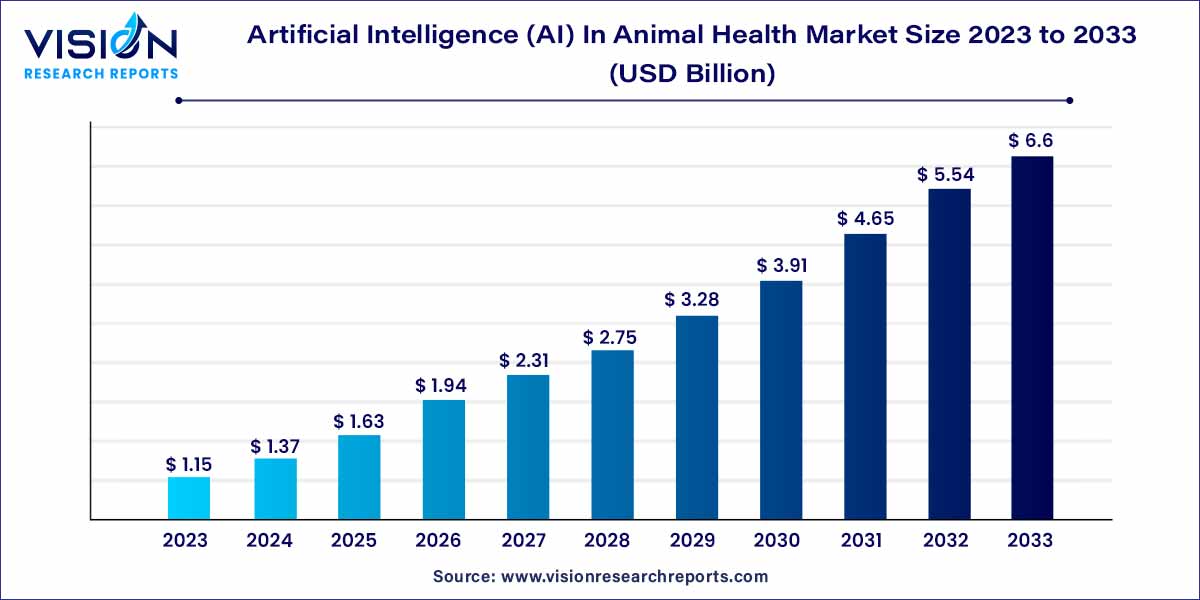

The global artificial intelligence (AI) in animal health market was valued at USD 1.15 billion in 2023 and it is predicted to surpass around USD 6.6 billion by 2033 with a CAGR of 19.09% from 2024 to 2033. Growing uses of AI in animal health, the accessibility of AI-based solutions, major firms' activities, rising animal-related costs, and the need to enhance animal health outcomes are some of the major factors propelling the market's expansion.

Artificial Intelligence (AI) has transcended traditional boundaries, making profound inroads into the field of animal health. This dynamic intersection of technology and veterinary care signifies a paradigm shift in the way we approach the well-being of our animal counterparts.

The growth of the artificial intelligence (AI) in animal health market is propelled by a confluence of factors that collectively contribute to its expanding trajectory. One key driver is the heightened demand for precise and swift diagnostics facilitated by AI algorithms. The ability of these algorithms to analyze extensive datasets enhances diagnostic accuracy, revolutionizing the approach to identifying and addressing animal health issues. Furthermore, the personalization of treatment plans, made feasible by AI, stands as a significant growth factor. Machine learning algorithms, adept at analyzing diverse data sets including breed specifics and medical histories, enable veterinarians to tailor therapeutic approaches for individual animals. The increasing adoption of predictive analytics, empowering proactive healthcare measures, is another influential factor. By foreseeing potential health issues through the analysis of trends and patterns, AI facilitates preventive interventions, thereby elevating overall animal welfare. Additionally, the market is driven by the advent of AI-powered remote monitoring solutions, allowing real-time tracking of vital signs and behavior. This innovation is particularly beneficial for both pets and livestock, enabling caregivers to respond promptly to emerging health concerns. As collaborations between technology firms, veterinary professionals, and pharmaceutical companies continue to thrive, the AI in animal health market is poised for sustained growth, underlining its pivotal role in shaping the future of veterinary care.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 19.09% |

| Market Revenue by 2033 | USD 6.6 billion |

| Revenue Share of North America in 2023 | 36% |

| CAGR of Asia Pacific from 2024 to 2033 | 21.07% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The hardware segment dominated the market with the revenue share of 64% in 2023. The software and services segment is estimated to grow at the fastest CAGR of about 20% over the forecast period. Continuous advancements in hardware and software technologies, such as sensors, imaging devices, computer vision, deep learning, and wearables, are fueling the growth of the segments. Improved performance, miniaturization, increased processing power, and cost reductions are making these solutions more accessible to animal owners. OneCup AI, for example, offers BETSY-an automated precision ranching solution forcattle, horses, and sheep using Artificial Intelligence and Computer Vision.

The growth of the market is also attributed to factors such as increasing collaborations between software developers, technology companies, veterinary clinics, research institutions, and industry associations. These partnerships have led to the development of innovative AI solutions tailored specifically for animal health applications. In May 2023, MYANIML introduced new geolocation technology as part of its AI-enabled predictive health platform, aiming to enhance the security of the beef and dairy supply chain. The new addition enables the identification and tracking of sick animals 2 to 3 days in advance of symptoms thus facilitating early disease prediction.

The diagnostics segment led the market with the highest revenue share of 51% in 2023. Some of the factors contributing to this growth include the increasing integration of AI in veterinary diagnostics, the availability of AI-powered diagnostic solutions, as well as the need to improve diagnostic capabilities in animal health. IDEXX; Zoetis; SignalPET; and Vetology LLC are some of the key market players operating in AI in the veterinary diagnostics sector. SignalPET’s portfolio, for instance, includes SignalRAY, AI-based radiology test panels for common clinical findings. SignalRAY+ is an AI tool that adds history to refine clinical answers, and SignalSMILE-an AI-based dental radiology test panel for common pathologies.

The others segment is projected to grow at the highest CAGR of 22.05% during the forecast period. It includes emerging applications of AI in animal health such as drug discovery & development, precision medicine, etc. For instance, FidoCure- a One Health Company (OHC) sequences canine DNA, identifies mutations, creates a personalized DNA report, and helps veterinary practitioners prescribe targeted therapies based on AI-informed decision-making. The Personalized Prediction Profile by ImpriMed on the other hand, provides AI-based drug response predictions for canine leukemia or lymphoma using the patient’s live cancer cells, medical history, and breed.

The companion animal segment held the highest revenue share of 71% in 2023. The increasing availability of AI-based pet health solutions, growing pet expenditure, and humanization of pets are some of the key drivers contributing to the segment share. Vetology LLC for instance, is a U.S.-based company that offers Veterinary Artificial Intelligence software & services for veterinary radiology. As of 2022, the company reported generating over 154,000 AI reports with over 6.6 million images in its image bank. ImpriMed, Inc., on the other hand, provides an AI-driven drug response prediction profile for treating canine cancer.

The production animal segment is expected to grow at the notable CAGR of 20.04% during the forecast period. The global demand for animal protein, such as meat and dairy products, continues to rise due to population growth, urbanization, and changing dietary preferences. This drives the need for efficient and sustainable livestock production thus fueling the awareness and uptake of precision livestock farming solutions. AI-enabled devices and wearables can track and monitor vital signs, activity levels, and behavior of animals remotely. This helps in the early detection of health changes, ensuring timely intervention and reducing the need for frequent veterinary visits.

North America dominated the market with the largest revenue share of 36% in 2023. AI algorithms can analyze radiographs, CT scans, and MRI images to assist veterinarians in diagnosing diseases and abnormalities. These algorithms can detect patterns and markers that may be difficult for humans to identify, leading to improved accuracy and faster diagnosis. The growing integration of AI in veterinary diagnostics and advanced veterinary healthcare infrastructure in the U.S. and Canada are key factors contributing to the regional share.

Asia Pacific region is anticipated to grow at the noteworthy CAGR of 21.07% from 2024 to 2033. This is due to the increasing animal population and initiatives by local market players. Alibaba Cloud’s ET Agricultural Brain, for instance, extends the company’s self-developed AI technology to agriculture. The technology uses voice recognition, visual recognition, and real-time environmental parameter tracking to monitor animal activity, pregnancy, growth indicators, and other health conditions. ET Agricultural Brain is already adopted by a number of leading pig farming enterprises in China.

By Solutions

By Application

By Animal Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Solutions Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Artificial Intelligence (AI) In Animal Health Market

5.1. COVID-19 Landscape: Artificial Intelligence (AI) In Animal Health Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Artificial Intelligence (AI) In Animal Health Market, By Solutions

8.1. Artificial Intelligence (AI) In Animal Health Market, by Solutions, 2024-2033

8.1.1 Hardware

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Software & Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Artificial Intelligence (AI) In Animal Health Market, By Application

9.1. Artificial Intelligence (AI) In Animal Health Market, by Application, 2024-2033

9.1.1. Diagnostics

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Identification, Tracking, and Monitoring

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Artificial Intelligence (AI) In Animal Health Market, By Animal Type

10.1. Artificial Intelligence (AI) In Animal Health Market, by Animal Type, 2024-2033

10.1.1. Companion Animals

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Production Animals

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Artificial Intelligence (AI) In Animal Health Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Solutions (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by Animal Type (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Solutions (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Animal Type (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Solutions (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Animal Type (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Solutions (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by Animal Type (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Solutions (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Animal Type (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Solutions (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Animal Type (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Solutions (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Animal Type (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Solutions (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Animal Type (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Solutions (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by Animal Type (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Solutions (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Animal Type (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Solutions (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Animal Type (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Solutions (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Animal Type (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Solutions (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Animal Type (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Solutions (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by Animal Type (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Solutions (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Animal Type (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Solutions (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Animal Type (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Solutions (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Animal Type (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Solutions (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Animal Type (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Solutions (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by Animal Type (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Solutions (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Animal Type (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Solutions (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Animal Type (2021-2033)

Chapter 12. Company Profiles

12.1. Zoetis Services LLC.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Merck & Co., Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Heska Corporation.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. SignalPET.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. VetCT.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Vetology LLC

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. OneCup AI.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Petriage

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. ImpriMed, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. IDEXX Laboratories, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others