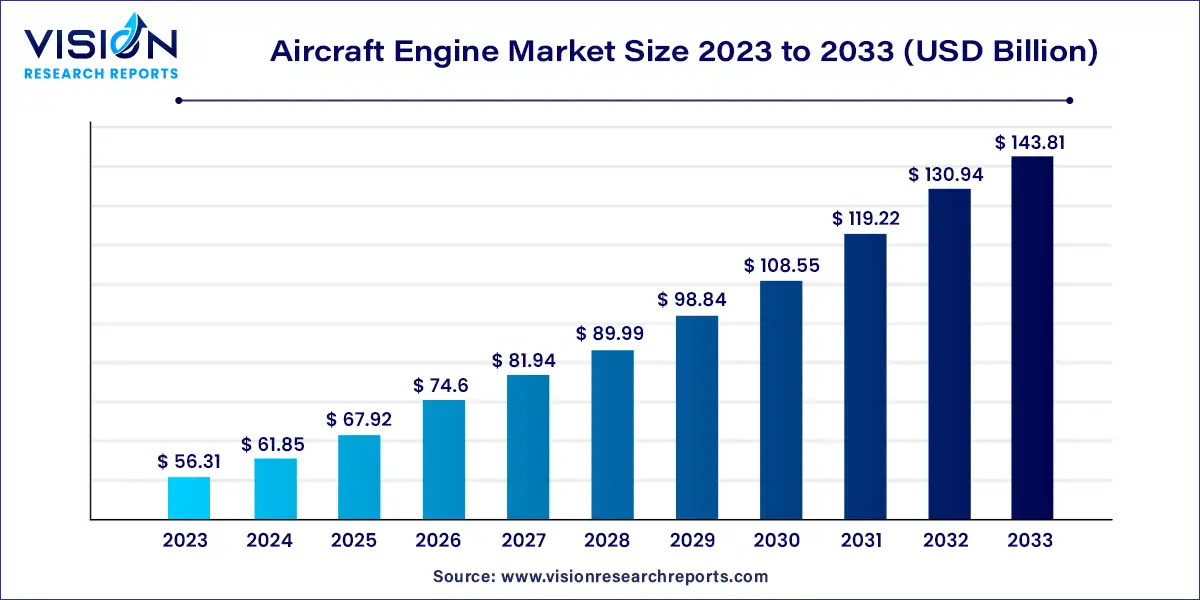

The global aircraft engine market size was estimated at around USD 56.31 billion in 2023 and it is projected to hit around USD 143.81 billion by 2033, growing at a CAGR of 9.83% from 2024 to 2033. The aircraft engine market is a dynamic sector within the aerospace industry, characterized by continuous innovation and technological advancements. As a critical component of aircraft propulsion systems, engines play a pivotal role in determining performance, efficiency, and operational costs of both commercial and military aircraft.

The growth of the aircraft engine market is fueled by an increasing global air passenger traffic, coupled with a rising demand for fuel-efficient and environmentally friendly engines, drives continuous innovation in engine technology. Military modernization programs worldwide further bolster market expansion. Despite challenges such as high initial costs and stringent regulatory requirements, ongoing advancements in materials and digital technologies, like more electric aircraft (MEA) systems, promise to enhance efficiency and reliability. The competitive landscape, dominated by major players like GE Aviation, Rolls-Royce Holdings, and Pratt & Whitney, emphasizes ongoing research and development to meet future demands for performance, sustainability, and reduced environmental impact.

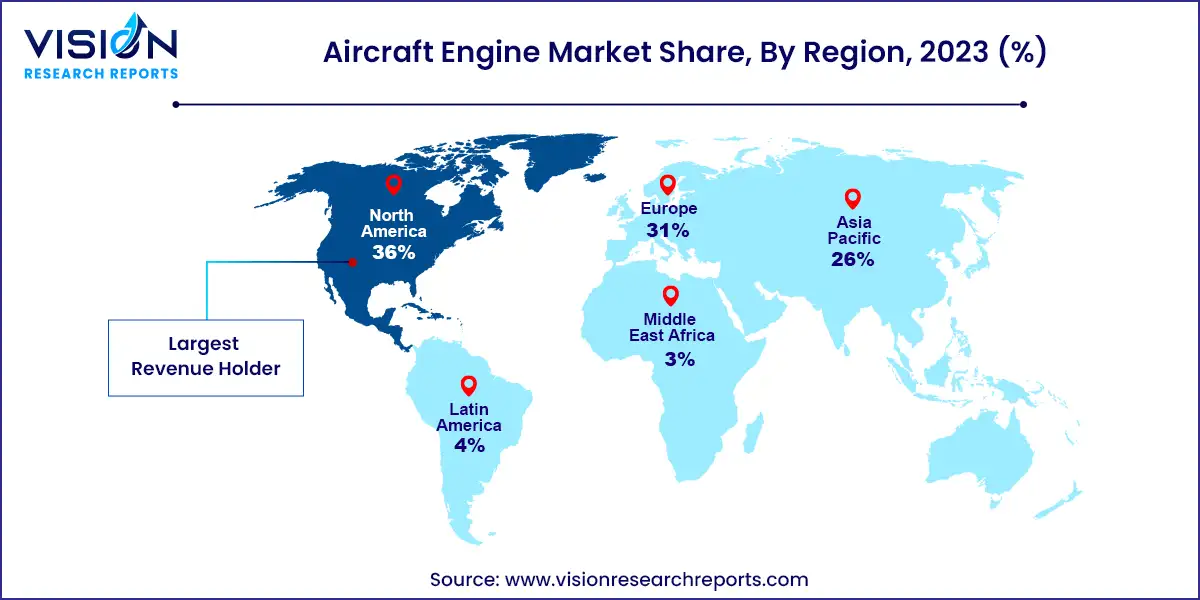

North America aircraft engine market captured the largest revenue share of 36% in 2023, driven by rising air travel demand, fleet expansions, and demand for fuel-efficient engines. Technological advancements in lightweight materials, advanced engine designs like geared turbofans, and enhanced maintenance practices are key growth factors. Regulatory shifts towards emissions reduction and noise abatement are prompting significant investments in engine efficiency, bolstering market prospects.

| Attribute | North America |

| Market Value | USD 20.27 Billion |

| Growth Rate | 9.82% CAGR |

| Projected Value | USD 51.77 Billion |

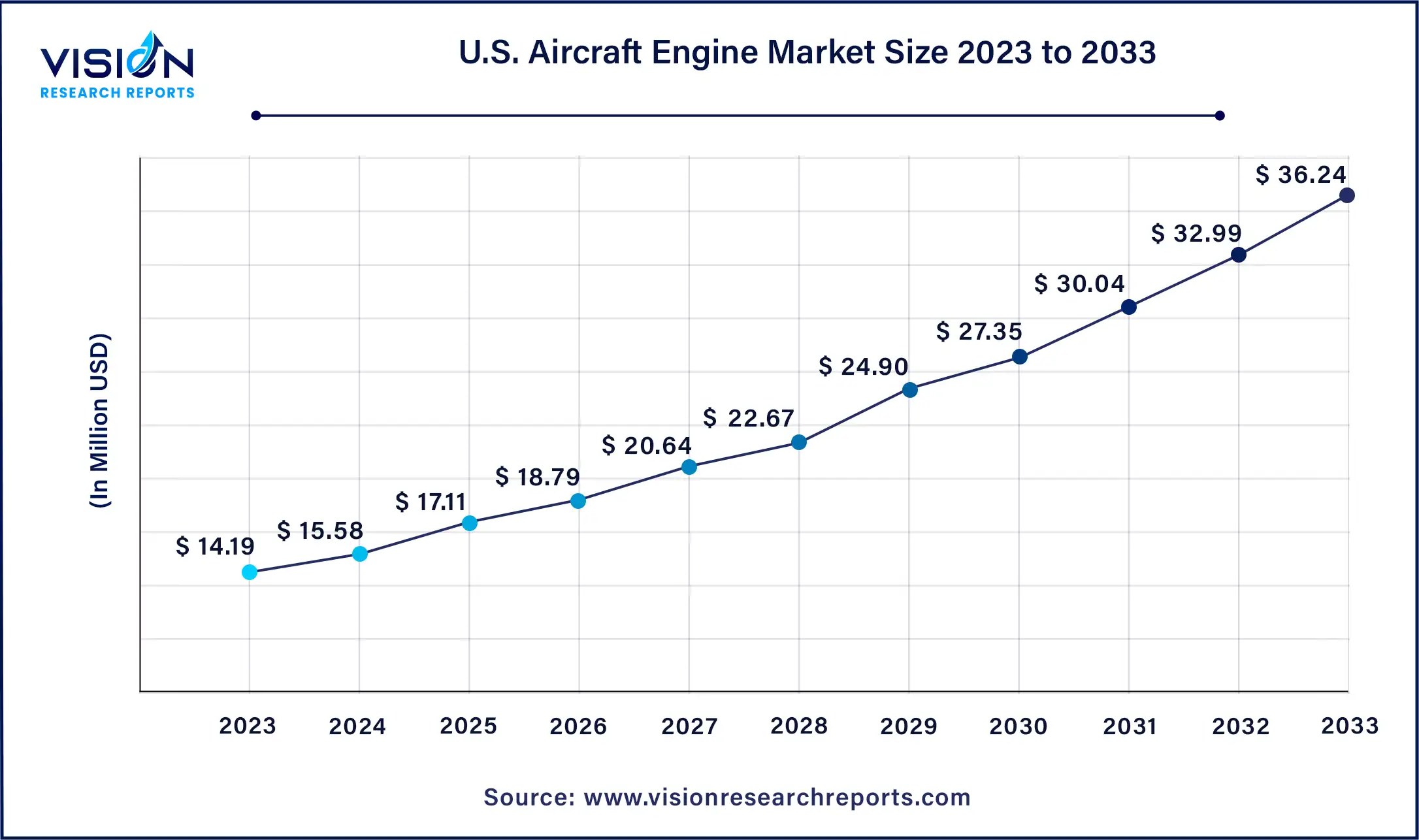

The U.S. aircraft engine market size was valued at USD 14.19 billion in 2023 and is anticipated to reach around USD 36.24 billion by 2033, growing at a CAGR of 9.82% from 2024 to 2033.

Asia Pacific aircraft engine market noteworthy revenue share in 2023, fueled by rapid expansion of airline fleets to meet escalating air travel demand. Emerging economies such as China and India are pivotal contributors, investing substantially in new aircraft acquisitions. Technological advancements in engine efficiency and the establishment of regional MRO facilities are augmenting market growth.

Japan Aircraft engine market expected to witness significant growth from 2024 to 2033, supported by collaborations with international engine manufacturers and advancements in aerospace technology. Japan's emphasis on high-performance, fuel-efficient engines for both commercial and defense applications is driving market expansion.

Turbofan engines dominated with 72% of revenue share in 2023, driven by robust demand in commercial and military aircraft sectors. Known for their fuel efficiency, reduced noise levels, and versatility across various flight conditions, manufacturers are intensifying efforts in advanced technologies like high-bypass ratio engines and geared turbofans to meet stringent environmental standards and enhance overall aircraft performance.

Turboshaft engines segment expected to achieve an 11% CAGR from 2024 to 2033, turboshaft engines are crucial for helicopters and rotorcraft, supporting diverse missions in military, medical, and commercial fields. Advances in design, focusing on power-to-weight ratios and fuel efficiency, are augmenting their operational reliability. Growing applications in emergency medical services, offshore operations, and military deployments are further propelling this specialized segment's growth.

Commercial aircraft segment leading in revenue share for 2023, this segment is driven by escalating global air travel demand. Airlines are investing in modern, fuel-efficient aircraft equipped with advanced engine technologies to enhance operational efficiency and environmental sustainability. Manufacturers are concentrating on high-thrust engines that offer improved fuel efficiency and emissions control, aligned with stringent regulatory requirements. Ongoing fleet modernization initiatives and expanding air connectivity are pivotal in sustaining demand for new engine installations.

Military aircraft segment projected to exhibit the highest CAGR from 2024 to 2033, bolstered by global defense modernization efforts and geopolitical dynamics. Governments are channeling investments into next-generation military aircraft equipped with advanced propulsion systems to enhance performance, stealth capabilities, and operational flexibility. Engine manufacturers are innovating with high-thrust engines tailored for military applications, emphasizing reliability, durability, and maintenance efficiency. Technological innovations such as adaptive cycle engines and enhanced fuel efficiency are key growth drivers in this strategic sector.

Aftermarket point of sale segment dominating market revenue in 2023, driven by escalating global air traffic and aging aircraft fleets. Airlines and operators prioritize efficient engine maintenance and repair services to maximize operational uptime and reduce costs. Advancements in predictive maintenance and data analytics are revolutionizing aftermarket services, offering tailored solutions for engine health monitoring and performance optimization. This segment's expansion underscores its critical role in sustaining the longevity and reliability of aircraft engines worldwide.

OEM point of sale segment expected to witness moderate CAGR from 2024 to 2033, fueled by rising global demand for new aircraft. Original Equipment Manufacturers (OEMs) are innovating with advanced engine technologies focused on fuel efficiency, reliability, and environmental sustainability. Increasing orders from airlines and leasing companies are bolstering growth, supported by advancements in engine design and manufacturing processes. Strategic partnerships and investments in research and development further strengthen OEMs' market position in the dynamic aerospace industry.

By Engine

By Aircraft

By Point of Sale

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Engine Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Aircraft Engine Market

5.1. COVID-19 Landscape: Aircraft Engine Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Aircraft Engine Market, By Engine

8.1. Aircraft Engine Market, by Engine, 2024-2033

8.1.1 Turboprop

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Turbofan

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Turboshaft

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Piston Engine

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Aircraft Engine Market, By Aircraft

9.1. Aircraft Engine Market, by Aircraft, 2024-2033

9.1.1. Commercial Aircraft

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Military Aircraft

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Business and General Aviation Aircraft

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Aircraft Engine Market, By Point of Sale

10.1. Aircraft Engine Market, by Point of Sale, 2024-2033

10.1.1. OEM

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Aftermarket

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Aircraft Engine Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Engine (2021-2033)

11.1.2. Market Revenue and Forecast, by Aircraft (2021-2033)

11.1.3. Market Revenue and Forecast, by Point of Sale (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Engine (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Aircraft (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Point of Sale (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Engine (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Aircraft (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Point of Sale (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Engine (2021-2033)

11.2.2. Market Revenue and Forecast, by Aircraft (2021-2033)

11.2.3. Market Revenue and Forecast, by Point of Sale (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Engine (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Aircraft (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Point of Sale (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Engine (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Aircraft (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Point of Sale (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Engine (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Aircraft (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Point of Sale (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Engine (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Aircraft (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Point of Sale (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Engine (2021-2033)

11.3.2. Market Revenue and Forecast, by Aircraft (2021-2033)

11.3.3. Market Revenue and Forecast, by Point of Sale (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Engine (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Aircraft (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Point of Sale (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Engine (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Aircraft (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Point of Sale (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Engine (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Aircraft (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Point of Sale (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Engine (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Aircraft (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Point of Sale (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Engine (2021-2033)

11.4.2. Market Revenue and Forecast, by Aircraft (2021-2033)

11.4.3. Market Revenue and Forecast, by Point of Sale (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Engine (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Aircraft (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Point of Sale (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Engine (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Aircraft (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Point of Sale (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Engine (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Aircraft (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Point of Sale (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Engine (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Aircraft (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Point of Sale (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Engine (2021-2033)

11.5.2. Market Revenue and Forecast, by Aircraft (2021-2033)

11.5.3. Market Revenue and Forecast, by Point of Sale (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Engine (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Aircraft (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Point of Sale (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Engine (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Aircraft (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Point of Sale (2021-2033)

Chapter 12. Company Profiles

12.1. Advanced Atomization Technologies Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Enjet Aero.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Engine Alliance.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Safran Group.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Pratt & Whitney.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Rolls-Royce

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. MTU Aero Engines AG.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. CFM International

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. General Electric Company.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. ITP Aero

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others