Aromatic Solvents Market Size and Trends

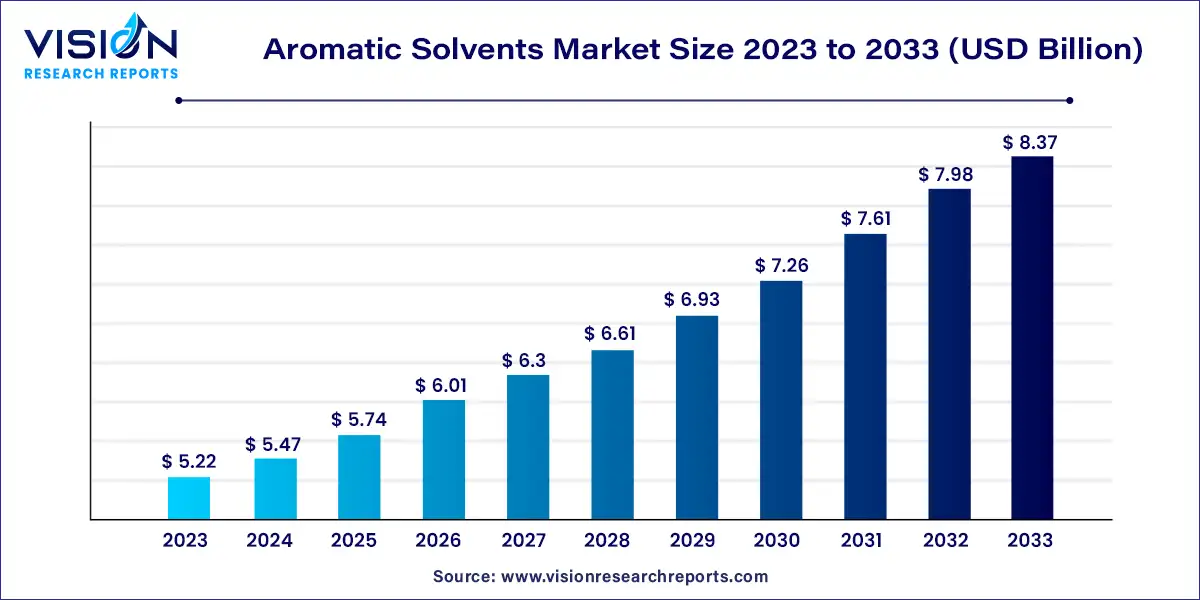

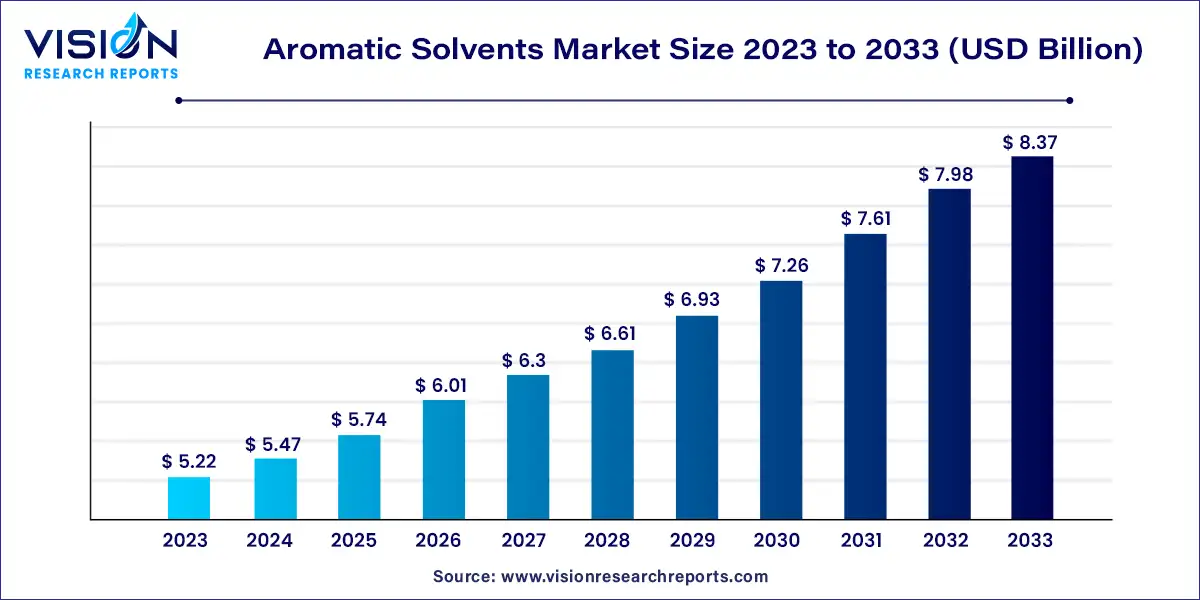

The global aromatic solvents market size was estimated at around USD 5.22 billion in 2023 and it is projected to hit around USD 8.37 billion by 2033, growing at a CAGR of 4.83% from 2024 to 2033.

Key Pointers

- Asia Pacific led the global market with the largest market share of 43% in 2023.

- By Product, the toluene solvents segment held a significant market share of 51% in 2023.

- By Application, the paints and coatings segment captured the maximum market share of 51% in 2023.

Aromatic Solvents Market Overview

The aromatic solvents market is a dynamic sector within the chemical industry, characterized by a wide range of applications and a diverse product portfolio. From paints and coatings to pharmaceuticals and adhesives, aromatic solvents play a crucial role in various manufacturing processes.

Aromatic Solvents Market Growth Factors

The growth of the aromatic solvents market is propelled by an expanding demand across diverse industries such as paints and coatings, pharmaceuticals, and automotive underscores the versatile utility of aromatic solvents. Moreover, robust growth in construction activities, particularly in emerging economies, continues to drive the need for solvents in applications like adhesives and sealants. Additionally, ongoing advancements in product development, leading to the introduction of innovative formulations with enhanced performance characteristics, contribute significantly to market expansion.

Aromatic Solvents Market Trends:

- Rise in Demand for Low-VOC Solvents: With increasing environmental awareness and stringent regulations on volatile organic compound (VOC) emissions, there is a growing demand for low-VOC or VOC-free aromatic solvents. Manufacturers are investing in research and development to formulate eco-friendly alternatives to traditional solvents.

- Shift towards Bio-Based Solvents: The market is witnessing a shift towards bio-based aromatic solvents derived from renewable sources such as biomass, agricultural residues, and waste streams. This trend is driven by sustainability concerns and the need to reduce dependence on fossil fuels.

- Focus on Product Innovation: Companies are focusing on product innovation to develop aromatic solvent formulations with improved performance characteristics, such as higher solvency power, lower toxicity, and enhanced compatibility with other materials. These innovations aim to meet evolving customer demands and differentiate products in a competitive market landscape.

- Expansion in Emerging Markets: The aromatic solvents market is experiencing significant growth in emerging economies, driven by rapid industrialization, urbanization, and infrastructure development. Manufacturers are expanding their presence in regions such as Asia Pacific and Latin America to capitalize on the growing demand from end-use industries.

Aromatic Solvents Market Restraints:

- Stringent Environmental Regulations: The aromatic solvents market is significantly impacted by stringent environmental regulations aimed at reducing volatile organic compound (VOC) emissions. Compliance with these regulations requires investment in costly emission control technologies and may limit the use of certain aromatic solvents in specific applications.

- Health and Safety Concerns: Some aromatic solvents pose health risks to workers due to their toxic properties, inhalation hazards, and potential carcinogenicity. Concerns about worker safety necessitate strict adherence to occupational health and safety regulations, which may increase operational costs and regulatory compliance burdens for manufacturers.

- Volatility in Raw Material Prices: Fluctuations in the prices of crude oil, a primary raw material for aromatic solvents, can significantly impact production costs and profit margins for manufacturers. Price volatility introduces uncertainty into supply chains and may require companies to adjust pricing strategies or seek alternative raw material sources to mitigate financial risks.

- Competition from Substitutes: The aromatic solvents market faces competition from alternative solvents, such as aliphatic hydrocarbons, glycol ethers, and bio-based solvents. These substitutes offer similar performance characteristics while potentially addressing environmental and health concerns associated with aromatic solvents. Market players must differentiate their products and demonstrate superior performance or environmental benefits to maintain competitiveness.

Product Insights

The toluene solvents segment held a significant market share of 51% in 2023, largely due to its versatility. Toluene finds widespread applications in industries such as paints, coatings, and adhesives. Its affordability compared to other aromatic solvents also makes it an attractive option for manufacturers aiming to cut costs. Toluene's favorable attributes, including its ability to dissolve various substances and its low volatility, further contribute to its popularity in specific applications.

Xylene, primarily utilized in pharmaceutical product manufacturing, is projected to witness the highest growth during the forecast period. Additionally, the increasing demand for glue and leather products is expected to drive sales of benzene-based products. Benzene plays a pivotal role as an essential aromatic solvent in the production processes of these industries.

Application Insights

The paints and coatings segment held a share of 51% in 2023, a trend expected to persist throughout the assessment period. Aromatic solvents are predominantly utilized as diluents and thinners in various end-user industries, including paints and coatings. With the global construction industry poised for expansion, there is anticipated to be a notable surge in demand for paints and coatings in the near future. Market growth is forecasted to be driven by increased product consumption in the construction, automotive, and general industries. Furthermore, rapid urbanization and industrialization in emerging countries such as India, China, and Southeast Asia are expected to further propel demand across various application sectors.

Despite several uncertainties in recent years, including economic slowdowns in major economies and fluctuations in crude oil prices, the global market has exhibited moderate growth. Factors such as the robust growth of the U.S. automotive and construction industries, the gradual recovery of various European nations, and evolving regulatory norms worldwide have influenced market dynamics positively and negatively.

Regional Insights

The North American aromatic solvents market is poised for significant growth during the forecast period, driven by the expanding construction industry and associated projects. This surge in construction activities is anticipated to elevate the demand for paints and coatings, consequently fueling the need for aromatic solvents across the region.

Asia Pacific region is projected to emerge as the dominant force in the global aromatic solvents market, surpassing North America and Europe. This dominance can be attributed to the presence of burgeoning economies like India and China, alongside other emerging markets. Moreover, the widespread utilization of aromatic solvents in the construction and automotive sectors in this region is expected to further propel market growth. Additionally, the emergence of various industries across Asia Pacific contributes significantly to the overall expansion of the aromatic solvents market in the region.

Aromatic Solvents Market Key Companies

- ExxonMobil Corporation

- China Petroleum & Chemical Corporation

- BASF SE

- Royal Dutch Shell PLC

- LyondellBasell Industries Holdings B.V.

- Total S.A.

- Indian Oil Corporation Limited

- Bharat Petroleum Corporation Limited

- Chevron Phillips Chemical Company

- Reliance Industries Limited

Recent Developments

- In January 2023, Clarity and TotalEnergies Fluids, a division of TotalEnergies, jointly introduced the world's inaugural sustainable ultra-pure solvent. Crafted from recycled plastic waste, this groundbreaking solvent caters to the stringent requirements of industries such as pharmaceuticals, cosmetics, and other high-demand markets. Products within these sectors necessitate solvents that are not only safe but also colorless, odorless, and tasteless, adhering to the highest purity standards set by pharmacopoeias. By deriving these solvents from plastic waste, the environmental footprint is significantly diminished, addressing the pressing issue of end-of-life plastics.

- In January 2021, Ineos Group Ltd. made headlines with its acquisition of BP plc's global aromatics & acetyls division for USD 5 billion. This strategic acquisition bolsters Ineos's global standing, fortifies its petrochemical business, and extends its international footprint.

Aromatic Solvents Market Segmentation:

By Product

- Toluene Solvents

- Xylene Solvents

- Ethylbenzene Solvents

- Others (High Flash Aromatic Naphtha, BTEX)

By Application

- Paints & Coatings

- Adhesives

- Printing Inks

- Cleaning & Degreasing

- Others

By Region

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East and Africa

Frequently Asked Questions

The global aromatic solvents market size was reached at USD 5.22 billion in 2023 and it is projected to hit around USD 8.37 billion by 2033.

The global aromatic solvents market is growing at a compound annual growth rate (CAGR) of 4.83% from 2024 to 2033.

The Asia Pacific region has accounted for the largest aromatic solvents market share in 2023.

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others