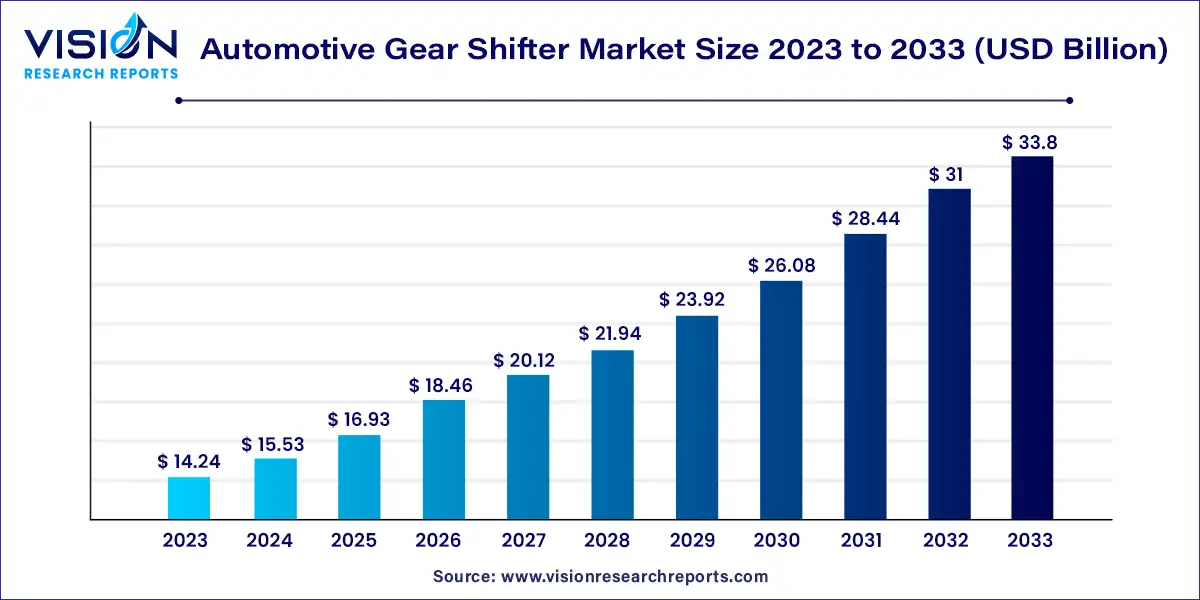

The global automotive gear shifter market size was estimated at around USD 14.24 billion in 2023 and it is projected to hit around USD 33.8 billion by 2033, growing at a CAGR of 9.03% from 2024 to 2033.

The automotive gear shifter market plays a pivotal role in the automotive industry, as it directly influences vehicle performance and driver experience. Gear shifters, or gear selectors, enable drivers to control the transmission system, making them essential components in both manual and automatic transmissions.

The automotive gear shifter market is experiencing robust growth driven by the rise in global vehicle production is a significant driver, as increasing numbers of vehicles on the road necessitate the demand for gear shifters. Advances in transmission technology, such as the development of electronic and semi-automatic gear shifters, are also propelling market growth by enhancing vehicle performance and driving comfort. Additionally, changing consumer preferences towards automatic transmissions for their convenience and ease of use are boosting the demand for modern gear shifting systems. Furthermore, the growing focus on improving fuel efficiency and reducing emissions aligns with the adoption of advanced gear shifters that contribute to better vehicle performance.

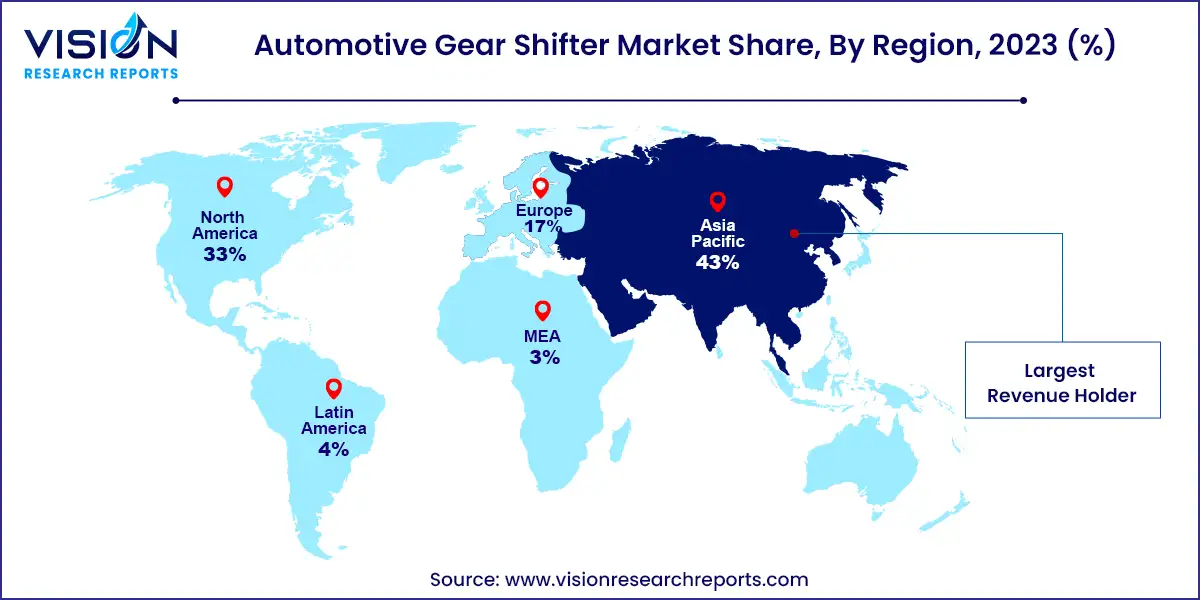

The Asia Pacific region dominated the automotive gear shifter market in 2023, accounting for 43% of global revenue. This region is anticipated to register the highest CAGR from 2024 to 2033 due to rapid growth in the automotive sector, driven by urbanization, rising income levels, and expanding middle-class populations. Key contributors to this growth include China, Japan, and India.

| Attribute | Asia Pacific |

| Market Value | USD 6.12 Billion |

| Growth Rate | 9.03% CAGR |

| Projected Value | USD 14.53 Billion |

The North American automotive gear shifter market is projected to see notable growth from 2024 to 2033. North American consumers are increasingly seeking customization and luxury features in their vehicles, including gear shifters with premium materials and unique designs. Luxury automakers are leading this trend by offering bespoke gear shifter options.

In the U.S., the automotive gear shifter market is expected to grow significantly from 2024 to 2033. The increasing popularity of SUVs and crossovers is driving demand for advanced automatic and semi-automatic transmission systems, which in turn fuels the need for innovative gear shifters that enhance driving performance and fuel efficiency.

In Europe, the automotive gear shifter market is expected to grow considerably from 2024 to 2033. Strict emission norms and safety regulations imposed by the European Union are encouraging manufacturers to adopt advanced gear shifter technologies. The European Automobile Manufacturers Association (ACEA) reports that the EU produced 18.1 million motor vehicles in 2022, with a growing number featuring electronic and automatic gear shifters.

In 2023, the solenoid actuator segment led the market with a revenue share of 59%. The advancement of automotive electronics has facilitated the development of sophisticated transmission systems. Enhanced microcontrollers, sensors, and software algorithms have improved gear shifting efficiency and reliability, making solenoid actuator-based systems increasingly attractive. As consumer expectations for smooth and responsive driving experiences rise globally, solenoid actuators, which offer faster and more precise gear changes, are becoming more popular. The growing adoption of electric and hybrid vehicles, which benefit from the seamless integration of solenoid actuators with electric powertrains, is expected to further drive the demand for this segment.

The CAN module segment is projected to experience significant growth from 2024 to 2033. This is due to the increasing emphasis on safety and stringent regulatory standards, as CAN modules enhance safety features in gear shifters by enabling precise control and real-time monitoring of transmission systems. The rising demand for vehicles equipped with Advanced Driver Assistance Systems (ADAS) also contributes to this growth, as CAN modules are crucial for facilitating communication between gear shifters and other critical systems such as adaptive cruise control and lane assist.

The passenger vehicle segment held the largest revenue share in 2023. With more consumers favoring automatic transmissions for their convenience, manufacturers are focusing on developing intuitive and ergonomic gear shifter designs. Gear shifters are becoming a key interior design element, with passenger vehicle manufacturers offering customizable options, including premium materials and finishes, to cater to the luxury segment. This trend is anticipated to drive continued demand in the passenger vehicle segment.

The commercial vehicle segment is expected to grow significantly from 2024 to 2033. This growth is driven by the increasing need for efficient and reliable transmission systems in modern commercial vehicles, which are often equipped with telematics systems that provide real-time performance data. Gear shifters integrated with these systems optimize transmission control and improve fleet management. The expansion of logistics and transportation sectors is further driving demand for gear shifters in commercial vehicles.

The mechanical gear shifter segment dominated the market in terms of revenue in 2023. Manual transmissions are favored in sports cars and performance vehicles for their enhanced control and driver engagement. Mechanical gear shifters are also preferred for their lower cost and reduced maintenance requirements compared to automatic systems. These factors are driving the continued demand for manual gear shifters.

The automatic gear shifter segment is expected to experience the highest CAGR from 2024 to 2033. Urbanization and increased traffic congestion make automatic transmissions more desirable for their convenience. Additionally, the aging population favors automatic gear shifters for their ease of use. The rise in hybrid and electric vehicles, which typically use automatic transmissions, is also a significant driver for this segment.

By Vehicle Type

By Component Type

By System Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Vehicle Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Gear Shifter Market

5.1. COVID-19 Landscape: Automotive Gear Shifter Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Gear Shifter Market, By Vehicle Type

8.1. Automotive Gear Shifter Market, by Vehicle Type, 2024-2033

8.1.1 Passenger Vehicle

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Commercial Vehicle

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Automotive Gear Shifter Market, By Component Type

9.1. Automotive Gear Shifter Market, by Component Type, 2024-2033

9.1.1. Solenoid Actuator

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. CAN Module

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Electronic Control Unit (ECU)

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Automotive Gear Shifter Market, By System Type

10.1. Automotive Gear Shifter Market, by System Type, 2024-2033

10.1.1. Mechanical

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Automatic

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Automotive Gear Shifter Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Component Type (2021-2033)

11.1.3. Market Revenue and Forecast, by System Type (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Component Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by System Type (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Component Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by System Type (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Component Type (2021-2033)

11.2.3. Market Revenue and Forecast, by System Type (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Component Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by System Type (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Component Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by System Type (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Component Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by System Type (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Component Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by System Type (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Component Type (2021-2033)

11.3.3. Market Revenue and Forecast, by System Type (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Component Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by System Type (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Component Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by System Type (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Component Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by System Type (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Component Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by System Type (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Component Type (2021-2033)

11.4.3. Market Revenue and Forecast, by System Type (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Component Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by System Type (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Component Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by System Type (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Component Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by System Type (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Component Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by System Type (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Component Type (2021-2033)

11.5.3. Market Revenue and Forecast, by System Type (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Component Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by System Type (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Component Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by System Type (2021-2033)

Chapter 12. Company Profiles

12.1. ATSUMITEC Co., Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. BorgWarner Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Eaton.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Ficosa Internacional SA.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Kongsberg Automotive.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Leopold Kostal GmbH & Co. KG

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Lumax Industries.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Orscheln Products

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Stoneridge.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. ZF Friedrichshafen AG.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others