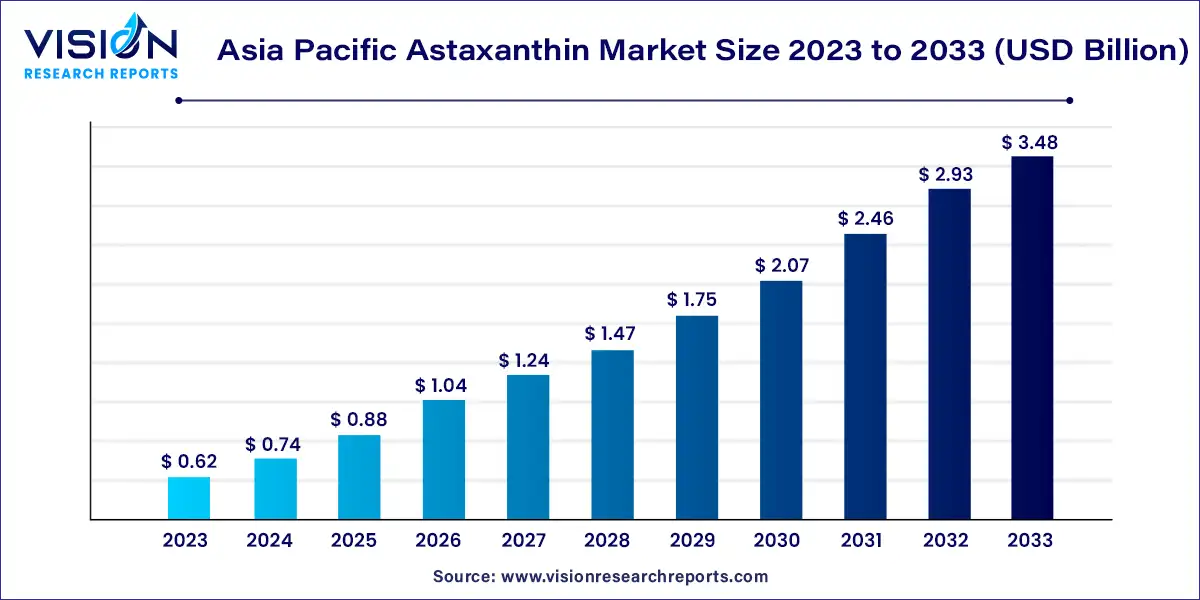

The Asia Pacific astaxanthin market size was estimated at around USD 0.62 billion in 2023 and it is projected to hit around USD 3.48 billion by 2033, growing at a CAGR of 18.83% from 2024 to 2033.

The Asia Pacific astaxanthin market is experiencing significant growth driven by increasing awareness of its health benefits and its widespread applications across various industries. Astaxanthin, a potent antioxidant derived from microalgae, is garnering attention for its potential to support cardiovascular health, skin protection, and eye health, among other benefits.

The growth of the Asia Pacific astaxanthin market growth is driven by the rising demand for nutraceuticals, driven by increasing health consciousness among consumers, is driving the adoption of astaxanthin-based supplements. Additionally, the expanding applications of astaxanthin in cosmetics, owing to its antioxidant properties and anti-aging benefits, are contributing to market growth. Furthermore, the thriving aquaculture industry in the region is fueling demand for astaxanthin as a pigment enhancer in aquafeed, particularly for fish and shrimp. Technological advancements in production methods have also played a pivotal role in driving market growth by improving efficiency and scalability.

The natural astaxanthin sector dominated with a substantial revenue share of 56% in 2023. Various natural sources contribute to astaxanthin production, including yeast, algae, salmon, shrimp, trout, crayfish, and krill, with Haematococcus pluvialis being recognized as one of the premier sources. This form of astaxanthin experiences heightened demand across multiple industries, including food, animal feed, pharmaceuticals, and nutraceuticals.

Projections indicate that the natural astaxanthin segment is poised to witness the swiftest CAGR of 21.43% from 2024 to 2033. This accelerated growth is primarily fueled by its acclaimed benefits in enhancing skin health, prompting its widespread integration as a primary ingredient in various cosmetic formulations. Furthermore, the anticipated surge in demand for natural astaxanthin stems from its increasing adoption in the treatment and management of complex ailments such as hypercholesterolemia, cancer, Alzheimer’s, stroke, and Parkinson’s disease.

The dried algae meal or biomass category emerged as the leader, commanding a significant share of 26% in 2023. This type of product comprises a dry blend of algae cells, molasses, concentrated corn solubles, and ethoxyquin. Utilized for feed production, astaxanthin biomass enhances the coloration of aquatic animals such as salmon, shrimp, trout, as well as poultry. Notably, numerous industry players have introduced novel products in recent years, aiming to enrich their product portfolios, thus fostering market expansion in the region.

In the same timeframe, the softgel segment is poised for remarkable growth, projected to achieve a lucrative CAGR of 19.43%. This upsurge is primarily fueled by the increasing acceptance of softgels containing astaxanthin. Nutraceutical suppliers prefer veggie softgels, crafted from glycerin and modified cornstarch, owing to their natural origin and minimal adverse effects. Astaxanthin-based softgels are increasingly favored by consumers seeking to nurture and enhance skin health and vision.

In 2023, the aquaculture and animal feed sector emerged as the dominant force, securing the largest revenue share of 47%. Astaxanthin finds widespread use in this segment for fish pigmentation, nutraceutical development, cosmetic formulations, food and beverage production, as well as disease treatment. Notably, one of the primary applications of natural astaxanthin lies in the creation of dietary supplements.

Anticipated to achieve a noteworthy CAGR of 19.83% between 2024 and 2033, the nutraceuticals segment is poised for substantial growth. This trajectory can be attributed to the escalating demand for nutritional supplements containing astaxanthin. Moreover, heightened awareness regarding astaxanthin's potent antioxidant properties has prompted its integration into various dietary supplements. Factors such as nutrient deficiencies, sedentary lifestyles prevalent in urban areas, and the burgeoning geriatric population are forecasted to further drive the demand for nutraceuticals in the foreseeable future.

In 2023, the Japan astaxanthin market captured the largest revenue share, accounting for 25%. Several factors contribute to the market's growth, including the extensive production of nutraceuticals, the introduction of novel natural astaxanthin therapies by key industry players, a growing elderly population, and the high consumption of fish. The presence of prominent companies such as Fuji Chemical Industries Co., Ltd., ENEOS Techno Materials Corporation, BASF SE, and BGG Japan Co., Ltd. (BGG WORLD) further bolsters market expansion in Japan.

The South Korean astaxanthin market is poised to witness a robust CAGR of 19.55% from 2024 to 2033. Authorities in South Korea have been actively working to enhance the aquaculture industry, positioning it as one of the few countries adept at salmon farming. The burgeoning aquaculture sector, coupled with increasing demand for natural ingredients and the introduction of new products by key players, is expected to drive market growth in South Korea.

By Source

By Product

By Application

By Country

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Source Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Asia Pacific Astaxanthin Market

5.1. COVID-19 Landscape: Asia Pacific Astaxanthin Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Asia Pacific Astaxanthin Market, By Source

8.1. Asia Pacific Astaxanthin Market, by Source, 2024-2033

8.1.1 Natural

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Synthetic

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Asia Pacific Astaxanthin Market, By Product

9.1. Asia Pacific Astaxanthin Market, by Product, 2024-2033

9.1.1. Dried Algae Meal or Biomass

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Oil

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Softgel

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Liquid

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Asia Pacific Astaxanthin Market, By Application

10.1. Asia Pacific Astaxanthin Market, by Application, 2024-2033

10.1.1. Nutraceuticals

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Cosmetics

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Aquaculture & Animal Feed

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Food

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Asia Pacific Astaxanthin Market, Regional Estimates and Trend Forecast

11.1. Asia Pacific

11.1.1. Market Revenue and Forecast, by Source (2021-2033)

11.1.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. Fuji Chemical Industries Co., Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. ENEOS Techno Materials Corporation.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. BASF SE.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. BGG Japan Co., Ltd. (BGG WORLD).

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. DSM (dsm-firmenich).

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Sv Agrofood

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others