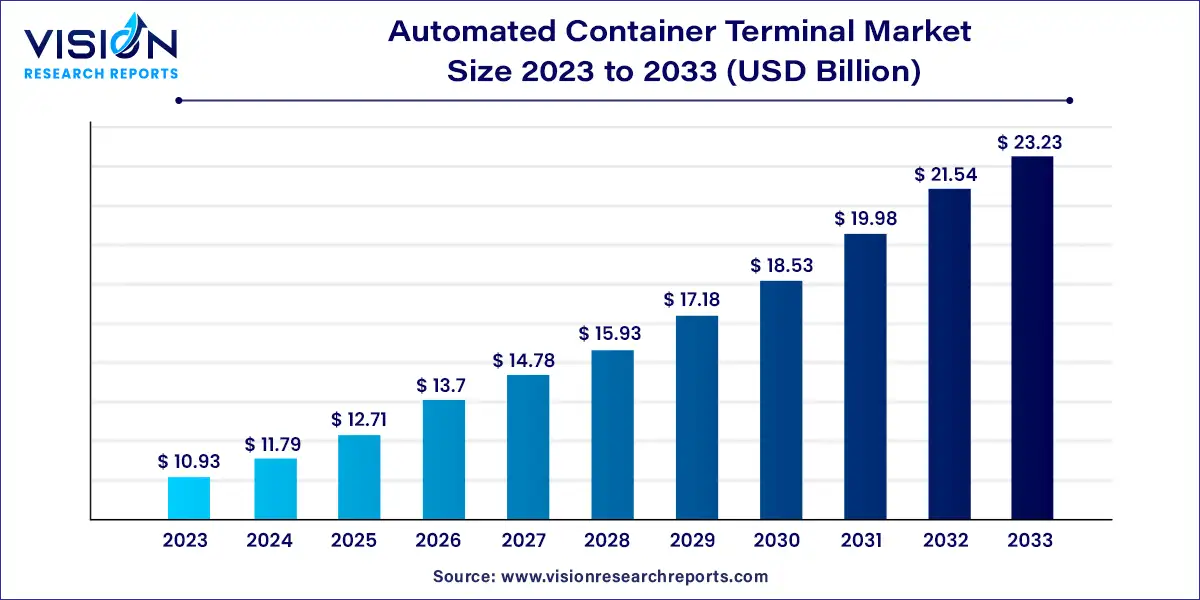

The global automated container terminal market size was estimated at around USD 10.93 billion in 2023 and it is projected to hit around USD 23.23 billion by 2033, growing at a CAGR of 7.83% from 2024 to 2033. The global automated container terminal market is experiencing significant growth due to the rising demand for efficient and reliable port operations. Automation in container terminals enhances productivity, reduces operational costs, and minimizes human errors, making it an attractive solution for modern ports.

The growth of the automated container terminal market is propelled by the surge in global trade volumes necessitates more efficient and reliable container handling solutions, driving ports to adopt automation technologies. Secondly, the labor shortage in the maritime industry is compelling ports to reduce their dependence on manual labor, thereby turning to automated systems to maintain operational continuity. Thirdly, the need for cost-efficient operations is a significant driver, as automation helps lower labor costs, minimize human errors, and optimize resource utilization. Lastly, the push towards sustainability and reduced emissions is encouraging ports to implement automated systems that enhance energy efficiency and environmental performance.

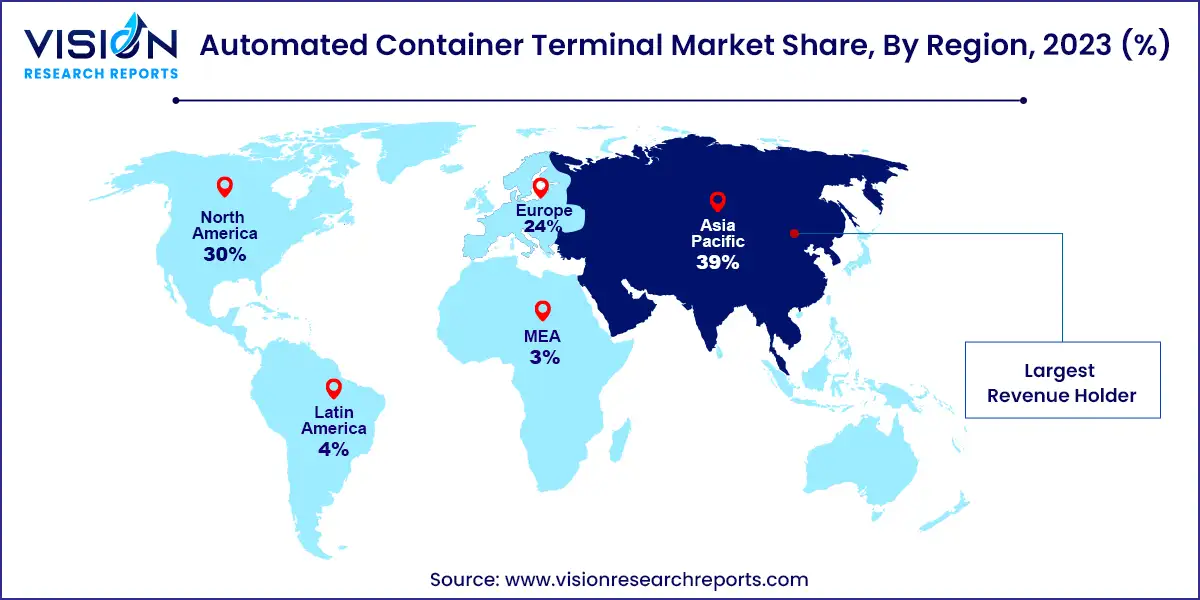

The Asia Pacific automated container terminal market asserted its dominance in 2023, capturing the largest revenue share at 39%. The region is home to some of the busiest ports in the world, particularly in countries like China, Singapore, and South Korea, which have heavily invested in advanced automation technologies to handle large volumes of container traffic efficiently. Rapid industrialization and urbanization in the Asia Pacific have driven significant growth in maritime trade, necessitating the adoption of automated solutions to enhance port capacities and operational efficiencies. Supportive government policies and investments in infrastructure development have encouraged the deployment of automation technologies across ports in the region.

| Attribute | Asia Pacific |

| Market Value | USD 4.26 Billion |

| Growth Rate | 7.82% CAGR |

| Projected Value | USD 9.05 Billion |

The North American automated container terminal market held a notable 16.53% revenue share in 2023 due to its extensive network of major ports along the East and West coasts, including key hubs like Los Angeles, New York/New Jersey, and Savannah. These ports handle substantial volumes of container traffic from Asia and Europe, driving the demand for advanced automation solutions to improve efficiency and throughput. Additionally, North America's robust infrastructure, technological innovation, and favorable regulatory environment support the adoption of automated container handling technologies, further solidifying its position in the global market.

The automated container terminal market in Europe held the second largest revenue share, primarily due to its well-established ports and logistics infrastructure across major countries such as Germany, the Netherlands, and Belgium. These nations have been early adopters of automation technologies in ports, driven by stringent efficiency and environmental regulations. Furthermore, Europe's strategic position as a gateway between North America and Asia contributes to its significant role in global trade, further supporting the adoption of advanced container handling technologies.

The full automation segment held the largest revenue share of 47% in 2023 and registered the fastest CAGR of 8.23% from 2024 to 2033. This growth is due to its ability to significantly enhance operational efficiency and reduce labor costs by minimizing human intervention. Full automation ensures consistent and high-speed container handling, leading to increased throughput and reduced vessel turnaround times. Additionally, the integration of advanced technologies such as automated guided vehicles (AGVs) and robotic cranes allows for precise and reliable operations, further boosting productivity. The demand for full automation is also driven by the need to improve safety and reduce the risk of human errors in port operations.

The semi-automation segment registered a significant compound annual growth rate of 7.32% over the forecast period primarily because it offers a balance between operational efficiency and cost-effectiveness. Semi-automated terminals utilize technologies such as automated stacking cranes (ASCs) and remote-controlled equipment, which streamline container handling processes while still requiring some level of human supervision and intervention. This approach appeals to ports seeking to upgrade their operations gradually without fully committing to the expense and complexity of full automation.

The equipment segment held the largest market share of 50% in 2023 due to substantial investments made by port operators in upgrading their infrastructure with advanced automation technologies. This segment includes various types of equipment, such as automated stacking cranes (ASCs), automated guided vehicles (AGVs), and robotic arms, which are essential for automating container handling operations. These technologies enable ports to achieve higher efficiency, faster turnaround times, and increased throughput, all of which are critical in meeting the growing demands of global trade and container traffic. Moreover, equipment upgrades are often seen as foundational investments that pave the way for subsequent improvements in software and services to optimize overall terminal performance.

The services segment registered the fastest compound annual growth rate (CAGR) of 8.33% over the forecast period because it encompasses essential offerings such as maintenance, support, and consulting services that complement the adoption of automation technologies. As ports increasingly invest in automation equipment and software, the demand for specialized services to integrate, operate, and maintain these systems has surged. Service providers offer tailored solutions to optimize terminal operations, improve efficiency, and ensure the seamless functioning of automated equipment. Moreover, as automation evolves, there is a growing need for consultancy services to guide ports through the complexities of adopting new technologies and optimizing their operations for maximum efficiency and profitability.

The brownfield projects segment held the largest market share of 69% in 2023 because it involves the upgrading and retrofitting of existing terminals with automation technologies, which is often a more practical and cost-effective approach for many established ports. Brownfield projects leverage existing infrastructure, allowing ports to modernize operations while minimizing disruptions to ongoing activities. These projects enable ports to adopt automation solutions incrementally, starting with key areas such as container handling and logistics, thereby optimizing efficiency and throughput over time.

The greenfield projects segment registered the fastest compound annual growth rate (CAGR) of 9.63% over the forecast period due to the increasing preference for developing new, purpose-built terminals with integrated automation technologies from the ground up. Greenfield projects allow for the implementation of state-of-the-art automation solutions without the constraints of existing infrastructure, facilitating more efficient and optimized terminal operations. These projects often attract significant investments from stakeholders looking to capitalize on the advantages of modern technology and streamline port operations right from inception.

By Type of Automation

By Offering

By Project

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type of Automation Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automated Container Terminal Market

5.1. COVID-19 Landscape: Automated Container Terminal Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automated Container Terminal Market, By Type of Automation

8.1. Automated Container Terminal Market, by Type of Automation, 2024-2033

8.1.1 Full Automation

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Semi-Automation

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Automated Container Terminal Market, By Offering

9.1. Automated Container Terminal Market, by Offering, 2024-2033

9.1.1. Equipment

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Software

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Services

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Automated Container Terminal Market, By Project

10.1. Automated Container Terminal Market, by Project, 2024-2033

10.1.1. Greenfield Projects

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Brownfield Projects

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Automated Container Terminal Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type of Automation (2021-2033)

11.1.2. Market Revenue and Forecast, by Offering (2021-2033)

11.1.3. Market Revenue and Forecast, by Project (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type of Automation (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Offering (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Project (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type of Automation (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Offering (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Project (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type of Automation (2021-2033)

11.2.2. Market Revenue and Forecast, by Offering (2021-2033)

11.2.3. Market Revenue and Forecast, by Project (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type of Automation (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Offering (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Project (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type of Automation (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Offering (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Project (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type of Automation (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Offering (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Project (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type of Automation (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Offering (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Project (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type of Automation (2021-2033)

11.3.2. Market Revenue and Forecast, by Offering (2021-2033)

11.3.3. Market Revenue and Forecast, by Project (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type of Automation (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Offering (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Project (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type of Automation (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Offering (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Project (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type of Automation (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Offering (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Project (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type of Automation (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Offering (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Project (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type of Automation (2021-2033)

11.4.2. Market Revenue and Forecast, by Offering (2021-2033)

11.4.3. Market Revenue and Forecast, by Project (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type of Automation (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Offering (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Project (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type of Automation (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Offering (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Project (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type of Automation (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Offering (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Project (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type of Automation (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Offering (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Project (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type of Automation (2021-2033)

11.5.2. Market Revenue and Forecast, by Offering (2021-2033)

11.5.3. Market Revenue and Forecast, by Project (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type of Automation (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Offering (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Project (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type of Automation (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Offering (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Project (2021-2033)

Chapter 12. Company Profiles

12.1. ABB Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Cargotec Corporation.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Konecranes.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Liebherr Group.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Shanghai Zhenhua Heavy Industries Co., Ltd. (ZPMC).

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Künz GmbH

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. CLT.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. TMEIC (Toshiba Mitsubishi-Electric Industrial Systems Corporation)

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. LASE Industrielle Lasertechnik GmbH.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Siemens AG

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others