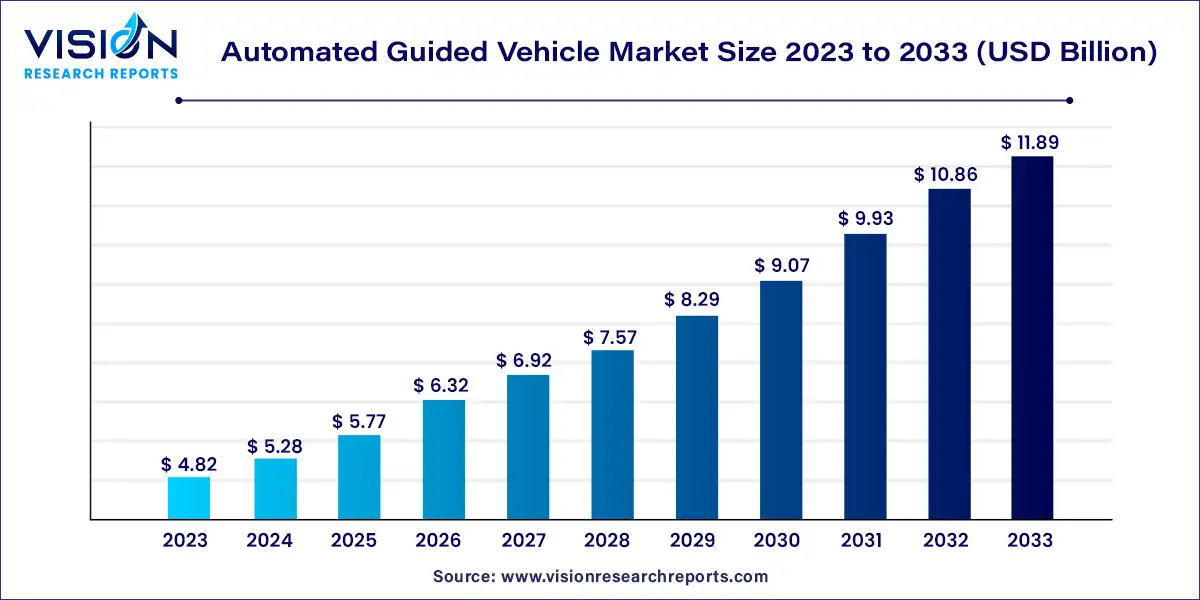

The global automated guided vehicle market size was estimated at USD 4.82 billion in 2023 and it is expected to surpass around USD 11.89 billion by 2033, poised to grow at a CAGR of 9.45% from 2024 to 2033.

The automated guided vehicle market has experienced significant growth, driven by the escalating demand for automation solutions in manufacturing, logistics, and warehousing sectors. With the relentless pursuit of operational excellence and cost optimization, businesses are increasingly adopting AGVs to streamline their internal logistics processes. The market is characterized by a diverse range of AGV types, including tow vehicles, unit load carriers, pallet trucks, and forklifts, catering to varying application requirements.

The growth of the automated guided vehicle (AGV) market is propelled by an increasing demand for operational efficiency and productivity gains across industries drives the adoption of AGVs. These autonomous vehicles streamline material handling processes, reducing manual labor and optimizing throughput. Secondly, the imperative to enhance workplace safety is a significant growth driver. AGVs operate autonomously, minimizing human intervention in hazardous environments, thereby mitigating the risk of accidents. Additionally, advancements in sensor technologies, artificial intelligence, and navigation algorithms have bolstered the capabilities of AGVs, enabling them to navigate complex environments with precision and adaptability. Moreover, the integration of AGVs into interconnected manufacturing ecosystems, facilitated by Industry 4.0 and the Internet of Things (IoT), further accelerates market growth.

The laser guidance segment dominated the market in 2023 and accounted for a revenue share of over 37% owing to the adoption of technological advancements in the automotive sector. For instance, two vehicles use laser guidance technology to navigate. Further, laser targets are positioned all over the warehouse to identify the precise location of each vehicle. These vehicles' software effectively coordinates the movements based on incoming instructions and vehicle traffic. The AGV system has been connected with the existing management systems for warehousing center operations to offer two-way communication of product movement.

The natural navigation segment is expected to register the fastest CAGR over the forecast period. The vision guidance segment is expected to witness healthy growth during the study period. The need for intelligent and efficient routing contributes to the increasing adoption of automated vehicles. Computer vision and related software solutions allow AGVs to analyze the environment in real-time better, thereby boosting the demand for AGVs for operations in challenging environments, such as maneuvering significant components through narrow aisles

The tow vehicle segment dominated the market in 2023 and accounted for a revenue share of over 40%, owing to high requirements for bulk movement of products into and out of warehouse areas. AGV towing vehicles are used in various applications, including moving bulk products into and out of warehouse areas. Side path spurs are placed in shipping or receiving areas to facilitate loading or unloading goods from trains off the main line.

The unit load carrier segment is expected to grow at the fastest CAGR from 2024 to 2033. Unit load AGVs are used for delivering pallets, large containers, and roll handling. Also, it allows scheduling tasks efficiently by reducing aisle traffic and product damage. For instance, in September 2021, Addverb Technologies Private Limited, a robotics and automation firm, announced its business expansion across Australia, Europe, and Singapore markets. This initiative was initiated in response to the growing need for unit load AGVs, robotics, and automation solutions in the global market.

The logistics and warehousing segment dominated the market in 2023 and accounted for a revenue share of over 41%. The logistics & warehousing segment has been further divided into transportation, cold storage, wholesale & distribution, and cross-docking. Enterprises upgrading their existing facilities and building new facilities are aggressively adopting modern retrieval and automated storage systems and other material handling equipment to save on labor costs and boost efficiency and productivity.

The assembly segment is expected to grow at the fastest CAGR over the forecast period. Modern retrieval and automated storage systems, as well as other material handling equipment, are rapidly adopted by businesses renovating their current facilities and establishing new ones to reduce labor costs and increase productivity and efficiency. For instance, in February 2021, SAFELOG GmbH, an automated transportation company, launched warehouse robots, SafeLogAGV L1 lifts which load up to 15000kg.

The indoor segment dominated the market in 2023 and accounted for a revenue share of over 76%. The growth can be attributed to increased warehouse automation powered by AGVs. AGVs have seen heightened demand in warehouses and distribution centers, driven by the necessity for efficient material handling to meet the rising demands of e-commerce and inventory management. Enhanced safety features and operational efficiency offered by AGVs, facilitated by advancements in sensor technology and navigation systems, further maintain indoor environments.

The outdoor segment is poised for significant growth in the coming years. Advancements in technology, especially in navigation systems and durability, are expanding the applications of AGVs beyond traditional indoor settings to outdoor environments such as agriculture, construction, and logistics. The rising demand for autonomous solutions across industries, associated with infrastructure development efforts and the surge in e-commerce, further propels the adoption of outdoor AGVs.

The manufacturing segment dominated the market in 2023 and accounted for a revenue share of over 77%. The manufacturing industry is further sub-segmented into aerospace & defense, automotive, electronics, pharmaceuticals, chemicals, plastics, FMCG, and tissue. The wholesale and distribution sector segment is expected to expand at the fastest CAGR over the forecast period. Also, the wholesale & distribution sector is further sub-segmented into e-commerce, grocery stores, retail chains/conveyance stores, and hotels & restaurants.

Automated guided vehicles are equipped with cameras, laser heads, and other sensors, which help them operate safely around machinery, structures, and employees. While operators can make errors that can lead to accidents and mishaps in a manufacturing or distribution facility, AGVs can help improve the accuracy of the workflows, thereby reducing waste and augmenting productivity.

The lead battery segment dominated the market in 2023 and accounted for a revenue share of over 62%. These batteries have low-cost advantages over other battery types. Besides, it offers good reversibility, stable voltage, and long service life and is suitable for various applications. The lithium-ion battery segment is expected to grow at the fastest CAGR over the forecast period. The AGV market is witnessing a progressive switch from lead-acid to lithium-ion batteries.

Compared to lead-acid batteries, lithium-ion batteries have higher costs. Lithium-ion batteries support high-power charge and discharge. Also, it meets different industry conditions of user demand, including excellent temperature performance, high energy density, and a long life cycle. These advantages of lithium-ion batteries are anticipated to encourage AGV manufacturers to adopt lithium-ion among battery types.

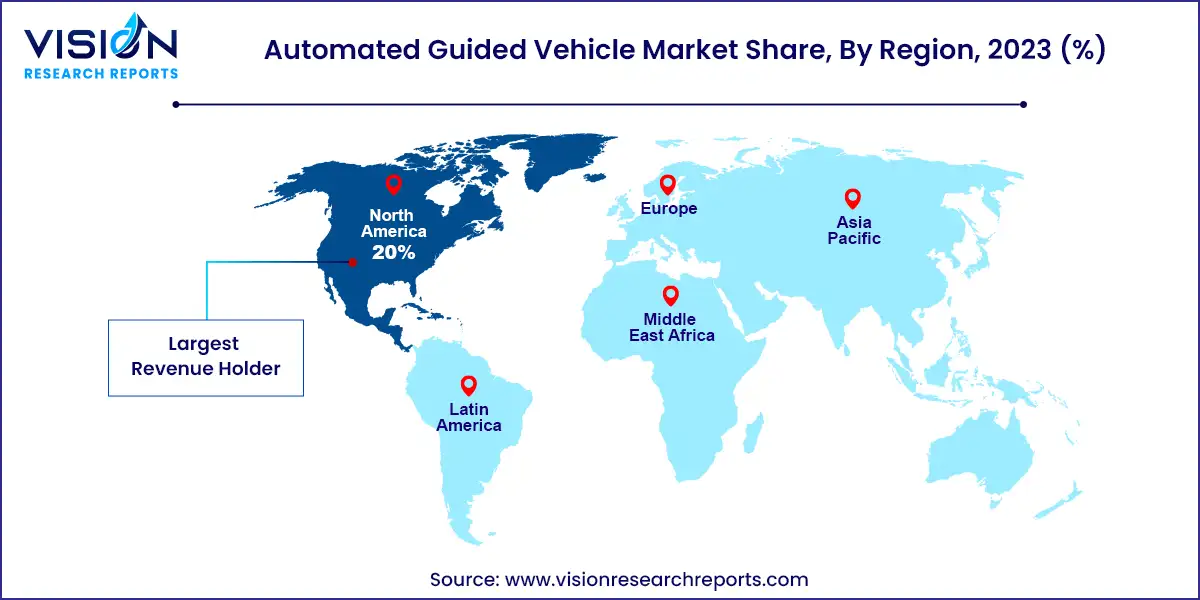

North America held a dominant revenue share of over 20% in 2023. The region's growing adoption of automated guided vehicles is propelled by its strong manufacturing and logistics sector, which is reliant on automation for efficient material handling. With the aging workforce and a shrinking labor pool, companies are turning to automation to increase efficiency and productivity. Additionally, e-commerce has led to a significant increase in the demand for automated guided vehicles. These systems can handle large volumes of orders efficiently, reducing the need for manual labor.

The AGV market in Asia Pacific is anticipated to register the highest CAGR over the forecast period. The e-commerce industry has been growing considerably in emerging economies of Asia Pacific, such as China and India. For instance, in February 2023, Mitsubishi Electric Asia, a subsidiary of Mitsubishi Electric Corporation, launched a new Integrated Solutions Centre. The new center showcases the company’s advanced and comprehensive digital technologies to facilitate co-creation with clients and create next-generation integrated solutions.

By Vehicle Type

By Navigation Technology

By Application

By End-use Industry

By Component

By Battery Type

By Mode of Operation

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others