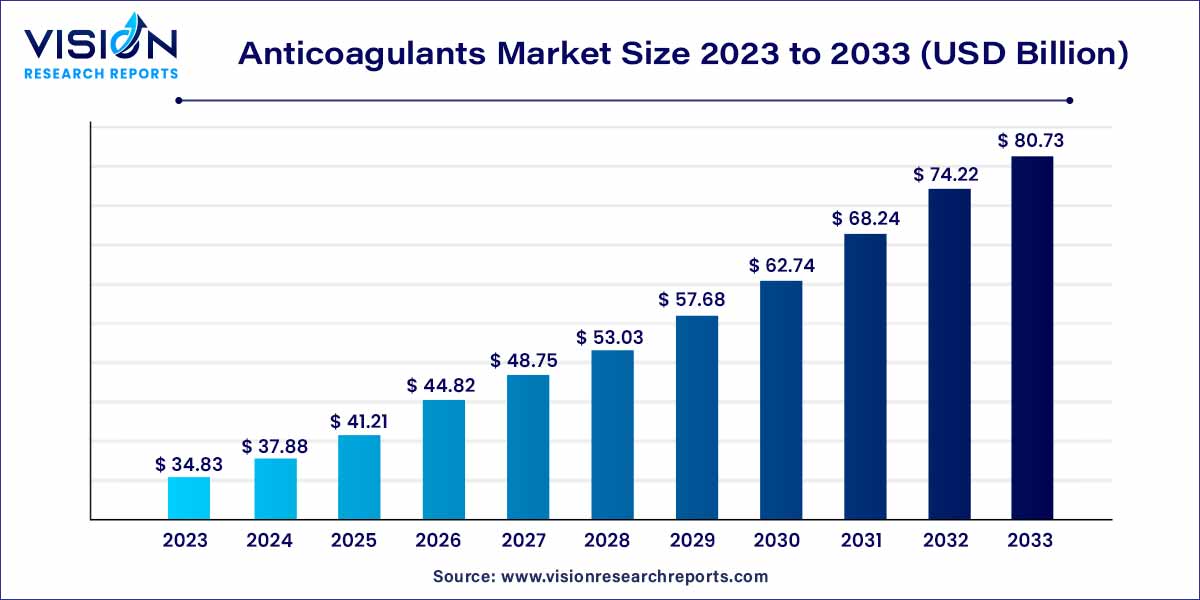

The global anticoagulants market size was estimated at around USD 34.83 billion in 2023 and it is projected to hit around USD 80.73 billion by 2033, growing at a CAGR of 8.77% from 2024 to 2033. Major drivers propelling the market's growth include the aging population's increased susceptibility to disorders requiring anticoagulant medication and the rising prevalence of cardiovascular diseases such deep vein thrombosis, pulmonary embolism, and atrial fibrillation.

The anticoagulants market refers to the pharmaceutical sector dedicated to the development, production, and distribution of medications used to prevent blood clot formation. These drugs are vital in managing various medical conditions, including cardiovascular diseases, deep vein thrombosis, pulmonary embolism, and stroke. Anticoagulants work by inhibiting the clotting process, thus reducing the risk of harmful blood clots that can lead to serious health complications.

The growth of the anticoagulants market is driven by several key factors. Firstly, the increasing prevalence of cardiovascular diseases and related conditions worldwide is a major contributor. As the global population ages and lifestyles become increasingly sedentary, the incidence of conditions such as atrial fibrillation, deep vein thrombosis, and pulmonary embolism continues to rise, creating a growing demand for anticoagulant medications. Additionally, advancements in medical technology and treatment protocols have improved the effectiveness and safety of anticoagulants, leading to greater acceptance and utilization among healthcare providers and patients alike. Moreover, the expanding awareness about the importance of preventive healthcare measures and early intervention has spurred the adoption of anticoagulants as a crucial component of cardiovascular disease management. Furthermore, supportive government initiatives, favorable reimbursement policies, and increasing healthcare expenditure in both developed and emerging markets contribute to the sustained growth of the anticoagulants market. Overall, these factors collectively propel the market forward, fostering innovation, investment, and expansion in the field of anticoagulant therapies.

The Novel Oral Anticoagulants (NOACs) segment led the market in 2023, commanding a revenue share of 58%. This dominance is driven by the escalating adoption of NOACs in developing nations, where they are preferred over warfarin due to their efficacy and safety. NOACs offer fixed dosing regimens and predictable pharmacokinetics, streamlining patient management by eliminating the need for frequent monitoring and dose adjustments associated with warfarin. This improves patient compliance and convenience. Additionally, NOACs present fewer drug interactions compared to warfarin, reducing the risk of adverse reactions and complications from concurrent medications.

The Heparin and Low Molecular Weight Heparin (LMWH) segment is expected to exhibit the highest CAGR during the forecast period. This growth is fueled by the expanding indications for heparin and LMWH, which now include acute treatment and prevention in high-risk patients, such as those undergoing major surgery or experiencing prolonged immobilization. The increasing prevalence of thrombotic events further boosts the demand for heparin and LMWH. Moreover, these agents are often perceived as cost-effective anticoagulant options, particularly in healthcare settings with limited resources. Their affordability and effectiveness make them appealing choices across various healthcare systems worldwide.

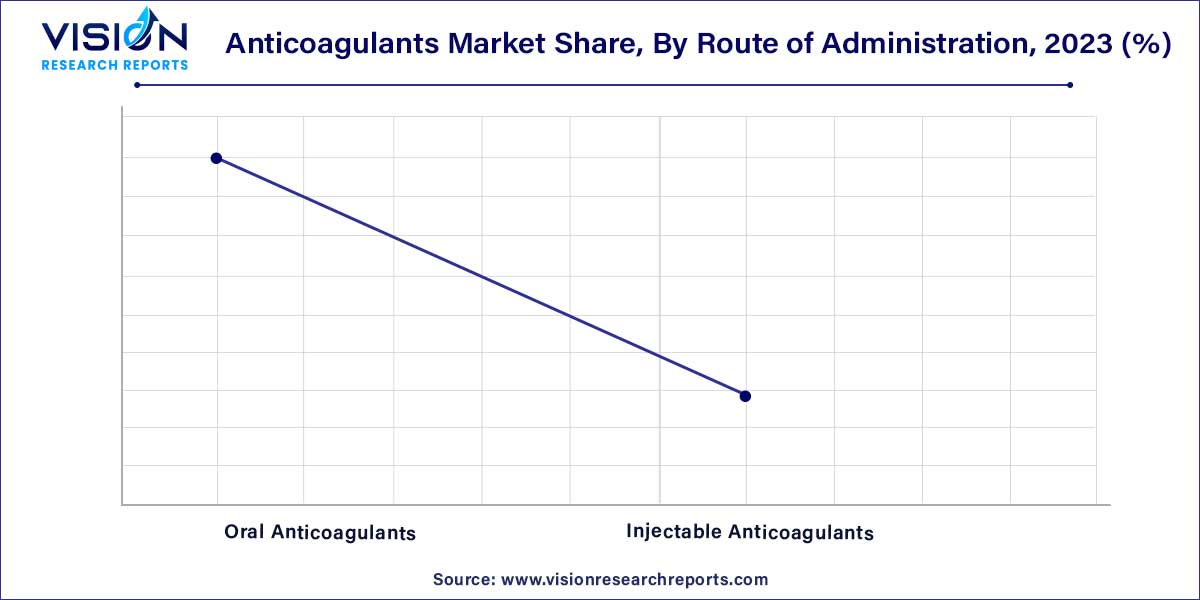

The oral anticoagulants segment commanded the largest share of the market in 2023 and is expected to experience the fastest growth rate throughout the forecast period. This segment has seen significant advancements in patient convenience, compliance, and drug development. Oral anticoagulants provide a user-friendly alternative to traditional injectable forms, particularly beneficial for long-term therapy where patient adherence is crucial. The ease of administration greatly contributes to the preference for oral anticoagulants among both healthcare providers and patients. Numerous pharmaceutical companies are actively involved in developing and commercializing oral anticoagulants, focusing on innovations such as novel formulations and improved safety profiles. For instance, in December 2020, NATCO Pharma Limited launched the Rivaroxaban molecule under the brand name RPIGAT, an oral anticoagulant medication used for treating blood clots, available in various strengths.

The Injectable Anticoagulants segment is projected to witness significant growth during the forecast period. This growth is driven by its expanding utilization in treating various medical conditions including deep vein thrombosis, pulmonary embolism, and atrial fibrillation. Injectable anticoagulants, administered through injections, offer a quicker onset of action compared to oral alternatives. Moreover, the global prevalence of chronic conditions such as atrial fibrillation, deep vein thrombosis, and pulmonary embolism is on the rise, necessitating anticoagulant therapy to prevent blood clots and associated serious complications like stroke and heart attack. These factors are expected to bolster the injectable anticoagulants segment in the coming years.

The Atrial Fibrillation/Myocardial Infarction (Heart Attack) segment dominated the market. Atrial fibrillation, a common heart condition that can lead to blood clots and stroke, has made anticoagulants a highly effective treatment option for reducing the risk of these complications. With the increasing prevalence of atrial fibrillation, there's a rising demand for anticoagulants, making the atrial fibrillation application segment a key driver of market growth. According to CDC estimates, approximately 12.1 million individuals in the US are expected to suffer from atrial fibrillation by 2030. Additionally, factors such as increasing healthcare expenditure and growing awareness about the benefits of anticoagulants have also contributed to this growth.

The Deep Vein Thrombosis (DVT) segment is projected to experience the fastest growth rate during the forecast period. The prevalence of DVT is on the rise globally due to factors such as an aging population, increased sedentary lifestyles, and rising obesity rates. For instance, according to CDC, approximately 900,000 people are affected by DVT annually in the US. Anticoagulants' usage is expanding in acute treatment in DVT management to include long-term prophylaxis for patients at high risk of recurrent DVT. This extended application is driving the growth of this segment.

North America claimed the largest revenue share in the market in 2023. The region's market growth is attributed to the strong demand for innovative products and the increasing prevalence of cardiovascular disorders. According to the CDC, heart diseases accounted for the deaths of approximately 659,000 individuals annually in February 2022, representing almost 25% of all U.S. deaths. This surge in cardiovascular diseases has led to a heightened demand for anticoagulants. Moreover, the presence of leading pharmaceutical and biotechnology companies engaged in therapeutic development, coupled with a well-established healthcare infrastructure, is driving the regional market's growth.

The Asia Pacific region is poised to achieve the fastest compound annual growth rate (CAGR) in the market. This growth is fueled by the increasing prevalence of chronic diseases, a growing geriatric population, and rising healthcare expenditure in the region. Additionally, factors such as increasing awareness about the benefits of early diagnosis and treatment of blood clots, escalating investments in the healthcare sector, and advancements in technology are contributing to market growth in this region.

By Drug Category

By Route of Administration

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others