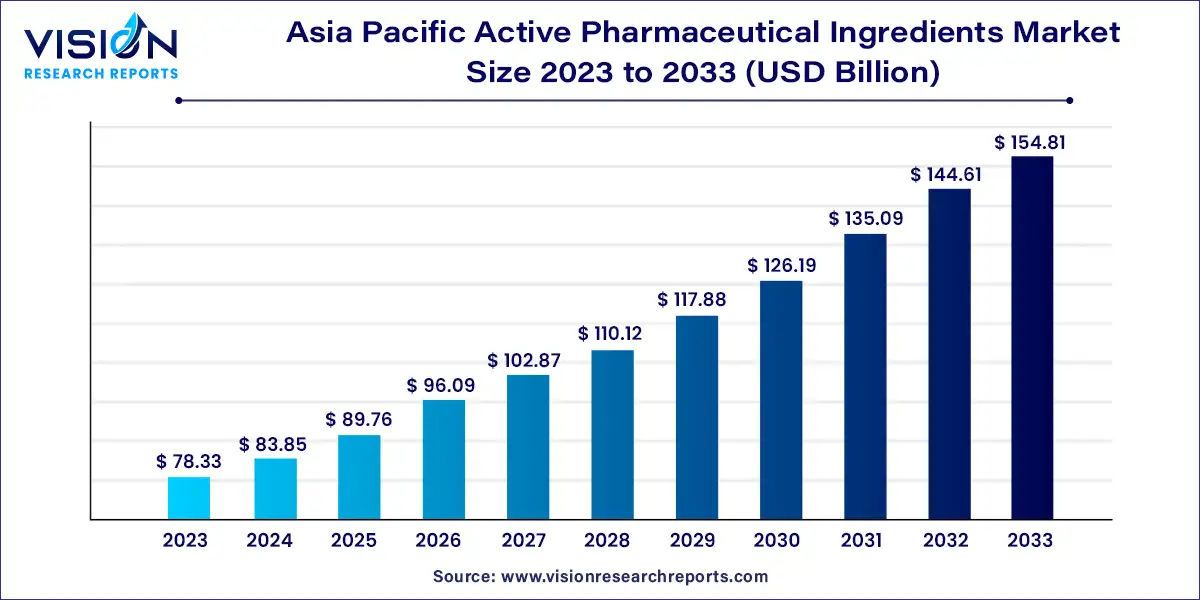

The Asia Pacific active pharmaceutical ingredients market size was valued at USD 78.33 billion in 2023 and is anticipated to reach around USD 154.81 billion by 2033, growing at a CAGR of 7.05% from 2024 to 2033.

The Asia Pacific active pharmaceutical ingredients (API) market is experiencing robust growth driven by several factors. The region's expanding pharmaceutical industry, increasing healthcare expenditure, and rising demand for generic drugs are key contributors to this trend. Countries like China and India play pivotal roles as major API manufacturers, benefiting from lower production costs and a skilled workforce. Moreover, advancements in technology and regulatory reforms are further shaping the market landscape, encouraging innovation and enhancing manufacturing capabilities.

The Asia Pacific active pharmaceutical ingredients (API) market is witnessing substantial growth due to several key factors. One of the primary drivers is the region's burgeoning pharmaceutical industry, fueled by increasing healthcare needs and a growing patient population. Additionally, rising government initiatives aimed at enhancing healthcare infrastructure and promoting local manufacturing capabilities are bolstering market expansion. Moreover, the shift towards generic drugs, driven by cost-effectiveness and patent expirations of branded medications, is further propelling demand for APIs in the region. Technological advancements and innovations in API production processes also play a crucial role in driving market growth by improving efficiency and reducing production costs.

Synthetic active pharmaceutical ingredients dominated the market, holding the largest share of 70% in 2023. This growth is driven by their affordability, crucial for price-sensitive markets, and their widespread adoption. Ongoing investments in research and development further enhance synthetic methodologies, incorporating green chemistry practices to comply with global environmental standards, thereby fueling segment growth. The streamlined regulatory environment in the Asia Pacific expedites approval processes for synthetic APIs, accelerating market expansion.

Biotech APIs also held a significant market share in 2023, propelled by the increasing prevalence of chronic diseases, an aging population, and the outsourcing trend in API production. The integration of biologics in disease management, regulatory approvals, and patent expirations for essential drugs additionally contribute to the segment’s growth.

Captive API manufacturing dominated with the largest revenue share of 51% in 2023. This growth is attributed to advancements in technology, improved manufacturing capabilities, and the imperative to meet demand for bulk APIs. Major investments by key players reinforce the dominance of captive API manufacturers, driving further market expansion.

Merchant API manufacturing witnessed substantial growth in 2023 due to the rising trend of outsourcing, the proliferation of contract manufacturing organizations (CMOs) in the region, and the emphasis on cost-effectiveness. Additionally, CMOs’ growing expertise in meeting stringent pharmaceutical quality standards bolsters the growth of the merchant API segment.

Innovative APIs led the market with a substantial revenue share in 2023, buoyed by increased funding and favorable regulatory environments fostering robust R&D pipelines. This conducive environment is expected to lead to the launch of numerous innovative API products in the near future.

Generic APIs also held a significant revenue share in 2023 and are projected to experience the fastest growth in the forecast period. This growth is primarily driven by patent expirations of various branded molecules, presenting lucrative opportunities for generic API manufacturers.

Cardiovascular diseases accounted for the largest market share of 22% in 2023, driven by increasing prevalence among younger demographics and the aging population. Factors such as hypertension, high cholesterol, smoking, and obesity significantly contribute to this segment’s growth.

Endocrinology registered substantial revenue in 2023 due to rising incidences of disorders like diabetes, thyroid conditions, and hormonal imbalances, particularly among the aging population. Increased awareness and advancements in therapies targeting these conditions further propel market growth.

China dominated the active pharmaceutical ingredients market with a revenue share of 35% in 2023. The growth is fueled by increasing prevalence of chronic diseases such as cardiovascular disorders and cancer, driving demand for innovative drugs. The country's extensive production capacity and favorable regulatory environment, including guidance from the National Medical Products Administration on API manufacturing, attract global players, thereby boosting market growth.

India witnessed substantial growth in its active pharmaceutical ingredients market in 2023, driven by large-scale production capabilities, a skilled workforce, and a favorable regulatory landscape attracting global investments. The country's emphasis on generic drugs and increased healthcare expenditure also contribute to market expansion.

By Type of Synthesis

By Type of Manufacturers

By Type

By Application

By Country

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Asia Pacific Active Pharmaceutical Ingredients Market

5.1. COVID-19 Landscape: Asia Pacific Active Pharmaceutical Ingredients Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Asia Pacific Active Pharmaceutical Ingredients Market, By Type of Synthesis

8.1. Asia Pacific Active Pharmaceutical Ingredients Market, by Type of Synthesis, 2024-2033

8.1.1. Synthetic

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Biotech

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Asia Pacific Active Pharmaceutical Ingredients Market, By Type of Manufacturers

9.1. Asia Pacific Active Pharmaceutical Ingredients Market, by Type of Manufacturers, 2024-2033

9.1.1. Captive APIs

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Merchant APIs

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Asia Pacific Active Pharmaceutical Ingredients Market, By Type

10.1. Asia Pacific Active Pharmaceutical Ingredients Market, by Type, 2024-2033

10.1.1. Innovative APIs

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Generic APIs

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Colorectal

Chapter 11. Asia Pacific Active Pharmaceutical Ingredients Market, By Application

11.1. Asia Pacific Active Pharmaceutical Ingredients Market, by Application, 2024-2033

11.1.1. Cardiovascular Diseases

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Endocrinology

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. CNS and Neurology

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Oncology

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Gastroenterology

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Orthopedic

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Pulmonology

11.1.7.1. Market Revenue and Forecast (2021-2033)

11.1.8. Nephrology

11.1.8.1. Market Revenue and Forecast (2021-2033)

11.1.9. Ophthalmology

11.1.9.1. Market Revenue and Forecast (2021-2033)

11.1.10. Others

11.1.10.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Asia Pacific Active Pharmaceutical Ingredients Market, Regional Estimates and Trend Forecast

12.1. Asia Pacific

12.1.1. Market Revenue and Forecast, by Type of Synthesis (2021-2033)

12.1.2. Market Revenue and Forecast, by Type of Manufacturers (2021-2033)

12.1.3. Market Revenue and Forecast, by Type (2021-2033)

12.1.4. Market Revenue and Forecast, by Application (2021-2033)

Chapter 13. Company Profiles

13.1. Dr. Reddy’s Laboratories Ltd.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Sun Pharmaceutical Industries Ltd.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Cipla Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Aurobindo Pharma.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Asymchem Laboratories

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Reyoung Pharmaceutical

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. CSPC Pharmaceutical Group Limited

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Otsuka Pharmaceutical Australia Pty Ltd.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. GC Biopharma Corp.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. GC Biopharma Corp.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others