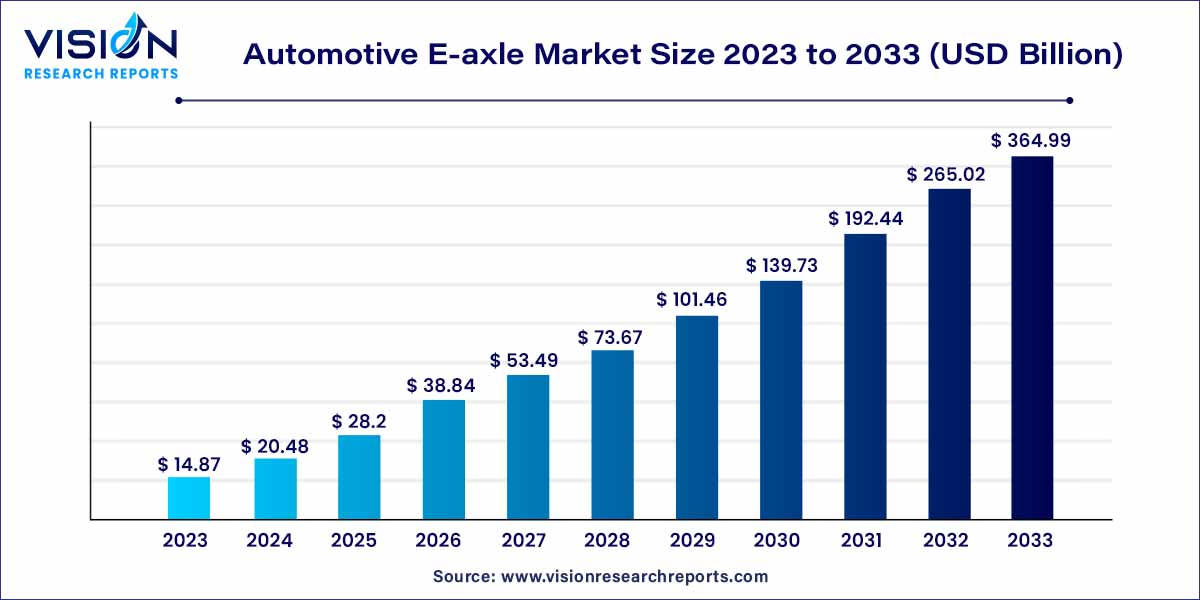

The global automotive E-axle market was estimated at USD 14.87 billion in 2023 and it is expected to surpass around USD 364.99 billion by 2033, poised to grow at a CAGR of 37.72% from 2024 to 2033. The market is mostly driven by the rising popularity of automotive e-axles in the light commercial vehicle segment and the increasing sales of battery electric vehicles. Additionally, the design of e-axles has improved as a result of the introduction of automotive e-axles for heavy commercial vehicles and increased funding for electric vehicle R&D.

In the ever-evolving landscape of the automotive industry, the Automotive E-axle market stands out as a pivotal force driving the transition towards electric mobility. An E-axle, or Electric Axle, represents a comprehensive solution, encapsulating the essential components of an electric vehicle's propulsion system into a single integrated unit. This amalgamation includes the electric motor, power electronics, and transmission, fostering efficiency, compactness, and enhanced performance.

The surge in global interest and investments in electric vehicles has propelled the Automotive E-axle market into the spotlight. As governments worldwide tighten regulations on emissions and consumers increasingly seek sustainable alternatives, automakers are strategically adopting E-axle technology to meet these demands.

The growth trajectory of the automotive e-axle market is propelled by a confluence of key factors. Foremost among these is the global paradigm shift towards electric mobility, driven by heightened environmental consciousness and stringent emissions regulations. As consumers increasingly prioritize sustainable transportation options, automakers are compelled to invest in electric axle (E-axle) technology. The inherent advantages of E-axles, including compact design, improved efficiency, and simplified drivetrains, contribute significantly to their widespread adoption. Technological advancements in electric vehicle infrastructure and battery capabilities further amplify the appeal of E-axles, addressing concerns related to range anxiety and overall performance. The growing infrastructure for electric vehicle charging stations and supportive government policies further bolster market expansion. Additionally, strategic collaborations between automotive manufacturers and E-axle system providers contribute to the development of innovative solutions, fostering a competitive landscape that drives continuous growth in the automotive e-axle market.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 37.72% |

| Market Revenue by 2033 | USD 364.99 billion |

| Revenue Share of North America in 2023 | 44% |

| CAGR of Europe from 2024 to 2033 | 39.63% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Based on application, the industry is segmented into rear and front. The rear segment held the highest market share of 71% in 2023 and is estimated to register the fastest CAGR of 41.53% over the forecast period. With the increasing popularity of electric vehicles, there is a growing demand for efficient and high-performance electric drivetrain systems. The rear segment of vehicles, especially passenger cars, and SUVs, is critical for integrating electric axles (e-axles) as they house the electric motor, power electronics, and other components necessary for electric propulsion. The shift towards electrification in the automotive industry has propelled the demand for e-axles in the rear segment.

The front segment is estimated to register a significant CAGR of over the forecast period. This can be attributed to the increasing production of entry and mid-level electric passenger cars in cost-sensitive economies. As the demand for electric vehicles continues to rise, automakers are actively developing and promoting EV models. E-axles, which combine the electric motor, power electronics, and transmission in a single unit, are a key component in electric drivetrains. The front segment, in particular, is seeing growth as automakers focus on developing compact and efficient electric powertrains for front-wheel-drive vehicles.

North America accounted for the largest market share of 44% in 2023. This growth is attributed to a rise in passenger vehicle sales in the region. The North American region is estimated to witness significant changes in the dynamics of passenger vehicle production. The shifting preference of the U.S. population from high horsepower vehicles and large SUVs to compact electric cars is expected to drive market growth for automotive e-axle in the region.

Europe is expected to grow at the notable CAGR of 39.63% over the forecast period. The European Union and various European governments have been implementing stringent emissions regulations and promoting the adoption of electric vehicles (EVs). These policies aim to reduce greenhouse gas emissions and combat air pollution. As a result, there are incentives and subsidies provided for EVs, which include e-axle-equipped vehicles. Such supportive policies have created a favorable environment for the growth of the automotive e-axle industry.

The market for Asia Pacific is expected to grow over the forecast period. Developing economies such as India and China, Japan, and South Korea are expected to help the region retain its dominance over the forecast period. The European region has been one of the early adopters of electric vehicles. Also, the region witnessed sluggish growth in conventional fuel vehicle production recently.

In June 2023, Idemitsu Kosan Co., Ltd., a global leader in energy and chemical products, is pleased to announce the successful development of a groundbreaking solution called "E AXLE and Electric Parts Cooling Oil." This cutting-edge innovation is designed to enhance the performance and efficiency of electric and hybrid vehicles' drive units, electronics, and battery systems.

In June 2023, NIDEC CORPORATION and Renesas Electronics Corporation have recently announced a collaborative partnership to develop semiconductor solutions for an advanced next-generation E-Axle system. This innovative X-in-1 system will integrate an electric vehicle (EV) drive motor and power electronics, further enhancing the performance and efficiency of electric vehicles.

In May 2023, Schaeffler India Limited, an automotive and industrial parts manufacturer and a subsidiary of the Germany-based Schaeffler Group, has recently received a significant order worth Rs 2700 crore (Euro 300 million). The order is for their innovative two-in-one electric axles as the company strategically transitions from internal combustion engines to electric powertrains

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive E-axle Market

5.1. COVID-19 Landscape: Automotive E-axle Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive E-axle Market, By Application

8.1. Automotive E-axle Market, by Application Type, 2024-2033

8.1.1. Front

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Rear

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Automotive E-axle Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Application (2021-2033)

Chapter 10. Company Profiles

10.1. Continental AG

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. ZF Friedrichshafen AG

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Melrose Industries PLC

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Dana Limited

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Robert Bosch GmbH

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Meritor, Inc.

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. LINAMAR

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. NIDEC CORPORATION

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. Magna International Inc.

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Schaeffler AG

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others