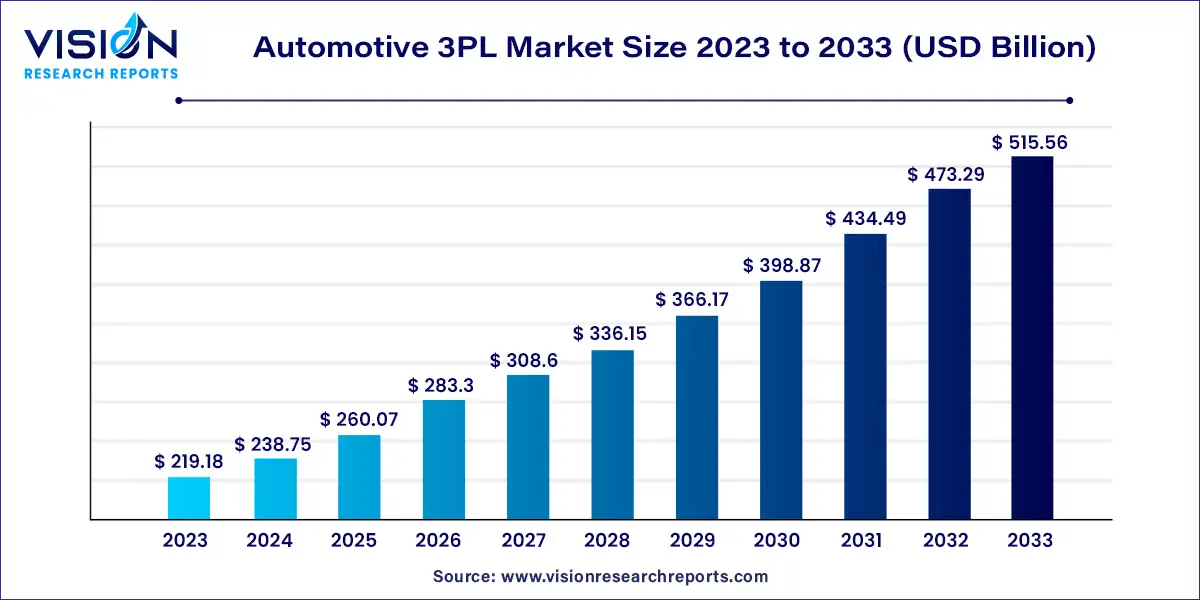

The global automotive 3PL market size was valued at USD 219.18 billion in 2023 and it is predicted to surpass around USD 515.56 billion by 2033 with a CAGR of 8.93% from 2024 to 2033. The automotive third-party logistics (3PL) market plays a crucial role in the global automotive industry, providing specialized logistics services that support the efficient movement of automotive parts and finished vehicles. This market has experienced significant growth due to increasing globalization, technological advancements, and the rising complexity of automotive supply chains.

The automotive 3PL market is experiencing robust growth due to the demand for outsourced logistics services. Firstly, the globalization of automotive supply chains is a major growth driver. As automotive manufacturers expand their operations internationally, they increasingly rely on 3PL providers to manage complex logistics across borders. This expansion necessitates efficient and reliable logistics solutions to ensure timely delivery of parts and finished vehicles. Additionally, technological advancements are revolutionizing the logistics sector. The adoption of technologies such as the Internet of Things (IoT), artificial intelligence (AI), and big data analytics enhances the efficiency and visibility of supply chains, making 3PL services more attractive to automotive companies. Furthermore, the rising complexity of automotive parts, driven by advancements in vehicle technology and design, requires specialized logistics solutions capable of managing diverse and intricate components. This complexity boosts the demand for 3PL services that can handle intricate logistics needs effectively.

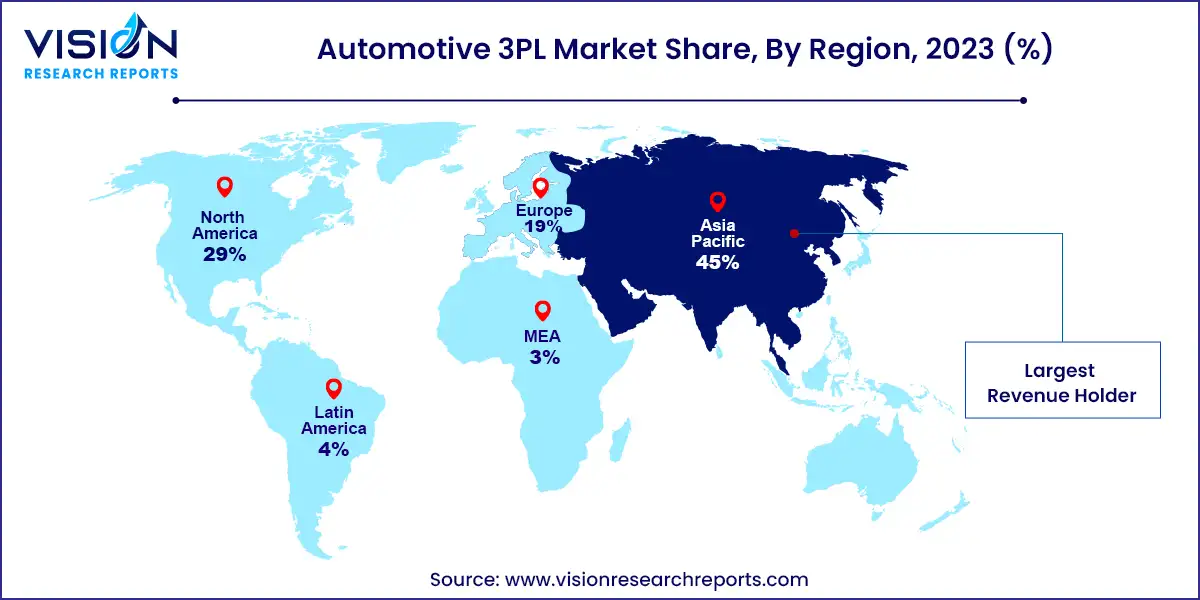

Asia Pacific led the global automotive 3PL market in 2023, holding over 45% of global revenue. The rapid growth of the automotive industry in emerging economies like China and India is fueling demand for 3PL services to manage expanding supply chains.

| Attribute | Asia Pacific |

| Market Value | USD 98.31 Billion |

| Growth Rate | 8.93% CAGR |

| Projected Value | USD 232.02 Billion |

Europe is anticipated to see significant growth in the automotive 3PL market from 2024 to 2033. This growth is driven by the push towards sustainability, spurred by the European Green Deal, which aims to achieve climate neutrality by 2050. Automakers and 3PL providers in Europe are increasingly adopting green logistics practices, including the use of electric trucks, alternative fuels, and carbon offset programs.

North America is projected to grow at a notable CAGR of 7.83% from 2024 to 2033. This growth is attributed to the increasing complexity of automotive supply chains and the rising demand for electric vehicles. The need for faster delivery times is prompting automakers and suppliers to rely on 3PL providers to streamline inventory management and distribution processes.

The automotive 3PL market is divided into two main segments: finished vehicles and components. In 2023, the finished vehicles segment led the market, capturing over 63% of global revenue. The surge in electric vehicle (EV) adoption has significantly influenced the logistics of finished vehicles. EVs, requiring specialized handling due to their unique battery systems, have increased the demand for 3PL providers with the expertise and equipment for safe transportation. Additionally, the rise in direct-to-consumer (D2C) sales models, where vehicles are delivered directly to customers, is further driving the need for specialized logistics solutions.

Conversely, the component segment is anticipated to experience the highest growth rate of 9.83% CAGR from 2024 to 2033. The complexity of managing automotive component supply chains necessitates advanced logistics solutions to ensure efficient component flow. The emergence of new automotive manufacturing hubs in developing markets adds to this complexity, positioning 3PL providers as crucial players in facilitating the cross-border movement of components.

In terms of service types, the market is categorized into Dedicated Contract Carriage (DCC)/Freight Forwarding, Domestic Transportation Management (DTM), International Transportation Management (ITM), Warehousing & Distribution (W&D), and Value Added Logistics Services (VALs). In 2023, the International Transportation Management (ITM) segment dominated, holding over 32% of global revenue. This dominance reflects the automotive industry's increasing globalization, which drives demand for ITM services to manage parts sourcing and global vehicle distribution. The integration of advanced technologies like IoT, blockchain, and AI into logistics is further enhancing the visibility and security of international shipments.

The Value Added Logistics Services (VALs) segment is expected to see substantial growth from 2024 to 2033. This growth is driven by the need for customized and flexible logistics solutions and efforts to improve operational efficiency. Automotive companies are increasingly relying on 3PL providers to handle complex logistics tasks, including those related to the growing demand for EVs and sustainable automotive practices. Specialized VALs, such as battery handling and reverse logistics for recycling, are becoming more prevalent.

The market's transport segment includes roadways, railways, waterways, and airways. In 2023, roadways held the largest share, accounting for over 57% of global revenue. The need for just-in-time (JIT) delivery in the automotive sector emphasizes the importance of efficient and flexible road transport solutions. The expansion of e-commerce, especially in the automotive aftermarket, has increased the demand for robust road logistics networks to ensure timely product delivery. Additionally, advancements in autonomous trucking, aimed at reducing delivery times and addressing truck driver shortages, are expected to further boost the roadways segment.

The airways segment is projected to experience the highest growth rate from 2024 to 2033. Air transport's ability to facilitate fast and reliable movement of goods across continents helps maintain agile and responsive supply chains. The integration of digital technologies in air freight, such as advanced tracking systems and automated customs processes, is enhancing efficiency. The growth of e-commerce has also heightened the demand for air freight services, driven by consumers' expectations for quicker delivery times.

By Type

By Service

By Transport

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive 3PL Market

5.1. COVID-19 Landscape: Automotive 3PL Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive 3PL Market, By Type

8.1. Automotive 3PL Market, by Type, 2024-2033

8.1.1 Finished Vehicles

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Components

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Automotive 3PL Market, By Service

9.1. Automotive 3PL Market, by Service, 2024-2033

9.1.1. Dedicated Contract Carriage (DCC)

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Domestic Transportation Management (DTM)

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. International Transportation Management (ITM)

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Warehousing & Distribution (W&D)

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Value Added Logistics Services (VALs)

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Automotive 3PL Market, By Transport

10.1. Automotive 3PL Market, by Transport, 2024-2033

10.1.1. Roadways

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Railways

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Waterways

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Airways

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Automotive 3PL Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Service (2021-2033)

11.1.3. Market Revenue and Forecast, by Transport (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Transport (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Transport (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Service (2021-2033)

11.2.3. Market Revenue and Forecast, by Transport (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Transport (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Transport (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Service (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Transport (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Service (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Transport (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Service (2021-2033)

11.3.3. Market Revenue and Forecast, by Transport (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Transport (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Transport (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Service (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Transport (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Service (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Transport (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.4.3. Market Revenue and Forecast, by Transport (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Transport (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Transport (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Service (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Transport (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Service (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Transport (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.5.3. Market Revenue and Forecast, by Transport (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Transport (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Transport (2021-2033)

Chapter 12. Company Profiles

12.1. CEVA Logistics.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. DB Schenker.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. DHL Group.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. DSV A/S.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Coyote Logistics.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Hub Group

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Kerry Logistics Network Limited.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Nippon Express Holdings

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. XPO Logistics.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others