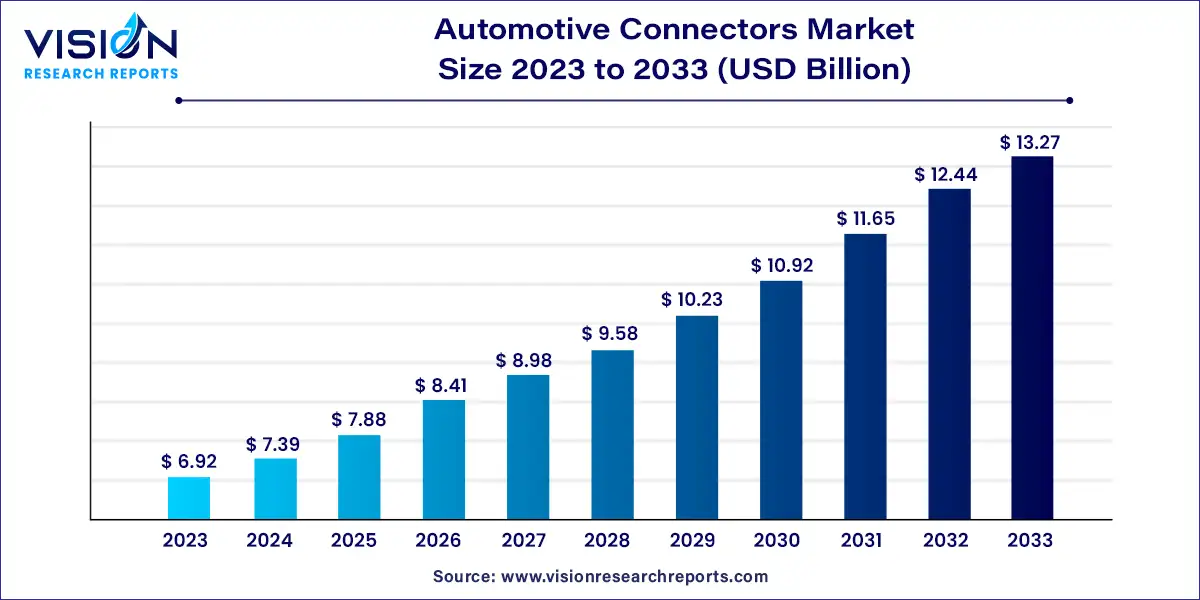

The global automotive connectors market size was estimated at around USD 6.92 billion in 2023 and it is projected to hit around USD 13.27 billion by 2033, growing at a CAGR of 6.73% from 2024 to 2033. The automotive connectors market plays a crucial role in the ever-evolving automotive industry, as these components enable the transmission of data, power, and signals between various electronic systems in a vehicle. With the growing adoption of advanced technologies such as electric vehicles (EVs), autonomous driving systems, and connected cars, the demand for reliable and efficient connectors is rapidly increasing.

The growth of the automotive connectors market is driven by an increasing adoption of electric vehicles (EVs) and hybrid vehicles, which require advanced electronic systems for efficient power distribution and data transmission. Additionally, the rise of autonomous driving technologies and connected vehicles has amplified the need for reliable connectors to support critical functions such as navigation, communication, and safety features. Stringent government regulations promoting vehicle safety and emissions reduction also contribute to market expansion, as modern vehicles integrate more sensors, cameras, and advanced driver-assistance systems (ADAS), all of which depend on high-performance connectors for seamless operation.

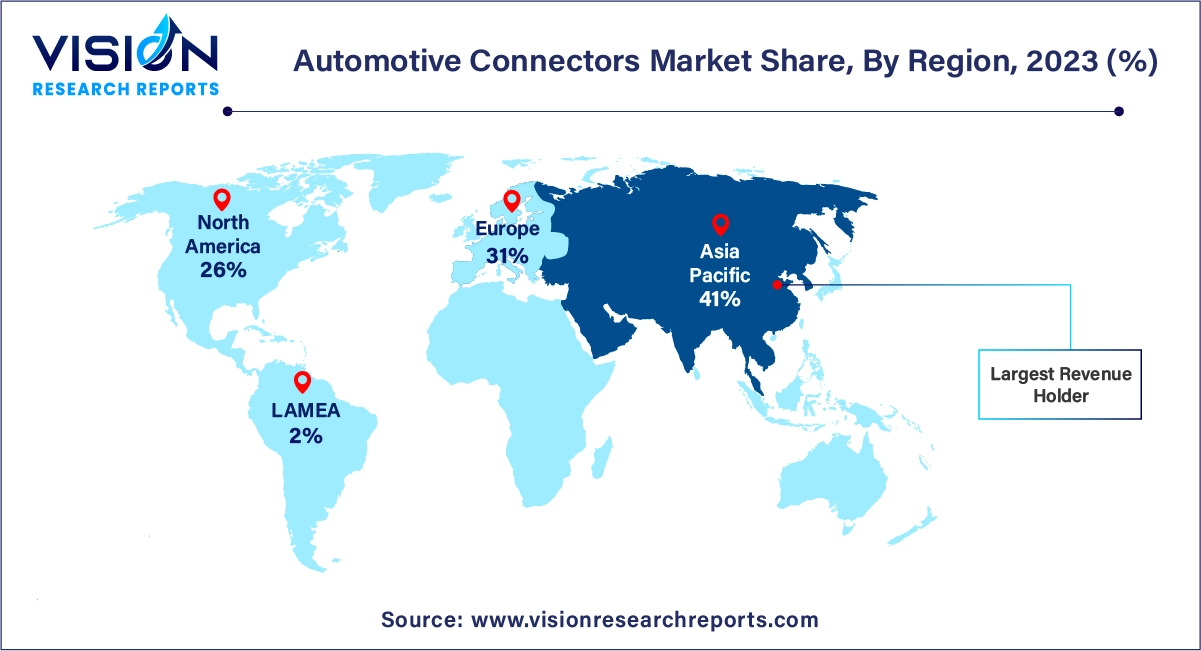

Asia Pacific led the market with the largest revenue share of 41% in 2023 and is projected to grow at the fastest CAGR of 10.03% over the forecast period. China, Taiwan, and Japan are major producers of automotive electronic components, benefiting from access to raw materials, low-cost labor, and advanced manufacturing facilities. China, a global car manufacturing hub, is playing a significant role in market growth due to its mass production capabilities, supportive government policies, and robust infrastructure.

| Attribute | North America |

| Market Value | USD 2.83 Billion |

| Growth Rate | 6.74% CAGR |

| Projected Value | USD 5.44 Billion |

North America dominated the global automotive connectors market with a 26% share in 2023. In the U.S., the market is expected to grow at a CAGR of 3.63% over the forecast period. The post-COVID-19 surge in car purchases, particularly among working professionals, has positively impacted the market.

Europe accounted for 31% of the global market in 2023, with Germany and the UK contributing significantly to regional growth. Advancements in Germany's automotive sector have increased demand for connectors. Additionally, several European countries plan to transition to electric vehicles, phasing out petrol/diesel cars, which is expected to further fuel regional market growth.

The fiber optic segment is projected to grow at the fastest CAGR of 9.63% during the forecast period. Key factors driving this growth include enhanced safety in transmission, compact size, and flexible design options. As automobile manufacturers continue to improve the features integrated into vehicles, the performance and quality of connectors become essential. Fiber optics enhance communication speed and sensing capacity, which boosts the performance of vehicle security features, thereby contributing to market expansion.

In 2023, the wire-to-wire segment held a market share of 33%. These connectors are widely used for power distribution and data transmission due to their ability to ensure seamless power flow and communication between electrical components.

Meanwhile, the wire-to-board segment is expected to register a CAGR of 5.53% over the forecast period. These connectors facilitate the transfer of commands between electronic devices and printed circuit boards (PCBs). The "others" category, which includes board-to-board connectors, is utilized for connecting multiple PCBs.

The passenger car segment dominated the market, capturing 74% of the revenue in 2023. The rising sales of passenger cars in densely populated and developing nations like China and India are driving this segment. Customers are increasingly seeking vehicles equipped with enhanced safety and security features.

The commercial vehicle segment is anticipated to witness the fastest CAGR of 7.32% from 2024 to 2033. Stringent government safety regulations for commercial vehicles and the growing industrial sectors worldwide are expanding supply and distribution networks, increasing the demand for commercial vehicles and positively impacting market growth.

In 2023, the safety and security segment held the largest market share at 26%. Technological advancements have introduced numerous safety features in vehicles, such as adaptive front lighting, adaptive cruise control, park assistance, and lane departure warning. These features rely on a range of electronic components, sensors, and ECUs.

The navigation and instrumentation segment is projected to grow at the fastest CAGR of 8.94% during the forecast period. Enhanced GPS accuracy and the integration of advanced software such as Apple CarPlay and Android Auto have driven the adoption of navigation systems in both commercial and passenger vehicles.

By Product

By Connectivity

By Vehicle

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others