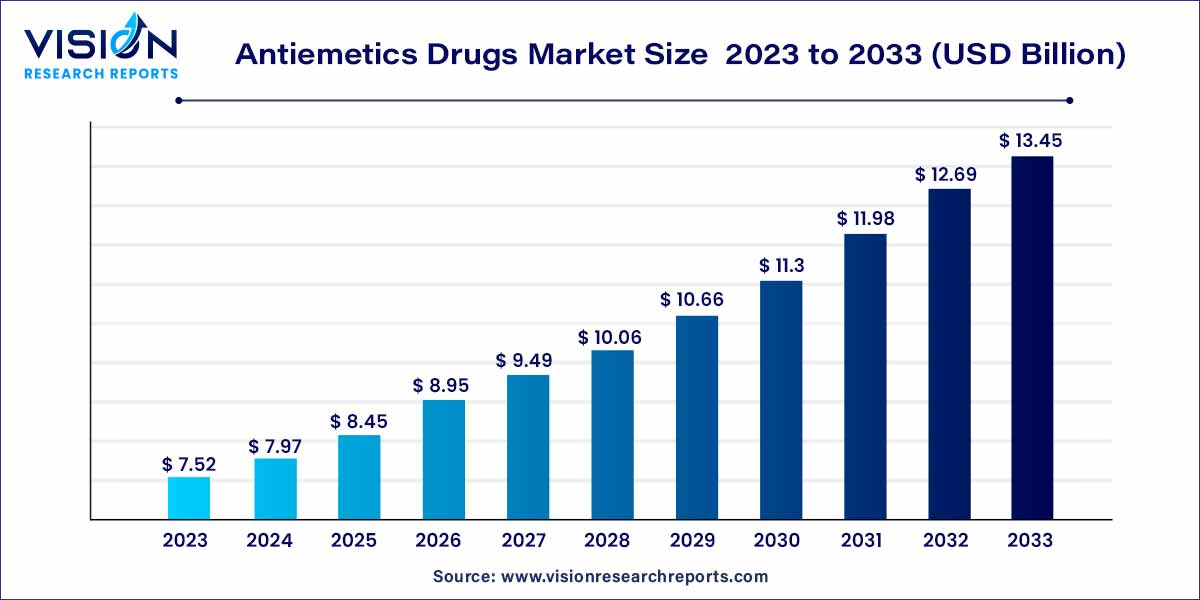

The global antiemetics drugs market was surpassed at USD 7.52 billion in 2023 and is expected to hit around USD 13.45 billion by 2033, growing at a CAGR of 5.99% from 2024 to 2033.

The antiemetics drugs market is a critical segment within the pharmaceutical industry, dedicated to addressing the challenges of nausea and vomiting, prevalent symptoms associated with various medical conditions and treatments. This overview aims to provide a comprehensive understanding of the antiemetics drugs market, covering key aspects such as market definition, current landscape, and future prospects.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 13.45 billion |

| Growth Rate from 2024 to 2033 | CAGR of 5.99% |

| Revenue Share of North America in 2023 | 37% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Anti-nausea and vomiting medications are employed to manage and prevent conditions like gastroenteritis and cancer. The expansion of the market can be attributed to the increasing occurrences of these ailments and the ongoing growth in research and development activities. Additionally, the rise in the introduction of generic alternatives is another factor shaping the demand in the market.

The increasing occurrences of diseases like gastroenteritis and cancer, which can lead to nausea and vomiting, are expected to drive up demand. Therapies such as chemotherapy for cancer and treatments for gastroenteritis often result in adverse effects, including nausea and vomiting. Antiemetic drugs play a crucial role in managing these side effects during treatments, leading to an anticipated increase in demand due to the growing prevalence of cancer and gastroenteritis.

According to the American Cancer Society, it is estimated that around 609,820 cancer deaths and 1,958,310 new cancer cases will occur in the U.S. in 2023. Additionally, a study published by NCBI in January 2019 highlighted the high prevalence of rotavirus gastroenteritis in India. Consequently, the rising incidence of diseases causing vomiting and nausea is expected to fuel market growth throughout the forecast period.

Moreover, the market is likely to expand further with the increasing number of drug approvals and ongoing research activities. Numerous industry participants are actively engaged in the research, development, and approval processes for antiemetic drugs. For example, in March 2022, Taiho Pharmaceutical Co., Ltd. received authorization to market and manufacture Arokaris, a selective NK1 receptor antagonist antiemetic drug designed for gastrointestinal symptoms associated with cancer chemotherapy. The introduction and approval of such products are poised to be significant drivers of market growth in the forecast period.

In 2023, the serotonin-receptor antagonists segment secured the largest market share at 30% and it is poised to experience the swiftest growth throughout the forecast period. This segment encompasses drugs such as Ondansetron (Zofran), Dolasetron (Anzemet), and Granisetron (Kytril), available in both injection and oral pill formulations. The notable market share and anticipated growth of this segment can be attributed to the increasing utilization of serotonin-receptor antagonist drugs to mitigate nausea and vomiting associated with chemotherapy, radiation therapy, and anesthesia. This trend is further accentuated by the escalating global incidence of cancer.

The dopamine receptor antagonist drugs segment held the second-largest market share, featuring drugs like Barhemsys, Inapsine, Haldol, Reglan, Gimoti, and Thorazine. The growth in this segment is attributed to the mounting approvals received by these drugs from regulatory authorities. For instance, in February 2020, BARHEMSYS, an antiemetic drug, obtained FDA approval for the prevention or treatment of postoperative nausea and vomiting.

In 2023, the chemotherapy segment contributed the largest market share of 46%. The heightened revenue share of this segment can be attributed to the increasing utilization of antiemetic drugs for managing nausea and vomiting associated with chemotherapy, coupled with a surge in product launches within this domain. Notably, in May 2018, in Brazil, Helsinn, a Swiss pharmaceutical company, in collaboration with Mundipharma, introduced the oral hard capsule AKYNZEO, designed to address nausea and vomiting induced by both acute and delayed phases of chemotherapy.

The postoperative surgery segment is forecasted to exhibit the fastest CAGR from 2024 to 2033. The anticipated growth in this segment is fueled by the growing adoption of antiemetic drugs to mitigate postoperative vomiting and nausea. Additionally, the prevalence of adverse effects, such as nausea and vomiting due to anesthesia, is expected to contribute to segmental growth throughout the forecast period. As highlighted in a November 2020 article by the Association of Anesthetists, approximately 30% of the general surgical population and about 80% of high-risk patients experience postoperative vomiting and nausea.

In 2023, the retail pharmacies segment asserted its dominance in the market, securing a substantial revenue share of 48%. The growth of this segment is fueled by the convenience and product availability offered by retail pharmacies. Additionally, the widespread presence of major retail pharmacy chains such as CVS Pharmacy, Walgreens Boots Alliance, and Rite Aid on a global scale is expected to drive the demand for these medications throughout the forecast period.

Conversely, the other segment, encompassing the procurement of drugs through online platforms or e-commerce, is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period. The expansion of this segment can be attributed to the increasing penetration of smartphones and the internet worldwide, a growing awareness of online pharmacies, and the industry's increasing emphasis on fortifying their online distribution networks. According to a study published in Frontiers in December 2022, approximately 92.8% of respondents were aware that they could purchase medicines online.

In 2023, North America dominated the market with the largest market share of 37%. The region's leadership is bolstered by the presence of key players such as Pfizer and GSK plc, contributing to a higher revenue share. Additionally, the ongoing approvals for antiemetic drugs in North America are expected to fuel further regional expansion. Notably, a May 2022 article from the Canadian Institutes of Health Research highlighted the approval of Ondansetron, a 5-HT3 antagonist, in Canada for use as an antiemetic in managing nausea and vomiting associated with chemotherapy and post-operation scenarios.

The Asia Pacific market is poised for significant growth, projected to achieve a noteworthy CAGR from 2024 to 2033. This trajectory is supported by the increasing incidences of cancer and gastroenteritis across the region, coupled with the expanding availability of various antiemetic medications. A November 2022 study published by the National Library of Medicine revealed a projected 12.8% increase in cancer cases in India within the five-year period from 2020 to 2025. Consequently, the escalating incidences of cancer, coupled with the growing prevalence of chemotherapy, are anticipated to be key drivers of regional growth throughout the forecast period.

By Drug Type

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Drug Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Antiemetics Drugs Market

5.1. COVID-19 Landscape: Antiemetics Drugs Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Antiemetics Drugs Market, By Drug Type

8.1. Antiemetics Drugs Market, by Drug Type, 2024-2033

8.1.1 Serotonin-receptor Antagonists

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Anticholinergics

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Dopamine Receptor Antagonists

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Neurokinin Receptor Antagonists

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others (Antihistamines, Cannabinoids)

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Antiemetics Drugs Market, By Application

9.1. Antiemetics Drugs Market, by Application, 2024-2033

9.1.1. Chemotherapy

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Gastroenteritis

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Post Operative Surgery

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Antiemetics Drugs Market, By End-use

10.1. Antiemetics Drugs Market, by End-use, 2024-2033

10.1.1. Hospital & Clinics

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Retail Pharmacy

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Antiemetics Drugs Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Pfizer Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Cipla Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Merck KGaA.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Eagle Pharmaceuticals, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Johnson & Johnson Services, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. GSK plc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Astellas Pharma Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. GLENMARK PHARMACEUTICALS LTD.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Viatris Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Baxter

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others