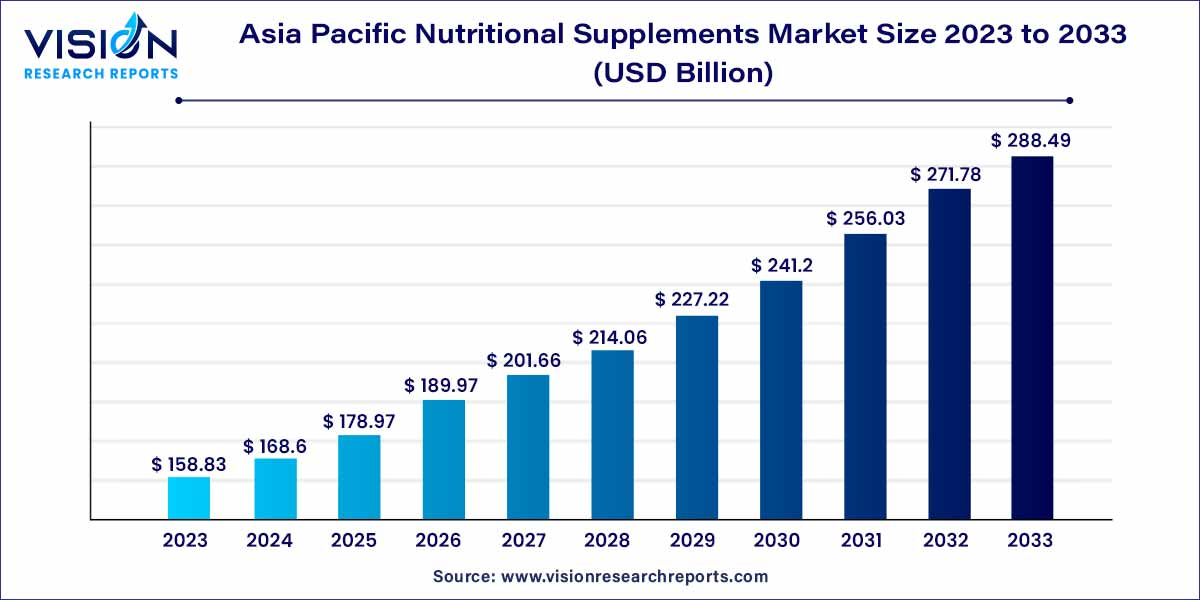

The Asia Pacific nutritional supplement market was valued at USD 158.83 billion in 2023 and it is predicted to surpass around USD 288.49 billion by 2033 with a CAGR of 6.15% from 2024 to 2033. The Asia Pacific nutritional supplements market is experiencing robust growth, driven by a confluence of factors that reflect changing consumer preferences and an increased emphasis on health and wellness. This overview provides insights into the key trends, market dynamics, and factors shaping the landscape of the nutritional supplements industry in the Asia Pacific region.

The Asia Pacific nutritional supplements market is experiencing notable growth, propelled by several key factors. A fundamental driver is the increasing health consciousness among consumers who actively seek products that contribute to their overall well-being. This trend is reinforced by a rising disposable income across the region, allowing individuals to invest in preventive healthcare measures. The prevalence of a preventive healthcare mindset is fueling demand for nutritional supplements as people proactively address specific health needs and seek to bridge nutritional gaps. The expansion of e-commerce platforms further facilitates easy access to a diverse range of nutritional products, contributing to market growth. As economic prosperity continues and consumer preferences evolve, the Asia Pacific nutritional supplements market is poised for sustained expansion, presenting opportunities for companies to innovate and cater to the diverse health and wellness needs of the region.

| Report Coverage | Details |

| Market Size in 2023 | USD 158.83 billion |

| Revenue Forecast by 2033 | USD 288.49 billion |

| Growth rate from 2024 to 2033 | CAGR of 6.15% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The functional food & beverages segment dominated the market with largest revenue share of 55% in 2023. The category comprises probiotics, Omega-3, fatty acids, and other products. Probiotics have been in demand since they promote a healthy gut, resulting in lesser changes in the stomach and GI-related chronic problems.

The sports nutrition segment is expected to grow at the fastest CAGR of 8.13% during the forecast period due to increased people moving towards a fitter and more active lifestyle. Asia Pacific is becoming a booming market for sports nutrition products owing to the increasing awareness regarding health and government initiatives towards making people fitter and healthier, thereby reducing the country's disease burden and saving billions of dollars on healthcare. All of these factors have contributed to the growth of the market.

The adult segment led the market with the highest revenue share of 30% in 2023, owing to their inactive lifestyles and rapid urbanization, the adult population has become more predisposed to chronic diseases like diabetes, hypertension, and cardiovascular diseases. The prophylactic base of treatment to avoid contracting these diseases has been consuming functional foods, nutrient-rich foods, and nutritional supplementation, thus driving the market.

The children segment is anticipated to grow at the fastest CAGR of 7.26% during the forecast period. The major products in this category are meant for good physical and mental growth. The importance of balanced nutrition and knowledge of the same is growing, positively impacting the growth of the Asia Pacific market.

The powder formulation segment contributed the largest market share of 39% in 2023, owing to the growing market for sports nutrition. Most of the products in the segment, like protein and amino acid supplementation, are in powder formulations. They are easier to absorb, and they come in a variety of flavors. This has been a major factor behind the success of the market.

The softgels segment is expected to grow at the fastest CAGR of 7.13% over the forecast period. Softgels have gained popularity as a favored dosage form for nutritional supplements within the Asia Pacific region due to their advantages, including ease of swallowing, precise dosing capabilities, and the ability to encapsulate diverse ingredients. The demand for nutritional supplements, particularly in softgel form, is influenced by critical factors such as product quality, efficacy, safety, and adherence to regulatory compliance. In the Asia Pacific market, consumers are displaying a growing preference for trusted brands and products that are backed by scientific evidence and adhere to stringent quality standards.

The capsule formulation segment is expected to grow at a lucrative CAGR during the forecast period. This is because functional food supplements like Omega-3 and certain probiotics are all in capsule formulations, and functional foods are a large market segment. The benefits associated with capsule formulation include including multiple supplements in one dose and ease of consumption by all age groups, which, in turn, is expected to fuel the market growth.

The brick and mortar segment generated the maximum market share of 70% in 2023. A large number of people are still purchasing through brick-and-mortar stores. However, online sales or e-commerce platform has been gaining much momentum. The ongoing pandemic, the availability of more options in a single place, and discounted rates have been the primary factors for the growth of the e-commerce platform. Many people who have shifted to purchasing from online platforms are bound to continue with it.

The E-commerce platforms segment is anticipated to grow at the fastest CAGR of 7.08% during the forecast period. It has been increasingly gaining a lot of traction due to COVID restrictions and lockdowns and initiatives the market players took to collaborate with e-commerce platforms to sell their products to reach a wider consumer base. All of these factors have contributed to the growth of the market.

By Product

By Consumer Group

By Formulation

By Sales Channel

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others