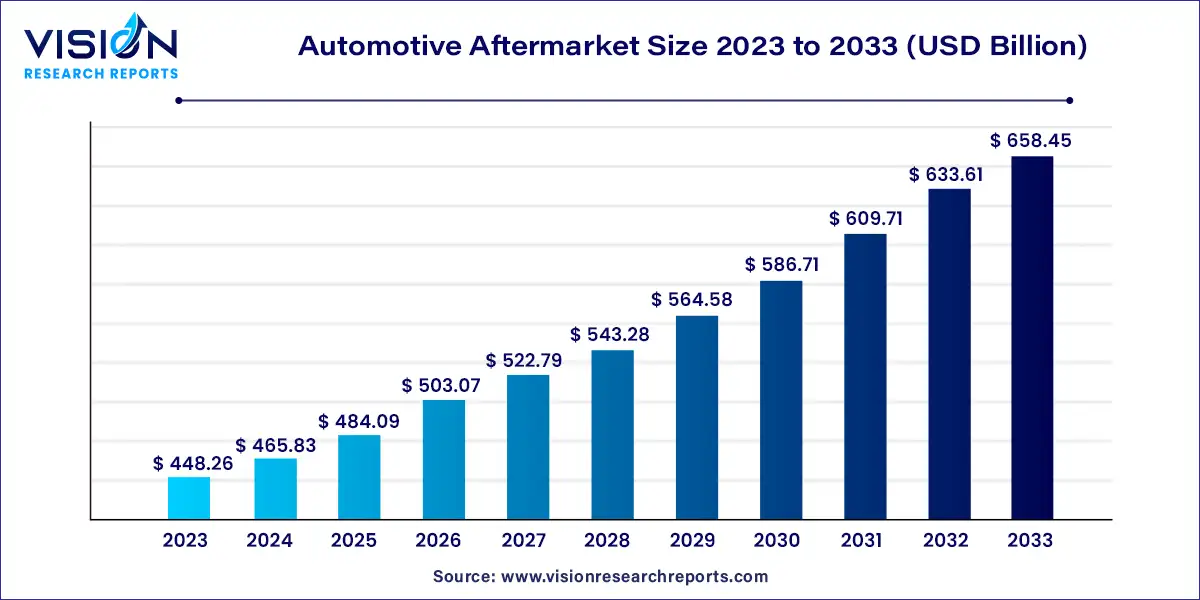

The global automotive aftermarket industry size was estimated at around USD 448.26 billion in 2023 and it is projected to hit around USD 658.45 billion by 2033, growing at a CAGR of 3.92% from 2024 to 2033.

The automotive aftermarket market is a dynamic sector that plays a crucial role in the automotive industry ecosystem. As vehicles continue to evolve with advancements in technology and design, the aftermarket industry adapts to meet the changing needs of vehicle owners.

The growth of the automotive aftermarket market is propelled by various factors contributing to its expansion. One significant driver is the increasing age of vehicles in operation, which leads to a higher demand for replacement parts and maintenance services. Additionally, rapid technological advancements within the automotive industry stimulate innovation in aftermarket products, including advanced accessories and performance upgrades, driving further growth. Moreover, evolving consumer preferences, such as a desire for customization options and value-added services, fuel the demand for aftermarket solutions. Furthermore, stringent regulatory standards concerning vehicle safety, emissions, and performance create opportunities for aftermarket products that help vehicle owners comply with these requirements. Overall, these growth factors collectively contribute to the continuous expansion and development of the automotive aftermarket market.

In terms of market size, the genuine parts segment held the majority share at 52% in 2023, indicating its dominance in the market. This segment is projected to maintain its lead in the aftermarket sector by 2033. Conversely, the uncertified parts segment is expected to experience notable revenue growth from 2024 to 2033. Counterfeit parts, being illegal and lacking testing or certification, come with no warranty. On the other hand, genuine parts, produced by car manufacturers or OEMs (Original Equipment Manufacturers), boast quality assurance, availability, and warranty coverage. However, they are often pricey and typically require purchase from dealerships.

Certified automotive parts undergo rigorous testing and inspection by accredited organizations. The Certified Automotive Parts Association (CAPA), established in 1987, stands as a non-profit entity offering programs to verify and assure the quality and compatibility of automotive replacement parts. Originally conceived by automotive insurance firms, CAPA was established to uphold the quality standards of replacement parts used by collision repair shops. Certified parts emerge as cost-effective alternatives to expensive genuine parts. Meanwhile, uncertified parts, though not endorsed by the vehicle manufacturer, present a lower-cost option, driving substantial growth potential within this segment.

In terms of market size, the tire segment is forecasted to hold the largest share at 23% in 2023. This dominance is expected to persist throughout the forecast period due to the relatively frequent replacement cycle of tires compared to other automotive components. The aftermarket replacement part suppliers encompass a variety of sectors, including accessories, lubricants, tires, and other component replacement providers. Additionally, the industry value chain includes service enablers such as repair service providers and entertainment service suppliers. The automotive industry is witnessing a surge in demand for hybrid electric vehicles, which is projected to drive the need for exhaust parts and specialized tools tailored for these vehicles.

This trend is partly driven by the escalating prices of gasoline and conventional petrol engine-based vehicles. Moreover, the rise in disposable incomes in emerging economies like China and Brazil is anticipated to positively influence industry growth. Furthermore, the increasing demand for vehicles, including locomotives, is expected to boost sales of automotive components. Stringent regulatory standards pertaining to car safety worldwide are likely to stimulate market dynamics. Major companies in the industry are increasingly adopting modern production technologies such as 3D printing for automotive parts to optimize production costs. 3D printing offers efficient fabrication capabilities and contributes to reducing emission toxicity.

In terms of market size, the retail segment asserted its dominance with a share of 56% in 2023 and is projected to maintain this leading position throughout the forecast period. Conversely, the wholesale & distribution segment is anticipated to experience notable revenue growth from 2024 to 2033. Automotive aftermarket economies play a vital role in the overall automotive manufacturing and maintenance landscape, ensuring timely replacement of automotive components to uphold vehicle performance.

The increasing influence of technological advancements is reshaping the market landscape towards digitization. The aftermarket is transitioning online, altering the traditional marketplace dynamics. Parts and services are now readily available for purchase online. Every stakeholder in the value chain, including Original Equipment Manufacturers (OEMs), Original Equipment Suppliers (OESs), wholesalers, insurers, and workshops, is adapting to this growing online aftermarket trend. Factors such as advanced technology utilization in auto parts fabrication, increased production of consumer and passenger automobiles, and the digitalization of automotive repair and maintenance services are expected to drive market growth.

In terms of market size, the original equipment (OE) segment held a commanding share of 71% in 2023, establishing its dominance. Projections indicate that the OE segment will continue to lead the aftermarket arena in terms of size by 2033. Meanwhile, the Do-It-Yourself (DIY) segment is expected to experience notable revenue growth from 2024 to 2033. DIY customers possess technical expertise and interest in independently maintaining, repairing, and upgrading their vehicles. Conversely, Do-It-For-Me (DIFM) customers purchase parts online but opt to have them installed by professional workshops.

The aftermarket service channel encompasses various entities, including raw material suppliers, tier 1 distributors, automobile exhaust hubs/manufacturing units, and aftermarket units comprising jobbers, culminating in repair shops. Repair centers serve as pivotal stakeholders within the service channel. The industry is witnessing a trend of strategic alliances and collaborations between collision repair centers and prominent auto insurance companies to gain a competitive advantage and secure a significant market share. Notable examples include partnerships between Utica Mutual Insurance Company, State Farm Mutual Automobile Insurance Company, and Progressive Casualty Insurance Company with certified automotive repair shops across all states in the U.S.

In 2023, the Asia Pacific automotive aftermarket claimed the largest market share at 29%. Expectations suggest significant growth for this regional market from 2024 to 2033. The digitalization of automotive component delivery services emerges as a driving force behind car sales in the region, alongside the adoption of advanced technologies in auto parts production. Furthermore, the increasing output and sales of consumer and passenger vehicles contribute to the anticipated growth in the Asia Pacific automotive aftermarket.

The North America automotive aftermarket is projected to experience a compound annual growth rate (CAGR) of 2.75% from 2024 to 2033. Additionally, there's a noticeable trend of vehicle customization in the region, with owners opting to modify their vehicles according to their personal tastes and preferences. This customization trend encompasses aftermarket upgrades such as performance enhancements, aesthetic modifications, audio system upgrades, lighting adjustments, and more.

By Replacement Parts

By Distribution Channel

By Service Channel

By Certification

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others