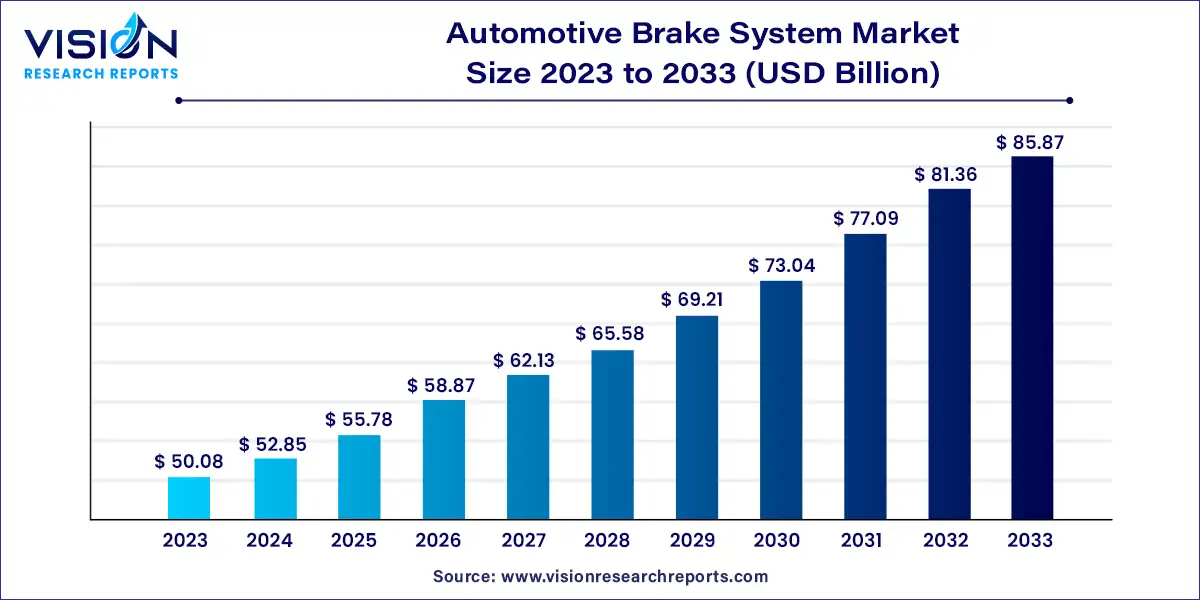

The global automotive brake system market size was estimated at around USD 50.08 billion in 2023 and it is projected to hit around USD 85.87 billion by 2033, growing at a CAGR of 5.54% from 2024 to 2033.

The automotive brake system market is a critical component of the automotive industry, playing a pivotal role in ensuring vehicle safety and performance. With advancements in technology and increasing emphasis on safety standards, the market for automotive brake systems continues to evolve and expand.

The growth of the automotive brake system market is driven by the stringent government regulations and safety standards worldwide are driving the demand for advanced braking systems that can enhance vehicle safety and reduce the risk of accidents. Additionally, the increasing production and sales of automobiles globally contribute to the expansion of the market. Furthermore, technological advancements such as anti-lock braking systems (ABS), electronic brake-force distribution (EBD), and regenerative braking systems are fueling market growth by offering improved performance and efficiency. Moreover, consumer preferences for vehicles equipped with advanced braking technologies that provide better comfort and driving experiences are also driving market growth.

The automotive brake system market, based on type, is segmented into drum brakes and disc brakes. The disc brake segment held the largest market share of 62% in 2023. In recent years, the application of disc brakes has grown significantly. The growth of disc brakes is attributed to their capacity to work in adverse weather conditions without overheating or fading. Additionally, its compatibility with other advanced systems is further propelling the growth of the disc brake segment.

The drum brake segment mainly comprises multiple gas extractors and is estimated to exhibit a significant CAGR of 3.54% over the forecast period. Drum brakes have an enclosed design and employ circular components (brake shoes) to provide the necessary friction for lowering speed. In contrast, disc brakes use a narrow rotor and caliper to stop wheel movement. As a result, performance suffers. Although disc-based systems have more braking power than drum-based systems, automakers choose drums because they are more cost-effective.

The market based on the vehicle is segmented into commercial vehicles and passenger cars. Passenger cars dominated the market, with the highest revenue share of 73% in 2023. Passenger cars are increasing due to population growth, disposable income, and urbanization.

Manufacturers tend to develop a braking system more efficiently for more safety features. The ADAS is the most important element influencing the passenger car's primary market share and growth. Furthermore, growing expenditures in ADAS are expected to influence the brake systems market due to an increase in the requirement for electromagnetic induction braking systems in automobiles, motorcycles, and other vehicles during the forecast period.

Similarly, many manufacturers are developing different variants of the braking system aimed at offering increased braking power in multiple terrain types. The manufacturers are prioritizing reducing the weight of the brake system, which has led to the development of high-performance, lighter braking systems in the market.

On the other hand, the commercial vehicles segment is expected to grow at a significant CAGR of 4.52% over the forecast period. The global demand for commercial vehicles, such as trucks, buses, and vans, has steadily increased. This growth can be attributed to expanding e-commerce, rising logistics and transportation needs, and growth in industries like construction and mining. As the commercial vehicle fleet expands, the demand for reliable and efficient braking systems also grows.

The market based on technology is segmented into antilock brake systems (ABS), traction control systems, electronic stability control, and electronic brake-force distribution. Electronic Stability Control (ESC) dominated the market with the highest revenue share of 33% in 2023. Electronic stability control technology is becoming more widely adopted because of its perceived benefits in regaining vehicle control in an emergency. Therefore, it is expected to drive the growth of the market during the forecast period.

The ABS segment held a significant CAGR of e of 32.35% over the forecast period. The growth of ABS technology is due to the aggressive efforts of several automobile groups toward the mandated deployment of ABS in key regions.

The Traction Control System (TCS) segment is expected to witness significant growth of CAGR of 6.63%. The TCS technology provides added safety by ensuring traction in difficult driving conditions. TCS is generally used with an anti-lock braking system for efficient work. Traction control stops the wheel spin by applying brake pressure by ABS and controlling the throttle. As a result, automakers could acquire a better New Car Assessment Program (NCAP) rating for a car by including advanced braking systems.

Asia Pacific dominated the market with the largest revenue share of 59% in 2023. Due to the availability of low-cost labor and raw materials, regional firms offer significant cost savings. Furthermore, countries such as China and India, among others, are the automotive manufacturing hub. The rising popularity of automotive brake systems and increased sales of luxury and premium automobiles are expected to drive market growth. Moreover, the increasing number of accidents and the surge in automobile sales contribute to the overall market growth.

North America is expected to grow at the fastest CAGR of 5.73% during the forecast period. The growing desire for better performance of vehicles in adverse weather, the presence of major car manufacturers, and growth in the supply of light commercial vehicles and passenger cars have driven the expansion of the market in this region. Furthermore, since 2018, the mandated installation of ESC technology in all light cars has driven regional market growth.

By Type

By Vehicle Type

By Technology

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others