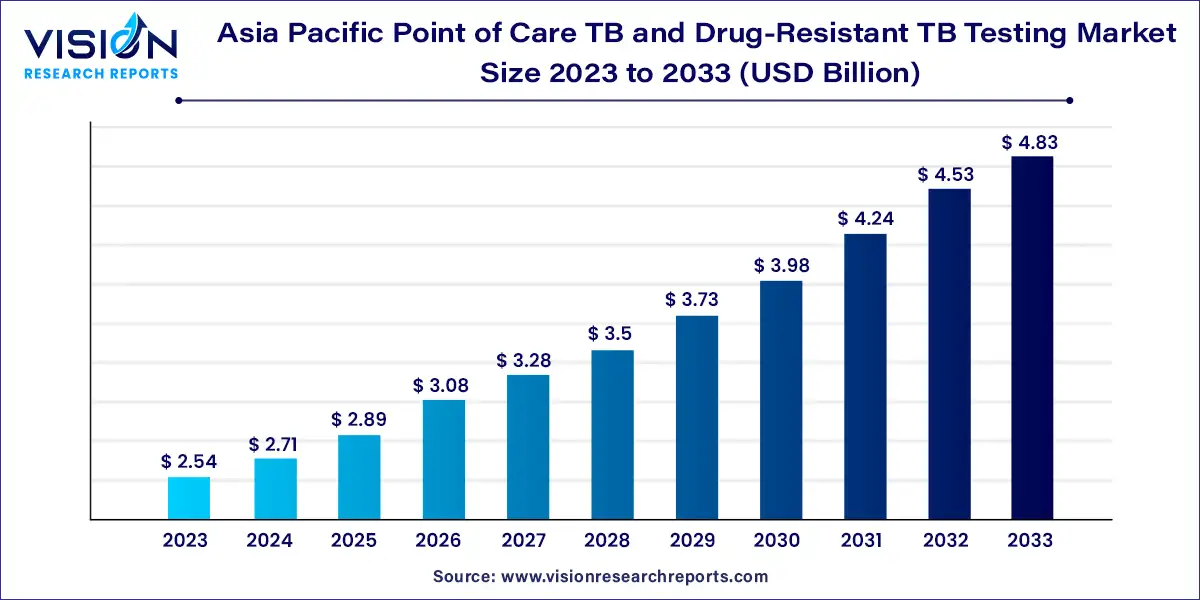

The Asia Pacific point of care TB and drug-resistant TB testing market size was estimated at around USD 2.54 billion in 2023 and it is projected to hit around USD 4.83 billion by 2033, growing at a CAGR of 6.63% from 2024 to 2033. The Asia Pacific point-of-care (POC) tuberculosis (TB) and drug-resistant TB testing market is gaining significant momentum as TB remains a major public health concern in the region. The market's growth is driven by factors such as the high prevalence of TB, the increasing incidence of drug-resistant strains, advancements in diagnostic technologies, and government initiatives to combat the disease.

The growth of the Asia Pacific point-of-care TB and drug-resistant TB testing market is primarily driven by the region's high burden of tuberculosis, including the increasing prevalence of multidrug-resistant TB. Governments and healthcare organizations are intensifying efforts to combat the spread of the disease through early detection and effective treatment strategies. Advancements in diagnostic technologies, such as rapid molecular assays and portable testing devices, are facilitating quicker and more accurate diagnosis at the point of care, reducing delays in treatment initiation. Additionally, growing awareness, increased funding for TB programs, and the expansion of healthcare infrastructure in emerging economies are further fueling market growth.

In 2023, the immunoassays segment held a significant market share of 35%, largely due to the technology's proven effectiveness, user-friendliness, and versatility across various settings. Immunoassays, including enzyme-linked immunosorbent assays (ELISA) and lateral flow tests, are highly regarded in TB diagnostics for their sensitivity and specificity in identifying TB biomarkers and antibodies. The QuantiFERON-TB Gold test exemplifies this, offering reliable results for latent TB infections by assessing immune responses to specific TB proteins. Such accuracy is particularly vital in regions with high TB prevalence, like India and Indonesia, where timely detection is essential for effective disease management.

The culture-based tests segment is projected to experience the highest growth rate, with a CAGR of 6.63% during the forecast period. This growth is fueled by a growing demand for definitive diagnostic confirmation, advancements in culture technologies, and a deeper understanding of drug resistance. Culture-based tests, such as Löwenstein-Jensen cultures and liquid culture systems, are considered the gold standard for TB diagnosis due to their high sensitivity and ability to accurately identify drug resistance. Unlike molecular and immunoassay tests, culture methods confirm the presence of Mycobacterium tuberculosis and provide crucial drug susceptibility information necessary for managing drug-resistant TB.

In 2023, the clinics and hospitals segment dominated the market, accounting for 49% of revenue. This leadership position stems from the critical role these healthcare facilities play in comprehensive patient management, the advancement of diagnostic technologies, and the growing need for effective TB and drug-resistant TB diagnostics. Clinics and hospitals are essential for TB diagnosis and treatment, offering a broad range of diagnostic tests and treatment options. They are equipped to perform complex procedures, such as molecular tests and culture-based assays, which are vital for accurate TB detection and drug resistance profiling. The high prevalence of TB in the Asia Pacific region, particularly in countries like India, China, and Indonesia, underscores the necessity for sophisticated diagnostic capabilities available in these settings.

Diagnostic laboratories are expected to grow at the fastest CAGR of 7.53% during the forecast period. The increasing complexity of TB cases, including multidrug-resistant (MDR-TB) and extensively drug-resistant (XDR-TB) strains, demands specialized testing capabilities. Diagnostic laboratories are equipped to handle these intricate cases by offering comprehensive drug susceptibility testing and detailed microbiological analyses, which are crucial for effective treatment planning. The expansion of laboratory networks and the implementation of quality assurance programs have enhanced the capabilities of diagnostic laboratories, making them vital contributors to TB control. Additionally, investments in laboratory infrastructure and technology, along with government and international support, are further driving growth in this sector.

India Point of Care TB and Drug-Resistant TB Testing Market Trends

India's PoC TB and drug-resistant TB testing market is significantly influenced by the country's high TB burden, with 2.4 million cases reported in 2022, according to the Ministry of Health and Welfare. The nation faces challenges with multidrug-resistant (MDR-TB) and extensively drug-resistant (XDR-TB) strains. To address these issues, the government has launched several initiatives, including the Pradhan Mantri TB Mukt Bharat Abhiyan, which has engaged over 100,000 Ni-kshay Mitras to support more than 1.1 million TB patients. Additionally, the Ni-kshay Poshan Yojana has allocated approximately USD 311 million to over 9.5 million TB patients since 2018. New initiatives like the Family Care Giver Model and Differentiated Care aim to improve treatment success rates and reduce mortality.

Market growth is further supported by strategic partnerships and new product introductions. For example, in October 2023, Serum Institute of India Pvt. Ltd. and Mylab Discovery Solutions Pvt. Ltd. launched a cost-effective PoC skin test for Latent Tuberculosis Infection (LTBI), priced 50% to 70% lower than existing tests. These collective efforts are expected to drive significant market expansion in the coming years.

China Point of Care TB and Drug-Resistant TB Testing Market Trends

The PoC TB and drug-resistant TB testing market in China is growing in response to the country's substantial TB burden and ongoing public health initiatives. As one of the countries with the highest TB incidence rates, China plays a significant role in the global TB caseload. According to WHO data, in 2022, eight countries accounted for over two-thirds of global TB cases, with China responsible for 7.1%. In response, the Chinese government has prioritized TB control in its national health strategies, including the adoption of advanced diagnostic technologies. Regulatory bodies like the National Medical Products Administration (NMPA) are facilitating the introduction of new diagnostic technologies by streamlining approval processes. These initiatives, along with increased healthcare investments, are propelling the growth of the PoC TB and drug-resistant TB testing market in China.

Japan Point of Care TB and Drug-Resistant TB Testing Market Trends

Japan's PoC TB and drug-resistant TB testing market is expanding due to the country's advanced healthcare system and proactive TB management strategies. The Japanese government has implemented a comprehensive TB control program that includes routine screenings and cutting-edge diagnostic technologies. The Ministry of Health, Labour, and Welfare is supporting the integration of innovative diagnostic tools, such as rapid molecular assays, to enhance TB detection and management. In April 2024, the health ministry announced the establishment of a new expert body by April 2025 to prepare for future infectious disease crises. Additionally, strategic initiatives by key market players are driving growth; for instance, in April 2023, QIAGEN introduced its QIAstat-Dx syndromic testing solution in Japan, featuring a SARS-CoV-2 Respiratory Panel capable of detecting over 20 pathogens from a single patient sample. This highlights the country’s commitment to integrating innovative diagnostics into its healthcare framework.

By Test

By End Use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others