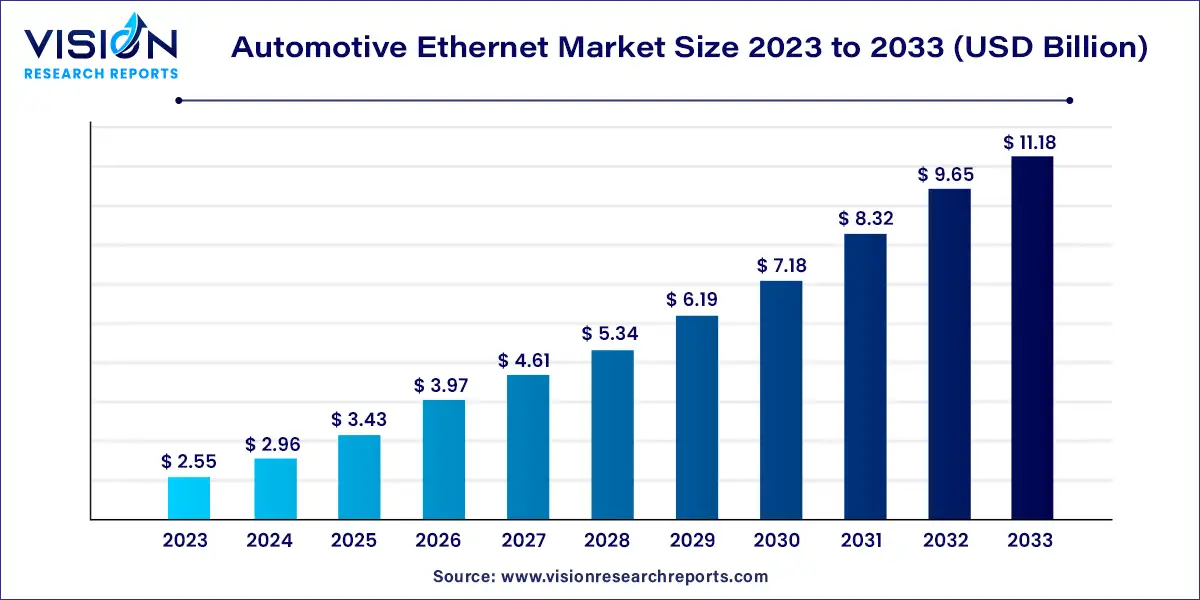

The global automotive ethernet market size was estimated at around USD 2.55 billion in 2023 and it is projected to hit around USD 11.18 billion by 2033, growing at a CAGR of 15.93% from 2024 to 2033. The automotive industry is undergoing a digital transformation, driven by the increasing integration of advanced technologies and communication systems in vehicles. Automotive Ethernet, a key player in this evolution, is revolutionizing how vehicles communicate, process data, and deliver enhanced features.

The growth of the automotive ethernet market is significantly influenced by an increasing complexity of modern vehicles, which now feature a plethora of electronic systems and advanced driver-assistance systems (ADAS), necessitates high-speed, reliable communication networks. Automotive Ethernet meets these requirements by offering robust bandwidth and low latency, essential for handling the vast amounts of data generated by various vehicle sensors and modules. Additionally, the rising demand for connected vehicles, driven by consumer expectations for enhanced infotainment systems, real-time diagnostics, and seamless integration with smart devices, is propelling the market forward. The push towards autonomous driving technology also plays a crucial role, as Ethernet provides the data transfer speed required for real-time processing of sensor data and communication between vehicle subsystems.

Case Study 1: Tesla Model 3

Overview: Tesla, a pioneer in electric vehicles, integrated automotive Ethernet into the Model 3 to enhance its connectivity and performance. The Model 3's architecture required a robust communication network to support advanced features like Autopilot, high-definition infotainment, and real-time diagnostics.

Implementation: Tesla implemented a multi-gigabit Ethernet solution to handle the high data throughput needed for its advanced driver-assistance systems (ADAS) and infotainment features. This involved deploying Ethernet switches and high-speed transceivers across the vehicle’s network. The architecture was designed to manage data from numerous sensors and cameras while ensuring low latency and high reliability.

Outcomes: The integration of automotive Ethernet in the Model 3 led to several key outcomes:

Case Study 2: Audi A8

Overview: Audi’s flagship model, the A8, features a sophisticated electronic architecture that utilizes automotive Ethernet to support its high-tech features, including advanced driver assistance and multimedia systems. The integration aimed to streamline data transfer and enhance system integration.

Implementation: Audi adopted the 1000BASE-T1 Ethernet standard to accommodate the high data rates required for its complex system architecture. The implementation involved upgrading the vehicle’s wiring infrastructure to support Ethernet connectivity, integrating high-speed switches, and ensuring compatibility with existing vehicle systems.

Outcomes: The deployment of automotive Ethernet in the Audi A8 resulted in:

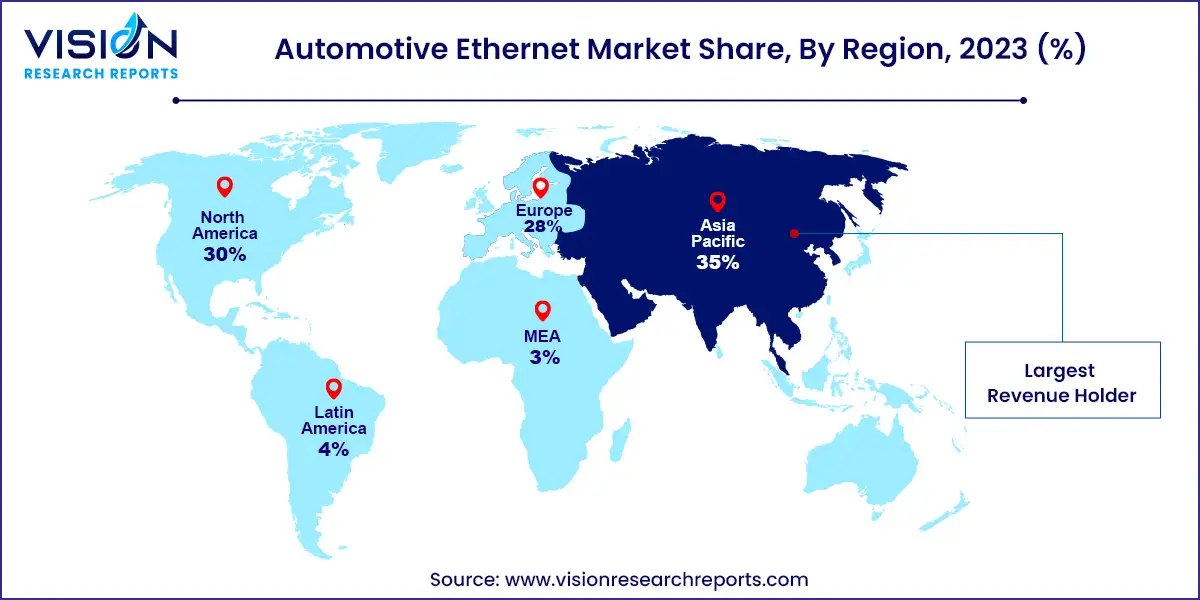

In 2023, the Asia Pacific region led the automotive Ethernet market, capturing 35% of global revenue. Rapid urbanization, technological advancements, and a booming automotive industry contribute to this market growth. The increasing demand for electric vehicles (EVs) and expanded automotive R&D efforts further bolster the growth of automotive Ethernet in the region.

| Attribute | Asia Pacific |

| Market Value | USD 0.89 Billion |

| Growth Rate | 15.95% CAGR |

| Projected Value | USD 3.91 Billion |

The North American automotive Ethernet market is anticipated to grow notably from 2024 to 2033. The region’s automotive industry is leading in adopting advanced technologies, including Ethernet, to enhance in-car connectivity, ADAS, and autonomous driving features. Major automotive manufacturers and technology providers in the U.S. and Canada are heavily investing in research and development to boost vehicle performance and safety. The growing emphasis on connected vehicles and smart infrastructure drives the demand for automotive Ethernet in North America.

The European automotive Ethernet market is expected to experience the highest CAGR from 2024 to 2033. European automotive manufacturers are adopting Ethernet technology to comply with stringent regulations and enhance vehicle safety features. The focus on ADAS, autonomous driving, and EVs drives the need for high-speed, reliable communication networks, fueling the market’s growth in Europe.

In 2023, the hardware segment led the market, accounting for 41% of global revenue. This segment includes essential components such as Ethernet switches, connectors, cables, and integrated circuits (ICs), which are crucial for managing data flow within vehicles. Innovations like compact, high-performance connectors and multi-gigabit transceivers are advancing vehicle architectures, supporting sophisticated systems like advanced driver-assistance systems (ADAS) and infotainment, and enhancing real-time data processing capabilities.

Looking ahead, the services segment is expected to experience substantial growth from 2024 to 2033. This segment covers consultation, design, testing, integration, maintenance, and support services tailored for complex Ethernet systems. As vehicles become increasingly connected and autonomous, there is a rising demand for specialized services that ensure seamless integration, reliability, and compliance with stringent automotive regulations.

In 2023, the 100 Mbps segment, defined by the 100BASE-T1 automotive Ethernet standard, dominated the market. This segment is growing due to its balanced cost, complexity, and performance. The 100 Mbps standard is well-suited for basic control functions and less demanding data transmission needs, such as simple sensor data and infotainment communication. Its cost-effectiveness and simplicity make it a popular choice for automakers looking to implement Ethernet connectivity affordably.

From 2024 to 2033, the 1 Gbps segment, specified by the 1000BASE-T1 standard, is expected to see significant growth. This bandwidth level supports higher data rates necessary for advanced automotive applications, including ADAS, high-definition cameras, and real-time data processing modules. The rapid advancement in automotive technology and the push towards more autonomous and connected vehicles drive the demand for robust networking solutions that can handle large data volumes efficiently.

In 2023, the passenger cars segment led the market, driven by rising demand for advanced connectivity and infotainment features. As passenger cars become more connected, automakers are integrating Ethernet to support high-speed data transfer for applications like ADAS, high-definition infotainment systems, and real-time diagnostics. Additionally, the trend towards electric and hybrid vehicles, which require sophisticated control systems, further accelerates Ethernet adoption in this segment.

The commercial vehicles segment is projected to grow significantly from 2024 to 2033. The need for improved connectivity and operational efficiency in fleet management is driving this growth. Ethernet technology is increasingly used in commercial vehicles to support advanced telematics, real-time tracking, and sophisticated driver assistance features, enhancing safety and operational effectiveness. The focus on fleet management solutions and IoT integration in commercial vehicles fuels the demand for reliable, high-speed communication networks.

In 2023, the ADAS segment was the market leader, driven by the increasing focus on safety and automation. The demand for ADAS has surged as manufacturers integrate various systems requiring high-bandwidth, low-latency communication networks. Automotive Ethernet is preferred for connecting sensors and cameras critical to these systems due to its high-speed data transmission capabilities. The growth of automated and connected driving technologies, along with the need to enhance vehicle safety and performance, supports the segment’s expansion.

The infotainment segment is expected to see significant growth from 2024 to 2033. Rising consumer demand for advanced, high-quality in-car entertainment and connectivity drives this growth. Automakers are integrating Ethernet to support high-bandwidth applications like streaming media, navigation systems, and interactive displays. The shift towards sophisticated infotainment systems, including multi-screen and high-definition interfaces, further increases the need for robust Ethernet networks.

By Component

By Bandwidth

By Vehicle

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others