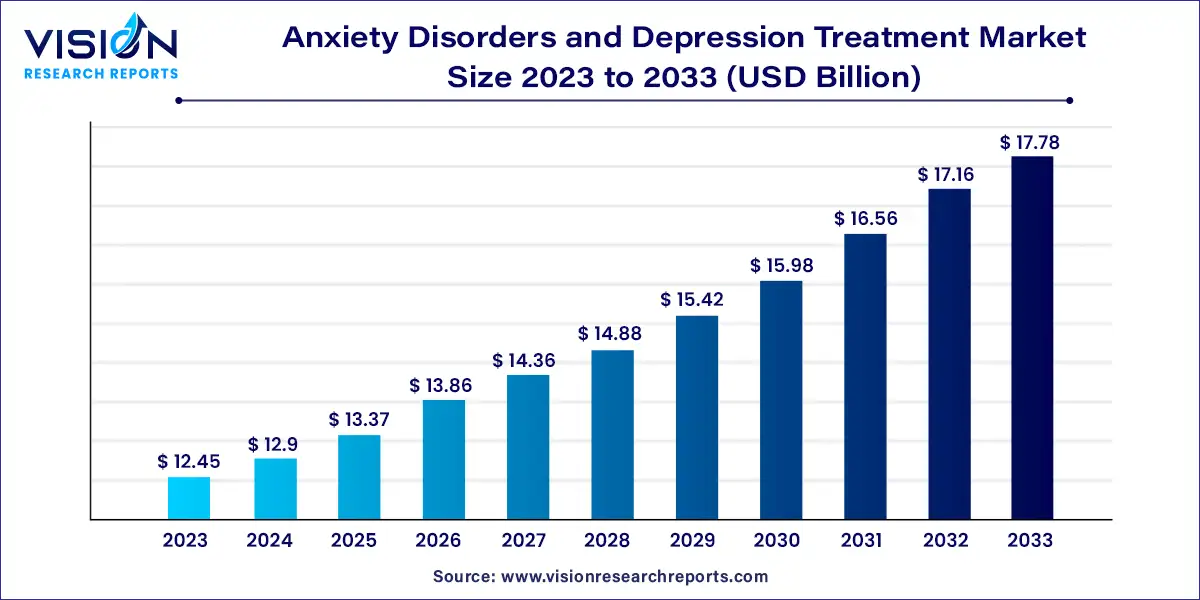

The global anxiety disorders and depression treatment market size was valued at USD 12.45 billion in 2023 and is anticipated to reach around USD 17.78 billion by 2033, growing at a CAGR of 3.63% from 2024 to 2033. The global anxiety disorders and depression treatment market is a significant segment within the mental health industry, driven by the increasing prevalence of anxiety disorders and depression worldwide. With rising awareness about mental health issues and advancements in treatment options, this market is witnessing substantial growth.

The growth of the anxiety disorders and depression treatment market is primarily fueled by an increasing rates of anxiety and depression globally, exacerbated by modern stressors and the impact of the COVID-19 pandemic, have heightened the demand for effective treatment options. Advances in medical research and technology are continuously introducing innovative therapies and improving existing treatments, thereby expanding treatment options and enhancing patient outcomes. Furthermore, the growing recognition of mental health as a critical component of overall well-being has led to increased public awareness and acceptance, encouraging more individuals to seek professional help. Additionally, rising healthcare expenditure and improved access to mental health services in both developed and developing regions contribute to market expansion, making mental health treatments more accessible to a broader population.

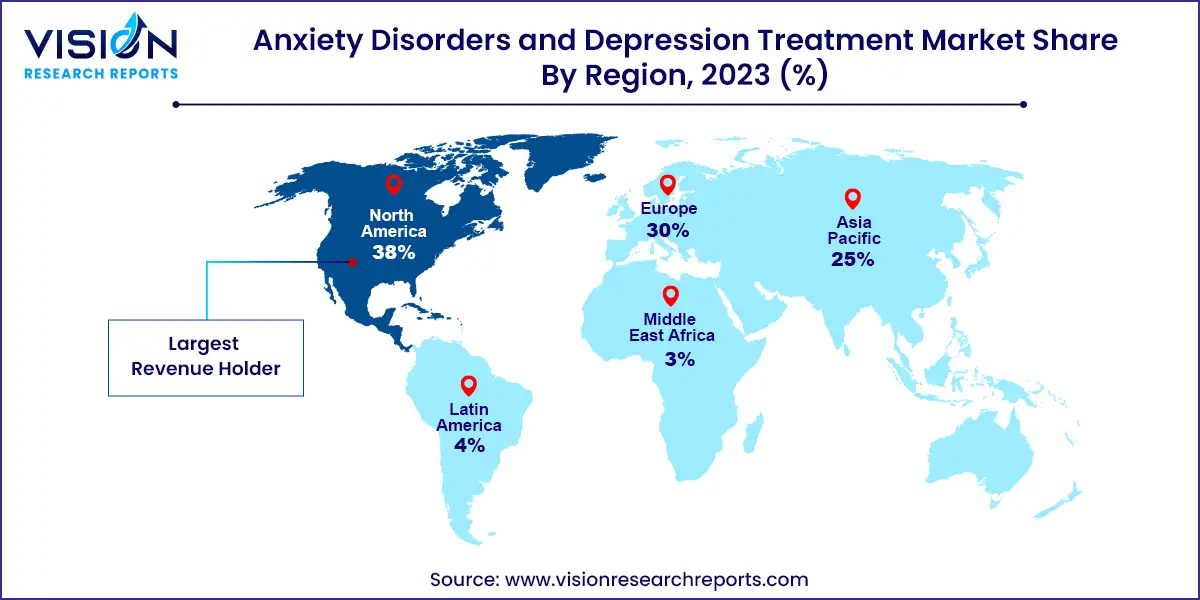

North America dominated the market with a 38% share in 2023, driven by the high rates of mental and anxiety disorders in the region. The presence of key market players, strong distribution networks, and advanced medical facilities contributes to this region's market leadership.

| Attribute | North America |

| Market Value | USD 4.73 Billion |

| Growth Rate | 3.63% CAGR |

| Projected Value | USD 6.75 Billion |

Europe Market Trends

Europe held a 30% share of the anxiety disorders and depression treatment market in 2023. Significant investments in research and development for antidepressant medications and increasing sales driven by rising mental health awareness have bolstered the market in this region.

Asia Pacific Market Trends

In Asia Pacific, the market for anxiety disorders and depression treatment captured a 23.63% share in 2023. The region's growth is attributed to rising mental health issues and economic growth in countries such as China, Japan, and India.

The antidepressants segment led the market in 2023, capturing the largest revenue share of 33%. This dominance is driven by the increasing prevalence of major depressive disorder, obsessive-compulsive disorder, generalized anxiety disorder, and panic disorder. The heightened awareness of mental health and depression, spurred by government and NGO initiatives, has led to a rise in the prescription of antidepressant medications.

In contrast, the atypical antipsychotics segment held a 19.67% market share in 2023. These drugs are preferred for their reduced risk of extrapyramidal side effects compared to traditional antipsychotics. The segment's growth is fueled by rising cases of anxiety, depression, and bipolar disorders. Increased mental health awareness has led patients to choose these medications as a first-line treatment due to their safety and effectiveness.

In 2023, the anxiety segment led the market with a 56% share, reflecting the high incidence of phobias, social anxiety disorders, and similar conditions. Increased competition in various fields and unrealistic goal-setting have heightened anxiety and depression rates. Growing awareness of anxiety and its treatments is contributing to market growth.

The depression segment held a 44.8% market share in 2023. Rising mental health awareness has led to more diagnoses and increased willingness to seek treatment. Societal pressures, work-life balance challenges, and social media influence have further fueled the rise in depression cases, driving market growth.

Retail pharmacies led the market with a 56% share in 2023. Patients prefer these easily accessible and trustworthy locations for their medication needs. Retail pharmacies offer both branded and generic medications, provide immediate emergency aid, and build customer loyalty through quick and efficient service, supporting the segment's growth.

The online pharmacies segment is expected to grow significantly, with a projected growth rate of 8.63%. The rise of e-commerce platforms allows customers to order medications and pharmacy products directly to their homes. The subscription model offered by online pharmacies also addresses the issue of medication shortages by allowing regular, automated orders.

By Drugs

By Indication

By Distribution Channel

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others