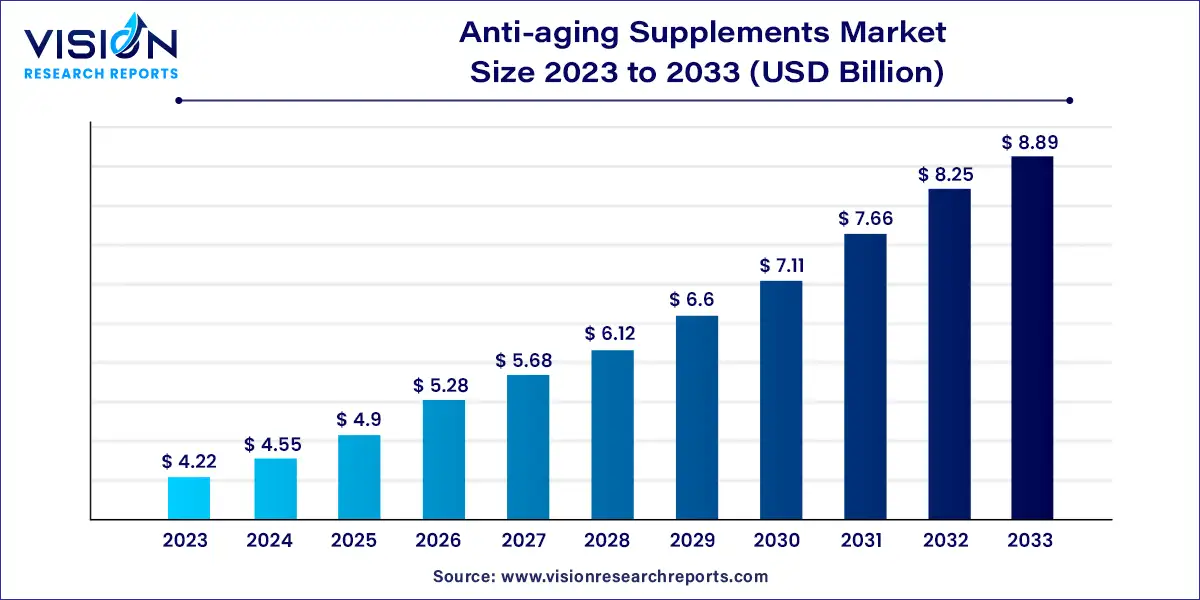

The global anti-aging supplements market size was estimated at around USD 4.22 billion in 2023 and it is projected to hit around USD 8.89 billion by 2033, growing at a CAGR of 7.73% from 2024 to 2033.

In an era where wellness and longevity are becoming increasingly prioritized, the anti-aging supplements market emerges as a dynamic and evolving landscape. With a growing aging population and rising awareness about preventive healthcare, the demand for anti-aging supplements continues to soar.

The growth of the anti-aging supplements market is fueled by the demographic shifts, including the aging population and increased life expectancy, drive the demand for products that promote healthy aging and longevity. Secondly, rising awareness about preventive healthcare and the importance of proactive measures in combating age-related issues contribute to market expansion. Additionally, lifestyle factors such as stress, poor diet, and environmental pollutants create a growing need for supplements that address nutritional deficiencies and support overall well-being. Moreover, advancements in research and development lead to the introduction of innovative formulations and ingredients, enhancing the efficacy and appeal of anti-aging supplements. Furthermore, changing consumer attitudes towards aging, coupled with a desire for natural and holistic approaches to wellness, further propel market growth.

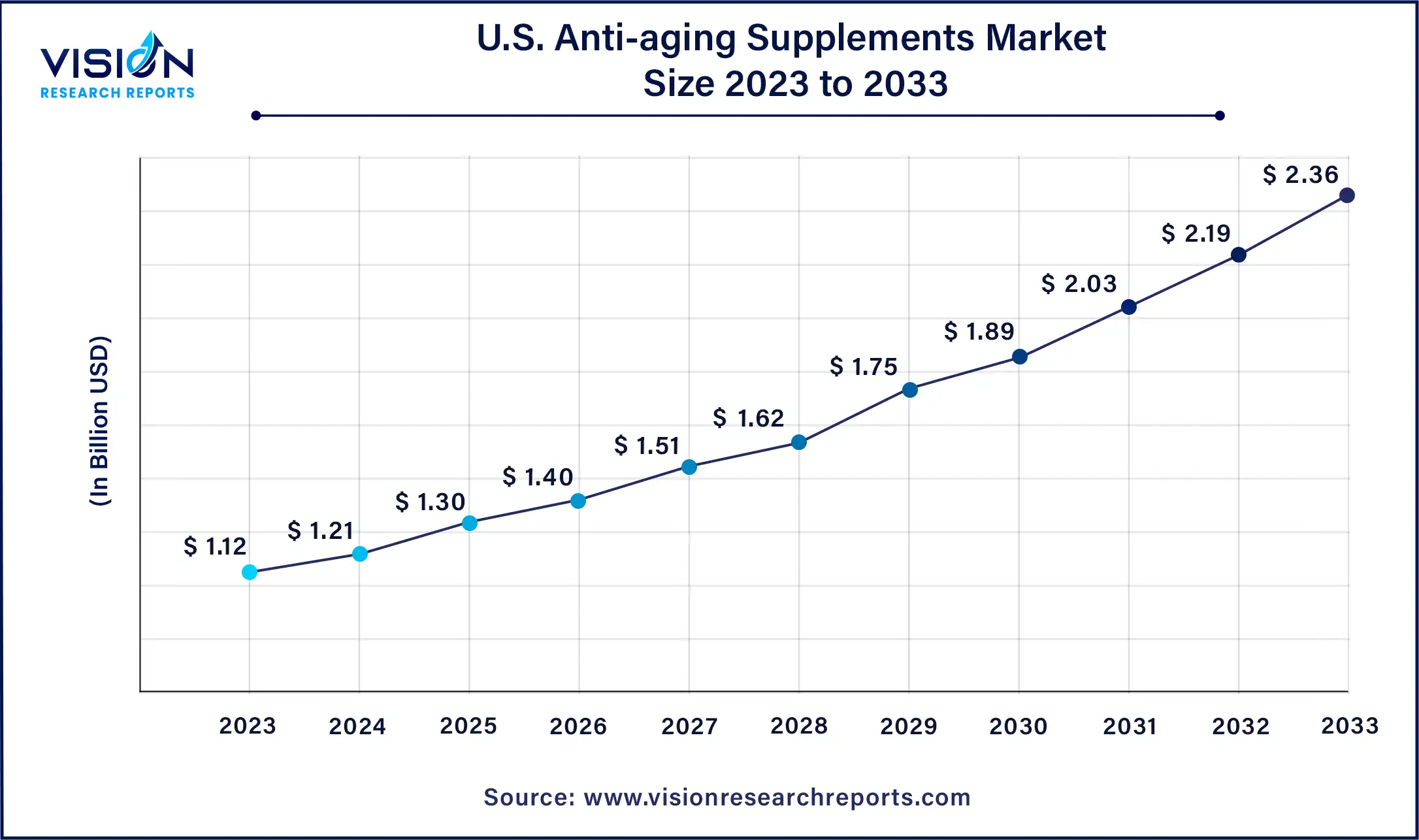

The U.S. anti-aging supplements market size was valued at around USD 1.12 billion in 2023 and is projected to hit around USD 2.36 billion by 2033, growing at a CAGR of 7.73% from 2024 to 2033.

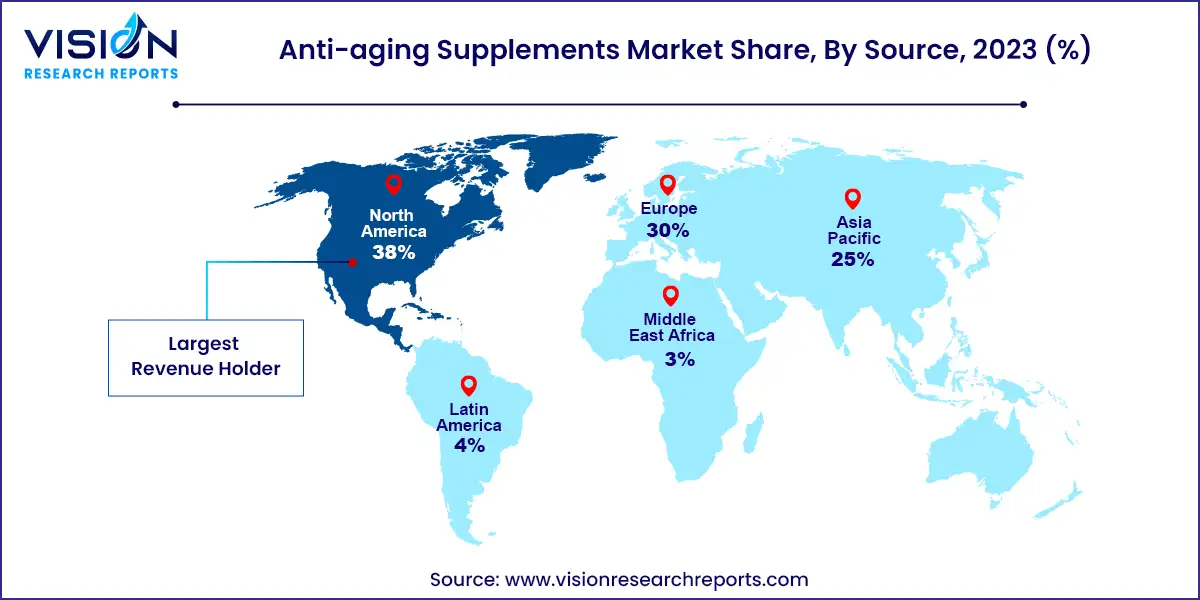

North America commanded the largest revenue share of 38% in 2023. Increasing consumer health awareness and the burgeoning aging population have propelled demand for products promoting vitality and longevity. According to the 2020 Census, between 1920 and 2020, the United States witnessed a notably higher growth rate in its population aged 65 and above compared to the overall population. By 2020, this age group constituted 55.8 million individuals, accounting for 16.8% of the entire U.S. population. Furthermore, advancements in research and development have facilitated the introduction of innovative formulations and ingredients, further augmenting market expansion.

The anti-aging supplements market in Asia Pacific experienced the highest CAGR of 8.53% throughout the forecast period, primarily propelled by the region's burgeoning aging population. As life expectancy increases and demographic transformations unfold, there is a surging demand for products that promote healthy aging and vitality. By 2050, the Asian Development Bank forecasts that one out of every four individuals in Asia and the Pacific region will be aged 60 or above.

The collagen segment asserted its dominance in the market, capturing a revenue share of 21% in 2023. This growth is fueled by collagen's pivotal role in enhancing skin elasticity, joint health, and overall wellness. With a heightened awareness among individuals regarding health and a preference for natural aging solutions, the demand for collagen supplements has surged significantly. For instance, in April 2021, Revelox, a Canadian health and wellness company, unveiled Dermalux, an innovative marine collagen supplement aimed at supporting hair, skin, and nails. Such initiatives are poised to substantially contribute to the expansion and development of the collagen segment within the market.

The Nicotinamide Mononucleotide (NMN) segment is anticipated to register the fastest CAGR over the forecast period. This growth is propelled by the increasing recognition of NMN's potential anti-aging benefits, including enhanced cellular function and metabolism. For example, in February 2024, a heritage brand announced its forthcoming release of the NJHealth NMN 20000mg supplement, designed to promote healthy aging. Crafted with patented technology, this product aims to elevate NAD⁺ (nicotinamide adenine dinucleotide) levels, thereby supporting the process of healthy aging. The launch of such products is expected to drive demand for NMN and foster the segment's expansion.

The hair, skin & nail care segment emerged as the market leader, commanding a share of 41% in 2023 and is projected to exhibit the highest CAGR over the forecast period. This growth is attributed to the increasing geriatric population and the societal emphasis on beauty & grooming across regions. These supplements often feature a blend of vitamins, minerals, and plant-based extracts, intended to promote healthier hair, skin, and nails.

The energy & stamina segment is witnessing remarkable growth over the forecast period, driven by the escalating demand for products that support overall well-being and vitality. To sustain an active lifestyle and counteract the impact of aging on energy levels, individuals are increasingly turning to anti-aging supplements aimed at boosting stamina. These supplements typically incorporate a blend of adaptogens, vitamins, minerals, and other natural ingredients believed to enhance mental and physical performance.

The capsule segment asserted its dominance in the market in 2023, commanding a revenue market share of 37%. This can be attributed to various factors including convenience, portability, and ease of consumption offered by capsules. They provide consumers with a hassle-free way to consume their daily doses of anti-aging supplements, making them a popular choice among health-conscious individuals. The introduction of new products has further contributed to the growth of the capsule market. For example, in December 2023, Reversal announced the launch of its NMN anti-aging supplement, driving the growth of this segment over the forecast period.

The powder segment is expected to exhibit the fastest CAGR over the forecast period. Consumers are increasingly drawn to powdered supplements due to their ease of use, versatility in consumption, and ability to be mixed with various beverages or foods. For instance, in June 2023, Codex Labs, a biotech-skintech company based in Silicon Valley, unveiled an additional product to their line, the Antü Skin Barrier Support Supplement. Designed to complement their Antü skincare collection, this new launch aims to fortify, rejuvenate, and bolster the skin's protective barrier.

The offline segment emerged as the dominant force in the market, capturing a revenue share of 62% in 2023. This growth is fueled by increasing consumer awareness and demand for products promoting longevity and overall wellness. Traditional retail channels such as pharmacies, health food stores, and specialty supplement shops have witnessed a surge in sales as aging populations seek solutions to address aging-related concerns. Additionally, offline marketing efforts including in-store promotions, demonstrations, and collaborations with healthcare professionals have contributed to the segment's expansion.

The online segment is poised to demonstrate the most rapid CAGR throughout the forecast period, driven by the widespread accessibility of e-commerce platforms and the convenience of purchasing products from the comfort of one's home. Consumers are increasingly turning to online channels to research and purchase anti-aging supplements, drawn by transparent reviews and competitive pricing. The ascent of digital marketing strategies, including targeted advertising, influencer partnerships, and informative content, has further amplified online sales. Moreover, the COVID-19 pandemic has hastened the transition to online shopping, with more individuals embracing digital platforms for their health and wellness requisites.

By Ingredients

By Application

By Formulation

By Distribution Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Anti-aging Supplements Market

5.1. COVID-19 Landscape: Anti-aging Supplements Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Anti-aging Supplements Market, By Ingredients

8.1. Anti-aging Supplements Market, by Ingredients, 2024-2033

8.1.1. Collagen

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Resveratrol

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Vitamins

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Minerals

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Hyaluronic Acid

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. NMN

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Anti-aging Supplements Market, By Application

9.1. Anti-aging Supplements Market, by Application, 2024-2033

9.1.1. Hair, Skin, And Nail Care

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Bone & Joint Health

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Energy & Stamina

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others (immune support, vision health)

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Anti-aging Supplements Market, By Formulation

10.1. Anti-aging Supplements Market, by Formulation, 2024-2033

10.1.1. Capsules

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Tablets

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Powder

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Anti-aging Supplements Market, By Distribution Channel

11.1. Anti-aging Supplements Market, by Distribution Channel, 2024-2033

11.1.1. Offline

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Online

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Anti-aging Supplements Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Ingredients (2021-2033)

12.1.2. Market Revenue and Forecast, by Application (2021-2033)

12.1.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.1.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Ingredients (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Ingredients (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Ingredients (2021-2033)

12.2.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.2.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Ingredients (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Ingredients (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Ingredients (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Ingredients (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Ingredients (2021-2033)

12.3.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.3.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Ingredients (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Ingredients (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Ingredients (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Ingredients (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Ingredients (2021-2033)

12.4.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.4.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Ingredients (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Ingredients (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Ingredients (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Ingredients (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Ingredients (2021-2033)

12.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.5.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Ingredients (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Ingredients (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 13. Company Profiles

13.1. Shaklee Corporation

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Decode Age

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Thorne.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. GNC Holdings, LLC

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Life Extension.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Nu Skin Enterprises

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Nutrova

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Cureveda

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Tru Niagen

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Oziva

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others