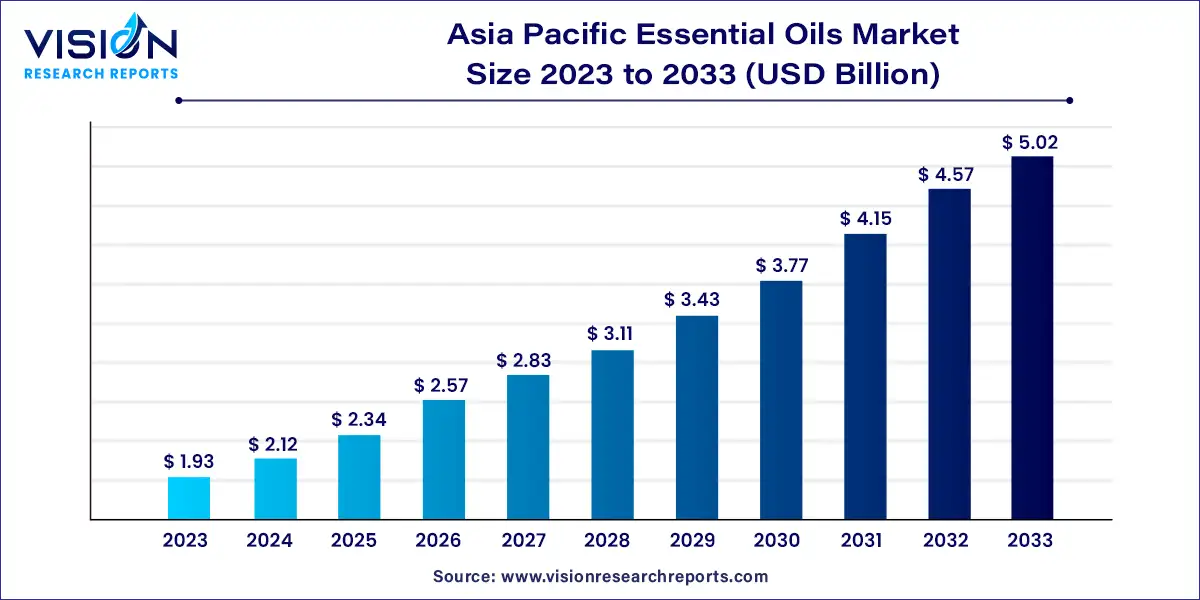

The Asia Pacific essential oils market size was estimated at around USD 1.93 billion in 2023 and it is projected to hit around USD 5.02 billion by 2033, growing at a CAGR of 10.04% from 2024 to 2033.

The Asia Pacific essential oils market presents a dynamic landscape shaped by various factors, including increasing consumer awareness regarding natural products, growing demand for aromatherapy, and expanding applications across diverse industries such as cosmetics, food & beverage, and pharmaceuticals. This region boasts a rich diversity of plant species, contributing to a wide array of essential oils with unique aromatic profiles and therapeutic properties.

The Asia Pacific essential oils market is experiencing robust growth driven by an increasing consumer awareness and preference for natural and organic products are pivotal, bolstered by a rising inclination towards aromatherapy and holistic wellness solutions. This trend is further fueled by expanding applications across diverse industries such as cosmetics, pharmaceuticals, and food & beverage, where essential oils are valued for their therapeutic properties and aromatic benefits. Advances in extraction technologies and sustainable sourcing practices are also contributing significantly to market expansion, ensuring high-quality products that meet regulatory standards. Moreover, the region's rich biodiversity and abundant plant species provide a diverse range of essential oils, catering to a growing demand for unique and effective natural ingredients.

The segment dominated by orange products achieved the highest revenue share in 2023. Orange is widely recognized across multiple economies for its extensive consumption, with its oil garnering considerable interest among manufacturers due to its medicinal and cosmetic properties. In medicine, orange oil is utilized to enhance libido, mitigate PMS-related issues, and combat hypertension owing to its vasodilatory effects. Its anti-inflammatory and circulation-enhancing attributes also make it beneficial as a digestive aid. Furthermore, the high vitamin C content in orange essential oil positions it as an ideal ingredient for cosmetic formulations. Its antioxidant properties contribute to reducing dark spots and wrinkles, thereby driving demand in the personal care industry.

The Acorus calamus oil segment is poised to exhibit the fastest compound annual growth rate (CAGR) during the forecast period. Widely employed in aromatherapy and perfumery, Acorus calamus essential oil has a rich history in Ayurvedic medicine due to its medicinal properties such as antioxidant, nervine, cicatrizant, cephalic, circulant, hypothermic, anti-rheumatic, and anti-inflammatory effects. Compounds like asarone, cis-ocimene, and methyl isoeugenol found in this plant contribute to its therapeutic benefits. Asarone, specifically, is recognized for its antibacterial properties. Additionally, the oil aids in treating respiratory ailments like bronchitis and asthma, and it is valued in traditional Indian medicine for its anesthetic properties, relieving headaches and toothaches while easing gastrointestinal discomfort. These health benefits are anticipated to drive its demand significantly in the foreseeable future.

The direct selling segment is projected to expand at a rapid CAGR during the forecast period. This channel is primarily employed by multi-level marketing companies to engage consumers through knowledgeable agents who highlight product benefits and applications. Leading firms like dōTERRA leverage this model to build extensive consumer awareness, prompting competitors to adopt direct sales strategies to enhance their market presence. The growing popularity of wellness trends, preference for organic products, and the substantial female consumer demographic have collectively propelled the segment's growth in the region.

Meanwhile, the other sales channel segment includes retail outlets such as convenience stores and online platforms. Retail presence allows consumers to compare products and make informed decisions based on preferences, while the booming e-commerce sector in Asia Pacific has significantly boosted essential oil sales online. Companies leverage their websites to showcase product ranges and offer attractive promotions, enhancing customer loyalty and operational efficiency.

In terms of applications, the spa and relaxation segment accounted for the largest revenue share in 2023, driven by the region's rapid industrialization and urbanization trends leading to increased stress-related issues. Consequently, there is a heightened demand for aromatherapy and spa treatments, bolstering essential oil sales. Moreover, with a growing working population focusing on wellness and self-care, there has been a notable rise in personal care product sales, particularly those featuring natural ingredients. This trend has spurred the proliferation of essential oil manufacturers catering to diverse consumer preferences.

On the other hand, the food & beverages segment is poised to witness the fastest CAGR of 10.33% during the forecast period. The global demand for natural and minimally processed food products has spurred the use of floral extracts and essential oils in this sector. These ingredients' antimicrobial properties contribute to extending the shelf life of food and beverages, meeting consumer expectations for freshness without compromising quality. Manufacturers' emphasis on maintaining product integrity aligns with market growth in this application area.

China led the Asia Pacific essential oils market with a significant revenue share of 26% in 2023. The country's rapid economic growth, driven by technological advancements, a sizable population, and abundant low-cost labor and raw materials, underpins robust demand for essential oils. A growing urban workforce has heightened demand for personal care products, while essential oils find extensive use in China's thriving food & beverage and medical industries. Technological advancements in extraction techniques and regulatory frameworks promoting safe usage are expected to further bolster the market's expansion in China.

India is poised to make substantial contributions to regional market growth during the forecast period. The country holds a prominent position in global spice oil production and is a leading producer of mint oils. Increasing adoption of organic ingredients among India's youthful demographic has prompted manufacturers to innovate and incorporate natural extracts into their products. Additionally, rising consumption of natural extracts in carbonated and non-carbonated beverages and the popularity of ready-to-eat meals among working women present lucrative opportunities for essential oil producers in the food & beverage sector.

By Product

By Application

By Sales Channel

By Country

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others