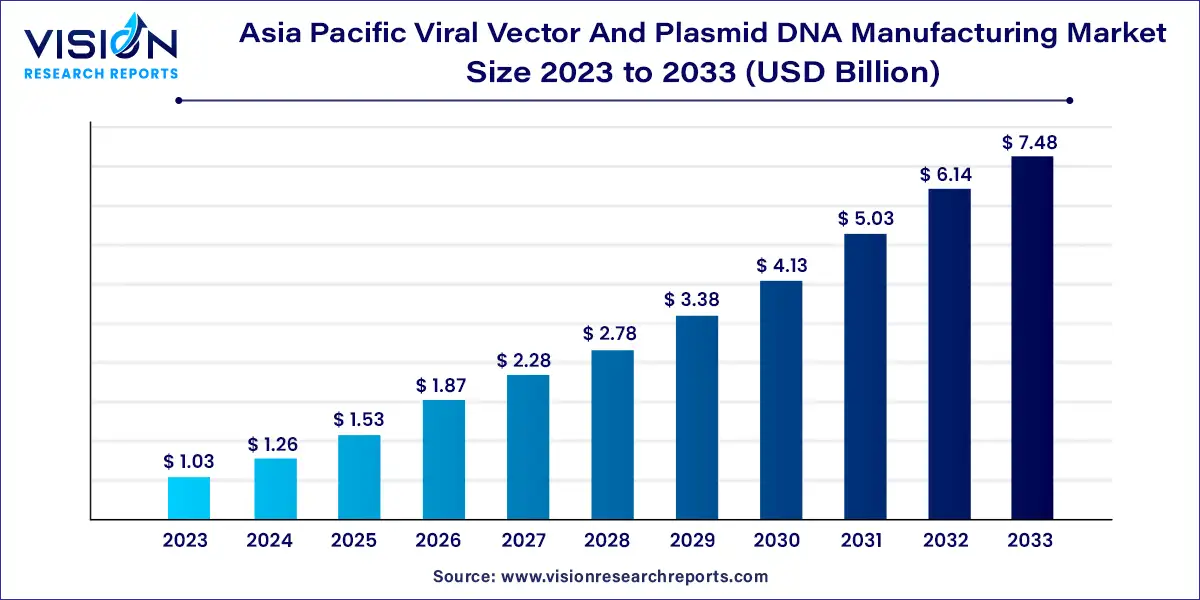

The Asia Pacific viral vector and plasmid DNA manufacturing market was estimated at USD 1.03 billion in 2023 and it is expected to surpass around USD 7.48 billion by 2033, poised to grow at a CAGR of 21.93% from 2024 to 2033. The Asia Pacific region is witnessing significant growth in the viral vector and plasmid DNA manufacturing market, driven by advancements in biotechnology and gene therapy research.

The growth of the Asia Pacific viral vector and plasmid DNA manufacturing market is driven by an increasing investment in biotechnology and gene therapy research across the region is fueling demand for viral vectors and plasmid DNA for gene delivery applications. Secondly, advancements in manufacturing technologies are enhancing production efficiency and scalability, enabling manufacturers to meet the growing demand for gene therapy products. Additionally, the rising prevalence of genetic disorders and chronic diseases in the Asia Pacific region underscores the need for innovative treatment solutions, further driving market growth. Moreover, favorable regulatory policies and initiatives aimed at promoting biopharmaceutical innovation are facilitating market expansion. Collaborations between academia, research institutions, and industry players are also fostering innovation and driving market growth by facilitating knowledge exchange and technology transfer.

The adeno-associated virus (AAV) segment dominated the market in 2023, capturing the largest revenue share at 21%. AAV is increasingly favored for its precise gene delivery capabilities, driving its adoption across various research applications in gene therapy. Moreover, AAV-based vectors are gaining traction in neuroscience research, serving as a valuable preclinical tool for brain connectivity mapping and studying neurocircuit and cellular functions.

Meanwhile, the lentivirus segment is forecasted to exhibit the highest compound annual growth rate (CAGR) of 22.03% during the projected period. Lentiviral vectors have demonstrated notable success in reprogramming induced pluripotent stem cells (iPSCs) and have been instrumental in utilizing a Cre-Lox-based reversible system, opening new avenues for research. This development has paved the way for therapeutic exploration in iPSC technology.

The downstream processing segment led the market in 2023, commanding a revenue share of 54%. This segment encompasses various purification methods involving multiple steps, typically categorized into capture, intermediate purification, and polishing stages.

Conversely, the upstream processing segment is poised for a robust growth trajectory, with a projected CAGR of 21.03% during the forecast period. Upstream processing involves the initial steps of introducing cells to the virus, cultivating these cells, and isolating the virus from them. Innovations in product development, such as the ambr 15 microbioreactor system for high-throughput upstream process development, are expected to propel advancements in this field.

In 2023, the vaccinology segment commanded the largest revenue share of 23%, driven by the escalating demand for vaccines to combat infectious diseases. Ongoing research on various viral vectors underscores their potential in accelerating the development of viral vector-based vaccines.

Concurrently, the cell therapy segment is anticipated to grow at a notable CAGR of 24.23% over the forecast period. The adoption of next-generation transfer vectors has facilitated the increasing utilization of cell therapy-based medicines, with patient samples expanded, extracted, and transduced using gene therapy vectors.

Research institutes dominated the market in 2023, capturing a revenue share of 58%. The segment's growth is fueled by the rising demand for viral vectors and the growing involvement of scientific communities in gene and cell therapy research. Research entities' efforts to enhance vector production techniques are further propelling segment growth.

Meanwhile, pharmaceutical and biotechnology companies are expected to witness a CAGR of 22.24% over the forecast period. Increased investments in cell and gene therapy have prompted many biopharmaceutical companies to shift focus, resulting in heightened research activities to explore the potential of these advanced therapies.

The cancer segment emerged as the dominant revenue contributor in 2023, capturing a share of 39%. This growth trajectory is fueled by the escalating incidence of cancer cases and the extensive use of plasmid DNA and viral vectors in developing gene therapies. Lifestyle factors, including Western dietary habits and sedentary lifestyles, are also contributing to the rising prevalence of cancer.

The genetic disorders segment is poised for significant growth, with a projected CAGR of 22.03% during the forecast period. Gene therapy has emerged as a promising treatment modality for rare genetic disorders such as hemophilia, Adenosine Deaminase-Severe Combined Immunodeficiency (ADA-SCID), and Lipoprotein Lipase Deficiency (LPLD). These conditions stem from genetic abnormalities or missing genes, affecting specific traits. While most genetic disorders manifest from birth, some may arise due to spontaneous mutations. Common genetic diseases encompass sickle cell anemia and hemophilia, characterized by abnormal hemoglobin production and impaired blood clotting, thereby affecting oxygen transport in the blood.

The China viral vector and plasmid DNA manufacturing market held a revenue share of 20% in 2023, driven by advancements in the regulatory framework governing cell-based research activities within the country. Additionally, numerous biopharmaceutical companies are redirecting their focus toward advanced therapies, fueling investments in cell and gene therapy. Notably, VectorBuilder's announcement of a USD 500 million investment in April 2022 to establish a state-of-the-art cell and gene therapy research and manufacturing facility in Guangzhou, China, underscores this trend. Equipped to produce various forms of vectors, including AAV, plasmids, cell lines, lentivirus, and mRNA, this facility is anticipated to catalyze the growth of the viral vector and plasmid DNA manufacturing market in China.

The Japan viral vector and plasmid DNA manufacturing market are projected to grow at a CAGR of 20.63% over the forecast period, driven by its well-developed pharmaceutical and biotechnology sectors within the region. Moreover, the high prevalence of chronic diseases and rare genetic disorders has spurred intensified research and development efforts aimed at novel therapies and vaccines. Consequently, there is a heightened demand for plasmid DNA manufacturing solutions for research purposes in Japan.

By Vector Type

By Workflow

By Application

By End-use

By Disease

By Country

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Asia Pacific Viral Vector and Plasmid DNA Manufacturing Market

5.1. COVID-19 Landscape: Asia Pacific Viral Vector and Plasmid DNA Manufacturing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Asia Pacific Viral Vector and Plasmid DNA Manufacturing Market, By Vector Type

8.1. Asia Pacific Viral Vector and Plasmid DNA Manufacturing Market, by Vector Type, 2024-2033

8.1.1. Adenovirus

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Retrovirus

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Adeno-Associated Virus (AAV)

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Lentivirus

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Plasmids

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Asia Pacific Viral Vector and Plasmid DNA Manufacturing Market, By Workflow

9.1. Asia Pacific Viral Vector and Plasmid DNA Manufacturing Market, by Workflow, 2024-2033

9.1.1. Upstream Manufacturing

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Vector Amplification & Expansion

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Vector Recovery/Harvesting

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Downstream Manufacturing

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Purification

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Fill Finish

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Asia Pacific Viral Vector and Plasmid DNA Manufacturing Market, By Application

10.1. Asia Pacific Viral Vector and Plasmid DNA Manufacturing Market, by Application, 2024-2033

10.1.1. Antisense & RNAi Therapy

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Gene Therapy

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Cell Therapy

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Vaccinology

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Research Applications

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Asia Pacific Viral Vector and Plasmid DNA Manufacturing Market, By End-use

11.1. Asia Pacific Viral Vector and Plasmid DNA Manufacturing Market, by End-use, 2024-2033

11.1.1. Pharmaceutical and Biopharmaceutical Companies

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Research Institutes

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Asia Pacific Viral Vector and Plasmid DNA Manufacturing Market, By Disease

12.1. Asia Pacific Viral Vector and Plasmid DNA Manufacturing Market, by Disease, 2024-2033

12.1.1. Cancer

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Genetic Disorders

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Infectious Diseases

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Others

12.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Asia Pacific Viral Vector and Plasmid DNA Manufacturing Market, Regional Estimates and Trend Forecast

13.1. Asia Pacific

13.1.1. Market Revenue and Forecast, by Vector Type (2021-2033)

13.1.2. Market Revenue and Forecast, by Workflow (2021-2033)

13.1.3. Market Revenue and Forecast, by Application (2021-2033)

13.1.4. Market Revenue and Forecast, by End-use (2021-2033)

13.1.5. Market Revenue and Forecast, by Disease (2021-2033)

Chapter 14. Company Profiles

14.1. FUJIFILM Holdings Corporation

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Wuxi Biologics

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Takara Bio Inc.

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Astellas Pharma, Inc. (Audentes Therapeutics)

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Lonza

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Charles River Laboratories (Cobra Biologics)

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Virovek Incorporation

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. BioMarin

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others