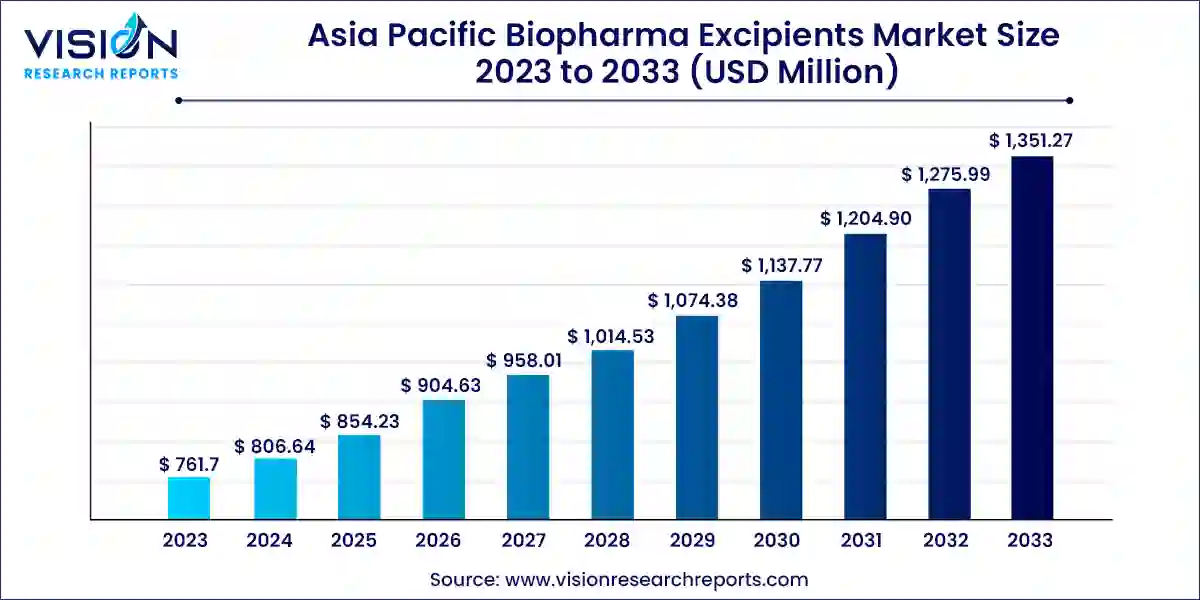

The Asia Pacific biopharma excipient market size was valued at USD 761.7 million in 2023 and it is predicted to surpass around USD 1,351.27 million by 2033 with a CAGR of 5.9% from 2024 to 2033. The Asia Pacific biopharma excipients market is experiencing significant growth, driven by the increasing demand for biopharmaceuticals, advancements in drug delivery systems, and a rising focus on personalized medicine. Excipients play a crucial role in the formulation of biopharmaceutical products, serving as inactive substances that aid in drug stability, efficacy, and delivery.

The growth of the Asia Pacific biopharma excipients market is primarily driven by an increasing incidence of chronic diseases, such as diabetes and cancer, has led to a surge in biopharmaceutical development, necessitating effective excipients for drug formulation. Additionally, advancements in drug delivery technologies, including targeted and sustained-release systems, require specialized excipients to enhance drug stability and bioavailability. Moreover, the region's robust investments in biopharmaceutical research and development, supported by government initiatives and favorable regulatory frameworks, further fuel market expansion. The growing trend towards personalized medicine also plays a crucial role, as it demands innovative excipients tailored to specific patient needs and therapeutic applications.

Carbohydrates led the market, capturing the largest revenue share of 36% in 2023. These excipients, derived from sources like sugar, starch, and fiber, are utilized as sweeteners, diluents in tablets and capsules, and tonicity agents. Dextrose, sucrose, and starch are the most commonly used carbohydrates for stabilizing proteins. Other carbohydrate excipients include trehalose, maltose, galactose, and mannose. Pure carbohydrates, particularly trehalose, are gaining traction in the production of biosimilars due to their ability to enhance yield, stabilize various biologics, minimize aggregation, and improve the overall biopharmaceutical manufacturing process.

Polyols are projected to experience a CAGR of 6.13% during the forecast period. Commonly available as sorbitol, maltitol, or isomalt, these excipients have a minimal impact on blood glucose levels, making them popular among individuals with diabetes and those looking to lose weight. Their versatility in drug formulations is becoming increasingly vital. In protein therapeutics, polyols play a significant role in enhancing tonicity and stability, thereby maintaining the integrity of protein-based medications. They are also utilized as excipients in tablets, syrups, and elixirs due to their moisture-retaining properties and ability to improve texture.

The Asia Pacific biopharma excipients market represented a significant portion of the market in 2023. Contributing factors to this growth include an aging population, lifestyle changes, and increased urbanization, leading to a higher prevalence of non-communicable diseases such as diabetes, cancer, and autoimmune disorders. The large patient base with unmet medical needs in Asian countries, coupled with the increasing involvement of market participants, is driving R&D activities related to biosimilars in the biopharmaceutical sector.

Japan Biopharma Excipient Market Trends

Japan's biopharma excipient market held a dominant share of 31% in the Asia Pacific region. The increasing elderly population and the rise in chronic diseases have fueled the demand for biopharmaceuticals, necessitating specialized excipients. Japan has become a leading player in this market due to several key growth factors. The country’s strong focus on high-quality products, often marketed at premium prices, has significantly bolstered its position in the biopharma excipients landscape.

China Biopharma Excipient Market Trends

The growth of the biopharma excipient market in China has been driven by increased R&D activities, prompt access to medications, advancements in the healthcare industry, and a rising demand for safe and effective medical practices and therapies. Additionally, the Chinese government’s increasing investments in healthcare and the ongoing demand for pharmaceuticals have further supported the expansion of the biopharma excipient market.

India Biopharma Excipient Market Trends

The biopharma excipient market in India is expected to grow at a projected CAGR of 6.5% during the forecast period. The demand for specific excipients to enhance formulation and delivery has risen due to the surge in Indian biotech companies focusing on the development and improvement of biological drugs, driving market growth in the coming years.

By Product

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Asia Pacific Biopharma Excipients Market

5.1. COVID-19 Landscape: Asia Pacific Biopharma Excipients Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Asia Pacific Biopharma Excipients Market, By Product

8.1.Asia Pacific Biopharma Excipients Market, by Product Type, 2024-2033

8.1.1. Solubilizers & Surfactants/Emulsifiers

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Polyols

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Carbohydrates

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Specialty Biopharma Excipients/Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Asia Pacific Biopharma Excipients Market, Regional Estimates and Trend Forecast

9.1. Asia Pacific

9.1.1. Market Revenue and Forecast, by Product (2021-2033)

Chapter 10. Company Profiles

10.1. Signet Excipients Pvt. Ltd.

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. ABITEC

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Sigachi Industries.

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Roquette Frères

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Abbot

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Colorcon

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Meggle GmbH & Co. KG

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. CLARIANT

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. DFE Pharma

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. SPI Pharma

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others