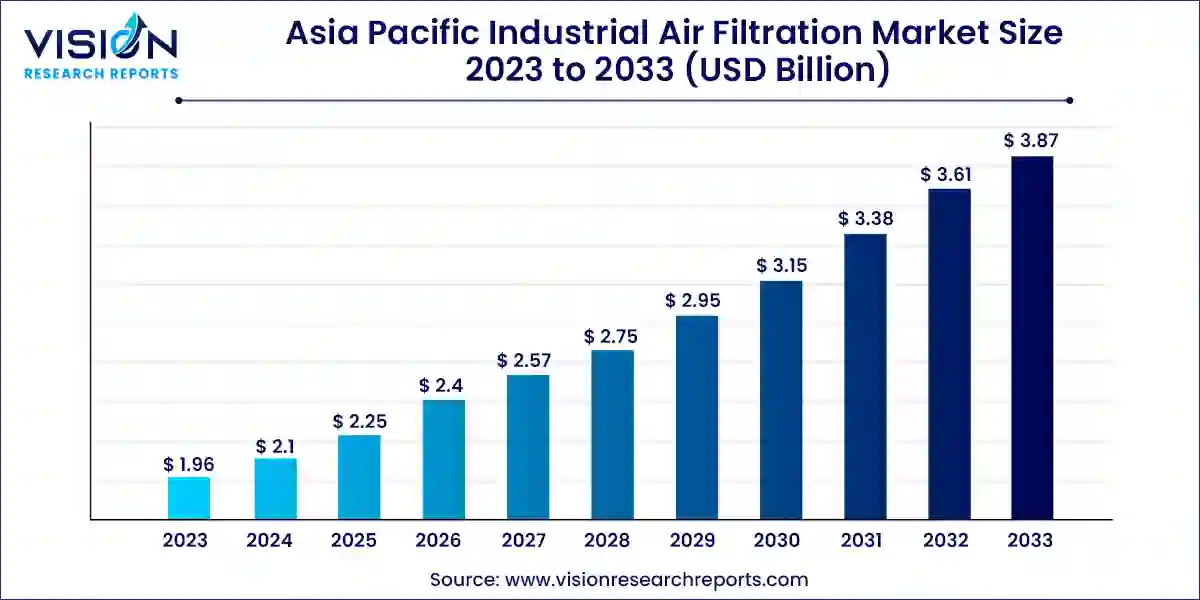

The Asia Pacific industrial air filtration market was estimated at USD 1.96 billion in 2023 and it is expected to surpass around USD 3.87 billion by 2033, poised to grow at a CAGR of 7.03% from 2024 to 2033.

The Asia Pacific region has witnessed significant growth in the industrial air filtration market in recent years, driven by several key factors. As industries across sectors such as manufacturing, automotive, pharmaceuticals, and food and beverage continue to expand, the demand for effective air filtration solutions has escalated. This growth is further fueled by increasing awareness of environmental regulations and the need to maintain high indoor air quality standards in workplaces.

The Asia Pacific industrial air filtration market is experiencing robust growth due to several key factors. Rapid industrialization in countries like China, India, and Southeast Asia has led to increased emissions and air pollutants, necessitating stringent regulatory measures and driving demand for advanced filtration technologies. Technological advancements in filters such as electrostatic precipitators, HEPA filters, and activated carbon filters are enhancing efficiency and performance, further fueling market expansion. Rising awareness of health hazards associated with poor indoor air quality is also pushing industries to adopt air filtration solutions to safeguard workers and comply with health and safety standards. Moreover, competitive dynamics among market players are fostering innovation and driving down costs, making these technologies more accessible across diverse industrial sectors in the region.

The HEPA filter segment led in product type with a significant revenue share of 30% in 2023 and is projected to grow at the fastest CAGR throughout the forecast period. The increasing demand for HEPA filters is driven by heightened awareness of indoor air quality across diverse industries including pharmaceuticals, electronics, food processing, and healthcare. HEPA filters are highly effective in capturing minute particles, making them essential for various industrial applications. Notably, HEPA filters have become standard in the aviation industry for ensuring clean air on airplanes. The COVID-19 pandemic has accelerated the adoption of UVC-LED and Automated Disinfection Facilities in airports, enhancing safety and cleanliness across airport operations.

For instance, starting in July 2023, airports across Southeast Asia began installing HEPA filters in terminals, baggage areas, security checkpoints, and air purifiers to ensure efficient and rapid sanitization, thereby maintaining smooth operations without disrupting passenger flow. In 2023, the dust collectors segment also held a significant market share. These industrial dust collectors play a crucial role in capturing and eliminating harmful particles and pollutants from industrial air streams. They are widely utilized in manufacturing and processing industries to uphold clean and safe working environments and ensure compliance with stringent air quality regulations.

The food & beverage segment emerged as the dominant market segment, accounting for a share of 22% in 2023. This sector necessitates stringent air quality standards to safeguard the safety and quality of products. Effective removal of contaminants such as dust, allergens, and microorganisms is essential to prevent contamination. Industrial air filtration systems play a critical role in maintaining clean environments, preventing cross-contamination, and adhering to rigorous food safety regulations.

The pharmaceutical segment is expected to witness the fastest CAGR over the forecast period. Air filtration systems are indispensable in pharmaceutical industries to maintain controlled environmental conditions crucial for the production of medicines. These systems efficiently filter out contaminants like dust, microbes, and airborne particles, ensuring the purity of pharmaceutical products and safeguarding machinery. Moreover, clean air from these systems enhances worker safety by minimizing exposure to hazardous substances, promoting a healthier work environment, and meeting regulatory standards in pharmaceutical manufacturing.

China dominated the market with the largest revenue share of 42% in 2023. The country's rapid urbanization and industrialization have significantly heightened air pollution levels, driving robust demand for air purification solutions, including industrial filtration systems. Stringent environmental regulations and emission standards implemented by the Chinese government to combat pollution and enhance air quality have further bolstered the demand for industrial filtration systems across various industries, thereby contributing to market growth in China.

India is poised to experience the highest market growth rate over the forecast period, driven by stringent environmental regulations aimed at improving air quality and reducing pollution levels. These regulations focus on promoting the use of non-toxic materials, implementing modifications in manufacturing processes, adopting conservation techniques, and encouraging the reuse of materials to minimize pollution. The Indian government has launched initiatives to combat air pollution and enhance air quality through the adoption of industrial air filtration systems. The National Clean Air Program in India aims to achieve a 30% reduction in particulate matter pollution by 2024 through collaborative efforts involving institutions such as the Indian Institute of Technology Kanpur and the Department of Environment, Forest & Climate Change, with support from the Clean Air Fund.

By Product

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Asia Pacific Industrial Air Filtration Market

5.1. COVID-19 Landscape: Asia Pacific Industrial Air Filtration Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Asia Pacific Industrial Air Filtration Market, By Product

8.1. Asia Pacific Industrial Air Filtration Market, by Product, 2024-2033

8.1.1. Dust Collectors

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Mist Collectors

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Fume Collector

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. HEPA Filters

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Cartridge Collectors & Filters

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Baghouse Filters

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Asia Pacific Industrial Air Filtration Market, By End-use

9.1. Asia Pacific Industrial Air Filtration Market, by End-use, 2024-2033

9.1.1. Cement

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Food & Beverage

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Metal

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Power

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Pharmaceutical

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Chemical & Petrochemical

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Paper & Wood Processing

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. Agriculture

9.1.8.1. Market Revenue and Forecast (2021-2033)

9.1.9. Other

9.1.9.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Asia Pacific Industrial Air Filtration Market, Regional Estimates and Trend Forecast

10.1. Asia Pacific

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. 3M

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. ABSOLENT

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Daikin Industries, Ltd.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Donaldson Company, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. General Electric

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Honeywell International Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Industrial Air Filtration, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. IQAir

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. MANN+HUMMEL

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Pall Corp.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others