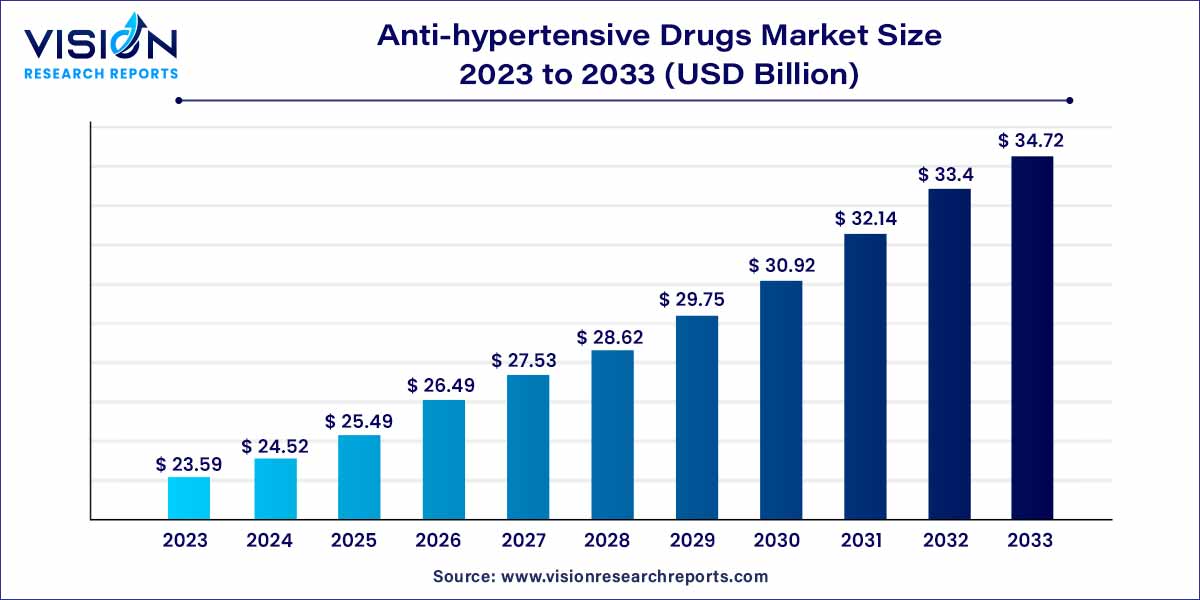

The global anti-hypertensive drugs market was estimated at USD 23.59 billion in 2023 and it is expected to surpass around USD 34.72 billion by 2033, poised to grow at a CAGR of 3.94% from 2024 to 2033.

The anti-hypertensive drugs market plays a pivotal role in addressing the global health challenge posed by hypertension, a prevalent condition characterized by elevated blood pressure levels. This overview provides insights into the key facets shaping the market, including market dynamics, major players, therapeutic classes, and notable trends.

The growth of the anti-hypertensive drugs market is propelled by several key factors. Firstly, the escalating global prevalence of hypertension, exacerbated by lifestyle changes and an aging population, serves as a primary driver for market expansion. Additionally, ongoing advancements in pharmaceutical research and development contribute to the discovery of innovative drugs, fostering increased efficacy and minimized side effects. Government initiatives promoting healthcare awareness and increased expenditure further create a conducive environment for market growth. The evolving trend towards personalized medicine, tailoring treatment approaches to individual patient profiles, and the increasing adoption of combination therapies to enhance efficacy represent significant factors shaping the trajectory of the anti-hypertensive drugs market. As digital health solutions become integrated for monitoring and managing hypertension, the market is poised for sustained growth, driven by a comprehensive approach to addressing the complex and widespread health challenge posed by elevated blood pressure levels.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 34.72 billion |

| Growth Rate from 2024 to 2033 | CAGR of 3.94% |

| Revenue Share of North America in 2023 | 38% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Anti-hypertensive Drugs Market Restraints

Anti-hypertensive Drugs Market Opportunities

Calcium channel blockers (CCB) segment held the largest market share of 27% in 2023 owing to lesser side effects exhibited by these drugs compared to other anti-hypertensive drugs. Moreover, long-acting CCBs provide more consistent blood pressure control throughout the day and require less frequent dosing. Their efficacy, safety profile, diverse options, and suitability for combination therapy make CCD a vital component of hypertension management. These factors are contributing to the large share of the market.

ACE inhibitors segment is expected to grow at the fastest CAGR of 4.98% over the forecast period. The rising prevalence of high blood pressure and increasing prescription of these drugs for cardiovascular diseases & other chronic conditions are major drivers for the segment growth. Moreover, availability of generic forms makes it a cost-effective option for hypertension management, which is anticipated to increase the prescription rate over the projected years.

Primary hypertension segment held the highest market share of 72% in 2023. It is the most common type of hypertension and accounts for majority of cases. According to the National Ambulatory Medical Care Survey 2019, in the U.S. medical records, 33.2% of patients visit physician offices due to primary hypertension. Growing number of cases of essential hypertension, driven by factors such as lifestyle choices, an aging population, improved detection, and effective treatment guidelines, contributes to the expansion of the market.

Secondary hypertension segment is expected to grow with a significant CAGR of 4.38% over the forecast period attributed to increasing prevalence of underlying medical conditions such as kidney disease & hormonal disorders, improved diagnosis of secondary hypertension, and development of new anti-hypertensive drugs. Moreover, major pharmaceutical companies are investing in developing new anti-hypertensive drugs for secondary hypertension through various strategies such as collaborations, new product launches, mergers, and acquisitions.

Oral segment contributed the largest market share of 76% in 2023 and is expected to grow at the fastest CAGR. This growth is attributed to increased patient preference for oral medications and growing demand for fixed-dose combinations of anti-hypertensive drugs. Pharmaceutical companies constantly develop new oral anti-hypertensive drugs with improved efficacy and safety profiles. This is also driving the growth of the market's oral route of administration segment. In April 2021, the FDA approved Macitentan Tablets, 10 mg of Zydus Worldwide DMCC. These tablets are used to treat pulmonary arterial hypertension and reduce the risks of disease progression.

Injectables segment held the second-largest share of the market. Injectable anti-hypertensive drugs are a crucial component of the treatment in cases of hypertensive emergencies, where rapid and precise blood pressure reduction is necessary. Moreover, increasing hospitalization due to life-threatening diseases and chronic conditions, such as heart attacks, strokes, and kidney disease, is expected to increase the demand for injectable drugs.

Hospital pharmacy segment accounted for the largest market share of 54% in 2023. This can be attributed to increase in the number of hospitalizations due to high blood pressure and other chronic diseases. Additionally, anti-hypertensive drugs are prescription-based medications prescribed by specialized healthcare professionals who are available in hospital settings, contributing to segment's growth. A doctor's prescription enables healthcare professionals to assess the patient's overall health and medication regimen to minimize risks and manage any potential side effects or drug interactions. It is expected to fuel the demand for anti-hypertensive drugs in the hospital pharmacy segment.

Online pharmacy segment is expected to grow at the fastest CAGR during the projected timeframe attributed to increasing convenience, affordability, and privacy that online pharmacies offer to patients. Moreover, government bodies are ensuring that patients have access to the medications they need to manage their hypertension. For instance, in November 2019, the National Health Service (NHS) Digital Pharmacy Program UK introduced the Electronic Prescription Service (EPS). The EPS makes it easier for patients to obtain anti-hypertensive and other drugs.

North America accounted for the largest revenue share of 38% in 2023 owing to the availability of anti-hypertensive drugs and development of new and more effective anti-hypertensive drugs. Moreover, surge in the incidence of hypertension and rise in obesity significantly contribute to the growth of the market in the region. According to Centers for Disease Control and Prevention, obesity in the U.S. affects 100.1 million people in 2023, with adults 41.9% and 19.7% of children. These factors are contributing to the significant share of the region.

Asia Pacific is estimated to grow at the fastest CAGR during the forecast period. Increasing prevalence of hypertension in Asia Pacific region is a major driver for the market. As the population ages and lifestyles change, incidence of hypertension is rising. Excessive salt consumption is a significant contributor to the prevalence of hypertension in the Asia Pacific region. According to the WHO, China consumes excessive salt in food, an average of 9.3 grams per day in home cooking, which is approximately double as compared to the recommended amount. More than 27.5% of Chinese adults have high blood pressure and cardiovascular disease. These factors are expected to drive the regional market growth.

By Drug Class

By Type

By Route of Administration

By Distribution Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Anti-hypertensive Drugs Market

5.1. COVID-19 Landscape: Anti-hypertensive Drugs Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Anti-hypertensive Drugs Market, By Drug Class

8.1. Anti-hypertensive Drugs Market, by Drug Class, 2024-2033

8.1.1. Diuretics

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. ACE Inhibitors

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Calcium Channel Blockers

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Beta-adrenergic Blockers

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Vasodilators

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Anti-hypertensive Drugs Market, By Type

9.1. Anti-hypertensive Drugs Market, by Type, 2024-2033

9.1.1. Primary Hypertension

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Secondary Hypertension

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Anti-hypertensive Drugs Market, By Route of Administration

10.1. Anti-hypertensive Drugs Market, by Route of Administration, 2024-2033

10.1.1. Oral

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Injectables

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Anti-hypertensive Drugs Market, By Distribution Channel

11.1. Anti-hypertensive Drugs Market, by Distribution Channel, 2024-2033

11.1.1. Retail Pharmacy

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Hospital Pharmacy

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Online Pharmacy

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Anti-hypertensive Drugs Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Drug Class (2021-2033)

12.1.2. Market Revenue and Forecast, by Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.1.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Drug Class (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Drug Class (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Drug Class (2021-2033)

12.2.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.2.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Drug Class (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Drug Class (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Drug Class (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Drug Class (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Drug Class (2021-2033)

12.3.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.3.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Drug Class (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Drug Class (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Drug Class (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Drug Class (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Drug Class (2021-2033)

12.4.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.4.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Drug Class (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Drug Class (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Drug Class (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Drug Class (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Drug Class (2021-2033)

12.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Drug Class (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Drug Class (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 13. Company Profiles

13.1. Sanofi

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Boehringer Ingelheim International GmbH

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Novartis AG

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Johnson & Johnson Services, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. DAIICHI SANKYO COMPANY, LIMITED.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Merck & Co., Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. AstraZeneca

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Pfizer Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Lupin

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Sun Pharmaceutical Industries Ltd.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others