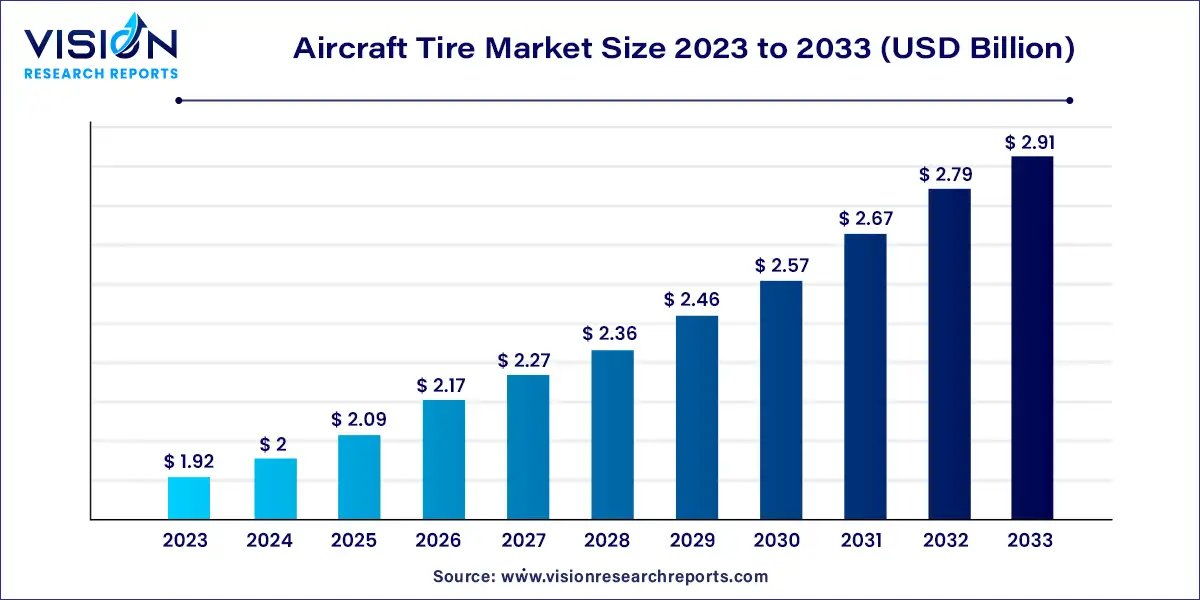

The global aircraft tire market size was valued at USD 1.92 billion in 2023 and it is predicted to surpass around USD 2.91 billion by 2033 with a CAGR of 4.23% from 2024 to 2033. The aircraft tire market is a critical component of the aerospace industry, encompassing the manufacturing and maintenance of tires used in various types of aircraft, including commercial, military, and general aviation.

The growth of the aircraft tire market is driven by the rising demand for air travel globally, which necessitates the expansion of aircraft fleets and subsequent tire replacements. Technological advancements in tire materials and designs that enhance performance and durability also contribute significantly. Moreover, stringent regulatory standards for aircraft safety and maintenance drive the continuous demand for high-quality tires.

The aircraft tire market size in U.S was estimated at around USD 0.67 billion in 2023 and it is projected to hit around USD 1.01 billion by 2033, growing at a CAGR of 4.18% from 2024 to 2033.

The aircraft tire market in the United States is expected to grow at a steady CAGR of 3.2% over the forecast period. Regulatory mandates from authorities such as the Federal Aviation Administration (FAA) and Aerospace Industries Association (AIA) enforcing stringent aircraft safety standards will drive consistent demand for aircraft tires and maintenance services across the country.

North America emerged as the dominant region in the aircraft tire market, capturing a significant revenue share of 50% in 2023. The region's leadership is underpinned by robust demand for passenger transportation and a concerted focus on reducing carbon emissions through the adoption of lightweight materials in aircraft manufacturing. This strategic approach not only enhances aircraft fuel efficiency but also amplifies the demand for aircraft tires. Presence of major aerospace manufacturers like Boeing, Northrop Grumman, and Lockheed Martin further augments market growth prospects in North America.

| Attribute | North America |

| Market Value | USD 0.96 Billion |

| Growth Rate | 4.18% CAGR |

| Projected Value | USD 1.45 Billion |

Asia Pacific is anticipated to witness the fastest growth rate of 5.63% in the aircraft tire market over the upcoming years. This growth trajectory is fueled by escalating demand for commercial aircraft, leading to the expansion of Maintenance, Repair, and Overhaul (MRO) services and the establishment of extensive maintenance facilities. Government initiatives aimed at bolstering domestic manufacturing capabilities in countries like China, coupled with increased exports to the U.S., are poised to further elevate the demand for aircraft tires across the region during the forecast period.

The aircraft tire market faces several significant challenges that impact its operations and growth prospects. Firstly, high production costs pose a persistent obstacle, driven by the need for advanced materials and stringent manufacturing processes required to meet aviation safety standards. These costs are compounded by the continuous demand for innovation to enhance tire performance and durability, placing pressure on manufacturers to maintain competitiveness while managing overhead expenses.

Secondly, regulatory compliance presents a formidable challenge. The aviation industry operates under strict safety regulations mandating the use of high-quality tires and adherence to rigorous maintenance schedules. Compliance with these standards not only increases operational complexities but also necessitates ongoing investments in research and development to ensure tire reliability and performance under diverse operational conditions. Moreover, regulatory updates and international standards further add to the compliance burden, requiring tire manufacturers to navigate a complex landscape of requirements across different regions and aircraft types. Addressing these challenges requires a strategic approach that integrates technological advancements, sustainable practices, and efficient supply chain management to sustain growth in the global aircraft tire market.

The radial segment dominated the aircraft tire market with a substantial revenue share of 70% in 2023 and is poised to exhibit the fastest compound annual growth rate (CAGR) during the forecast period. Radial tires are favored for their superior performance attributes, including enhanced fuel efficiency, extended tread life, and heightened durability under heavy loads. With increasing global travel expenditure and improved connectivity driving heightened aircraft production and maintenance activities, the adoption of radial tires is expected to escalate further, bolstering their market demand.

The cross-ply segment is anticipated to grow significantly over the forecast period, supported by its proven durability and ability to navigate rough and unpaved runways, prevalent in emerging economies and remote regions. Known for robust construction that offers superior resistance to cuts and impacts, cross-ply tires are particularly favored for military, cargo, and regional aircraft operating in challenging environments. Additionally, their lower initial cost compared to radial tires makes them a cost-effective choice for budget-conscious airline operators, further driving market demand in the years ahead.

The commercial segment dominated the market with a robust revenue share of 52% in 2023 and is expected to sustain significant growth throughout the forecast period. Escalating demand for commercial aircraft is driven by increasing passenger and freight traffic, buoyed by enhanced global trade relations. This surge in demand for new aircraft and cargo services is set to propel the commercial aircraft market, thereby supporting robust growth in the aircraft tire industry.

The business segment is projected to achieve the fastest CAGR during the forecast period. Business aircraft, encompassing various applications from passenger aviation to specialized services like aerial surveys and patrol operations, are witnessing heightened demand due to their versatility and efficiency benefits. Factors such as increased mobility, productivity gains, and tax advantages are driving the expansion of the business aircraft market, consequently boosting demand for aerospace tires in this segment.

By Product

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Aircraft Tire Market

5.1. COVID-19 Landscape: Aircraft Tire Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Aircraft Tire Market, By Product

8.1. Aircraft Tire Market, by Product, 2024-2033

8.1.1. Radial

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Cross-ply

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Aircraft Tire Market, By End-use

9.1. Aircraft Tire Market, by End-use, 2024-2033

9.1.1. Commercial

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Business

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Military

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Aircraft Tire Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. Qingdao Sentury Tire Co., Ltd.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Petlas

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Specialty Tires of America

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Dunlop aircraft tires

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Compagnie Generale Des Etablissements Michelin

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Bridgestone Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Desser Holdings LLC

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Aviation Tires & Treads, LLC

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. The Goodyear Tire and Rubber Company

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Wilkerson Company, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others