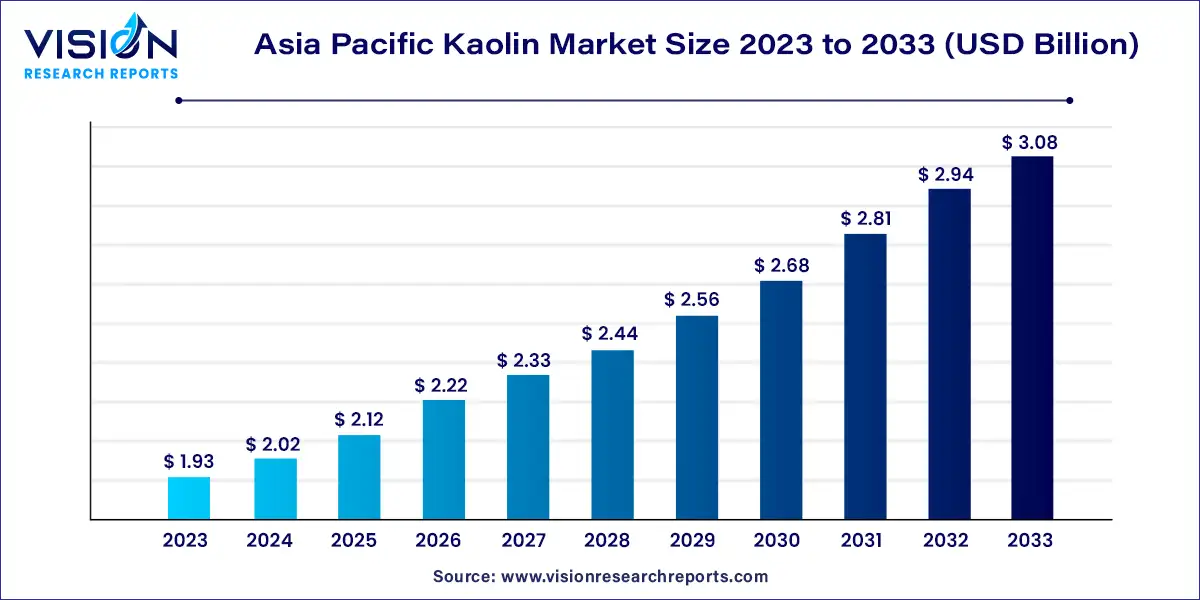

The Asia Pacific kaolin market size was estimated at around USD 1.93 billion in 2023 and it is projected to hit around USD 3.08 billion by 2033, growing at a CAGR of 4.8% from 2024 to 2033. The Asia Pacific kaolin market has witnessed significant growth in recent years, driven by the increasing demand for kaolin in various applications such as ceramics, paper, rubber, and plastics. Kaolin, also known as china clay, is a naturally occurring clay mineral composed predominantly of kaolinite, which is valued for its whiteness, chemical inertness, and fine particle size.

The growth of the Asia Pacific kaolin market is primarily driven by the rising demand from various end-use industries, including ceramics, paper, rubber, and plastics. As urbanization accelerates and infrastructure development intensifies across the region, the consumption of kaolin in construction materials and ceramic products has surged. Additionally, the paper industry continues to seek high-quality kaolin as a filler and coating material to enhance product performance and surface quality. The increasing awareness of environmentally friendly materials has also fueled demand for kaolin in applications such as paints and coatings, where it serves as a non-toxic, sustainable alternative. Moreover, technological advancements in mining and processing techniques are enhancing the quality and yield of kaolin, further propelling market growth. As countries in the region focus on improving manufacturing capabilities and increasing production efficiency, the kaolin market is set to expand significantly in the coming years.

In 2023, the paper segment captured the largest share of the Asia Pacific kaolin market, exceeding 38%. Kaolin is extensively utilized in the paper industry as a filler, enhancing printing quality and facilitating desirable flow characteristics. It also contributes to the overall quality of paper by increasing its brightness and opacity. The growing demand for high-quality paper products in sectors such as education, packaging, and media is further driving the expansion of this segment. Additionally, despite the trend towards digitalization, the demand for kaolin in the paper industry remains robust, particularly due to the ongoing need for high-quality graphics on packaging materials.

The ceramics segment ranks second in revenue and is anticipated to grow at the fastest rate of 5.25% from 2024 to 2033. Kaolin’s excellent molding properties make it a crucial ingredient in the ceramic industry, where it is used in the manufacturing of tiles, dinnerware, and sanitary ware. Rapid urbanization in countries like China and India is propelling the construction of residential and commercial structures, thereby boosting the demand for ceramic products.

China Kaolin Market Trends

China dominates the Asia Pacific kaolin market, representing 26% of the total revenue. This leadership position is driven by the country’s rapid urbanization and a burgeoning demand for cosmetics and personal care products. The increasing construction of residential and commercial buildings in China is expected to further elevate the demand for kaolin.

India Kaolin Market Trends

India is recognized as the second-fastest-growing market within the Asia Pacific kaolin sector, projected to experience a compound annual growth rate (CAGR) of 5.23% from 2024 to 2033. This growth is largely fueled by the rising demand from the construction industry. Additionally, the increasing need for kaolin across diverse sectors such as paper, ceramics, paints and coatings, fiberglass, plastics, rubber, pharmaceuticals, and cosmetics is anticipated to drive market expansion.

By Application

By Country

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Asia Pacific Kaolin Market

5.1. COVID-19 Landscape: Asia Pacific Kaolin Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Asia Pacific Kaolin Market, By Application

8.1. Asia Pacific Kaolin Market, by Application Type, 2024-2033

8.1.1. Paper

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Ceramics

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Paint & Coatings

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Fiberglass

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Plastic

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Rubber

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Pharmaceuticals & Medical

8.1.7.1. Market Revenue and Forecast (2021-2033)

8.1.8. Cosmetics

8.1.8.1. Market Revenue and Forecast (2021-2033)

8.1.9. Others

8.1.9.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Asia Pacific Kaolin Market, Regional Estimates and Trend Forecast

9.1. Asia Pacific

9.1.1. Market Revenue and Forecast, by Application (2021-2033)

Chapter 10. Company Profiles

10.1. BASF SE

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Imerys S.A.

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Ashapura Group

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. EICL Limited

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. SCR-Sibelco

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. 20 Microns Limited

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. WA Kaolin

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Jiangxi Sincere Mineral Industry Co., Ltd.

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. Uma Group of Kaolin

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Suvo Strategic Minerals

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others