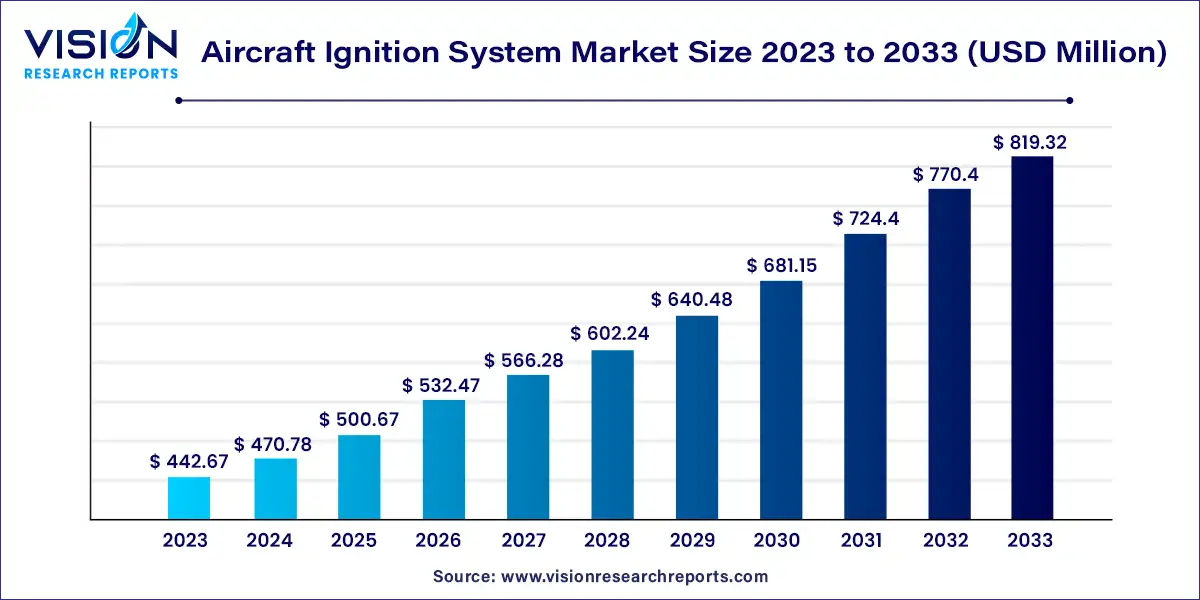

The global aircraft ignition system market size was estimated at USD 442.67 million in 2023 and it is expected to surpass around USD 819.32 million by 2033, poised to grow at a CAGR of 6.35% from 2024 to 2033.

The aircraft ignition system market plays a crucial role in ensuring the safe and efficient operation of aircraft engines. Ignition systems are responsible for initiating the combustion process by igniting the air-fuel mixture within the engine cylinders, enabling the aircraft to start and maintain flight. The market for aircraft ignition systems is driven by the increasing demand for air travel, advancements in aviation technology, and the growing need for fuel-efficient engines.

The aircraft ignition system market is expected to experience significant growth due to an increasing global demand for air travel, which is leading to higher production rates of commercial and military aircraft. This surge in production necessitates the adoption of reliable and efficient ignition systems to ensure optimal engine performance and safety. Additionally, advancements in aviation technology, including the development of more fuel-efficient and environmentally friendly engines, are fueling the need for advanced ignition systems. These systems contribute to better fuel combustion and lower emissions, aligning with stringent regulatory requirements for reduced environmental impact.

The electric ignition segment held a larger market share in 2023. Electric ignition systems have become increasingly prevalent in modern aviation due to their advanced technology and superior performance characteristics. These systems utilize electrical power to generate a spark that ignites the fuel-air mixture in the engine. They are known for their precision, reliability, and integration with digital engine control systems. The electric ignition systems enhance engine efficiency by providing consistent and controlled ignition timing, which is crucial for optimizing fuel combustion and reducing emissions. The trend towards incorporating these systems in newer aircraft models reflects the industry's push for improved performance and environmental compliance.

On the other hand, magneto ignition systems continue to be widely used, particularly in general aviation and smaller aircraft. These systems operate independently of the aircraft's electrical system, relying on a magneto to generate the electrical energy required for ignition. Their inherent reliability and simplicity make them a preferred choice for many small aircraft applications. Magneto ignition systems are valued for their durability and ease of maintenance, as they do not require an external power source to function. Despite being a more traditional technology, they remain integral to the aviation industry due to their robustness and cost-effectiveness.

Ignition leads are essential for transmitting the electrical energy from the ignition system to the spark plugs. These high-voltage cables are designed to withstand the extreme conditions within the engine compartment, including high temperatures and vibrations. The quality and durability of ignition leads are critical as they must maintain reliable electrical conductivity to ensure consistent engine performance. Modern ignition leads are engineered with advanced materials and insulation techniques to enhance their longevity and reliability, reflecting the ongoing improvements in aviation technology.

The spark plugs segment held a larger market share in 2023. Spark plugs, on the other hand, are the components responsible for igniting the air-fuel mixture within the engine's combustion chamber. They generate a high-voltage spark that initiates the combustion process, which is essential for the engine's operation. The performance of spark plugs directly impacts engine efficiency, fuel consumption, and overall engine health. Innovations in spark plug technology include enhancements in electrode materials and designs to improve ignition reliability, reduce fouling, and extend service intervals. High-quality spark plugs are crucial for maintaining optimal engine performance and reducing maintenance needs.

The turbofan engine segment generated the maximum market share in 2023. Turbofan engines, commonly used in commercial and military aircraft, are renowned for their efficiency and thrust capabilities. These engines feature a large fan at the front that drives a significant amount of air around the core of the engine, enhancing overall propulsion and fuel efficiency. The ignition systems for turbofan engines are designed to accommodate the complex operational demands of these engines. They must ensure reliable ignition in high-pressure and high-temperature environments, contributing to smooth and efficient engine performance. Advanced electronic ignition systems are often employed in turbofan engines to provide precise control and to adapt to varying flight conditions, which is crucial for maximizing fuel efficiency and meeting stringent emission standards.

Turbojet engines, by contrast, are primarily used in high-speed and military aircraft. These engines operate on the principle of ejecting exhaust gases at high speeds to produce thrust, which results in a more straightforward airflow compared to turbofan engines. The ignition systems for turbojet engines need to handle the extreme conditions of high-speed, high-temperature operations while ensuring reliable ignition of the fuel-air mixture. Traditional magneto ignition systems may be used in turbojet engines due to their robustness and simplicity, though modern designs increasingly incorporate advanced electronic systems to enhance performance and reliability. The choice of ignition system in turbojet engines reflects the need for durability and performance under demanding flight conditions.

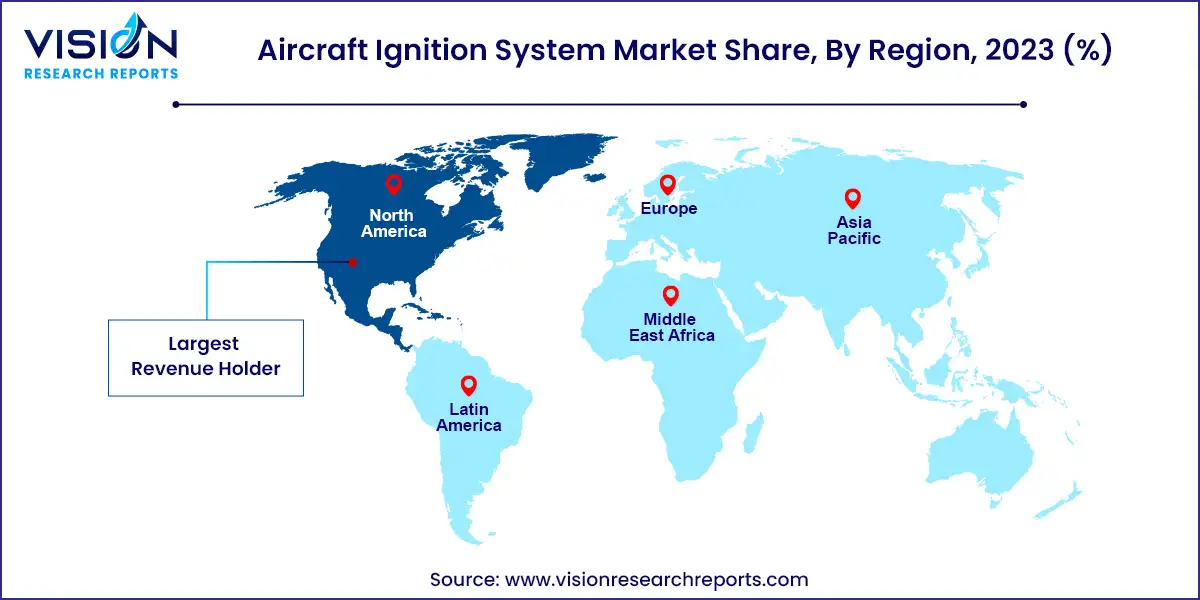

North America remains a leading market for aircraft ignition systems in 2023, driven by the region's well-established aviation industry and significant investments in aerospace technology. The United States, home to major aircraft manufacturers and a robust defense sector, continues to drive demand for advanced ignition systems. The presence of key industry players and ongoing innovation in both commercial and military aviation further bolster market growth in this region. Additionally, North America's stringent regulatory standards for emissions and fuel efficiency propel the adoption of cutting-edge ignition technologies, reinforcing the region's dominance in the global market.

Europe also plays a pivotal role in the aircraft ignition system market, with its emphasis on reducing emissions and enhancing fuel efficiency contributing to market expansion. The European aviation sector is characterized by a strong focus on sustainability and technological advancements, leading to increased adoption of advanced ignition systems. Major aerospace companies and a growing number of aircraft operators in Europe are driving demand for high-performance ignition solutions. The European Union's stringent environmental regulations and initiatives to support greener aviation technologies further fuel the market growth in this region.

In the Asia-Pacific region, rapid expansion in the aviation industry is significantly influencing the aircraft ignition system market. Countries such as China and India are experiencing substantial growth in aircraft production and air travel, creating a burgeoning demand for reliable and efficient ignition systems. The increasing investments in aerospace infrastructure, coupled with a rising middle class and greater air travel accessibility, are driving the market forward. As Asia-Pacific continues to develop its aviation sector, the demand for advanced ignition technologies is expected to increase, presenting significant opportunities for market players.

By Type

By Component

By Engine Type

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others