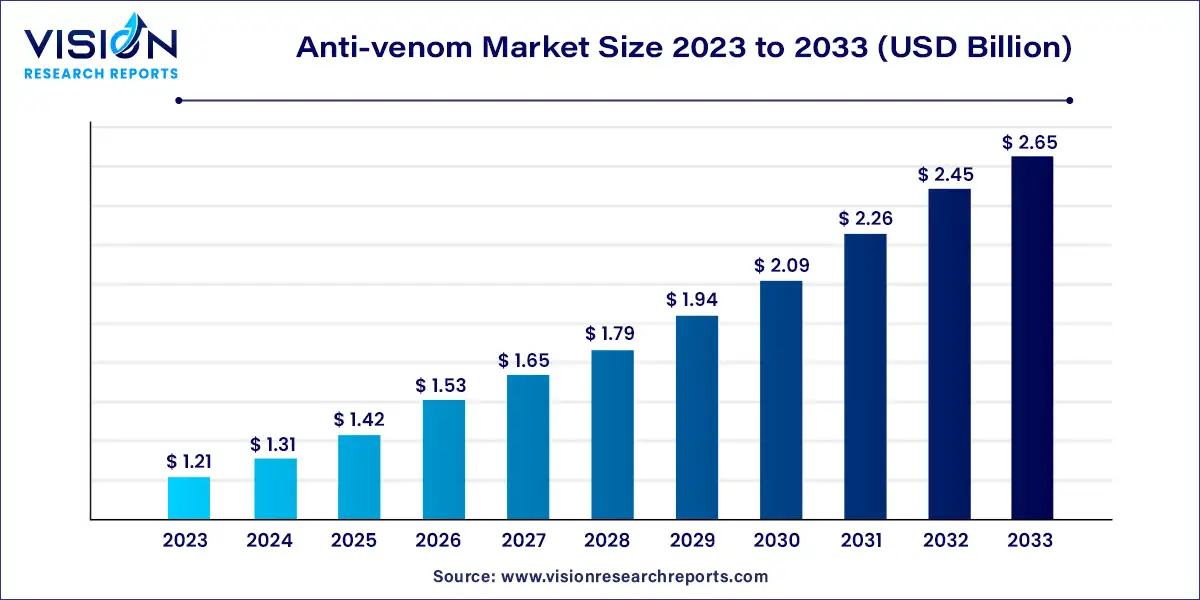

The global anti-venom market size was estimated at around USD 1.21 billion in 2023 and it is projected to hit around USD 2.65 billion by 2033, growing at a CAGR of 8.14% from 2024 to 2033. The anti-venom market is a crucial segment within the global healthcare industry, focused on the production and distribution of medical treatments designed to counteract the effects of venomous bites and stings. Anti-venoms are specific types of antivenins that neutralize the toxins produced by venomous animals, such as snakes, spiders, and scorpions, effectively reducing mortality and morbidity rates associated with venomous envenomations.

The growth of the anti-venom market is driven by the rising incidence of venomous bites and stings, particularly in tropical and subtropical regions, significantly boosts the demand for effective anti-venoms. As human populations encroach on wildlife habitats and climate change alters animal behavior, encounters with venomous species become more frequent, necessitating advanced treatment options. Secondly, technological advancements in anti-venom production, including innovations in biotechnology and improved manufacturing processes, contribute to the development of more effective and safer anti-venoms. These advancements not only enhance treatment efficacy but also make anti-venoms more accessible and affordable. Additionally, increased funding and support from governmental bodies and non-governmental organizations for research and distribution play a crucial role in market growth.

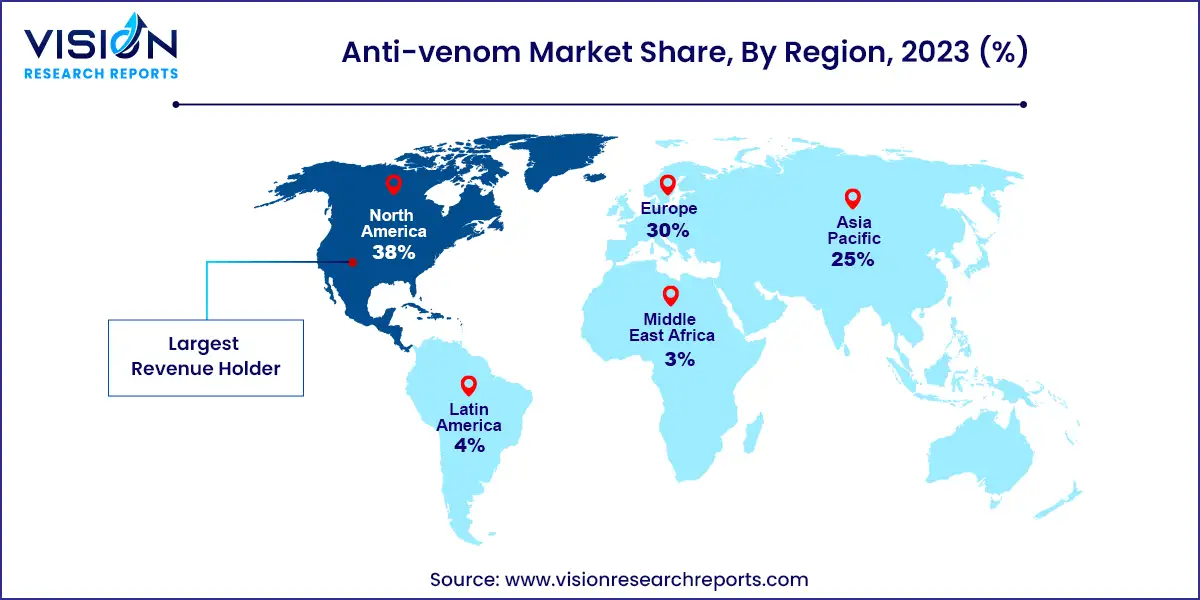

North America captured the largest revenue share of 38% in 2023. This is attributed to significant R&D efforts, a supportive regulatory environment, and good accessibility to anti-venom treatments. According to the Centers for Disease Control and Prevention (CDC), the region experiences about 7,000 to 8,000 venomous snake bites annually, with a low mortality rate. This high accessibility to anti-venom treatments supports the region's market growth.

| Attribute | North America |

| Market Value | USD 0.45 Billion |

| Growth Rate | 8.14% CAGR |

| Projected Value | USD 1 Billion |

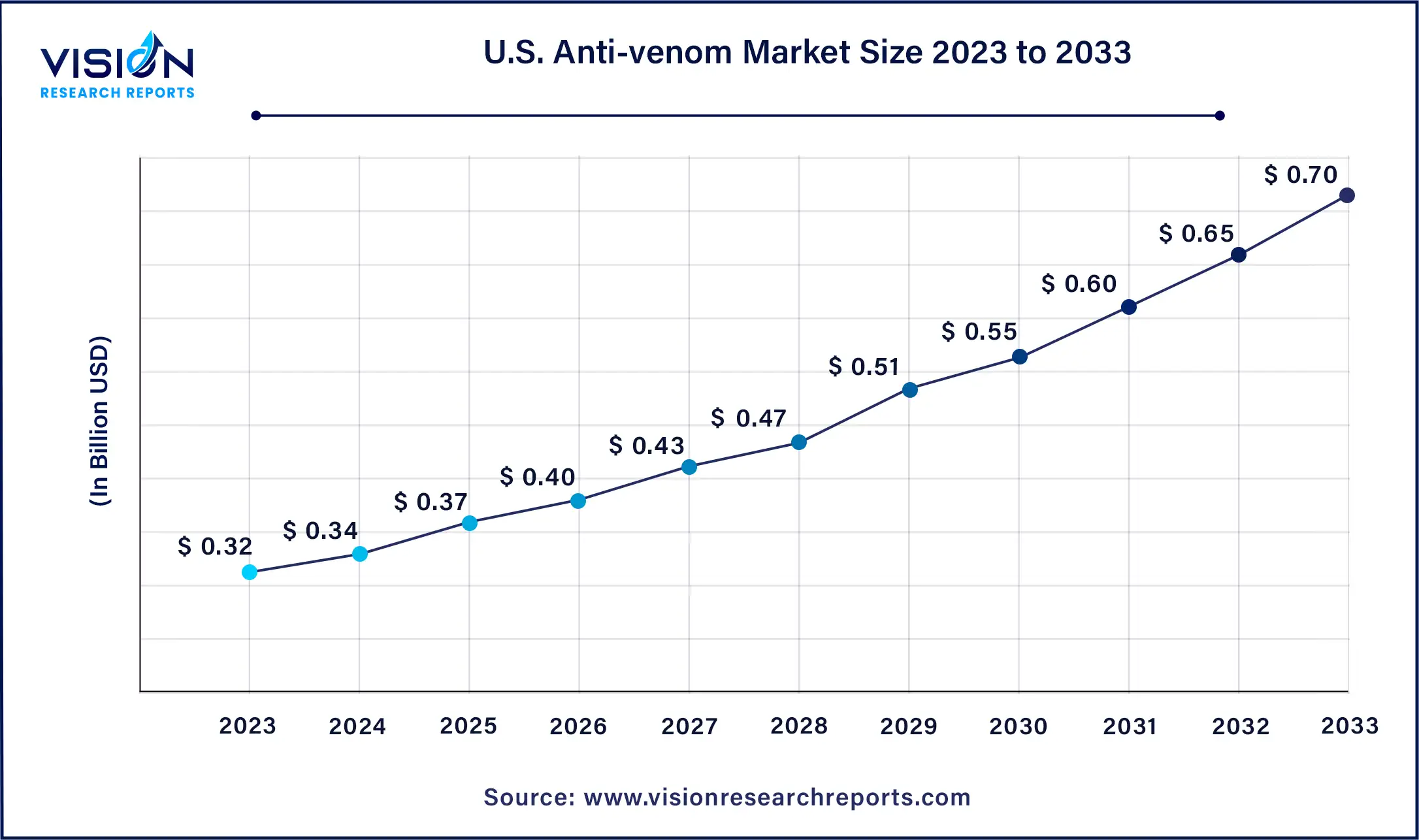

The U.S. anti-venom market size was estimated at USD 0.32 billion in 2023 and it is expected to surpass around USD 0.70 billion by 2033, at a CAGR of 8.14% from 2024 to 2033.

The U.S. market is expected to experience substantial growth. Factors contributing to this include advancements in anti-venom treatments, efforts to increase treatment accessibility, the presence of major market players, and a favorable regulatory environment.

The European market is anticipated to grow significantly due to increased government efforts to improve access to anti-venom treatments, enhanced funding for research, and rising incidents of snake bites. Government initiatives aimed at improving preparedness and ensuring access to anti-venom are driving demand in the region.

The Asia Pacific market is projected to grow at the fastest rate, with a CAGR of 9.14% over the forecast period. The high prevalence of venomous bites and increasing access to anti-venom treatments are key drivers. According to a WHO study published in July 2020, India alone reported about 1.2 million snakebite deaths from 2000 to 2019, averaging 58,000 bites annually. This high incidence, coupled with rising efforts to improve anti-venom accessibility, is expected to drive significant market growth.

The snake segment led the market with a revenue share of 51% in 2023. This dominance is due to the high frequency of snake bites, the need for specific treatments for various snake species, and widespread public awareness regarding the importance of timely treatment for such bites. Snake bites are notably more prevalent than those from other venomous animals, particularly in Africa, Latin America, and Asia. For example, the World Health Organization (WHO) reports that Africa sees approximately 435,000 to 580,000 snake bites annually.

In contrast, the scorpion segment is expected to grow at the fastest rate during the forecast period. This growth is driven by increased awareness of the severe effects of scorpion stings, which include pain, burning, respiratory issues, vomiting, severe swelling, and shock. Global initiatives to develop more effective treatments for scorpion stings are also contributing to this trend. Notably, in November 2023, the Indian Department of Science & Technology (DST) introduced a therapeutic drug formulation (TDF) incorporating low doses of α1-adrenoreceptor agonists, commercial equine anti-scorpion antivenom, and vitamin C. This new formulation aims to counteract the toxicity of the Indian red scorpion sting, thereby enhancing patient management.

The polyvalent anti-venom segment held the largest revenue share of 68% in 2023. Polyvalent anti-venoms are designed to treat bites from a variety of venomous species, making them highly versatile. These anti-venoms contain antibodies that neutralize the venom from multiple related species, which is particularly useful in emergencies where the specific venomous animal is unknown. The growing research and development efforts to create broad-spectrum anti-venoms are also bolstering this segment. For instance, in February 2024, scientists at Scripps Research developed an antibody capable of neutralizing lethal toxins from a range of snake venoms found in Asia, Africa, and Australia.

Conversely, the monovalent anti-venom segment is projected to experience the fastest growth. This is due to the increasing demand for anti-venoms tailored to specific venomous species. Monovalent anti-venoms offer more targeted protection against the poison of a particular species, which is expected to drive their demand. A study published in June 2023 on ResearchGate found that monovalent anti-venoms were four times more effective than commercial antivenoms against Moroccan Cobra (Naja haje) venom.

The neurotoxic anti-venom segment commanded the largest revenue share of 33% in 2023 and is expected to grow the fastest over the forecast period. This is due to the severe threat posed by neurotoxic venoms, which can be fatal within minutes depending on the dose. The Black Mamba, for example, is known for its neurotoxic venom, which has a 100% fatality rate if untreated. The high mortality risk associated with neurotoxic venoms drives the demand for effective treatments, thus fueling market growth.

The cytotoxic anti-venom segment is also anticipated to see significant growth. Cytotoxic venoms, which damage tissues and blood vessels, require specialized anti-venoms to mitigate their effects. Ongoing research in cell biology and proteomics is expected to advance the understanding of cytotoxic venoms and enhance the development of effective treatments.

Hospitals represented the largest revenue share of 63% in 2023. Due to their capability to handle emergencies with specialized staff and facilities, hospitals are the primary setting for the treatment of venomous bites and stings. They provide critical services such as rapid diagnosis, anti-venom administration, and supportive care, which contributes to their dominant market share.

The clinics segment is projected to grow rapidly. This growth is driven by a shift in patient preferences toward specialized treatment centers for venomous bites. Clinics dedicated to treating scorpion and snake bites and developing new treatment approaches are expanding. For instance, the UAB Comprehensive Snakebite Program, launched by UAB Comprehensive Wound Care Clinic in June 2022, offers specialized care, follow-ups, and research on new treatment methods for snake bites.

By Species

By Type

By Mode of Action

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others