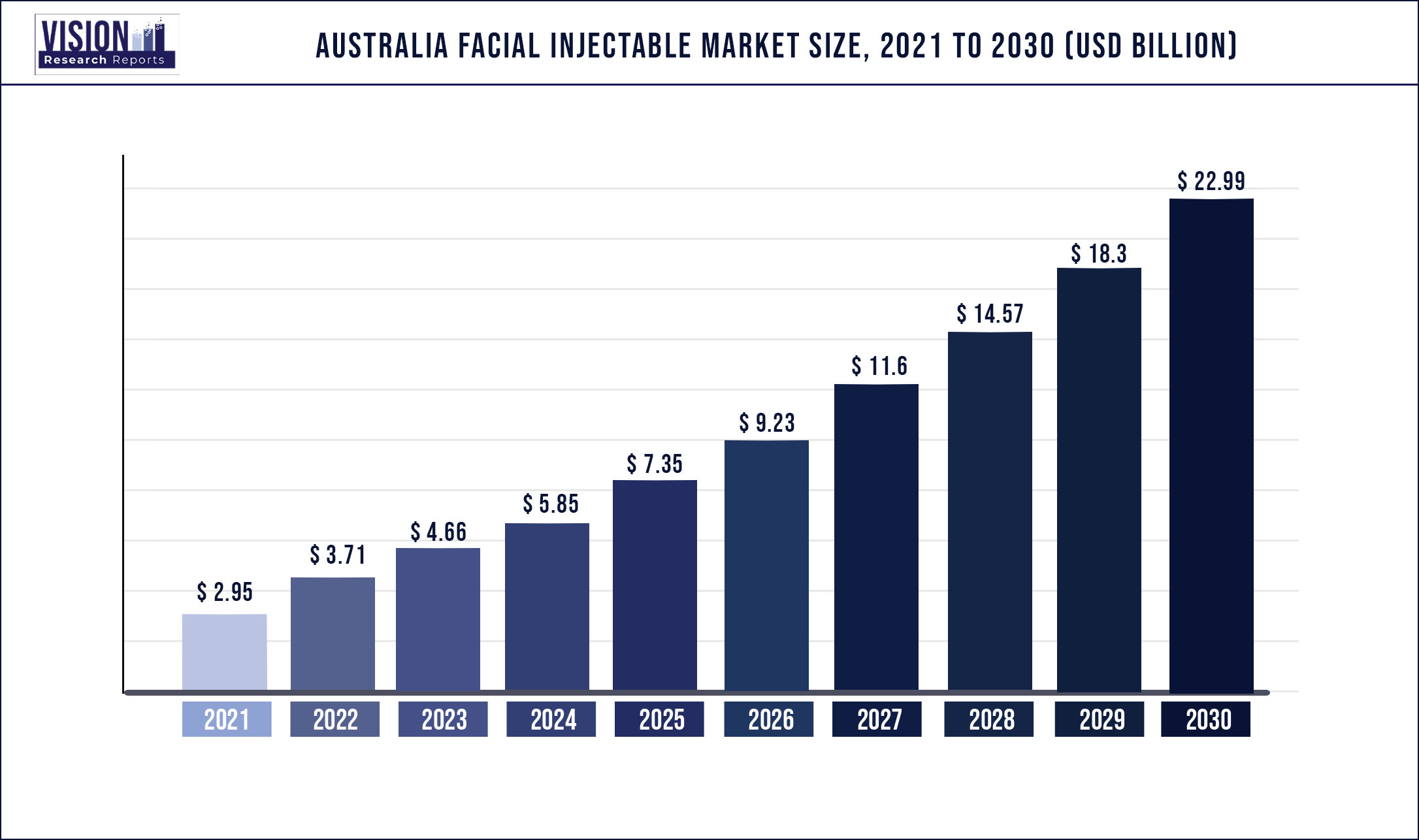

The Australia facial injectable market was valued at USD 2.95 billion in 2021 and it is predicted to surpass around USD 22.99 billion by 2030 with a CAGR of 25.63% from 2022 to 2030.

Facial Injectable is used to reduce wrinkles and fine lines, create volume and shaping, as well as build facial framework and structure. The rising awareness regarding cosmetic procedures and a rise in the elderly population are two key reasons predicted to propel the industry growth. In addition, developments in facial rejuvenation and the trend shift from invasive to minimally invasive procedures are other drivers anticipated to promote market growth over the projection period.

Dermatologists and other professionals can treat various facial areas, personalize treatments for each patient, and utilize a combination of products to get better results. These factors are anticipated to support the expansion of the market in Australia during the forecast period. Peer recommendations have a significant impact on millennials’ purchasing decisions, which are greatly influenced by social media. According to the Yellow Social Media Report 2020, 63% of Australians claimed that endorsements from celebrities or social media influencers make them less likely to make a purchase, while 15% of them said the opposite. In addition, according to the Mission Australia Youth Survey Report 2018, roughly 30.4% of participants expressed concern about their body image.

This, in turn, will increase the demand for cosmetic treatments, leading to market growth. The COVID-19 outbreak led to an increase in internet consultations. Australia undertook a widespread temporary closure of beauty and cosmetic services as a preventative action against COVID-19. The Centre for Mental Health at Swinburne University has been conducting research on how the closure of the beauty business has affected Australians’ mental health. According to the study, compared to before COVID-19, the general population reported having less interest in having cosmetic surgery or treatment after the end of the first lockdown in May, this, in turn, impacted the demand for facial injectables.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 2.95 billion |

| Revenue Forecast by 2030 | USD 22.99 billion |

| Growth rate from 2022 to 2030 | CAGR of 25.63% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, application |

| Companies Covered | Silk Laser Clinics; Advanced Clinics Australia; Results Laser Clinic; Australian Skin Clinics; Laser Clinics Australia |

Product Insights

On the basis of products, the industry has been further categorized into Hyaluronic Acid (HA), botulinum toxin type A, Calcium Hydroxylapatite (CaHA), and polymer fillers. The botulinum toxin type A product segment dominated the industry in 2021 and accounted for the maximum share of more than 54.82% of the overall revenue. On account of its potent water retention capabilities and thorough penetration of the epidermis, the demand for dermal filler is increasing. The botulinum toxin type A segment is anticipated to expand further at a significant growth rate during the forecast period.

This growth can be attributed to the increasing usage of BoNTA in cosmetics (aesthetics), for enhancing the facial look and minimizing the indications of aging. Cosmetic-grade HA’s low molecular weight makes it easier for the substance to penetrate deeply into the epidermis, aiding in the retention of water in the cells and the release of antioxidants that slow down the aging process. Hyaluronic acid works as a moisturizer and supports in the healing of burns, skin ulcers, and wounds. In plastic surgery, it is also applied as a lip filler. The segment is anticipated to grow at the fastest CAGR during the forecast period as a result of an increase in the usage of HA as a dermal filler or in cosmetic injectables.

Application Insights

On the basis of applications, the industry has been further categorized into aesthetics and therapeutics. On account of the rising spending on aesthetic procedures and the growing consumer awareness regarding these procedures, the aesthetics application segment dominated the overall industry in 2021. The segment accounted for the maximum share of more than 70.92% of the overall revenue in the same year. As a result of the increasing awareness about aesthetic operations and rising consumer disposable income levels, the aesthetics segment is anticipated to expand further at the fastest growth rate during the forecast period.

Market expansion is augmented by a rise in the usage of cosmetic injectables for facial wrinkles, parentheses lines, lip lines, lip augmentation, lip border repair, and crow’s feet lines. The therapeutic segment is also anticipated to register a significant growth rate during the forecast period. The increasing usage of facial injectables in the treatment of strabismus or crossed eyes, blepharospasm, Meige’s syndrome, hemifacial Spasms (HFS), Oromandibular Dystonia (OMD), and focal hyperhidrosis is increasing the demand for therapeutics, thereby supporting the segment growth.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Australia Facial Injectable Market

5.1. COVID-19 Landscape: Australia Facial Injectable Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Australia Facial Injectable Market, By Product

8.1. Australia Facial Injectable Market, by Product, 2022-2030

8.1.1. Collagen

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Hyaluronic Acid (HA)

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Botulinum Toxin Type A

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Calcium Hydroxylapatite (CaHA)

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Polymer Fillers

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Australia Facial Injectable Market, By Application

9.1. Australia Facial Injectable Market, by Application, 2022-2030

9.1.1. Aesthetics

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Therapeutics

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Australia Facial Injectable Market, Regional Estimates and Trend Forecast

10.1. Australia

10.1.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.2. Market Revenue and Forecast, by Application (2017-2030)

Chapter 11. Company Profiles

11.1. SILK Laser Clinics

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Advanced Clinics Australia

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Results Laser Clinic

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Australian Skin Clinics

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Laser Clinics Australia

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others