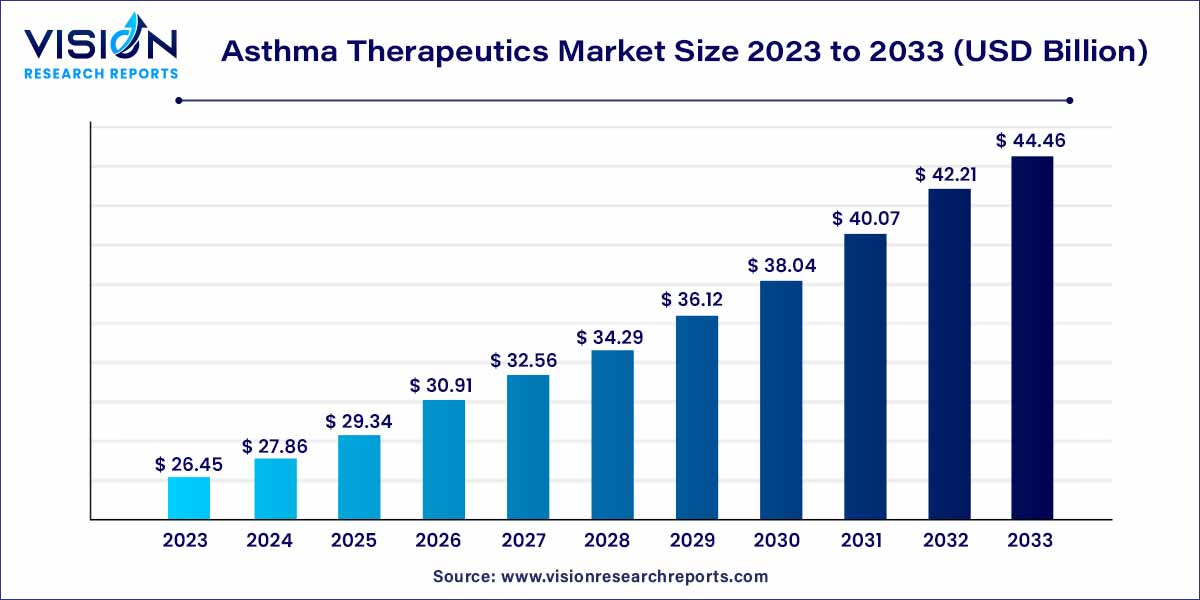

The global asthma therapeutics market size was estimated at around USD 26.45 billion in 2023 and it is projected to hit around USD 44.46 billion by 2033, growing at a CAGR of 5.33% from 2024 to 2033. The asthma therapeutics market is driven by an increasing prevalence of asthma, rising healthcare infrastructure in developing regions, and innovative drug development initiatives.

The global asthma therapeutics market has witnessed significant growth in recent years, driven by a rising prevalence of asthma worldwide. Asthma, a chronic respiratory condition characterized by inflammation of the airways, has prompted increased research and development efforts to enhance treatment options. This overview delves into key aspects of the asthma therapeutics market, including market trends, growth drivers, challenges, and future prospects.

The growth of the asthma therapeutics market is propelled by several key factors. Firstly, the escalating global prevalence of asthma has become a major driver, necessitating an increased demand for effective therapeutic solutions. Additionally, continuous advancements in medical research and technology have ushered in innovative treatments, such as inhalers and biologics, contributing to enhanced asthma management. The growing awareness among both patients and healthcare professionals regarding the importance of early diagnosis and improved treatment strategies has further fueled market expansion. Despite challenges like high treatment costs and generic competition, the market's trajectory remains positive. Looking forward, the pursuit of personalized medicine tailored to individual genetic profiles is anticipated to revolutionize asthma treatment approaches, fostering sustained growth in the market.

The dominant force in the market was the anti-inflammatory segment, which commanded a substantial 63% revenue share in 2023. This surge can be attributed to the introduction of cost-effective and innovative anti-inflammatory biologics designed to address the needs of severe asthmatic patients. An illustrative example is the FDA's approval of Xolair in April 2021, a biologic specifically formulated for the treatment of moderate to severe persistent allergic asthma, Chronic Idiopathic Urticaria (CIU), and nasal polyps. Distinguished by its capability to target and block IgE, Xolair exemplifies the evolving landscape of anti-inflammatory treatments. Noteworthy collaborations among pharmaceutical entities, research institutions, and healthcare organizations are propelling research and development efforts within the market. These collaborative endeavors play a crucial role in uncovering and bringing to market novel anti-inflammatory drugs, thereby amplifying the growth of this segment.

Concurrently, the combination therapy segment is poised to exhibit the most rapid Compound Annual Growth Rate (CAGR) from 2024 to 2033. Characterized by the simultaneous use of two medications targeting inflammation and bronchoconstriction – key elements in the pathophysiology of asthma – combination therapy is gaining prominence due to its efficacy compared to alternative drug combinations, ease of administration, and heightened patient compliance. The market is witnessing an upswing in the adoption of combination therapy, facilitated by the accessibility of various fixed-dose combination inhalers that enhance convenience for patients.

In 2023, the inhalers segment took the lead in revenue generation, and this achievement can be attributed to several factors such as their reliability, versatility, portability, and cost-effectiveness. Notably, the rising prevalence of asthma and Chronic Obstructive Pulmonary Disease (COPD), coupled with an increasing demand for emergency treatment alternatives during sudden attacks, played a pivotal role in securing a substantial market share for inhalers. This segment is poised for further expansion, driven by ongoing advancements leading to the development of more sophisticated products. A case in point is the approval of GSK Plc. and Innoviva's triple therapy inhaler, Trelegy Ellipta, in the U.S. for treating asthma and COPD, granted in September 2020. As the market continues to evolve, inhalers are anticipated to maintain their prominence.

Concurrently, the nebulizers segment is projected to register the fastest Compound Annual Growth Rate (CAGR) from 2024 to 2033. The primary catalyst behind this growth is the ease of use, making nebulizers particularly well-suited for children, elderly patients, and individuals with severe asthma who may struggle with inhaler techniques. The rising adoption of nebulizers in home healthcare and emergency medicine, driven by associated benefits like enhanced comfort, the ability to administer larger dosages ensuring sustained results, and favorable reimbursement scenarios, is expected to be a key driver for market expansion. Additionally, continuous advancements in nebulizer technology, including the introduction of portable and handheld devices, are enhancing patient compliance and convenience.

In 2023, the inhaled route of administration emerged as the leading segment in the industry. Recognized for its effectiveness, this method allows for the targeted delivery of medication directly to the inflamed airways, enhancing therapeutic outcomes. The preference for the inhaled route over oral or injectable alternatives stems from its ability to minimize adverse effects while maximizing the desired therapeutic impact. The continual growth of this segment is anticipated to be significantly influenced by new product launches and approvals. For instance, in July 2023, Viatris, Inc. introduced Breyna Inhalation Aerosol, an FDA-approved generic version of Symbicort tailored for asthmatic and COPD patients in the United States.

Concurrently, the oral segment is poised to exhibit the highest growth rate from 2024 to 2033. Utilizing the digestive system for absorption into the bloodstream, the oral route of administration stands out as the most common and convenient method for drug delivery. Its widespread acceptance is attributed to being well-tolerated, easy to use, and suitable for administration at home without requiring specialized equipment or training. The convenience, efficacy, and versatility of oral medications position them as a valuable tool for managing asthma, thereby propelling the growth of this segment.

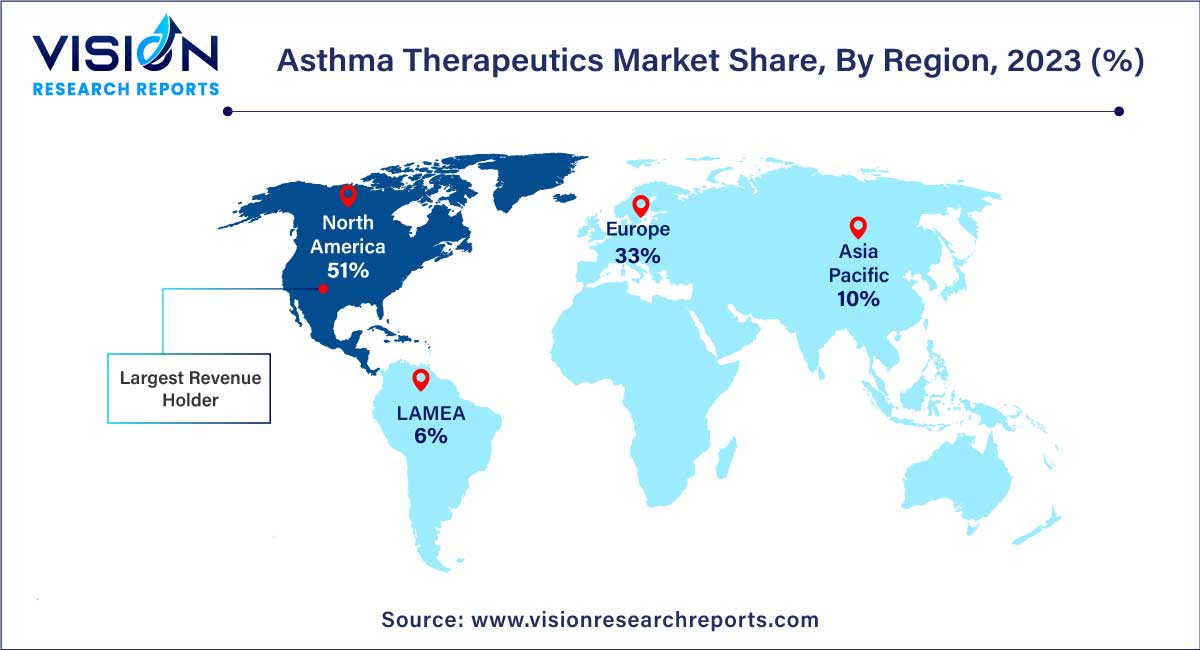

In 2023, North America dominated the market with the largest market share of 51%. This supremacy can be attributed to several factors, including the robust presence of major key players, well-established healthcare infrastructure, and a rising prevalence of diseases across the region. Notably, asthma's higher incidence among adult women compared to adult men in the U.S., as highlighted in the CDC's 2020 report indicating approximately 25 million asthma cases, underscores the substantial impact of respiratory conditions in the region. The Asthma and Allergy Foundation of America (AAFA) further reports around 5 million asthmatic children in the U.S.

Concurrently, Asia Pacific is poised to experience noteworthy growth, propelled by improving healthcare reforms. Several contributing factors include a rising geriatric population, the entry of new market players, increased healthcare expenditure, and heightened awareness about lung diseases. In Southeast Asia, asthma stands out as one of the most common non-communicable diseases, accounting for nearly 73% of outpatient clinic visits. This prevalence establishes a substantial target population for effective therapeutics, positioning the Asia Pacific region as a key area for potential market expansion.

By Drug Class

By Product

By Route of Administration

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Drug Class Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Asthma Therapeutics Market

5.1. COVID-19 Landscape: Asthma Therapeutics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Asthma Therapeutics Market, By Drug Class

8.1. Asthma Therapeutics Market, by Drug Class, 2024-2033

8.1.1 Anti- inflammatory

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Bronchodilators

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Combination Therapy

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Asthma Therapeutics Market, By Product

9.1. Asthma Therapeutics Market, by Product, 2024-2033

9.1.1. Inhalers

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Dry Powder

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Metered Dose

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Soft Mist

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Nebulizers

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Asthma Therapeutics Market, By Route of Administration

10.1. Asthma Therapeutics Market, by Route of Administration, 2024-2033

10.1.1. Oral

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Inhaled

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Asthma Therapeutics Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Drug Class (2021-2033)

11.1.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Drug Class (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Drug Class (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Drug Class (2021-2033)

11.2.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Drug Class (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Drug Class (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Drug Class (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Drug Class (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Drug Class (2021-2033)

11.3.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Drug Class (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Drug Class (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Drug Class (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Drug Class (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Drug Class (2021-2033)

11.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Drug Class (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Drug Class (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Drug Class (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Drug Class (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Drug Class (2021-2033)

11.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Drug Class (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Drug Class (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

Chapter 12. Company Profiles

12.1. Teva Pharmaceutical Industries Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. GSK plc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Merck & Co., Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. F. Hoffmann-La Roche Ltd.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. AstraZeneca.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Boehringer Ingelheim International GmbH

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Sanofi.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Koninklijke Philips N.V.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. BD.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Covis Pharma

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others