still provide effective braking. Independent brake systems are particularly beneficial in scenarios where individual wheel or axle control is required to manage braking forces and maintain stability, such as in landing gear configurations of larger aircraft or in complex ground maneuvering situations. These systems are designed to offer high reliability and operational safety by allowing for individual adjustments and control, enhancing overall braking effectiveness across various aircraft types.

The OEMs holds a prominent market share in 2023. OEM brake systems are integrated into new aircraft during the manufacturing process. These systems are designed and supplied by original equipment manufacturers to meet the specific requirements of the aircraft's design and performance standards. The OEM distribution segment involves close collaboration between brake system manufacturers and aircraft producers to ensure that the braking systems are tailored to the aircraft's specifications. This integration process is crucial for ensuring that the brake systems meet the rigorous standards for safety, reliability, and performance required for new aircraft.

The replacement segment, conversely, focuses on the aftermarket supply of brake systems for existing aircraft. This includes both scheduled replacements and upgrades to enhance performance or extend the service life of the braking systems. Replacement brake systems are supplied to operators and maintenance organizations to address wear and tear, upgrade technology, or comply with updated safety regulations. This segment is vital for maintaining the operational efficiency and safety of aging aircraft fleets and often involves a range of options, from standard replacements to advanced upgrades, depending on the specific needs and conditions of the aircraft in service.

By Aircraft Type

By Actuation

By Distribution

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others