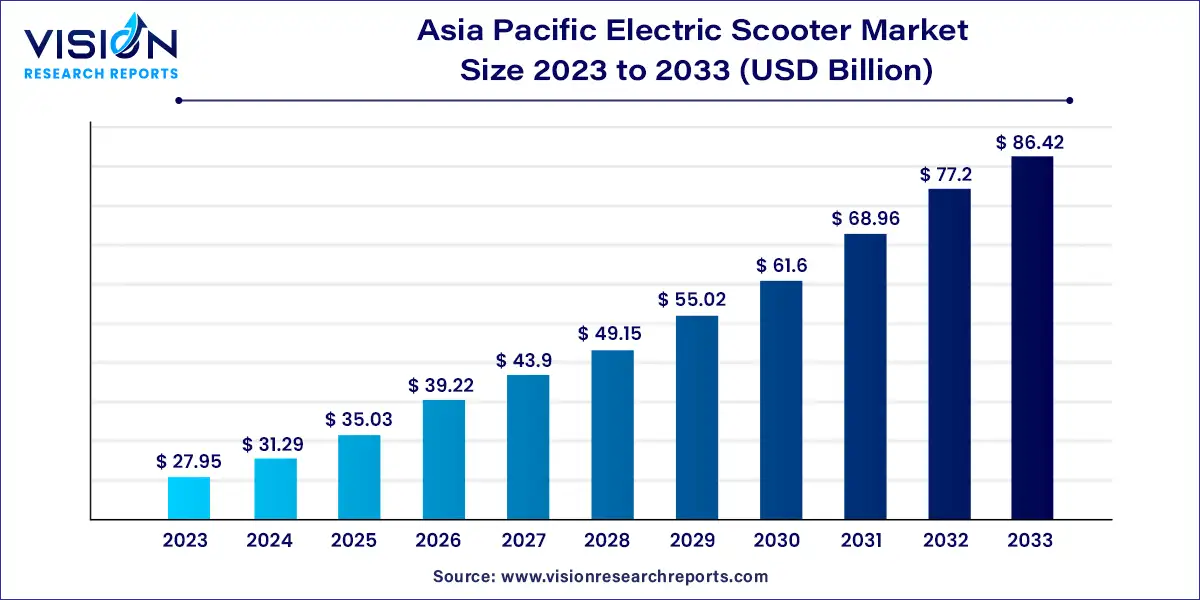

The Asia Pacific electric scooter market size was valued at USD 27.95 billion in 2023 and it is predicted to surpass around USD 86.42 billion by 2033 with a CAGR of 11.95% from 2024 to 2033. The Asia Pacific electric scooter market has witnessed remarkable growth over the past decade. Increasing environmental concerns, rising fuel prices, and the growing demand for efficient urban mobility solutions are key drivers shaping the market. With governments across the region focusing on reducing carbon emissions, electric scooters have emerged as a sustainable alternative to traditional fuel-powered vehicles.

The growth of the Asia Pacific electric scooter market is driven by an increasing environmental concern and the push for sustainable urban mobility solutions are encouraging the adoption of electric scooters as an eco-friendly alternative to traditional fuel-powered vehicles. Governments in the region are providing substantial incentives, including subsidies and tax rebates, to promote electric vehicle usage, further fueling market expansion. Technological advancements, particularly in battery efficiency and charging infrastructure, are enhancing the convenience and reliability of electric scooters, making them more appealing to consumers. Additionally, rising fuel prices and growing urbanization have contributed to the increased demand for cost-effective, efficient transportation options, accelerating market growth across major economies like China, India, and Japan.

The hub motor segment dominated the Asia Pacific electric scooter market in 2023, accounting for over 82% of the market share. This is primarily due to the cost-effectiveness of hub motors, as they reduce production costs compared to other drive types. Additionally, hub motors offer several technical advantages such as lower transmission power, better performance, and easier integration into electric scooters, making them the preferred choice for manufacturers. These benefits continue to drive the growth of this segment.

The belt drive segment is expected to witness significant growth during the forecast period. Belt drive scooters are gaining popularity due to their low maintenance, durability, and lightweight nature. They also offer better performance, enhanced motor cooling, and protection from overloading and slipping. These advantages make belt drive scooters an attractive option, and their adoption is likely to increase in the coming years.

The lithium-ion battery segment held the largest market share, accounting for over 75% in 2023. The growth of this segment is attributed to innovations in battery chemistry that provide improved range, faster charging times, and lower discharge rates. Moreover, the increasing focus on sustainable mobility has prompted major economies like India and China to introduce initiatives such as reduced import duties and subsidies to lower the cost of lithium-ion batteries, boosting electric scooter adoption.

For example, in February 2023, the Indian government reduced the customs duty on lithium-ion batteries from 21% to 13%, which is expected to lower electric scooter prices. Additionally, the government announced exemptions on duties for machinery and capital goods needed for lithium-ion battery production, further reducing battery costs over the forecast period.

The lithium-ion battery segment is projected to continue its growth trajectory, driven by advancements in battery structure and chemistry aimed at improving storage capacity and reducing charging time. Market leaders are also investing heavily in research and development to address challenges such as high battery costs and safety concerns, creating new opportunities for growth in this segment.

The personal use segment led the market with a 69% share in 2023. Key drivers for this segment include the integration of telematics, improved battery range, and the growing popularity of electric scooters among millennials. Additionally, manufacturers are strategically placing charging stations in high-traffic areas such as shopping centers and restaurants, further supporting the growth of the electric scooter market in the region.

The commercial segment is expected to grow significantly over the forecast period, driven by the use of electric scooters for last-mile deliveries by e-commerce companies. The rising demand for quick commuting options, especially in congested urban areas, has also spurred the growth of electric scooter rental services. Furthermore, the expansion of last-mile delivery and logistics sectors is leading to increased deployment of electric scooters, as manufacturers collaborate with delivery service providers to expand their fleets.

For instance, in April 2023, Hero Electric partnered with Shadowfax Technologies Pvt. Ltd., a third-party logistics platform, to supply electric scooters for last-mile deliveries. Hero Electric aims to convert 25% of Shadowfax's delivery fleet to electric scooters, supporting the transition to carbon-free mobility in logistics.

China held the largest market share in the Asia Pacific electric scooter market, accounting for 80% in 2023. The country's dominance can be attributed to the presence of major global manufacturers like Yadea, Jiangsu Xinri Electric Vehicle Co., Ltd., and Niu International, who have a large customer base. Additionally, factors such as rapid urbanization, increasing affordability of electric scooters, and rising consumer awareness of clean energy solutions are driving market growth in China. Technological advancements in battery management systems and the availability of raw materials are expected to create further opportunities for growth in the country.

The India electric scooter market is projected to grow significantly in the coming years. This growth is driven by increased government support, both at the central and state levels, for electric vehicle adoption. Initiatives such as reduced customs duties on machinery needed for lithium-ion cell production, as well as the growing preference for electric scooters in tier 2 and 3 cities, are contributing to the market's expansion.

By Drive Type

By Battery Type

By End-use

By Country

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Drive Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Asia Pacific Electric Scooter Market

5.1. COVID-19 Landscape: Asia Pacific Electric Scooter Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Asia Pacific Electric Scooter Market, By Drive Type

8.1. Asia Pacific Electric Scooter Market, by Drive Type, 2024-2033

8.1.1 Belt Drive

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Chain Drive

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Hub Motors

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Asia Pacific Electric Scooter Market, By Battery Type

9.1. Asia Pacific Electric Scooter Market, by Battery Type, 2024-2033

9.1.1. Lead Acid

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Lithium-Ion

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Other

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Asia Pacific Electric Scooter Market, By End-use

10.1. Asia Pacific Electric Scooter Market, by End-use, 2024-2033

10.1.1. Personal

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Commercial

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Asia Pacific Electric Scooter Market, Regional Estimates and Trend Forecast

11.1. Asia Pacific

11.1.1. Market Revenue and Forecast, by Drive Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Battery Type (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Ola Electric Mobility

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Gogoro, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. TVS Motor Company.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Yadea Technology Group Co., Ltd.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Greenwit Technologies Inc

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Honda Motor Co. Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Jiangsu Xinri E-Vehicle Co., Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Terra Motors Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Yamaha Motor Company Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Hero Electric

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others