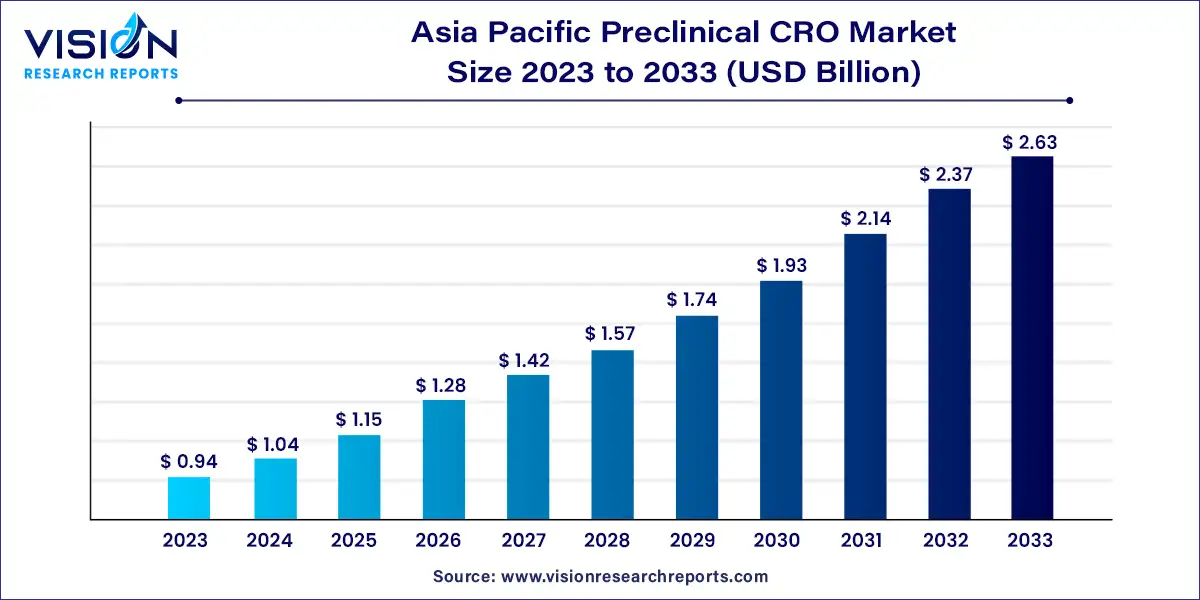

The Asia Pacific preclinical CRO market size was estimated at around USD 0.94 billion in 2023 and it is projected to hit around USD 2.63 billion by 2033, growing at a CAGR of 10.83% from 2024 to 2033.

The Asia Pacific Preclinical contract research organization (CRO) market is experiencing substantial growth, driven by the increasing demand for outsourced preclinical services. These organizations play a critical role in drug discovery and development, offering a range of services from pharmacokinetics and toxicology studies to regulatory compliance and preclinical trials.

The Asia Pacific preclinical CRO market is experiencing significant growth driven by the rapid expansion of the pharmaceutical and biotechnology industries in the region, particularly in countries like China, India, and Japan. These nations are increasing their R&D investments, leading to a growing pipeline of new drug candidates that require extensive preclinical testing. Additionally, outsourcing to CROs in the Asia Pacific offers substantial cost savings compared to conducting research in-house or in Western countries, due to lower labor and operational costs.

The toxicology testing segment dominated the market in 2023, capturing the largest market share of 23%. This growth is primarily driven by the increasing demand for preclinical services in countries like India and China, where CROs provide cost-effective solutions. Additionally, the burgeoning pharmaceutical industry in the region and the rising incidence of chronic diseases, such as cancer and heart disease, are further fueling the segment's expansion.

The bioanalysis and DMPK studies segment also held a significant market share in 2023, spurred by the prevalence of chronic diseases, the availability of low-cost CROs, and increasing government investments in research and development activities. The rapidly growing biopharmaceutical industry in the region is also driving the demand for preclinical research services.

In 2023, the Patient Derived Organoid (PDO) models segment held the largest revenue share of 81%. This growth is attributed to the rising emphasis on precision medicine and the need for more representative and personalized disease models. PDO models, derived from patient tissues, can replicate the complexity and heterogeneity of human organs, making them valuable tools for studying disease mechanisms, screening drug candidates, and personalizing treatment approaches. The increasing prevalence of chronic diseases and the expanding biopharmaceutical industry in the region are also contributing to the segment's growth.

Patient Derived Xenograft (PDX) models are expected to witness substantial growth due to the region's expanding biopharmaceutical industry and the trend of outsourcing drug discovery services to CROs. The growing awareness of precision medicine in the Asia Pacific region is driving the adoption of PDX models for cancer treatment approaches.

The biopharmaceutical companies segment held the largest revenue share of 82% in 2023. This growth is driven by the increasing focus on cost-effective and time-efficient drug development. Additionally, the rising incidence of chronic diseases and increased R&D spending by key pharmaceutical, biotechnology, and medtech companies in the region are contributing to the segment's growth.

Government and academic institutes registered a significant revenue share in 2023 due to the growing trend of outsourcing preclinical services to CROs by these entities. Increased government investments in research and development, particularly in countries like India and China, are also boosting the demand for preclinical CRO services.

In 2023, China held the largest market share of 33% in the Asia Pacific preclinical CRO market. This growth is driven by the country's pool of skilled professionals, cost efficiency, and expanding pharmaceutical industry. Additional factors such as rising investments, low operational costs, adherence to R&D standards, and strong demand for preclinical CRO services are also contributing to the market's growth.

The preclinical CRO market in Japan is anticipated to experience significant growth in the coming years, driven by the expanding pharmaceutical industry, increasing number of preclinical trials, and government support.

By Service

By Model Type

By End-use

By Country

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others