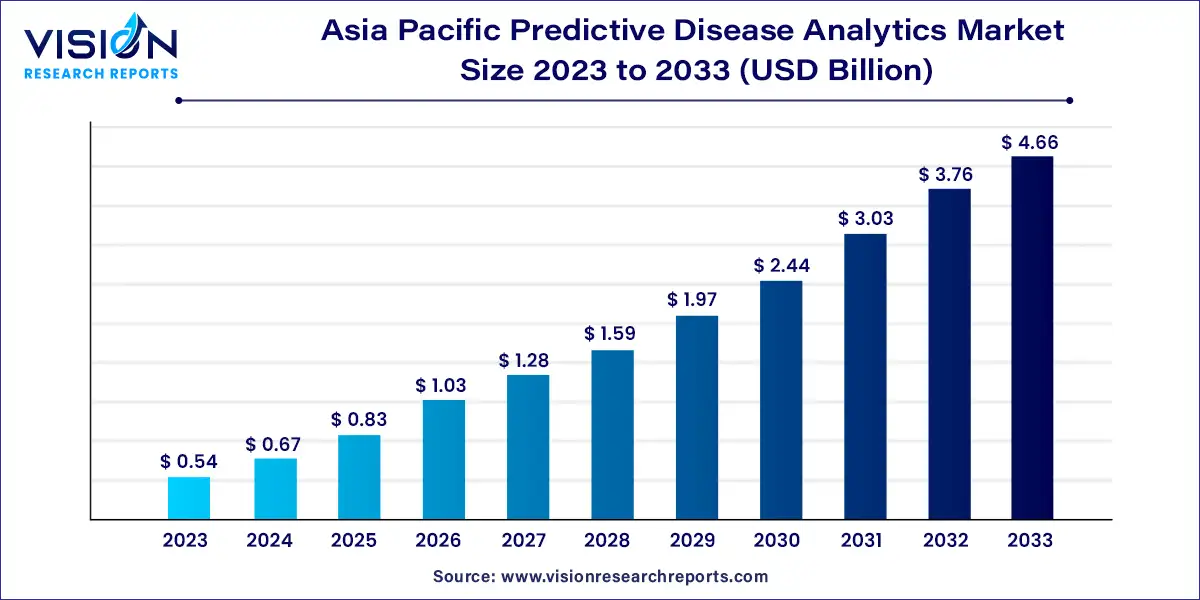

The global Asia Pacific predictive disease analytics market size was estimated at around USD 0.54 billion in 2023 and it is projected to hit around USD 4.66 billion by 2033, growing at a CAGR of 24.05% from 2024 to 2033. The Asia Pacific predictive disease analytics market is witnessing significant growth due to the rising demand for advanced healthcare solutions and the increasing burden of chronic diseases in the region. Predictive analytics leverages historical data, machine learning, and statistical algorithms to identify potential health risks, improve patient outcomes, and enhance healthcare decision-making.

The growth of the Asia Pacific predictive disease analytics market is significantly driven by several key factors. Firstly, the rising prevalence of chronic diseases, such as diabetes, hypertension, and cardiovascular issues, is compelling healthcare providers to adopt predictive analytics solutions to enhance disease management and patient outcomes. Secondly, advancements in technology, particularly in big data analytics, artificial intelligence, and machine learning, are enabling healthcare organizations to harness vast amounts of data for insightful predictions and proactive decision-making. Furthermore, government initiatives aimed at promoting digital health and improving healthcare infrastructure are fostering an environment conducive to the adoption of predictive analytics. Additionally, the increasing focus on personalized medicine and population health management is pushing healthcare systems to leverage analytics for tailored interventions and resource optimization.

On the basis of components, the industry has been further segmented into software & services and hardware. The software & services segment accounted for the largest share of 72% of the overall revenue in 2023. The segment is anticipated to expand further at the fastest CAGR of 24.44% retaining its dominant position throughout the forecast period. The rising patient load on healthcare facilities, coupled with the rising prevalence of diseases, is contributing to the market growth in this segment.

In addition, the growing pressure to offer better patient care at a low cost is creating opportunities for this segment to grow. Moreover, the development of data analytics and platforms is drawing investments into the IT sector in the healthcare industry. As the majority of healthcare systems don’t have dedicated data analytics divisions, they tend to outsource it to IT companies. This is propelling the growth of data analytics firms, which, in turn, is driving the segment growth.

On the basis of deployments, the market has been segmented into on-premise and cloud-based. The on-premise deployment segment accounted for the largest share of 67% of the overall revenue in 2023. The segment growth is attributed to the benefits associated with the adoption of on-premise solutions, such as reduced costs, low power consumption, and low maintenance. Moreover, this type of deployment also offers security and convenience of access, which is motivating various healthcare institutions to install instruments and software at their premises.

The cloud-based segment is anticipated to grow at the fastest CAGR of 25.13% over the forecast period. The growth is attributed to the low capital requirement, ease of storage, and enhanced efficiency. The cloud-based solutions are capable of increasing user engagement and providing remote access to medical information at any time and from anywhere, which is expected to drive the growth of this segment over the forecast period.

On the basis of end-uses, the industry has been segmented into healthcare payers, healthcare providers, and others. The healthcare payers end-use segment dominated the market in 2023 and accounted for the largest share of 42% of the overall revenue. The healthcare payers segment includes health plan sponsors, insurance companies, third-party payers, and government agencies. Payers are adopting predictive disease analytics tools to evaluate insurance claims and reduce risks arising from fraud.

The healthcare providers segment is anticipated to register the fastest growth rate of 24.38% from 2024 to 2033 owing to the increasing healthcare expenditure and rising investment for the development of healthcare infrastructure in the region. Furthermore, the growing geriatric population coupled with the rising incidences of chronic disease is creating an opportunity for predictive disease analytics to grow as it assists in clinical decision-making, treatment, and resource allocation as per future needs.

In 2023, India emerged as the leader in the regional market, capturing a substantial share of 25% of the total revenue. The country's market is anticipated to grow at an impressive rate of 24.9%, solidifying its dominant position throughout the forecast period. This growth is largely driven by the significant presence of major companies such as IBM Corp. and Oracle Corp., which are implementing strategies to enhance their market influence, thereby propelling overall market expansion.

For example, in 2022, Google partnered with Apollo Hospitals to leverage deep learning models for diagnostic applications, including x-rays. Additionally, government initiatives and funding aimed at bolstering the healthcare sector in India are also contributing to this growth. As reported by India Today, public funding for the Digital India Mission saw a 67% increase in FY 2022-23, promoting the adoption of AI-based tools to improve healthcare outcomes and agricultural productivity.

By Component

By Deployment

By End-use

By Country

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Component Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Asia Pacific Predictive Disease Analytics Market

5.1. COVID-19 Landscape: Asia Pacific Predictive Disease Analytics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Asia Pacific Predictive Disease Analytics Market, By Component

8.1. Asia Pacific Predictive Disease Analytics Market, by Component, 2024-2033

8.1.1 Hardware

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Software & Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Asia Pacific Predictive Disease Analytics Market, By Deployment

9.1. Asia Pacific Predictive Disease Analytics Market, by Deployment, 2024-2033

9.1.1. On-premise

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Cloud-based

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Asia Pacific Predictive Disease Analytics Market, By End-use

10.1. Asia Pacific Predictive Disease Analytics Market, by End-use, 2024-2033

10.1.1. Healthcare Payers

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Healthcare Providers

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Other End-users

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Asia Pacific Predictive Disease Analytics Market, Regional Estimates and Trend Forecast

11.1. Asia Pacific

11.1.1. Market Revenue and Forecast, by Component (2021-2033)

11.1.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. IBM Corp.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Verisk Analytics, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. McKesson Corp.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. SAS Institute, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Cotiviti, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Optum, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. MedeAnalytics, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Oracle

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others