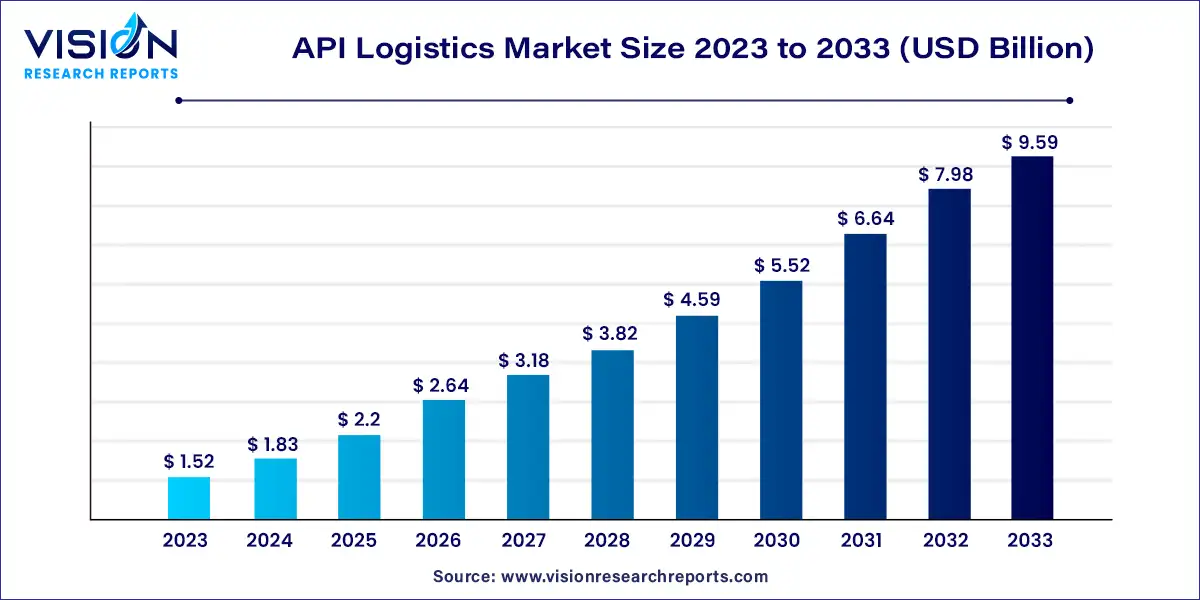

The global API logistics market size was estimated at around USD 1.52 billion in 2023 and it is projected to hit around USD 9.59 billion by 2033, growing at a CAGR of 20.23% from 2024 to 2033.

In the modern logistics, Application Programming Interface (API) integration has revolutionized efficiency and connectivity across supply chains worldwide. The API logistics market encompasses a broad spectrum of technologies and services designed to streamline operations, enhance transparency, and optimize resource utilization for businesses involved in transportation, warehousing, and distribution.

The API logistics market is experiencing robust growth driven by the rapid expansion of e-commerce is fueling demand for agile and integrated logistics solutions that can handle the complexities of online retail operations efficiently. Secondly, advancements in technology, particularly in IoT and AI, are enhancing the capabilities of API-driven platforms by enabling real-time data analysis and predictive insights. Thirdly, the increasing globalization of supply chains necessitates interoperable logistics solutions that APIs facilitate, thereby improving transparency and operational efficiency. These factors combined are propelling the API logistics market forward, poised for continued expansion in the years ahead.

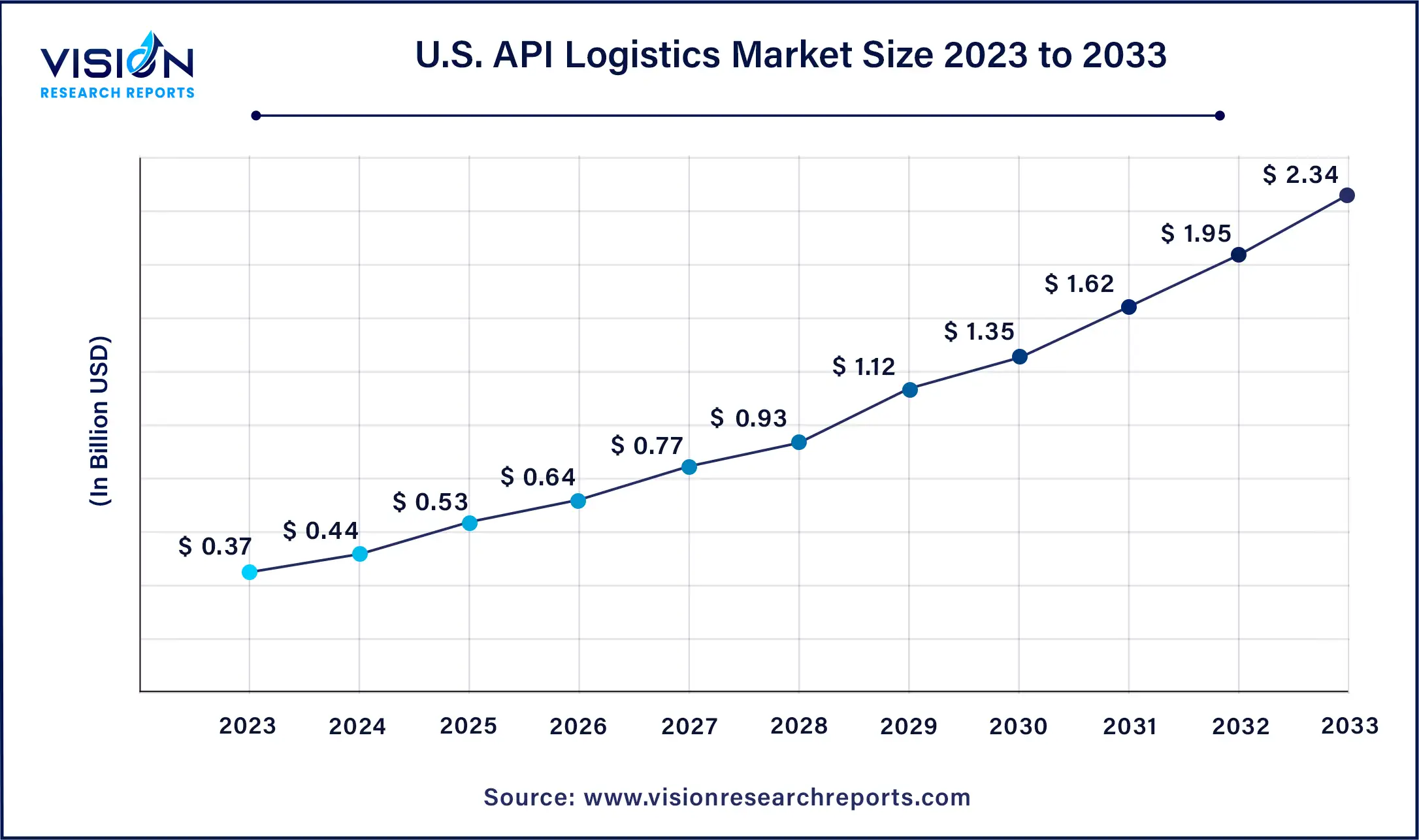

The U.S. API logistics market size was valued at around USD 0.37 billion in 2023 and is projected to hit around USD 2.34 billion by 2033, growing at a CAGR of 20.25% from 2024 to 2033.

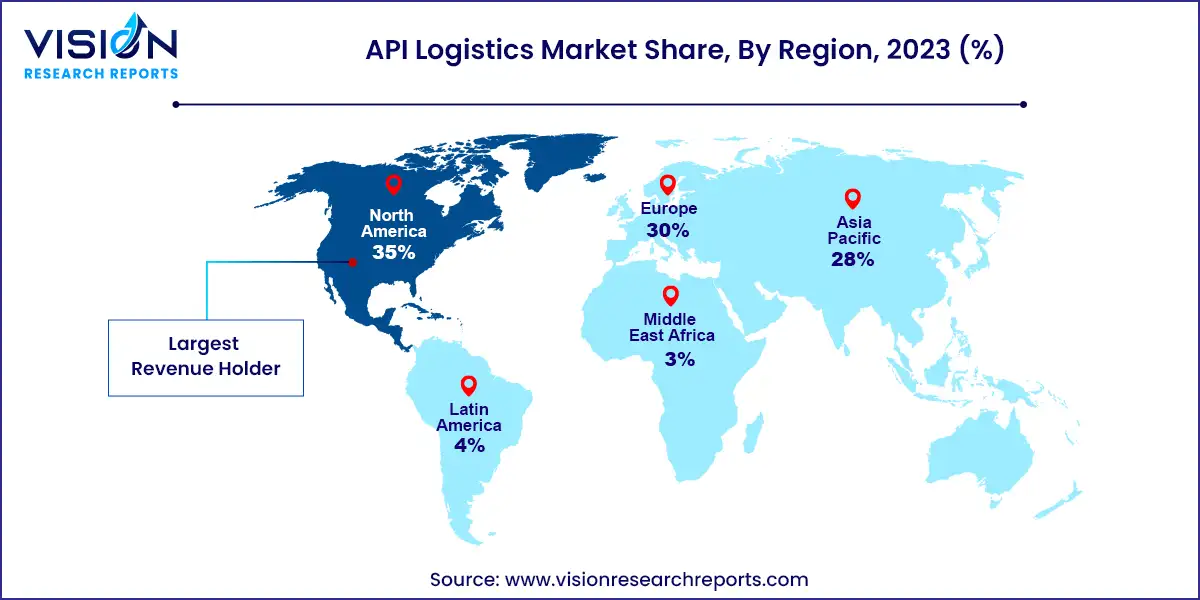

North America emerged as the dominant region in the API logistics market, accounting for over 35% of the revenue share in 2023. The region's leadership position is attributed to its advanced technological infrastructure, widespread adoption of cloud computing, big data, IoT, and AI, which collectively facilitate seamless integration of APIs in logistics operations. Additionally, the robust transportation and logistics sector in North America fosters high adoption of APIs, enhancing efficiency and fostering innovation in logistics services.

On the other hand, the Asia Pacific region is poised to witness the fastest CAGR of 21.33% from 2024 to 2033 in the API logistics market. The region's rapid growth can be attributed to the burgeoning e-commerce activities in countries like China, India, and Southeast Asian nations. Moreover, the ongoing development of technological and logistics infrastructure supports market expansion in Asia Pacific. Rapid urbanization and increasing consumer expectations for swift and reliable delivery services are driving the demand for advanced logistics solutions, wherein APIs play a pivotal role in enabling real-time updates and optimizing operational processes.

The API logistics market is categorized into three main components: API management platform, API, and services, with the API segment leading with a significant revenue share of over 45% in 2023. This dominance is primarily driven by the surge in e-commerce activities and the adoption of omnichannel retail models, which necessitate efficient logistics solutions. APIs play a crucial role in enabling seamless integration between e-commerce platforms and logistics providers, facilitating streamlined inventory management, automated order processing, and efficient last-mile delivery.

The API management platform segment is projected to witness the highest compound annual growth rate (CAGR) of 20.93% over the forecast period. This growth is fueled by the increasing complexity of supply chains driven by evolving consumer preferences and market dynamics. The digitization of supply chains is accelerating the adoption of API management platforms, which facilitate the creation, deployment, and management of APIs crucial for integrating diverse technologies and enabling new digital services.

In terms of transportation modes, the road segment dominated the API logistics market in 2023, capturing the largest revenue share. This dominance is attributed to the cost-effectiveness and flexibility offered by road freight transport, which enables efficient door-to-door delivery services due to extensive connectivity. The growing complexity of last-mile delivery, propelled by the surge in e-commerce sales, further drives the demand for real-time tracking capabilities in road freight, thereby positively impacting the API logistics market.

Conversely, the air segment is poised to register the highest CAGR during the forecast period. This growth is driven by the increasing demand for expedited delivery of goods. Air transportation, known for its rapid delivery times and extensive route options, is essential for time-sensitive and high-value shipments. The adoption of APIs is expected to grow significantly in this segment to facilitate real-time tracking and efficient handling of air cargo.

The visibility application segment dominated the API logistics market in 2023, holding the largest revenue share. The segment's growth is driven by the critical need for real-time information to mitigate risks and enhance operational efficiency across supply chains. Real-time data updates are indispensable in logistics operations due to the industry's complexity and time-sensitive nature. APIs play a pivotal role in enabling real-time data sharing and monitoring, empowering logistics companies to track shipments, manage inventory levels, and ensure timely deliveries to designated locations.

Meanwhile, the warehouse & fulfillment application segment is projected to exhibit the fastest CAGR during the forecast period. This growth is fueled by the escalating need for efficient inventory management to meet the rising shipment volumes propelled by the expansion of e-commerce. APIs facilitate streamlined integration of automation systems and aid in managing fulfillment processes and inventory data in warehouses, further driving their adoption.

By Component

By Transportation Mode

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others