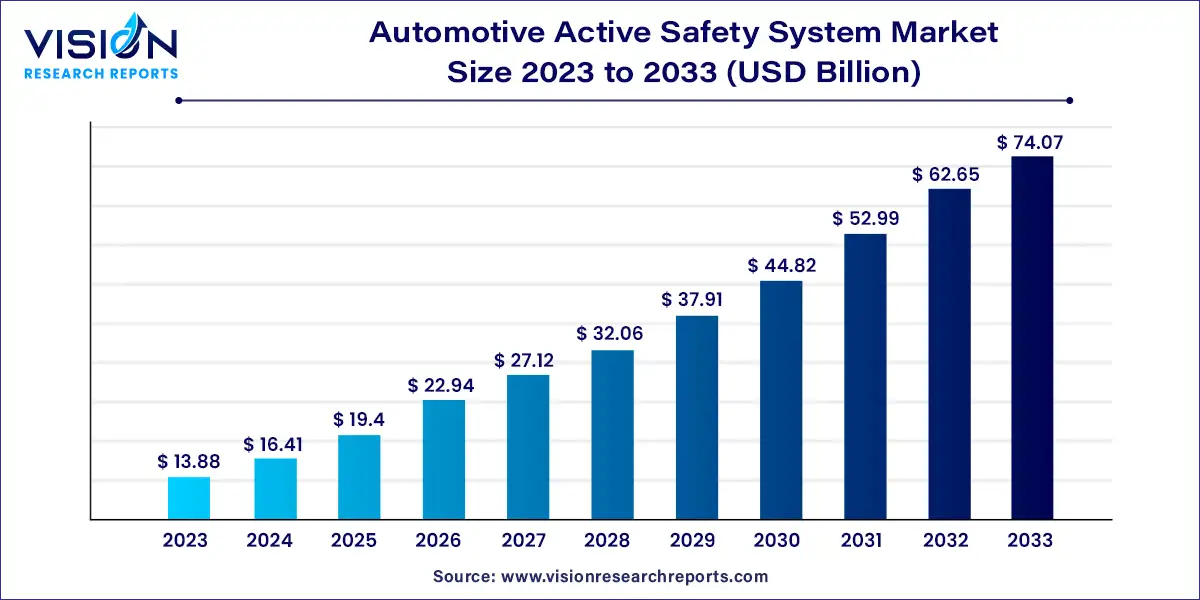

The global automotive active safety system market size was estimated at USD 13.88 billion in 2023 and it is expected to surpass around USD 74.07 billion by 2033, poised to grow at a CAGR of 18.23% from 2024 to 2033.

The automotive active safety system market is experiencing rapid growth due to increasing consumer awareness of vehicle safety and stringent government regulations aimed at reducing road accidents. These systems, designed to prevent accidents or reduce their severity, are becoming a standard feature in modern vehicles, driven by advancements in technology and growing demand for enhanced driving experiences.

The growth of the automotive active safety system market is primarily driven by the increasing emphasis on vehicle safety and the rising number of road accidents worldwide. Governments are implementing stricter safety regulations, mandating the integration of advanced safety technologies in vehicles, which has significantly boosted market demand. Additionally, the growing consumer awareness of the benefits of active safety systems, coupled with advancements in sensor technology and artificial intelligence, is fueling the adoption of these systems. The expansion of the automotive industry, particularly in emerging markets, and the rising demand for luxury vehicles equipped with state-of-the-art safety features further contribute to the market's robust growth trajectory.

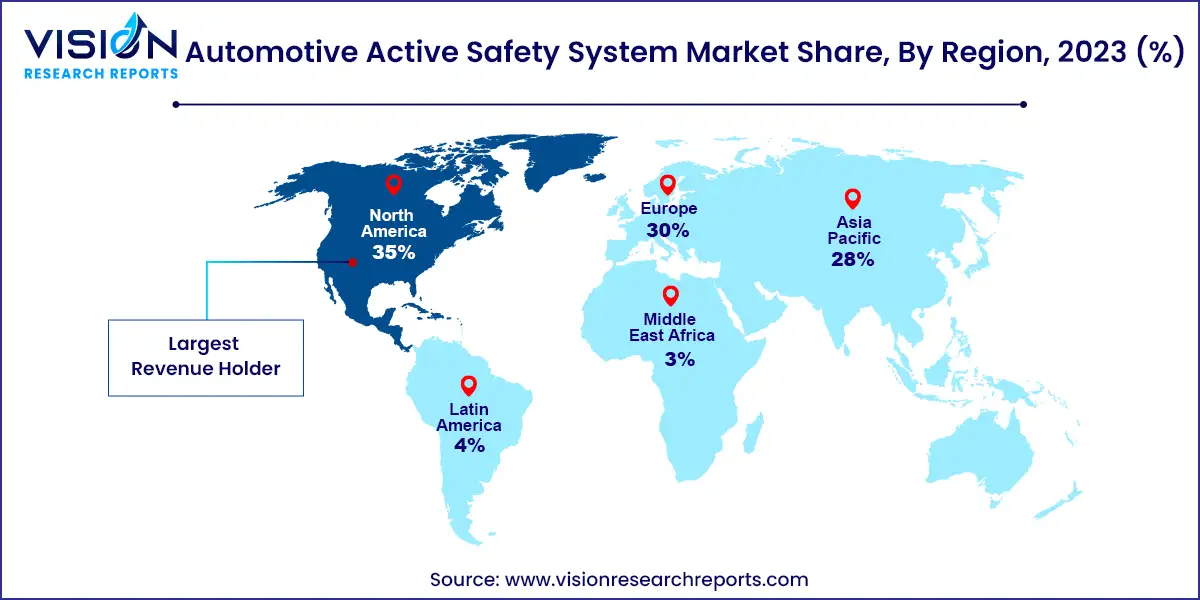

North America held the largest share of the automotive active safety system market in 2023, accounting for 35% of global revenue. The region’s strong automotive manufacturing sector and substantial investments in autonomous driving technologies support the continuous development and integration of active safety systems, driving market growth.

| Attribute | North America |

| Market Value | USD 4.85 Billion |

| Growth Rate | 18.25% CAGR |

| Projected Value | USD 25.92 Billion |

The U.S. automotive active safety system market size was estimated at around USD 3.40 billion in 2023 and it is projected to hit around USD 18.14 billion by 2033, growing at a CAGR of 18.25% from 2024 to 2033.

In the U.S., the automotive active safety system market is expected to grow significantly from 2024 to 2033. Stringent federal safety regulations and high consumer demand for advanced safety features are major growth drivers. Regulatory bodies like the National Highway Traffic Safety Administration (NHTSA) are promoting the adoption of sophisticated safety systems, including AEB, lane-keeping assist, and adaptive cruise control.

Europe is projected to grow at a notable rate from 2024 to 2033. The market’s growth is driven by strong regulatory frameworks and a high emphasis on safety standards. Europe enforces stringent safety regulations, such as the new Vehicle General Safety Regulation (GSR2), which mandates the inclusion of advanced driver assistance systems in vehicles.

The Asia Pacific region is expected to grow at the highest rate from 2024 to 2033. Factors such as increasing vehicle production, rising disposable incomes, and growing road safety awareness contribute to this growth. Major contributors include China, Japan, India, and South Korea. The region’s increasing popularity of electric and autonomous vehicles is also boosting the demand for advanced active safety systems.

In 2023, the adaptive cruise control segment led the market, capturing a 25% share of global revenue. The rise of ACC, a sophisticated system that automatically adjusts a vehicle's speed to maintain a safe distance from the vehicle ahead, is fueled by technological advancements, safety concerns, and consumer demand. ACC enhances convenience and safety by optimizing speed and minimizing unnecessary acceleration and braking, which improves fuel efficiency and reduces emissions. This aligns with the growing emphasis on environmental sustainability in the automotive sector, further driving ACC's adoption.

The antilock braking system segment is anticipated to experience substantial growth from 2024 to 2033. Innovations in ABS technology have improved vehicle stability and control during hard braking or on slippery surfaces by preventing wheel lockup. Increased awareness of road safety and the need to lower accident rates are fueling demand for these systems, as they are crucial for preventing skidding and maintaining steering control. The rising need for advanced safety features and stringent global safety standards are also driving the growth of ABS.

In 2023, radar sensors dominated the market. These sensors deliver precise, real-time data on the distance, speed, and movement of objects around a vehicle, which is essential for systems like adaptive cruise control and collision avoidance. Radar's ability to function effectively in various weather conditions, such as rain and fog, enhances its demand, as it improves overall driver and passenger safety.

The camera sensor segment is projected to grow significantly from 2024 to 2033. Camera sensors provide critical visual data that enhances the accuracy and functionality of safety features by detecting lane markings, road signs, pedestrians, and other vehicles. Advancements in camera technology, including improvements in image processing and low-light performance, are expected to drive the demand for camera sensors during this period.

The passenger car segment led the market in 2023, driven by the increasing production and sales of various types of passenger vehicles such as SUVs, sedans, and luxury cars, all equipped with advanced safety features. Active safety systems in passenger cars enhance accident prevention, vehicle control, driver awareness, and compliance with safety regulations, making them essential for modern vehicle safety and driver assistance.

The light commercial vehicle segment is expected to see significant growth from 2024 to 2033. Businesses and logistics companies are increasingly prioritizing safety and efficiency, which is driving demand for advanced active safety systems in LCVs. Global enforcement of stricter safety regulations is also pushing for the integration of advanced safety features in these vehicles, contributing to the segment’s growth.

2023, the ICE segment dominated the market. Active safety systems in ICE vehicles are designed to enhance driver control and prevent accidents, particularly during emergency situations requiring rapid braking or acceleration. The increasing integration of systems like adaptive cruise control and lane departure warning in ICE vehicles highlights their benefits and supports segment growth.

The electric vehicle segment is projected to experience significant growth from 2024 to 2033. The global rise in EV adoption is driving this growth, supported by advancements in sensor technologies such as lidar, radar, and cameras. The integration of AI and machine learning in EVs enhances real-time data processing and decision-making, which improves driving safety and contributes to the segment's expansion.

By Type

By Sensor Type

By Vehicle Type

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others