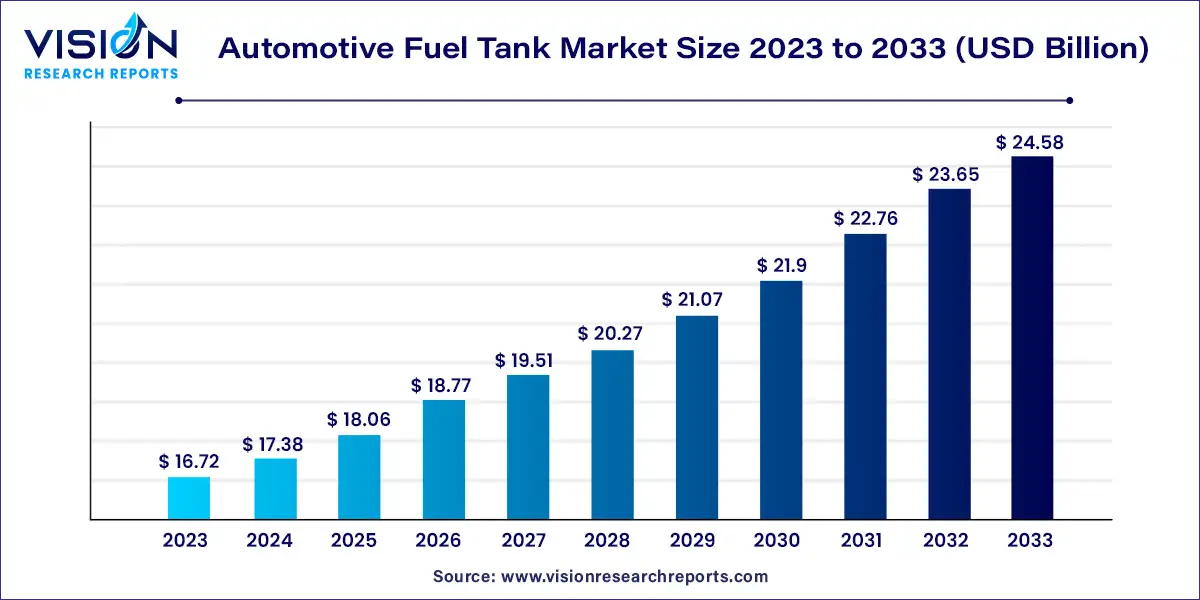

The global automotive fuel tank market size was valued at USD 16.72 billion in 2023 and it is predicted to surpass around USD 24.58 billion by 2033 with a CAGR of 3.93% from 2024 to 2033.

The automotive fuel tank market plays a crucial role in the automotive industry, providing safe storage for fuel in vehicles of various types, including passenger cars, commercial vehicles, and others. As the automotive sector evolves with advancements in technology and environmental regulations, the demand for efficient, lightweight, and durable fuel tanks continues to grow.

The growth of the automotive fuel tank market is propelled by an increasing global vehicle production, particularly in emerging economies, drives demand for automotive fuel tanks. Stringent emissions regulations worldwide push for advanced fuel tank technologies to reduce environmental impact. Moreover, the automotive industry's focus on lightweighting vehicles to enhance fuel efficiency fuels innovations in lightweight and durable fuel tank materials. These factors collectively contribute to the expanding automotive fuel tank market, fostering technological advancements and market growth.

The market is segmented based on capacity into three categories: less than 45 liters, 45 to 75 liters, and greater than 75 liters. The less than 45 liters category dominates the global market, primarily due to its prevalence in passenger cars such as hatchbacks and sedans. With urbanization, rising disposable incomes, and advancements in automotive technologies driving increased sales and production of passenger cars worldwide, this segment is experiencing significant growth. There is also a growing preference among consumers, particularly the younger generation, for low-emission, lightweight, and high-performance vehicles, further boosting market expansion.

Automotive manufacturers are heavily investing in research to develop lightweight components, including fuel tanks made from materials like High-Density Polyethylene (HDPE). This innovation supports the demand for high-performance vehicles with better mileage, meeting consumer preferences and regulatory requirements alike.

The market is segmented into plastic and metal tanks. Plastic tanks, specifically those made from HDPE, hold the largest share and are expected to maintain their dominance. Automotive manufacturers globally are increasingly adopting plastic tanks due to their lightweight nature, flexibility in design, corrosion resistance, and durability. These qualities make them ideal for various vehicle types, including passenger cars, SUVs, and light commercial vehicles. The growing demand for plastic tanks is driving the market for HDPE as well, both in volume and value terms.

In terms of vehicle types, the market is segmented into passenger cars, light commercial vehicles (LCV), and heavy commercial vehicles (HCV). Passenger cars currently lead the market, driven by urbanization, industrial expansion, improved living standards, and rising disposable incomes globally. Automotive manufacturers are focusing on lightweight materials for fuel tanks to enhance vehicle efficiency and reduce emissions. The shift towards lightweight vehicles, encouraged by stringent emission regulations and policies promoting high-performance and fuel-efficient vehicles, further propels the demand for plastic fuel tanks, especially in the passenger car segment.

The light commercial vehicle (LCV) segment is also witnessing substantial growth, fueled by urban development, expanding road infrastructure, and increased industrial activities such as construction and logistics.

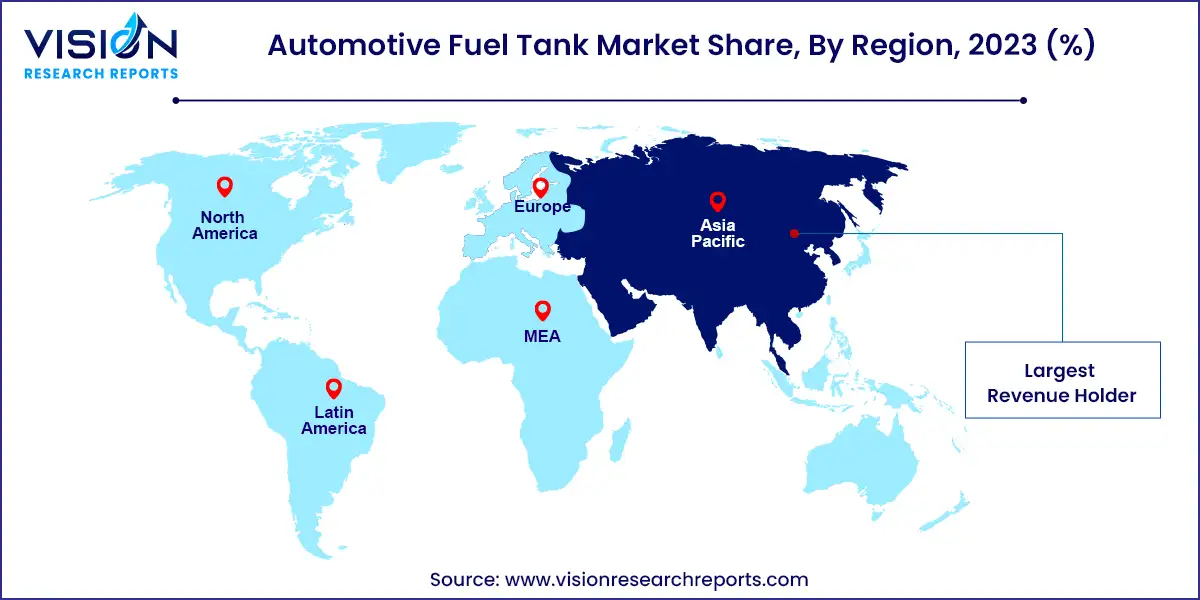

Asia Pacific holds the largest market share and is expected to maintain its position, driven by countries like India, China, Japan, and South Korea. These nations lead in automobile sales and production, supported by rapid urbanization, industrial growth, infrastructure development, and rising incomes. Manufacturers in the region are focusing on lightweight materials for automotive components, including plastic fuel tanks, to meet the demand for high-efficiency vehicles. Government regulations promoting fuel emission reduction and subsidies for lightweight vehicle manufacturing further bolster market growth in this region.

North America follows with a significant market share, driven by a high volume of commercial vehicles and stringent emission regulations. Increasing consumer demand for fuel-efficient vehicles is also contributing to market expansion.

By Capacity Type

By Material Type

By Vehicle Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Capacity Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Fuel Tank Market

5.1. COVID-19 Landscape: Automotive Fuel Tank Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Fuel Tank Market, By Capacity Type

8.1. Automotive Fuel Tank Market, by Capacity Type, 2024-2033

8.1.1 Less than 45 L

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. 45 L – 75 L

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Greater than 75 L

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Automotive Fuel Tank Market, By Material Type

9.1. Automotive Fuel Tank Market, by Material Type, 2024-2033

9.1.1. Plastic

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Metal

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Automotive Fuel Tank Market, By Vehicle Type

10.1. Automotive Fuel Tank Market, by Vehicle Type, 2024-2033

10.1.1. Passenger Cars

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Light Commercial Vehicles (LCV)

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Heavy Commerical Vehicles (HCV)

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Automotive Fuel Tank Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Capacity Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Material Type (2021-2033)

11.1.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Capacity Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Material Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Capacity Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Material Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Capacity Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Material Type (2021-2033)

11.2.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Capacity Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Material Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Capacity Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Material Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Capacity Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Material Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Capacity Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Material Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Capacity Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Material Type (2021-2033)

11.3.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Capacity Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Material Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Capacity Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Material Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Capacity Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Material Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Capacity Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Material Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Capacity Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Material Type (2021-2033)

11.4.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Capacity Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Material Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Capacity Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Material Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Capacity Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Material Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Capacity Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Material Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Capacity Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Material Type (2021-2033)

11.5.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Capacity Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Material Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Capacity Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Material Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

Chapter 12. Company Profiles

12.1. Yachiyo Industry Co., Ltd.(Japan).

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Continental AG(Germany).

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Kautex Textron GmbH & Co. KG(Germany).

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. TI Automotive Inc. (U.K).

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Magna International Inc.(Canada).

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. YAPP Automotive Parts Co. Ltd.(China)

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. SMA Serbatoi S.P.A. (Italy).

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. The Plastic Omnium Group (France)

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Martinrea International Inc. (Canada).

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Unipres Corporation (Japan)

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others